The gold price is 30% higher in the past year, silver is +130% in the last five months. Some are wondering what the next bull market move in metals and mining will be. I think there's a good chance it will be uranium. An increase in the spot price from today's $31/lb to $40/lb would make a world of difference for sector sentiment. Earlier this year, the price hit a 4.5-year high of $34.2/lb.

All eyes are on Cameco and Kazatomprom as they buy uranium in the spot market to help meet their customer requirements. The more they buy, and the longer they're active in the market, the more likely we will see a spike in the price. Uranium prices can move very fast. In a six-week stretch from mid-March to late April the price soared 42% from $24.00 to $34.05/lb.

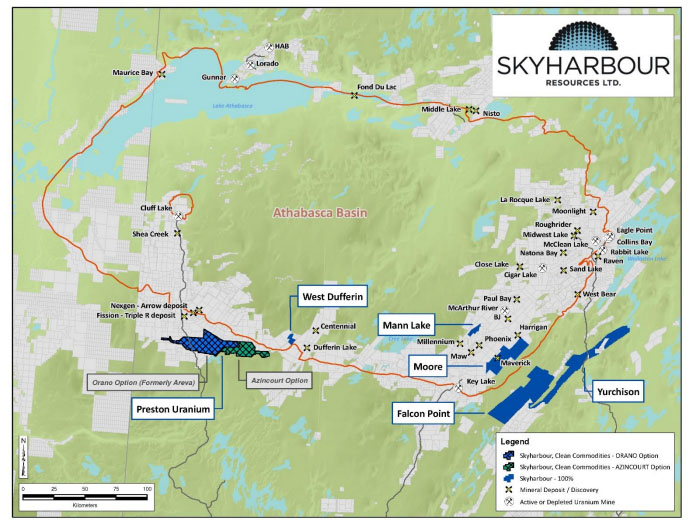

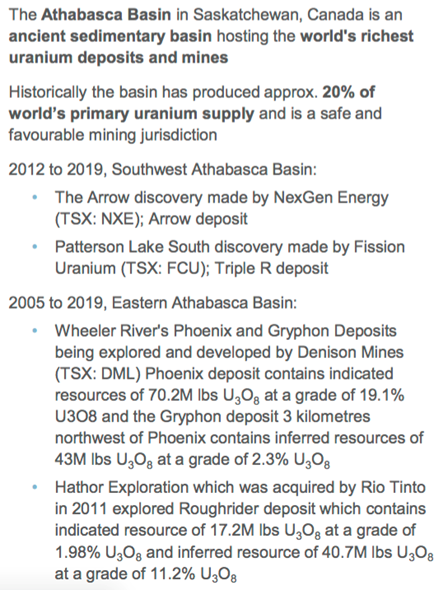

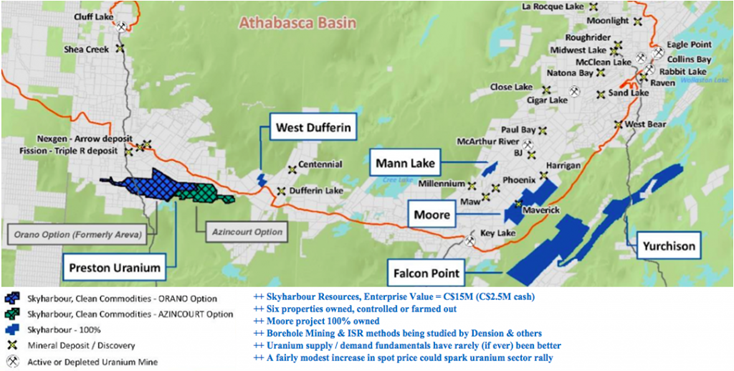

Yet, that was merely a bounce off of oversold levels. A 30% increase from today's $31/lb would get the price to $40/lb, still on the low side over the past 15 years. Now, instead of me reporting facts and figures from the World Nuclear Association website, I turn to Jordan Trimble, CEO of Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQB), to get his up-to-the-minute views. He expertly reads between the lines so that we don't have to….

Peter Epstein: Uranium fundamentals were great two years ago…. they were extraordinary a year ago…. and even more compelling now. Yet, the uranium spot price sits at US$31/lb. How soon before we see prices above US$40?

Jordan Trimble: The uranium price is moving in the right direction; the spot price has increased from the mid $20s to the low $30s/lb U3O8. Summer is seasonally slow, but I believe we're now witnessing the early days of a new bull market. First, we saw a major supply side response play out due to historically low prices. Then, the pandemic caused further significant supply curtailments.

Primary producers shut down or cut back production including Cameco with Cigar Lake shut for five months (and McArthur River is still on care and maintenance). Several producers in Africa have slowed or closed.

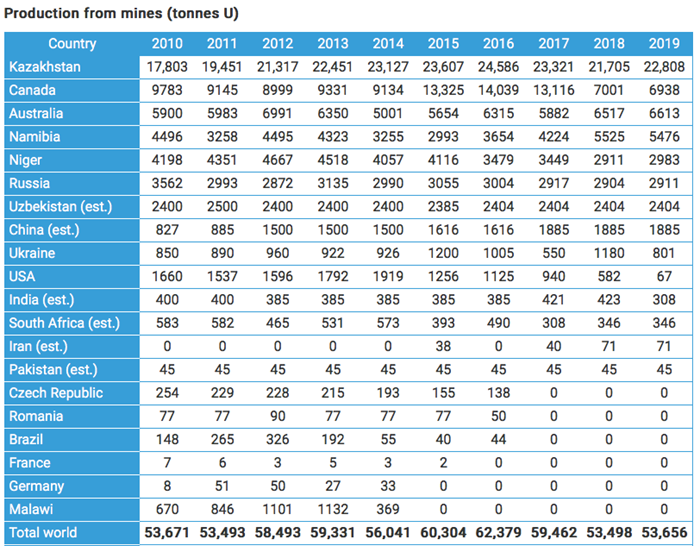

Kazatomprom in Kazakhstan, which accounts for up to 40% of global production, said output would be down 16% in 2020. In order to meet contractual requirements with utilities, producers need to acquire millions of pounds of uranium in the spot market this year.

A major supply deficit is forming to the tune of 50–60 million pounds of U3O8 in a market of 180 million pounds. This could be exacerbated if Kazakhstan is unable to ramp ISR production up as quickly as it would like. Shifting to demand, the story has been improving; demand exceeds pre-Fukushima levels and has outstripped primary supply over the past few years. Finite inventories and other secondary supplies are being depleted to make up the difference.

Furthermore, well over 50% of all utility contracts require renewal by 2027. Utilities typically renew contracts 18–24 months before they expire. Several utilities have recently come to market with RFPs, but producers are unwilling to lock in long-term contracts at current levels.

Nuclear reactor demand for uranium is sticky and has been largely insulated from the pandemic versus other sources of power generation. It's still the only source of reliable, baseload, emissions-free electricity.

Lastly, demand is expected to increase on the back of new reactor construction. There are 56 reactors under construction, and that doesn't even consider the advent of SMRs (Small Modular Reactors).

Since 2003 we have experienced eight periods in which the spot price spiked over a short period of time. The average price increase was +58% over an average of 6.6 months. Worth noting is that spot and term prices are still below the average all-in cost of production and well below the incentive price needed to bring meaningful new production online.

Peter Epstein: It seems that the topic of restarts of Japanese reactors has faded and all eyes are on Cameco and Kazakhstan's Kazatomprom. Are these two companies the main story?

Jordan Trimble: Japan's role in nuclear energy should not be dismissed; there's still the potential for a positive catalyst from additional Japanese restarts. However, this narrative has rightfully diminished in importance with only nine of Japan's reactors back online. Additional restarts pale in comparison to new demand coming from China, India and other parts of the developing world.

Cameco and Kazatomprom are the two largest uranium producers in the world. With meaningful production at both further reduced from the second half of March through August, both companies have been drawing down inventory. Both are purchasing material on the spot market to meet contractual supply requirements.

While Cameco plans a restart at Cigar Lake in September, the same cannot be said for Kazatomprom. The virus has hit Kazakhstan hard, lockdowns have impeded their wellhead drilling and operations. It could take a while to ramp production back up to pre-pandemic levels.

Peter Epstein: Skyharbour's crown jewel is its 100%-owned, 35,705-hectare, Moore project. What's the status of Moore?

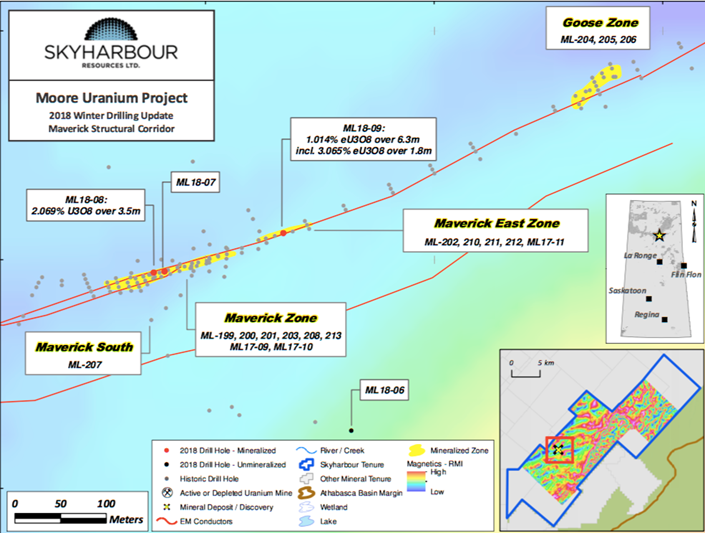

Jordan Trimble: We announced plans for a fully funded and permitted summer/fall drill program on our high-grade Moore Uranium project (see news release dated July 29th). Targets include both unconformity and basement-hosted mineralization along the Maverick structural corridor.

The project is 15 km east of Denison's Wheeler River project and 39 km south of Cameco's MacArthur River mine. Denison is our largest shareholder and an important partner.

We plan to expand high-grade mineralization recently discovered at the Maverick East Zone and to test the Viper target area along strike about 1.5 km to the northeast with a focus on basement-hosted mineralization.

Only 2.5 km of the total 4.7-km-long Maverick structural corridor has been systematically drill-tested, leaving robust discovery potential along strike both at the unconformity and at depth in the underlying basement rocks.

Peter Epstein: In recent interviews you've said your team believes Skyharbour is close to finding very high-grade feeder zones (like 10%+ U3O8 over 10+ meters). What makes you think you're close?

Jordan Trimble: We believe we're on the verge of discovering larger zones of higher-grade uranium in the basement rocks of the Moore project. We have already intersected grades up to 21% U3O8 in sandstone right above the unconformity. We know this mineralization comes from a source.

That source is likely a feeder zone in the underlying basement rocks. A great deal of time has been spent refining drill targets. We have a new geological model that will increase the chances that we find what we're looking for.

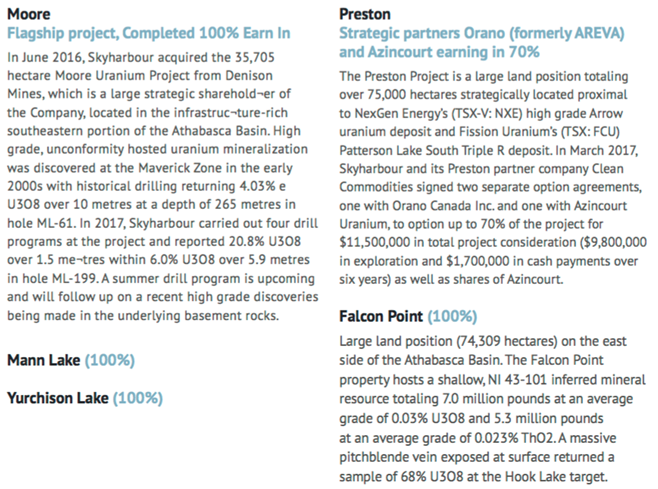

Peter Epstein: Azincourt Energy will soon finish earning a 70% interest in the East Preston project. Please give us the latest snapshot.

Jordan Trimble: As part of our prospect generator business, Azincourt completed its winter drill program and reported results on June 8th. They completed 2,431 meters in nine holes with promising basement lithologies and graphitic structures intersected along with associated, anomalous uranium, REE mineralization and favorable alteration.

On July 24th, Azincourt announced its upcoming geophysical target generation program. So, additional news is forthcoming. To complete the 70% earn-in, they issued 2.5 million shares to Skyharbour and has to make a $200,000 cash payment.

Peter Epstein: Vertically integrated French uranium miner Orano (formerly Areva) is earning a 70% position in your Preston project. Where does Orano stand in this regard?

Jordan Trimble: Orano recently completed an exploration program on the Preston project consisting of DC resistivity ground geophysics in order to prioritize areas to be drill-tested. Previous drilling intersected numerous and extensive, well developed and commonly graphitic ductile shear zones that were clearly reactivated over time.

Of note is that Preston Lake has seen little drilling to date. Our partner Orano is France's largest uranium mining and nuclear fuel cycle company. They have been exploring and mining uranium in Athabasca for years. In order to complete the 70% earn-in, they need to spend $8 million in exploration and cash payments.

Peter Epstein: Skyharbour has been trying to farm out three projects. Can you comment on Falcon Point, Mann Lake and Yurchison?

Jordan Trimble: As an explorer that also utilizes the project generator model, Skyharbour has teamed up with industry leading companies like Orano to increase the chances and lower the cost of new discoveries. This allows us to focus on our Moore project, while ensuring steady news flow/catalysts from secondary projects.

It brings in additional cash without us having to dilute shareholders as much. It allows us to leverage peer technical and geological teams. We're actively looking for partners at three 100%-owned projects; Falcon Point, Mann Lake and Yurchison. All three have promising geology and are drill ready.

Peter Epstein: A common refrain from uranium investors is that yes, Athabasca has monster grades, but it takes 10+ years to develop a resource into a mine. What do you say to that?

Jordan Trimble: Look, we're in the business of finding deposits and ultimately selling them to larger companies to develop. So, our value proposition and wealth creation opportunity is at the front end of this. New discoveries and resource delineation don't take 10+ years.

However, it's worth noting that there are mining methods, including ISR & SABRE (borehole mining) being proposed for high-grade Athabasca deposits. These methods could significantly reduce time to production and permitting hurdles. Companies with deposits amenable to these techniques stand to benefit immensely.

Peter Epstein: Thank you, Jordan, very insightful as always. I look forward to updates on Skyharbour's projects and expect to see the uranium price start to climb again soon.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned no shares in Skyharbour Resources, and Skyharbour was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Azincourt Energy. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources and Azincourt Energy, companies mentioned in this article.