Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:FSE) announced the signing of a share purchase and license agreement with Chemionex Inc., an Ontario company. The agreement states the terms for Cypress to acquire a license to use Chemionex's innovative Direct Lithium Extraction (DLE) technology—the Lionex Process—at Cypress' Clayton Valley Lithium Project (CVLP).

Chemionex is a leader in hydro-metallurgical process development and DLE technology. Its owner, Craig Brown, is an internationally recognized expert on aqueous-based chemical separations in the field of ion exchange, with extensive experience in electrochemistry, adsorption, filtration, membranes, evaporation & crystallization.

The purchase price at closing is $100,000. An additional $250,000 in cash and 1 million shares of Cypress will be placed in escrow. The escrowed cash will be released upon delivery of Chemionex-made equipment to the testing site later this month. Cypress will have 12 months following installation of the equipment to determine whether to retain the license by releasing the escrowed shares as final payment.

The purpose of the pilot plant is to ensure that all processes work together and identify and resolve scale-up/operational issues. Operation of the pilot plant will provide essential data for the upcoming Feasibility Study (FS), and enable mgmt. to produce marketing samples to support negotiations with potential off-take and strategic partners.

The full purchase price ($350k in cash + 1 million shares) would convey 100% ownership of a license to Cypress with no further payment or royalty obligations. Assuming the Lionex Process works and is amenable to large-scale commercialization (not a sure thing), this would meaningfully de-risk the Cypress story.

Nailing down water rights would further de-risk the company, as will generating a robust FS, and releasing encouraging pilot plant test results. Importantly, all of these milestones can be achieved with current cash on hand of $18 million.

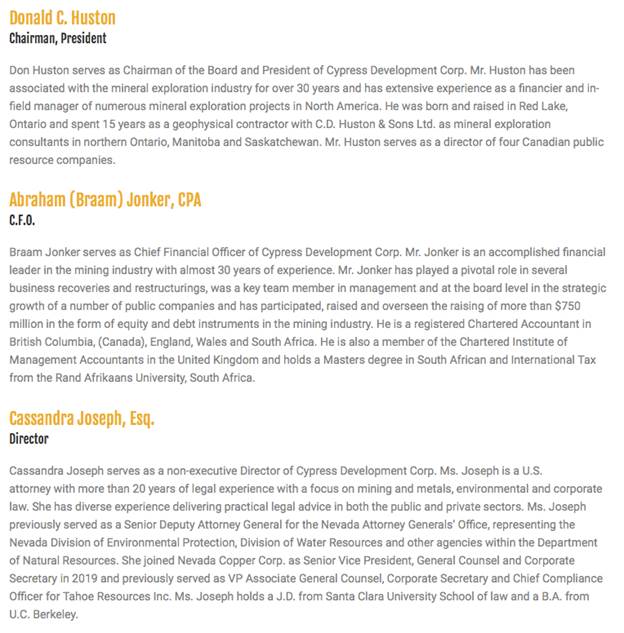

Cypress is making very significant progress in its FS and pilot plant, which is being assembled now in Nevada. It will operate for a few months and deliver initial results by October. Water rights are in the process of being locked down. Expanding the team is well underway with two new additions—director Cassandra Joseph, Esq. and CFO Braam Jonker, CPA.

There's been a lot of talk by industry pundits that China is ceding its overwhelming dominance of all things battery metals and EVs. Make no mistake, it will remain #1 in several categories, but meaningful competition is coming from North America and Europe.

All roads point to significant lithium production from the U.S.

In five years there will be substantial production of EVs across the U.S., Mexico and Canada. Half of those units will still be Teslas, but every EV production line from northern Mexico to southern Canada will want (and greatly benefit from) lithium hydroxide extracted & processed in Nevada. Not because a famous giga-factory is in that state, but because there are huge swaths of sedimentary (clay-hosted) lithium there.

By the early 2030s, millions of EVs/year will be rolling out of factories in North America. That means Lithium Americas' Nevada sedimentary (clay-hosted) lithium project Thacker Pass will get built.

Construction is slated to begin in Q1 2022. Bacanora's clay-hosted Sonora project in Mexico will get built, especially as lithium industry giant Ganfeng announced it is acquiring Bacanora.

Other mines likely to get built on U.S. soil by 2026 are ioneer ltd's sedimentary Rhyolite Ridge lithium-boron project, (also in NV), Piedmont Lithium's Carolina hard rock project in North Carolina and Standard Lithium's DLE project in Arkansas. Standard is partnered with US$7 billion German specialty chemicals player LANXASS.

Just five new lithium projects coming online in the U.S. by 2026….

While other DLE projects might cross the finish line, incl. some modeled after Standard Lithium's operations—and while others in California have a shot—I highly doubt any will be producing >10k tonnes LCE/year by 2026. Subject to permitting, funding, lithium pricing and securing a strategic partner, Cypress is expected to start production around 2025.

Think about it, including Cypress, just five new Li projects in the U.S. by 2026! Readers are reminded that it typically takes years to ramp up production, especially as companies plan to develop their operations in two or three phases.

Therefore, not including Albemarle's Silver Peak brine operations, well under 100k tonnes of new LCE supply is coming in 2025, 2026 and 2027. Perhaps the U.S. will pump out 100k new tonnes in 2028? That would be a small fraction of the >600k tonnes of LCE demand from North American by then.

There are a number of strong tailwinds behind Cypress. Not one, not two, but three sedimentary (clay-hosted) Li projects (Thacker Pass, Sonora and Rhyolite Ridge) will likely enter production in the 2024–2026 timeframe.

Astute readers are no doubt wondering how four sedimentary projects will start operations in the next five years, (three in Nevada), when NONE have made it before. The simple answer is time and money.

All three projects—Thacker Pass [1970s], Rhyolite Ridge [1980s] and Sonora [1990s]—have been explored, studied and developed (including by predecessor companies) for decades. Yet, until 2016 project economics simply didn't work, with lithium prices below $6k/tonne.

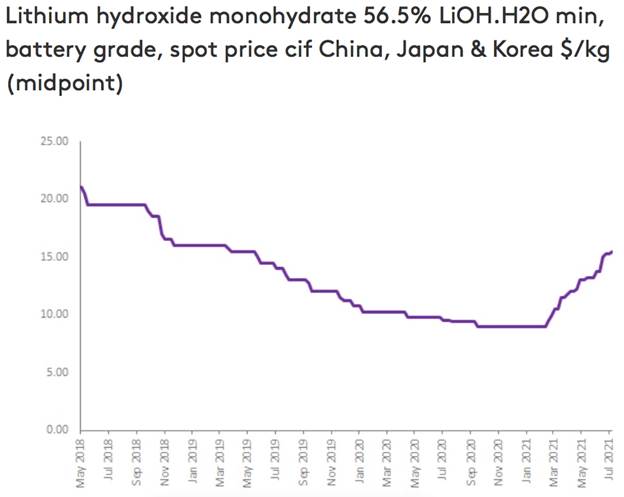

Still, over the years, technical advancements continued to be made. And last week, the Fastmarkets hydroxide price sat at $15.5k/tonne, up over 60% in the past six months.

Two years ago, long-term Li prices were widely expected to be US$10-$12k/tonne. Now, analysts, consultant groups and management teams believe the new normal might be US$12-$16k/tonne. Li pricing has gone from a headwind to a tailwind.

From a science and technology perspective, the stars are aligned for sedimentary (clay-hosted) Li projects to finally make hay. Ganfeng taking out Bacanora is a clear vote of confidence in the methodology. Another vote of confidence is that Thacker Pass is valued by the market at nearly $900 million.

Several sell-side analysts value it at well over a billion dollars. Cypress trades at ~1/8 the implied market value of Thacker Pass, and less than 1/10 that of analyst estimates.

In the next year, Cypress should achieve most of the following: operate a pilot plant and derive critically important insights, deliver a Feasibility Study, land a strategic/financial partner, obtain water rights, complete a Plan of Operations, hire additional execs and advance other key environmental, permitting, logistical and ESG protocols.

As important as Cypress Development's investment catalysts is what other industry players will be doing. As mentioned, three clay-hosted projects are coming online. Thacker Pass is blazing a path forward in Nevada for Cypress to follow. Lithium prices are expected to stay strong or continue to strengthen. Howard Klein and Rodney Hopper of RK Equity believe Li hydroxide prices could reach US$18k/tonne by year-end.

Over the next few years I suspect a number of lithium juniors will be acquired by larger lithium companies like Ganfeng, Albemarle, SQM, Livent, Sayona Mining (investing in hard rock prospects in Canada), IGO ltd., Mineral Resources Ltd., Jiangxi Special Electric Motor Co., Tianqi Lithium Corp., Sichuan Yahua Industrial Group and Shandong Ruifeng Chemical Co.

Yet, those companies are the tip of the iceberg. Potential acquirers of Li juniors will be found among Li-ion battery/cathode producers, automakers, sovereign wealth and private equity funds, commodities traders, and any metals/mining/minerals company looking to diversify into battery metals. Oil and gas companies have been investing in solar and wind farms, might they be interested in green-energy metals?

I'm not saying that Cypress will get taken out, but as other lithium peers get acquired, more and more eyes will be on Cypress. The company will likely find a strong, long-term strategic/financial partner to help carry the project all the way through.

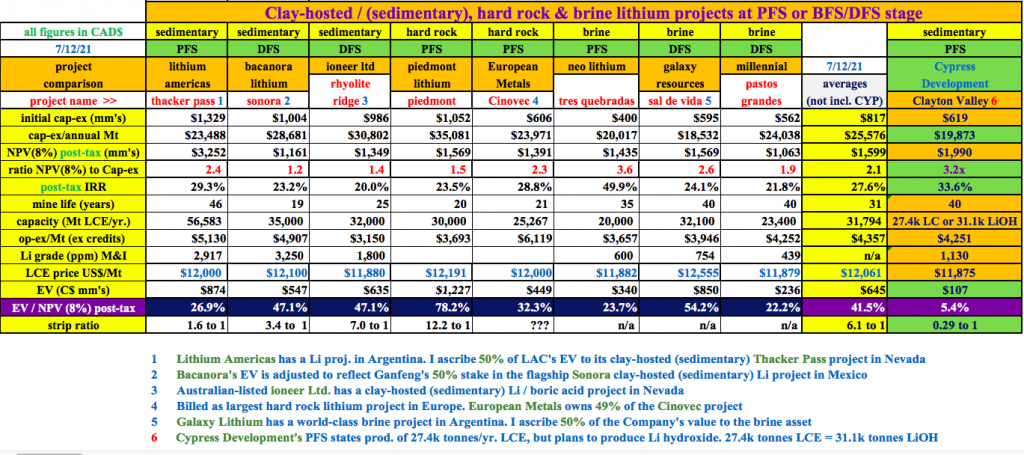

By de-risking the 100%-owned CVLP, management is closing the gap in project execution/technical risks, but Cypress Development Corp. (TSX-V: CYP) / (OTCQB: CYDVF) has yet to close the gap in valuation vs. similar-stage Li projects.

It's not even close. Note in the chart above that on an EV/after-tax NPV(8%) basis, the CVLP project is valued at an 87% discount to peer brine, hard rock and sedimentary (clay-hosted) projects. This disconnect won't last forever.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Cypress Development Corp. was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.