Battery metals are forecast to remain in short supply for years to come as the transition to green energy adds pressure to the surge in demand for lithium and nickel. Prices for these metals have skyrocketed in 2021 and are projected to climb further if demand continues to outstrip supply expansion.

If mining operations remain at their current levels and supply chain inefficiencies constrain the industry's capacity, battery metal inventories will be continually depleted, pushing futures pricing even higher. To counter rapidly rising demand, producers are initiating a new wave of investments in cutting-edge mining and processing methods, including ultra-thin foils and deep-sea mining.

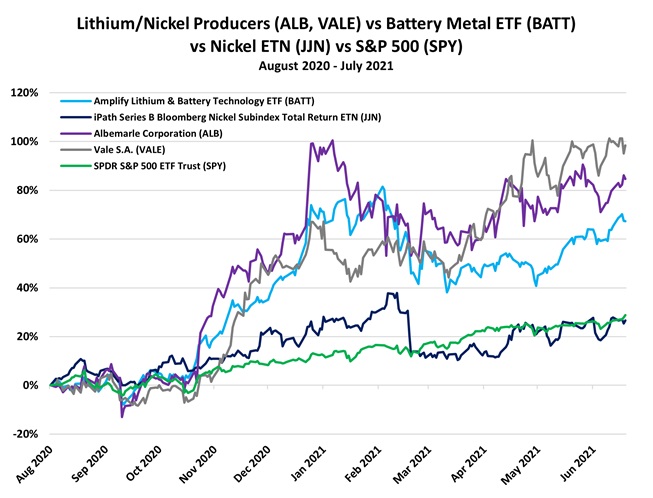

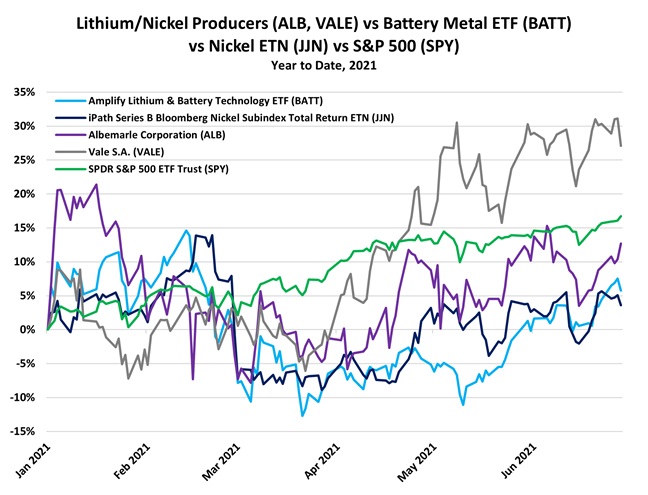

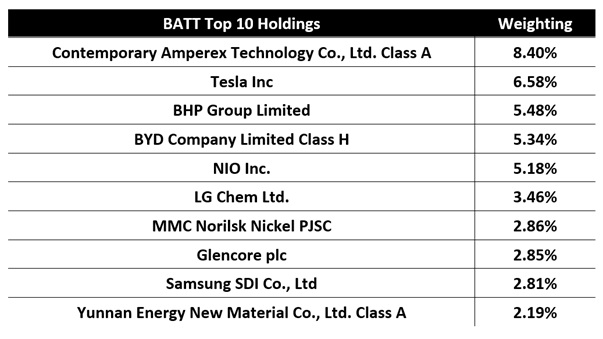

Related ETFs & Stocks: Amplify Lithium & Battery Technology ETF (BATT), iPath Series B Bloomberg Nickel Subindex Total Return ETN (JJN), Albemarle Corporation (ALB), Vale S.A. (VALE), Sustainable Opportunities Acquisition Corp. (SOAC)

Battery Metal Demand Remains Strong

Key battery metals, specifically lithium and nickel, have been hot commodities this year as EV production ramps up and expansion of supply remains limited.

According to Institutional Investor, EV sales have more than tripled since 2017, and analysts at Citibank have predicted that 75% of all lithium mined will go into the battery packs in EVs by 2025. Additionally, a recent report from the IEA projects lithium demand to jump by more than 40 times current levels by 2040.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on July 6.

Automakers continue to step up their efforts to further prioritize battery development and reduce carbon emissions as global EV adoption accelerates. General Motors recently struck a deal with Controlled Thermal Resources, an Australian lithium mining company, which aims to extract lithium from geothermal deposits in the US, a climate-friendly way to source the raw materials key to GM's battery manufacturing plans.

The California Energy Commission estimates GM's mining site could produce 600,000 tons of lithium carbonate annually, worth up to $7.2 billion, per The Verge.

Similarly, Sky News reported that Nissan has invested $1.4 billion into a new battery "gigafactory" based in the UK, striving to produce enough lithium-ion batteries for the country's entire vehicle fleet.

A recent Bloomberg report, highlighted by Mining.com, notes that analyst projections for annual lithium-ion battery demand have risen to 2.7 terawatt-hours per year by 2030, a 35% increase from Bloomberg's forecast last year.

As automakers continue to take the EV revolution seriously, rising demand for lithium-ion batteries should push prices for the raw material higher.

Supplies Still Threaten to Slip Into Shortage

According to Forbes, two investment banks updated their supply forecasts for lithium, as miners have yet to significantly raise up their production.

Macquarie Bank cites strong battery demand for EVs and energy storage systems have "more than offset" the small supply increase seen this year. The bank projects that a supply deficit will remain slight this year at 2,900 tons, but then rise to 20,000 tons in 2022 and jump to 61,000 tons in 2023.

Further, Macquarie believes the lithium market could remain in a "perpetual deficit", predicting limited supply responses could widen the deficit every year through 2027 and beyond.

Credit Suisse holds a similar sentiment, projecting a deficit of 248,000 tons in 2025.

With shortages on the horizon, lithium prices have been on a tear. Lithium carbonate is up 71% year to date, while lithium hydroxide is up even more at 91% this year, per Bloomberg analysis. Bloomberg expects the rally to continue through 2021 and into 2022, but prices could begin to plateau if miners begin to increase their production.

Reuters recently highlighted a Benchmark Mineral Intelligence report that found that lithium carbonate spot prices have risen above $12,000 per ton, more than double the levels seen in November 2020 and the highest price seen since January 2019.

Costs are expected to climb even further. Lithium mining giant Ganfeng Lithium Co., based in China, says after the industry halted new development during a major sell-off after lithium prices reached record highs in 2018, strong demand could create a tight lithium market for years to come.

Analysts at Benchmark Mineral Intelligence write that unless there is a significant investment in new lithium mining operations, heightened demand forecasts could cause shortages to persist through the decade.

To counter the rapid pace of demand growth, Albemarle Corp., the world's biggest producer of lithium, is now going all-in on making the lithium they process more efficient. The company's new lab in North Carolina will develop lithium products two to three times faster than previously, and work to accelerate production of ultra-thin lithium foils and anodes that could double energy density and reduce cost by as much as 50%.

Lithium isn't the only battery metal struggling with a supply and demand imbalance. Bloomberg recently highlighted a strike at one of Vale's Canadian nickel mines that shut down production on June 1, an issue that could last for several months.

Since the strike began, consumers have started to search for alternatives for nickel pellets used in battery production. One of those alternatives, called nickel briquette, has seen a rapid uptick in demand. Inventories of the material have fallen 9% since April, and are now at their lowest levels in more than a year.

Bloomberg writes that low inventory drove the premium on nickel briquette up 24%, pushing prices to their highest level since November 2019. Without a quick solution to the strike, battery-grade nickel could fall into a further deficit and keep prices elevated through 2021.

At some point down the line, both lithium and nickel production will need to scale up significantly, and some believe that means new sourcing and mining methods must be developed. Among them, the Metals Company of Vancouver sees metal-rich polymetallic nodules as opportunity resting at the bottom of the sea.

Not only has The Metals Company recently entered a $2.9 billion SPAC merger with Sustainable Opportunities Acquisition Corporation to take the company public, Axios reports it has also secured exploration rights to approximately 150,000 square kilometers of the Clarion Clipperton Zone in the Pacific Ocean. CEO Gerard Batton estimates rock resources in the basin will be sufficient for 280 million EVs.

Theme Alert

As governments continue to prioritize clean energy developments and EV sales remain at record levels, battery metals will remain in high demand. Prices have climbed steadily in 2021 and are forecast to rise further if mining production remains stagnant in the near term. Battery metal producers are set up for a solid year as demand remains strong and supply deficits push both lithium and nickel prices higher.

MRP added LONG Battery Metals to our list of themes on August 14, 2020, tracking the theme with the Amplify Lithium & Battery Technology ETF (BATT). Since then, the BATT has returned +67%, more than doubling the S&P 500's +29% return over the same period.

Originally published July 6, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.