Maurice Jackson: Joining us for a conversation is Jordan Trimble, the president, director, and CEO of Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQB), a preeminent uranium explorer in Canada's Athabasca Basin. Sir, please introduce us to Skyharbour Resources, and the opportunity you present to the market.

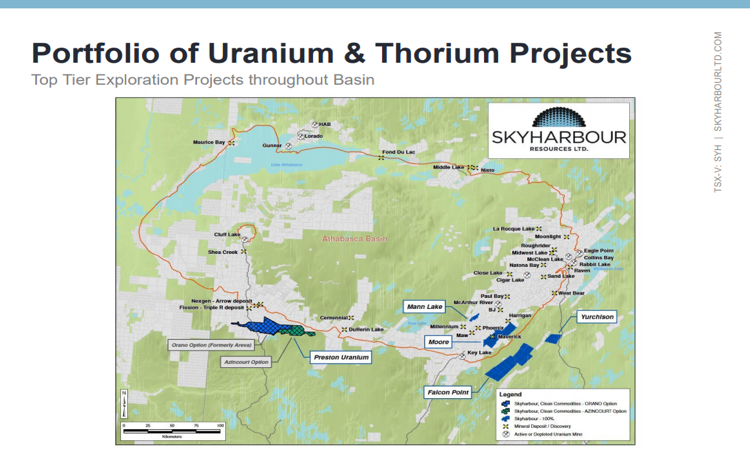

Jordan Trimble: Skyharbour is a high-grade uranium exploration and early stage development company with six projects scattered throughout the Athabasca Basin, which is in northern Saskatchewan in Canada. For those of you not familiar with the Athabasca Basin, it's the highest grade depository of uranium in the world. Saskatchewan is ranked as the number three mining jurisdiction in the world by the Fraser Institute—so, really, it'sthe best place in the world to be looking for and developing uranium deposits.

We started the company about six years ago, and what we saw was the contrarian opportunity in the uranium space to go out and really build a foundation, build a company up that would allow investors to get exposure to a couple of things.

[First, we saw] an improving uranium market, so as a uranium-focused company, when the uranium price moves up, we'll see our share price respond positively. Post-Fukushima, when we started the company, we saw an opportunity to go out and basically build an asset base, put a team together to take advantage of that.

And then secondly, we are an exploration company. We're out there looking for the next big, high-grade deposit in the Athabasca Basin. If you look at recent discoveries in the Athabasca Basin, some notable companies like NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT), Fission Uranium Corp. (FCU:TSX; FCUUF:OTCQX; 2FU:FSE), and Hathor Exploration Ltd. previously, which was acquired by Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) for $650 million. These companies went from small cap, $20 to $30 million valuations, to hundreds of millions on the back of high-grade uranium discoveries in the Basin. At Skyharbour, that is our main focus. We are an exploration, discovery-driven company. We're out there looking for more high-grade uranium mineralization.

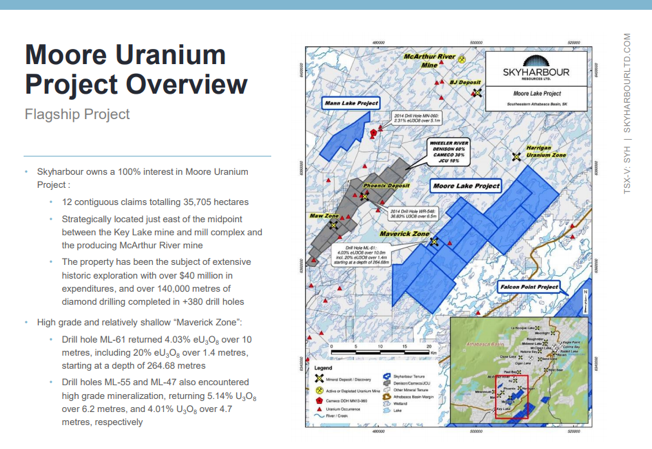

In addition to that we act as a prospect generator, so we do have a dual prong strategy at the company. We have our main flagship project, called the Moore Lake Project, which is situated in the eastern part of the Athabasca Basin, near the infrastructure, near mills and roads, and power. That is where we're drilling and exploring, and that's where we feel we have the best shot of finding more high-grade mineralization. It's important to note that we do have high grade at the project already, at what's called the Maverick Zone. We've found, and previous operators have found, high-grade uranium mineralization. We reported results as high as 21% U3O8over a meter and a half, 6% U3O8over six meters.

We have five other projects that we've acquired over the last five and a half, six years, in addition to our flagship, Moore. Those five other projects we look to option or joint venture out. We look to bring in partner companies, strategic partners if we can, and those partners come in and fund the exploration and development at those projects. We also get some cash and stock payments, typically, as well, and then they earn in, and thereafter, a joint venture partnership is formed.

So, that really allows us to have multiple irons in the fire. It allows us to have potentially exposure to multiple discoveries and successful exploration programs. As a shareholder, exposure to high grade discovery in the Athabasca Basin, which we've seen with other notable companies, has yielded significant returns for shareholders in recent years.

Maurice Jackson: The company employs a simple, efficient business model, known as PTP. What is PTP?

Jordan Trimble: It's an acronym we like to use to simplify the three real, key pillars of the business. It's the people—and within that you have the management team, the board, you have the technical and geological team, you have two notable strategic partners, one of which is our largest shareholder, Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT). They're listed in New York. They're one of the larger publicly traded uranium companies out there. Their president and CO, Dave Cates, is on our board, so [we have] a very close working relationship with them. And another strategic partner at the project level is a company called Orano, which is France's largest uranium mining company, headquartered in Paris—a state-run, big, multinational company. They're earning in 70% at one of our projects called the Preston Project, and to earn up to 70%, they have to spend $8 million, the bulk of which being spent in exploration and development activities over a six year period.

And then last but not least, within the people involved in the company, running the company, and helping us grow this company, are our shareholders, and there's some notable, large shareholders, that are a part of Skyharbour Resources.

The next letter stands for timing, and timing has everything to do with where we're at in the uranium cycle, where we're at in the uranium market right now. As I said earlier, we started this company in a depressed uranium market. We saw an opportunity to go in there and acquire projects at attractive valuations, and build a project portfolio, which we've been doing over the last five and a half, six years. We're starting to see a recovery. It appeared to have bottomed out in late 2016, traded down to $17.75, which is one of the lowest it's traded at, and that's on a per pound basis. It's one of the lowest it's traded at, in inflation adjusted terms, ever. And since then it's been ticking up.

It's been somewhat volatile, but we've seen it trade in between the low $20s and high $20s, but clearly the trend has reversed. So, timing with the uranium market, I think especially right now, is very important, and a key talking point for us as a uranium company.

And then last but not least, the projects—the asset base. As I talked about earlier, we have two strategies. One, we're focused on drilling and advancing our flagship Moore Project. You'll see a news flow out of that over the coming years. We just announced recent drill results from a winter spring program, and planning an upcoming summer program. And then secondly, prospect generation at the other properties, bringing in partner companies to fund and advance those projects, so that we can focus our time, money and effort at our flagship Moore Project.

Maurice Jackson: With regards to PTP, let's begin with the letter T. Jordan, I believe it's paramount for audience members to have a full comprehension on the supply and demand fundamentals of uranium, to truly appreciate the opportunity that Skyharbour Resources presents to the market. Mr. Trimble, what is the current and future demand for energy, and how does uranium fit into this narrative?

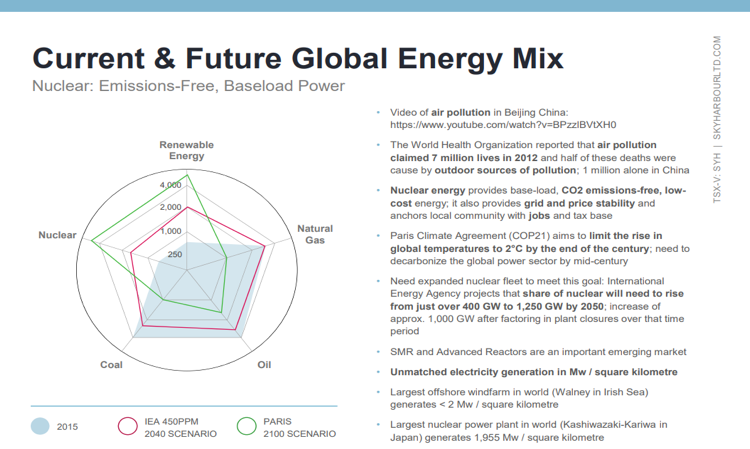

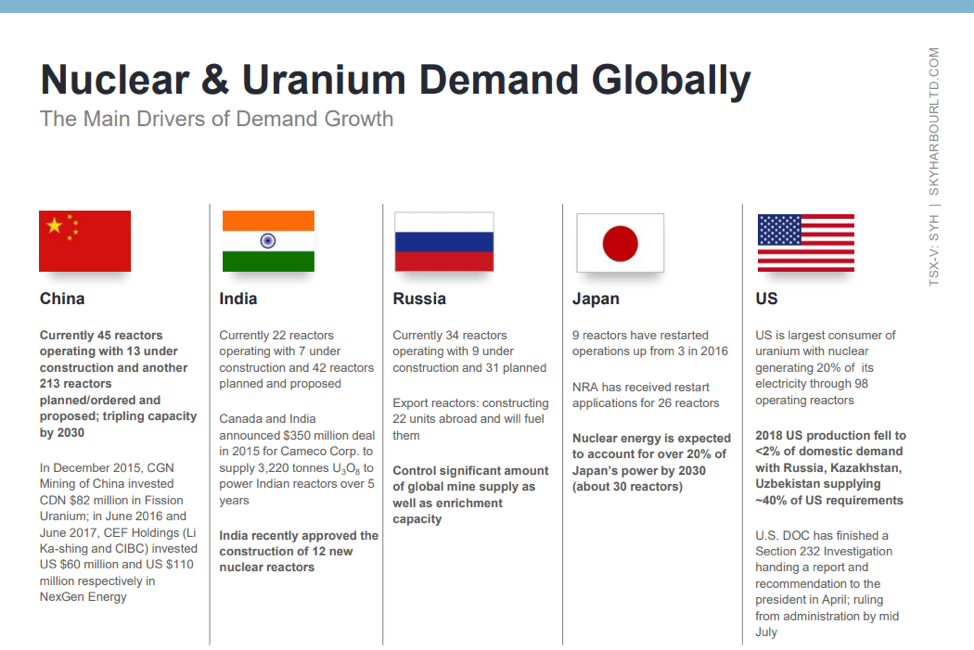

Jordan Trimble: Uranium is predominantly used for nuclear power. Globally right now, you are seeing a number of countries leading the charge, in particular in the developing world, specifically China, India, other parts of the developing world, which are pushing forward their nuclear power plant agendas. Nuclear energy provides base load, CO2 emissions-free, low-cost energy, right? So, it really is the only source of 24/7 clean electricity. It generates electricity to over 90% capacity factor, unlike renewables, [where] you need the wind blowing, you need the sun shining for wind and solar; you need rivers for hydro.

So, nuclear can generate clean electricity 24/7. It's effective. It's cost-effective, and it's quite safe, as well, despite what we may see in the media. Nuclear is reliable, it's low cost, and it's quite safe. It also provides grid and price stability, and anchors local community with jobs and a tax base, so it's a very important part of the global energy mix. It actually accounts for about 11% of global electricity generation. In the United States, it's about 20%, one in five homes, and if you look at countries like France, for example: France gets over 70% of its electricity from nuclear, so it's a very important part of the global energy mix.

It is unmatched electricity generation in a megawatt-per-square-kilometer basis. If you look at the largest offshore wind farm in the world, the Walney [Wind Farm in the Irish] Sea, it generates less than 2 megawatts per square kilometer, whereas the largest nuclear power plant in the world generates just under 2,000 megawatts per square kilometer, so it's also important to note that you can get a lot of clean electricity in a very small area.

So nuclear, as it pertains to the global energy mix, is important, but it's also going to be very important going forward combating climate change. So, if you look at the Paris Climate Agreement from a few years back, trying to limit the rising global temperatures to two degrees by the end of the century, if you run the models, nuclear has to play an important role. You have some major and well-known investors and thought leaders globally that are pro-nuclear, in particular a couple well known people in the U.S., including Bill Gates and Peter Thiel. These are perfect examples of individuals, thought leaders, successful entrepreneurs that have done their research and understand the importance of nuclear as a part of a clean energy grid and generation going forward.

Bottom line is you have global demand for electricity expected to grow by almost 80% by 2030, a big part of that being the advent of electric vehicles, and this is where uranium as the fuel for nuclear power is going to play a very important role. We need to find more of it. We need to see more investment in projects going forward, in new mines that can deliver that uranium, that fuel to the next wave of clean nuclear reactors.

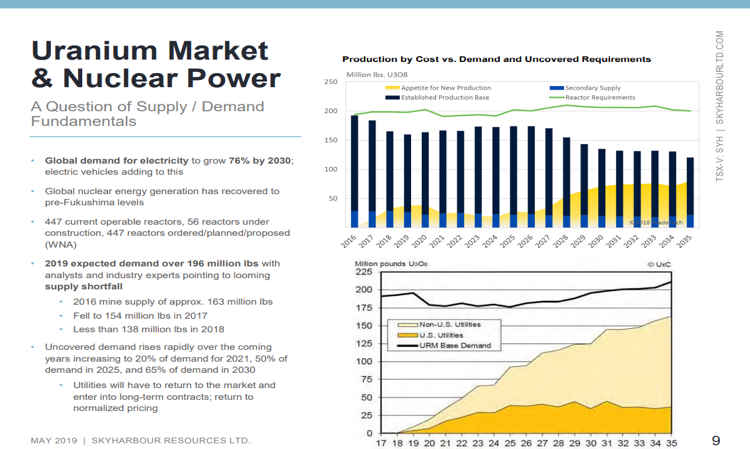

Maurice Jackson: Multilayered question: How many operable reactors in the world, how many are under construction, and how many more are being planned and or proposed?

Jordan Trimble: It's a great question. Currently you have 447 operable reactors globally. You have 56 reactors under construction, and you have about another 450 reactors ordered, planned and proposed. The growth centers for nuclear are in the developing world, where you have billions of people coming up into new middle classes, and these are the places that need a lot of clean electricity. They need base load power. China, India, even parts of Africa, are looking to build nuclear power plants. One good example also is Saudi Arabia, which is planning on developing about 16 nuclear reactors—$100 billion that they're planning to invest in nuclear, and that's quite interesting, given that it's the oil and the solar capital of the world. That says something about nuclear going forward.

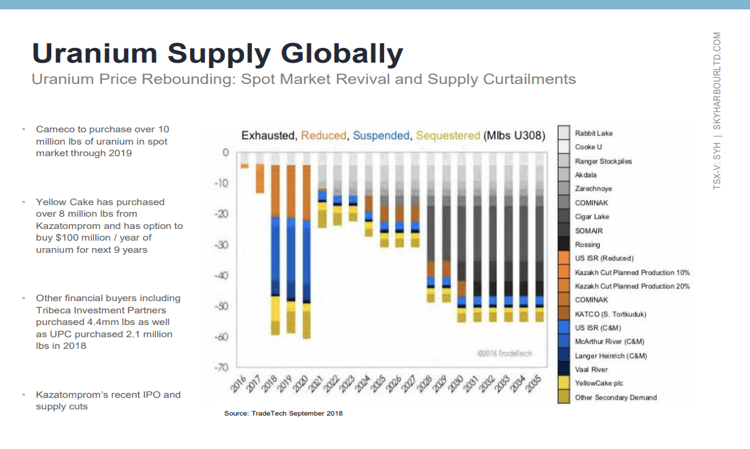

So, you see a pretty steady growth in nuclear reactors, and uranium demand going forward. Just to give you some numbers there: In 2019 we're expecting over 196 million pounds of demand of uranium, and over the last several years, we've seen major supply curtailments, project deferrals and mine closures. You've seen, in 2016, where the primary mine supply amounted to about 163 million pounds of uranium. That's fallen to less than 138 million pounds here, and we expect that number could continue to decrease with new projects that are being deferred. . .mines that have been producing uranium that are coming to the end of their mine lives, and simply underinvestment in new projects. So there is a major supply deficit looming here, with primary mine supply well below the average consumption of uranium. That supply deficit has had to be met by secondary supply, so we've been eating into inventories and secondary supplies to meet the annual demand and annual reactor requirements.

Maurice Jackson: What does the current cost of capital for uranium producers, versus the current spot price, suggest?

Jordan Trimble: Yeah, so this is a big talking point right now, where you have the current spot price at about just under $25 a pound. The contract, long-term contract price is about $32 a pound. The average all-in cost, globally, is between $40–45 a pound, and the price needed to incentivize new production to come online, new builds, new project development, a lot of analysts are estimating that between $50 to $60 a pound, so you are trading at a significant discount to the average, all-in cost of production, as well as the price needed to incentivize new development, and that's where it gets exciting in terms of the potential upside.

We've seen the price of this commodity over a 50-, 60-year period go through these boom and bust periods. It's a very cyclical commodity. We've seen it go through long periods of low prices, and it's like a coiled spring. It goes through these long bear markets, and then we see the supply side respond, which is what we're seeing right now. We see demand continuing to grow, and all of a sudden, we see the price shoot up, and we saw this a couple times in the last 15 years. In 2006–2007, we saw the price move from $15–20 a pound in the early 2000s, to a high of over $130 a pound, and needless to say, uranium equities did very well during that period of time. A lot of money was made.

And then again, after 2008, the price got down to $40 a pound, and we saw it almost double back up to $70 a pound in 2011, right before the Fukushima accident happened. So, now we're back down to $24–25 a pound, and I think we're gearing up for a big move over the coming years.

Maurice Jackson: With uranium, the spot price is only part of the story. What gets overlooked in the discussion is the contract price. Where is the supply going to come from, and at what cost?

Jordan Trimble: You see two prices for it. The spot price, which again is in the mid-$20s, seems to be what equity market participants look at. But the reality of it is most uranium historically has traded through these long-term contracts, and the current contract, long-term contract price is about $32 a pound. And what we see happen in this sector is the largest buyer of uranium—being utility companies, nuclear utility companies globally—typically get their uranium through these long-term contracts with mining companies, and so you don't see it like the spot market, moving as much on a daily basis. . .It's a little stickier, and it's based off of recent contract prices, but that's really the price that, again, most of the material is traded at, is bought at. So that's really the price that needs to be looked at.

Nonetheless, people still focus in on the spot price. We have seen quite a bit of spot market activity in the last several years, and I think this is a bullish indicator. In 2018, we saw over 88 million pounds transacted on the spot market, which is one of the highest, I believe, level of spot market activity in volume ever. So, when we talk about the price of the uranium, we look at 2016, and the spot market, as a bottom being put in. We are now seeing the volume indicate, along with the rising price, indicate a real recovery underway, and I think it's all gearing up for a breakout. There are a couple of key catalysts on the near term horizon that we'll talk about, but this is all bullish for the price, and it is, again, important to distinguish the contract long-term price, and the spot price.

Maurice Jackson: Does Section 232 in the United States factor into this discussion?

Jordan Trimble: That's a great question, and I'll get to that, but just before I do, and this ties in with that question, as well, I'd like to just talk briefly about what I think will be the biggest catalyst for the price, both in the spot and the contract price going forward—[which] is a new contracting cycle. And we've seen this in the past, 2006, 2007, 2009 to 2011: What really drove the price were new long-term contracts, big contracts being signed between the mining companies and the utility companies. If you look at the next five to ten years, there are a lot of uncovered requirements. That means uncovered fuel requirements at the current, operating nuclear reactors.

So, that's current contracts that will be expiring, and have to either be renegotiated. That material will then have to be bought somewhere else. So, if you look at the numbers here, about 20% of demand for 2021, 2022 is uncovered, 50% by 2025, and almost two thirds by 2030. And the U.S. nuclear utilities: In the next several years, their uncovered requirements go up quite a bit, so they're going to have to come back to the market here shortly, and that's important when we talk about this Section 232.

So, for those that aren't familiar with Section 232: It's a petition. A group of U.S. nuclear or uranium mining companies lobbied the Department of Commerce to open up an investigation into where the U.S. is importing its uranium from, and the effects of that on the domestic uranium mining industry. So, just a couple of stats here: As I said, nuclear power accounts for about 20% of electricity in the United States. It's the majority of clean electricity that's generated in the United States, but a lot of people don't know this. The U.S. actually has to import over 95% of its annual uranium demand now, and that is what they deem to be a national security issue, especially given that 40% of that comes from three, as they call them, adversarial nations: Kazakhstan, Russia, and Uzbekistan.

The U.S. only produces a very small amount of uranium domestically. In fact, in 2019, it's expected to be less than one million pounds. They consume almost 50 million pounds with the nuclear reactor fleet. And you've got to remember, the U.S. is still the largest consumer of uranium, they have the largest nuclear reactor fleet, so it's a big part of annual demand, yet they are reliant on foreign supply, in particular from those three nations, to get it.

The Section 232 investigation looked into this. A report announcing and reporting on the final findings of that investigation has been submitted as of mid-April, and there's a 90-day review period, which is currently underway, which ends in the middle of July, in which the Trump Administration will review this investigation and the report, and they will come out with a ruling.

Now, what this has created, and I don't think this was the intention of it, is a bit of a lull. It's created uncertainty in the market. U.S. nuclear utilities don't know what the findings are, and don't know what the ruling is going to be. What they're pushing for, and this was a part of the investigation, is pushing for a 25% quota system, so U.S. nuclear utilities would have to buy 25% of their uranium requirements from domestic sources of uranium. Now, the issue there is that the U.S., as I said, is not producing anywhere near that amount right now. For them to get to that level—of about 12 to 13 million pounds, up from less than one million pounds currently—is going to take probably five to seven years, and you're going to need to see a much, much higher uranium price, probably close to a doubling of where the spot price is right now. So, you need to see a two-tiered price system.

Even if that 25% quota is implemented, it's going to take a while to get there, and you're going to need to see a much higher price paid, because U.S. producers can't make a profit at the current spot price. What I think you'll see happen in the short period of time right after 232 [is] a number of positive things happen in the space. One, it'll take the uncertainty away from the utility companies. This cloud that's been hanging over the whole sector—that's put downward pressure, I believe, on the price recently. You will now see, I think, utility companies, especially in the U.S., come back to the market. As we talked about earlier, there's a lot of uncovered requirements in the next few years, so they'll have to come back to the market, but they'll have some clarity on where they have to get their uranium from.

So, you'll see these utilities coming back. They have not been contracting. There's been very little contracting over the last few years, and in particular in the last year, where you've had this uncertainty surrounding 232. I think you'll see utilities, the main buyer, coming back, [with] the largest buyer being U.S. nuclear utilities. That, I think will spur a price rally in the coming months, but also, it could benefit Canadian companies, and Australian companies, allies of the U.S., because where is the U.S. going to get supply of uranium over the next few years, if mining companies cannot supply what they need to meet that quota? It's likely that U.S. nuclear utilities will look north to Canada, and that will benefit Canadian uranium companies.

Maurice Jackson: What's going on on the demand side for uranium?

Jordan Trimble: Yeah, so we've talked about what's happening in the United States. That's really dominated headlines with 232, and it'll be good to have that out of the way. But globally, nuclear is growing, as I said, in the developing world. China's really leading the charge: Currently, [it has] 45 operating reactors, 13 under construction, and over 200 more planned and ordered. They're planning to triple their nuclear capacity by 2030. Air quality is a big problem in China. Millions of people a year are dying from poor air quality—pollution generated from coal plants, from gas and oil plants—o that's where nuclear and nuclear power comes in.

And if you look at what China's been doing over the last five or six years, they've made strategic investments into uranium companies, and in particular, into Athabasca Basin, high-grade uranium companies. In 2015, CGN [China General Nuclear Power Group] invested $82 million into Fission Uranium, becoming the largest shareholder, CGN being one of China's largest nuclear utility companies. And then also in 2016 and 2017, CEF Holdings Ltd.—Li Ka-Shing—has invested close to $200 million into NexGen Energy, so you are seeing Chinese money coming into Canadian Athabasca Basin stories.

And then if we move over to India, again, [we find] another growth center for nuclear power, [with] 22 reactors operating, 7 under construction, 42 reactors planned and proposed. Canada and India recently announced a $350 million deal whereby Cameco Corp. (CCO:TSX; CCJ:NYSE), the largest publicly traded uranium mining company based here in Canada, [will] supply India with uranium and nuclear fuel over a five-year period. And more recently, India's just approved the construction of 12 new nuclear reactors, so China and India are really leading the charge on new nuclear reactors. As I said, new nuclear reactors also being built in the Middle East, in Russia, in other parts of the developing world.

And then last but not least, Japan. And Japan really has been the elephant in the room. We all know what happened at Fukushima. Japan was one of the largest consumers of uranium, had one of the largest nuclear power plant fleets. They shut almost all of those down after Fukushima. We have started to see an acceleration in Japanese nuclear restarts. We now have nine reactors up and running, up from three in 2016. There are 26 reactor restart applications in Japan that the NRA (Nuclear Regulatory Authority) is looking at. And last but not least, you have a leading government there, the Abe Administration, that has stated they are pro nuclear. They want to bring nuclear back up to over 20% of Japan's electricity generation by 2030, so they'll need about 30 reactors online to do that, up from the current nine.

Maurice Jackson: Can you address some of the concerns on the supply side?

Jordan Trimble: This is really what has started this initial recovery, is we've seen the supply side respond to the low-price environment we've been in. It really started in 2016 and 2017. You had Cameco shut down a few of its mines. Orano, previously known as Areva, shut down some of its production. And then the big news came in 2017, when Kazatomprom, which is Kazakhstan's state-run uranium mining company, Kazakhstan's largest producer of uranium globally, they announced initial production cuts at some of their mines. And it's important to note that these are some of the lower cost mines in the world.

We're not talking about higher-cost, marginal production being shut down because of a low uranium price. We're talking about lower-cost producers shutting down production; a wave of curtailment and reduced production from several mining companies. Cameco followed suit by shutting down the world's largest uranium mine, at McArthur River. This accounts for about 12% of global annual production. It simply is more profitable right now for Cameco to buy material in the spot market in the mid-$20s, and then sell it into their higher price, longer-term contracts, than it is to be producing from the highest-grade uranium mine in the world at McArthur River.

So, that production has been shut down. It's going to take time for that to come back online. They're going to need to see a much higher price. We've seen a number of notable production curtailment, and we've also seen projects deferred, and we're now starting to see some big projects, some bigger mines that are coming to the end of their mine lives. . .a few in Africa, Rossing being one. We're seeing a few, [like] Akdala in Australia, as well, that are simply coming to the end of their mine lives, so millions of pounds will be coming offline over the coming years. Again, the supply side is starting to respond. I think that's what started this recovery that we're in, and I think you'll see that continue.

And then we've also now seen some funds, some new financial buyers, over the last couple years that have come in. They've recognized this structural mispricing in the uranium market. Most notably, about a year ago, a group of London called Yellow Cake Plc (YCA:LON), which is listed in London, raised over $200 million to buy just over eight million pounds of uranium directly from Kazatomprom, effectively taking that material out of the spot market, which has strengthened the market. Now, they have an option to raise and buy $100 million worth of uranium each year for the next nine years. So you've seen new funds, new financial buyers, coming into the market to take advantage of this structural mispricing. And then last but not least, again, I talked about Cameco shutting down McArthur River.

Cameco still has to deliver into these long-term contracts that they have, and it's more profitable for them right now to buy in the spot market, at the low price in the mid-$20s, and then sell into those contracts. Now, 2018 was the first year they started doing this. They helped drive the price this time last year from the low mid-$20s to the high $20s. We saw the uranium mining companies move up with that. We've seen that kind of stall out and pull back a little bit, and a big reason for that is that Cameco has been less active in the spot market recently.

I think we will see them coming back in, in a more meaningful way, between now and the end of the year. We know that they have to buy millions and more pounds before year-end to deliver into their contracts, so I think that's going to be yet another big near-term catalyst that will drive a higher price.

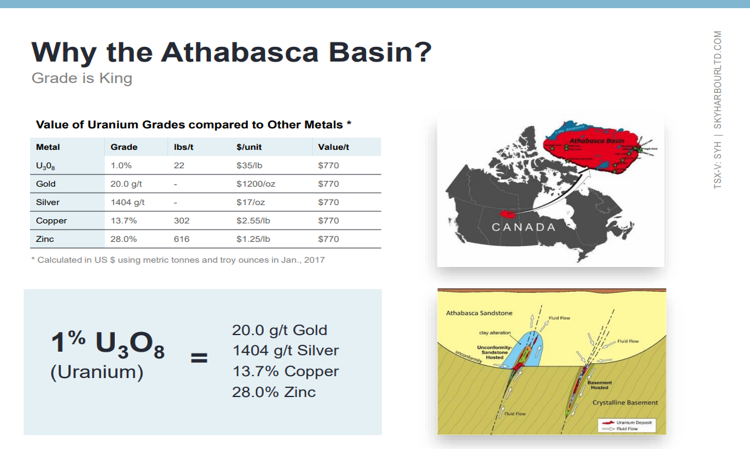

Maurice Jackson: Boy, what an opportunity we have before us in uranium. Let's discuss the value proposition before us in Skyharbour Resources. Now, Skyharbour is an exploration company, and prospect generator, in the Athabasca Basin. Strategically, why did the company invest most of its project portfolio in the Athabasca Basin?

Jordan Trimble: There are a couple of reasons that we were interested in building a project portfolio in the Athabasca Basin. We'll start with the fact that is the highest-grade depository of uranium in the world. It's unparalleled. The average grade in the Athabasca Basin is about 2% U3O8, whereas the global average is about 0.1% U3O8.So, a combination of unique geological qualities and characteristics create the environment for these super-rich uranium deposits, and as an exploration and early-stage development company, that's exciting for us. Because even in a low uranium price environment, as we've been in, you can still generate significant returns for shareholders through new high-grade discoveries.

And perfect examples of that, as I mentioned earlier, are NexGen, Fission, Hathor, Denison at the Gryphon Deposit recently, and previously at Phoenix. There's been a number of notable high-grade discoveries in the last 10 years in particular.

And secondly, when we started the company, we saw an opportunity to go into projects, acquire projects in the Basin, with a new look, using some new techniques, some new ideas, some new methodologies that have been used effectively to make these recent high-grade discoveries. [These include] some new geophysical techniques, understanding the geology and the geochemistry better, using some new drilling techniques, and then a big one has actually been looking for uranium deposits in what's called the basement rock.

I won't get in the weeds on the geological lingo, but there are a couple types of deposits in the Basin. You have the sedimentary sandstone above, and then below that, you have what's called the basement rock, and the contact between these two types of rock is what's called the unconformity. You typically find the uranium deposits above, in the sandstone, at the unconformity, or in the basement rock. More recently, exploration drilling has been focused on finding these new high-grade deposits in the underlying basement rock. That's where NexGen's deposit is, that's where Fission's deposit is. There's a lot of potential in the Basin on projects that have high-grade uranium in the sandstone or at the unconformity, but haven't been properly tested for the feeder zones, the source of that high-grade mineralization in the underlying basement rock. That is one of the key themes that we're going on, the key strategies that we're employing at our flagship project right now. We know we have high grade at the unconformity, and in the sandstone, but very little historical drilling [has been done] in the underlying basement rock. And just recently, we've started hitting our first high-grade zones of mineralization in the underlying basement rock, which is quite exciting for the company.

Maurice Jackson: I like the business acumen in the use of optionality. Skyharbour has six projects in the Athabasca, encompassing over 200,000 hectares, that have approximately $80 million worth of historical exploration, and was purchased at over four and a half million. Let's discuss the exploration projects first, and then cover the project generator second. Skyharbour has two deposits. Let's go to the Moore Lake flagship project. What makes Skyharbour Resources confident that you have the next big, great discovery here?

Jordan Trimble: We'll start with a quick overview of the project base before getting into a deeper dive on the specific project. So, six projects, about half a million acres worth of land scattered through the Athabasca Basin, both on the east and the west side of the Athabasca Basin. The flagship [is] our Moore Project—that's where we're drilling, that's where we're exploring, but we also have the five other projects, where we are looking to bring partner companies in as a part of our prospect generator model.

As far as valuation's concerned, we've acquired these projects at really pennies on the dollar, as you mentioned—about four and a half million in stock cash, and over a period of the last five and a half, six years. To shed some light on valuation, these projects have had over 80 million in historical exploration and development work on them. At one point in time, two of the projects, Moore Lake and Falcon Point, were in a company that was valued at over $350 million in the previous uranium boom in 2006-2007, so there's a strong rerating potential with the current asset base in the company right now.

If you go and look at our flagship project, Moore Lake, this is really what is going to be providing us and our shareholders the most catalyst coming up. We own 100% of it, and this is the most advanced stage project of all of them. There's a high-grade zone there called the Maverick Zone. There's actually several high-grade lenses, and as I said previously, we're just starting to drill a little bit deeper, looking for the source of that high-grade mineralization in the basement rock.

But in addition to the Maverick Zone—which is hosted on a four-kilometer corridor, so it's only a few hundred meters long for this Maverick Zone, or multiple lenses—there's other zones along strike that have yet to be fully drill tested. About two kilometers of that four-kilometer-long corridor has yet to be properly drill tested, as well as systematically drill tested.

There's still a lot of room to move along strike, and as I said, also at depth in the basement rocks. We do have about a dozen other regional targets on the property, and in our most recent round of drilling, we actually made a new discovery about seven kilometers away from the Maverick Zone, at what's called the Otter Zone. This is a brand-new zone that we just finished a couple drill holes at, and we hit, in one of the holes, uranium mineralization, so there will be some follow-up work regionally, as well as at the Maverick Zone, and the Maverick corridor, in our upcoming drill programs.

[In terms of] recent success at the Maverick Zone, some of our recent drill holes returned very high-grade mineralization, up to 21% U3O8 over a meter and a half. Just to put some perspective on that, 1% U3O8 is equivalent to about 20 grams per ton of gold, 1,400 per grams per ton of silver, almost 14% copper. So that just gives you an idea of how valuable that mineralization is on a per ton basis.

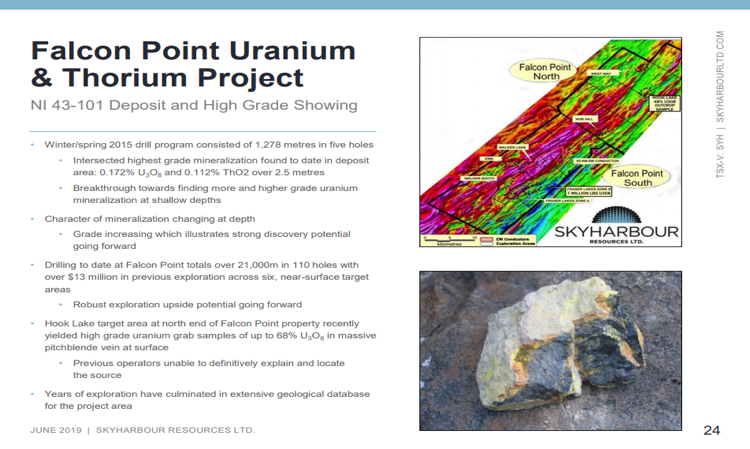

Maurice Jackson: To your second deposit, Falcon Point, which has an NI 43-101 published in 2015 demonstrating high-grade in the inferred category. Why are uranium investors excited about this project?

Jordan Trimble: Falcon Point is a very important project in our portfolio. It has an NI 43-101 inferred resource, both uranium and thorium credit, as well. We own 100% of it.

Now, Falcon Point plays in with our prospect generator strategy. We are currently looking to bring partner companies in there, when we can option off or joint venture off a part of the property. We have the deposit area on the south end of the project, but interestingly, we have a very high-grade surface showing that runs up to 68% U3O8at surface. We have plans to bring in a partner company that can then go and further test that high-grade surface showing. Some more geophysics can be done there, and then [we] ultimately look to drill test that.

With the NI 43-101 resource on the south end, high-grade surface showing at the north end of the property, and ties into our broader prospect generator strategy, our Preston Project and our East Preston Project are important part of our portfolio. These are perfect examples of where we've actually brought in partner companies to fund the exploration and development work going forward, starting with a strategic partner in Orano. Orano, as I mentioned, is France's largest uranium mining and fuel processing company. It is based in Paris. They have mines and projects all over the world. They have a big geological team. They know the Basin quite well, so we get to leverage that technical expertise as they fund the exploration and work at our Preston Project.

The deal is structured as such: [Orano] can earn up to 70% of the property by spending a total of $8 million over a six-year period. They're about halfway through that—$7.3 million of that in exploration, $700,000 in cash payments. At that point, a joint venture partnership will be formed, and Orano will become the majority owner of the project. They, this year, have a $2.2 million budget. They just completed a winter-spring drill program, with results to follow. They are planning for additional exploration and drilling programs going forward, so that's an important part of our story.

Just beside that project, on a property we have called the East Preston Project, we structured a similar deal with a company called Azincourt Uranium Inc. (AAZ:TSX.V), and Azincourt can earn up to 70%, as well, by spending just under $4 million in exploration and cash payments. They have $1.4 million that needs to be spent by March 2020, and then a couple hundred thousand dollars in cash payments that come in, as well. They've just announced recent drill results—the first drill program that they've carried out at East Preston—[and are] seeing all the right things. They are planning for a much larger program soon. They will get the drill rig back there to drill over a dozen undrilled targets that they have, and follow up on the first few holes that they drilled earlier this year.

So, collectively those two companies have made a big spend over a six-year period—about $11.5 million in project consideration, $9.8 million of that combined in exploration, $1.7 million in cash payments, and those companies can earn up to 70%.

Maurice Jackson: Is the ultimate goal for Skyharbour Resources to build a mine, or arbitrage?

Jordan Trimble: My history, and my management team and board of directors, we have a history of selling companies, selling projects—that is the ultimate goal here. We would like a larger company to come in and buy the projects, and or buy the company. We are looking for an ultimate acquisition of the company upon making new discoveries and advancing the projects, and hopefully we see that in a rising uranium market, and that will help get us a much higher valuation.

Maurice Jackson: Good. Let's address the bad. What can go wrong, and what is your action plan to mitigate that wrong?

Jordan Trimble: So, I think one of the things that does keep me up at night is we are in the business of exploration. It's high risk, high potential return, so you can't guarantee exploration or drilling success. What we do, though, as I mentioned, is we are using some innovative techniques. We are going through all of the, and have gone through all of the historical data, and adding the recent data from all the work that we've done, to really give us and our shareholders the best shot, the best potential of being a part of a new, big discovery. And so, that to us is a big part of what we do on a daily basis, when we go out there and we carry out these drill programs, or our partner companies carry out these drill programs and exploration programs, we want to know we have the best targets selected.

And there's a lot more tools at our disposal: geophysical techniques, certain types of drilling, directional drilling, more targeted drilling, some new geochemical analysis and understanding that we've done at our flagship Moore Project, that really give us the best chance at finding additional zones of high-grade mineralization, so you can never guarantee exploration success, but you can certainly increase your odds of finding more.

Maurice Jackson: Switching gears, let's discuss the people responsible for increasing shareholder value. Mr. Trimble, please introduce us to your board of directors.

Jordan Trimble: Getting back to the acronym PTP, this is the first P, and this could be one of the more important parts of the business, the people running it, the strategic partners, and as I said, the larger shareholders. So, I teamed up with my head geologist, a gentleman named Rick Kusmirski. We like to call him Radioactive Rick. He's been working in the Athabasca Basin for over 40 years. He's made multiple high-grade uranium discoveries in the Basin. He was previously the exploration manager at Cameco, and then he left Cameco and started his own company, JNR, in the late '90s, early 2000s. He had success there. He took the company from a $4 or $5 million valuation, and was trading at over $300 million in 2006–2007. He ultimately sold the company to Denison Mines. As I mentioned earlier, Denison is a strategic partner of ours. They're our largest shareholder, and Dave Cates, who's the president and CO of Denison Mines, is on our board of directors.

David Cates is an important part of the team. Again, a very close working relationship with Denison, and Dave's team there. And then the chairman of the company, who I've worked with for a number of years now, is Jim Pettit. Jim has over 30 years of experience in the industry. Previously, he ran a gold company called Bayfield Ventures. That's where I started my career in the industry. I was working with Jim at Bayfield, and what we did at Bayfield was we made a high-grade gold discovery in Ontario in 2010, we had success there, and then ultimately, the company was acquired by New Gold Inc. (NGD:TSX; NGD:NYSE.MKT) in 2013 and 2014. That's when I started Skyharbour, so Jim is the chairman. He and I work together here in Vancouver. My geological team, led by Rick, is in Saskatoon.

And then some other notable names on the board and advisory board. Paul Matysek is a strategic advisor, very well-known individual in the mining space. He's built and sold a number of companies in the last 12 years, most recently Lithium-X, as well as Goldrock Mines, but his biggest win was a company called Energy Metals Corp., which he started in 2004 at a $10 million valuation, and sold it three years later for $1.8 billion, to Uranium One Inc. (UUU:TSX). Paul knows a thing or two about building companies, about selling these companies; an important advisor to our team.

And then we also have Simon Dyakowski, who runs corporate development. He's a 10-year veteran, worked as a stockbroker and, as well, worked at a few larger banks, including RBC and Bank of Tokyo-Mitsubishi. And then [there is] Christine McKechnie, who's a consulting geologist, one of the head field geologists for us. She actually wrote her thesis on the deposit that we have at the Falcon Point project, so she knows our project base well. She previously worked at Eagle Point uranium mine in the Basin with Cameco. Dave Billard, who works directly with Rick, is one of our geologists as well. Nick Findler handles the investor relations, and then Don Huston, who's an industry veteran as well, is a director of the company.

So, [our] very well-rounded team [brings] capital markets experience, and management experience, as well as a geological and technical team with focused expertise on uranium exploration in the Basin. It's important to have people that know how to find specific types of deposits, and we have that with Rick, Christine and Dave leading the charge on the properties.

Maurice Jackson: Who is Jordan Trimble, and what makes him qualified for the task at hand?

Jordan Trimble: Yeah, so I started the company, like I said, about six years ago. I saw an opportunity to build a uranium company, to ride this next wave up—specifically, high-grade uranium exploration in the Athabasca Basin. As I said, previously I was working at a gold company with Jim called Bayfield Ventures. We had exploration success, and were ultimately acquired by a larger gold mining company. Again, this is what we're trying to accomplish here at Skyharbour.

I come from more of an entrepreneurial background. I've worked with several companies in the past, specializing in corporate finance and strategy, shareholder communications, deal structuring, capital raising and management. And I'm a CFA charterholder, I currently serve as a director on the board of the CFA Society, Vancouver. Been working in the industry for about 10 years now, so again, looking to have success here with Skyharbour, in the field, on our projects, with our partners, but also in the backdrop of a rising uranium market.

Maurice Jackson: Please provide the capital structure for Skyharbour Resources.

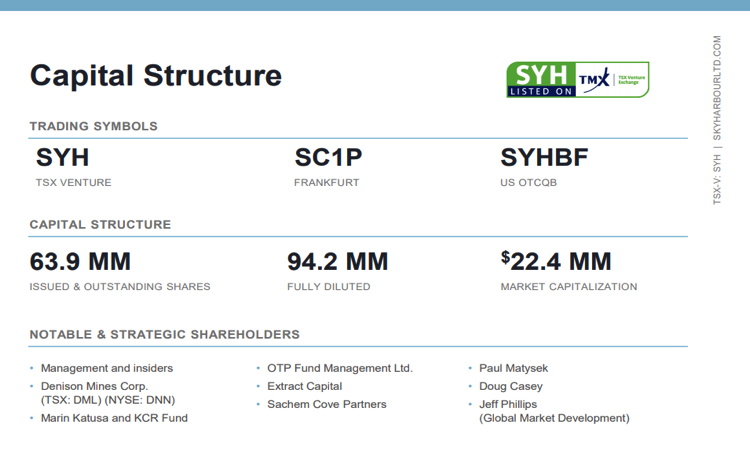

Jordan Trimble: Skyharbour has 64 million shares issued and outstanding. We trade on the TSX Venture at about CA$0.33—0.34, so [we have] about a CA$21 million market cap—still small cap, with a lot of room to move. We do have a U.S. OTCQB listing, SYHBF in the U.S., and the ticker symbol in Canada on the TSX Venture is SYH.

The structure? It's a very well-structured company, as I said, with 64 million shares issued and outstanding. The public float on that, I would say is about 50%, and just to cover some of the notable and strategic shareholders, we have management and insiders, we own a large position in the company. We believe in what we're doing. Denison Mines is our largest strategic shareholder. Marin Katusa and the KCR Fund: Marin's been a cornerstone investor, really from day one. He and his fund are two of our larger shareholders.

OTP Fund Management, which is OTP Bank, the largest bank in Hungary—they have a resource fund that is a large shareholder of the company. Extract Capital out of New York and Toronto [as well]. Sachem Cove Partners, run by Mike Alkin, is a new uranium fund that's taken a large position in the company. And then a couple of other notable names: Paul Matysek, who's a strategic advisor, and Jeff Phillips, down in California, are very large shareholders of the company.

Maurice Jackson: Multilayered question: What is the next unanswered question for Skyharbour Resources? when can we expect a response? And what determines success?

Jordan Trimble: The biggest one has to do with our exploration and drilling. So we just announced results from our winter and spring program. You can see those results. Again, the new zone, East Maverick zone, our first drill hole into it we've intersected high-grade uranium in the basement rock, so a big success for us there. Also, we found new zones of uranium mineralization regionally, new discoveries, so we want to follow up on all of this with our upcoming summer program, which will commence in the coming months. We will have news flow from that through the summer and into the fall.

Drilling and exploration really is the main catalyst for Skyharbour. Again, you look at recent discovery stories, like NexGen and Fission, and Hathor, previously: This is really what drives a higher share price with exploration drilling success. But secondly, as a uranium company, we do offer exposure to the underlying commodity, and as I've highlighted in this interview, there's some notable upcoming catalysts in the near term—again, the resolution of Section 232, Cameco spot market purchasing, supply cuts, and a supply side response. That's, I think, helping to drive higher uranium prices.

We will benefit from a rising uranium price. It's important to note that there's very few uranium companies left. We've seen a major contraction in the industry, and the combined market caps of all publicly traded uranium, of all publicly traded uranium companies, is less than CA$15 billion. We've seen a major contraction from hundreds of publicly listed uranium companies back in 2006–2007, to really less than 40 active companies.

So, what that means is that when money comes back into the space, and is looking to get investment exposure to the space, it only has a few names to go to, and Skyharbour is one of the few companies that's stuck around, that's been able to take advantage of these depressed market conditions. We'll be one of the first companies to benefit as we see this continued recovery, and I think break out in the next year or two with uranium price.

Maurice Jackson: Last question. What did I forget to ask?

Jordan Trimble: Everything. Again, getting back to the people, the timing, the projects, we have the right team in place to execute on our business plan, and our dual prong strategy going forward. The right management team, technical geological team, and strategic partners in Denison and Orano. Timing with the uranium market, I think that's vital right now. We're seeing a recovery play out. I think we'll see continued momentum, especially as new, longer-term contracts are signed, as 232 comes to a head.

And last but not least, the asset base, the projects, right? We're exploring them, we're advancing them. These projects were worth a lot of money in a previous company back in 2006–2007. I think there's strong rerating potential, and Skyharbour offers investors exposure, again, not only to high grade discovery potential at our project base, and with our partner companies, but also to a rising uranium price.

Maurice Jackson: The website is www.skyharbourltd.com. For direct inquiries, contact Nick Findler at (604) 639-3850 or you may e-mail [email protected]. Skyharbour Resources trades on the TSX.V: SYH |OTCQB:SYHBF. Skyharbour Resources is a sponsor of Proven and Probable.

As a reminder, I'm a licensed representative for provenandprobable.com for Mining Insights and Bullion Sales.

Jordan Trimble of Skyharbour Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Skyharbour Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned.Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources, a company mentioned in this article.

Images provided by the author.

Proven and Probable Disclosures:

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.