Frontier Lithium Inc.'s (FL:TSX.V; LITOF:OTCQX; HL2:FRA) newest infill drill results from its Spark lithium deposit in northern Ontario, Canada, show "high grade over large meterage," reported Canaccord Genuity analyst Katie Lachapelle in an August 17, 2022 research note.

The analyst also reported that Frontier Lithium's current valuation is "attractive" given the stock is trading at a discount, below its North American peers, at 0.62x net asset value (NAV) versus 0.76x NAV, respectively. The company's current share price is around CA$2.37, whereas Canaccord's target price on Frontier Lithium is CA$4 per share.

The latest infill drill data from Spark, for four holes, demonstrated wide intercepts and lithium (Li2O) grades well above the average grade of the existing resource, which is 1.38% (for Measured and Indicated plus Inferred resources). Highlight hole PL-060-22, for example, returned "world-class" results of 1.63% Li2O over 357.5 meters (357.5m), including 2.24% Li2O over 50m.

Also, Lachapelle pointed out that three of the four reported holes, PL-059-22, PL-060-22, and PL-061-22, ended in pegmatite at depth, showing continuity to the west at Spark. Frontier intends to extend these holes with future drilling.

"We continue to be encouraged by the consistency of Frontier's results from its infill drill program," Lachapelle commented. Of the 24 holes drilled in the program's current phase thus far, eight have been reported.

Given this consistency, Canaccord expects the majority of Frontier's existing Inferred resource at Spark, 18,100,000 tons of 1.37% Li2O, to be upgraded to the Measured and Indicated category and included in the future mine plan, noted Lachapelle. This upgrade should extend the life of mine by about 14–18 years.

A prefeasibility study, which will include the results of this current drill program, is expected by year-end.

Other results from the most recent batch include:

- Hole PL-061-22: 280.7m of 1.42% Li2O, including 7.7m of 2.67% Li2O and 9.4m of 2.56% Li2O

- Hole PL-059-22: 145m of 1.5% Li2O, including 77.1m of 1.6% Li2O

- Hole PL-068-22: 20–50m thick zones of 1.42–2% Li2O, including 39.1m of 2.17% Li2O and 12m of 3% Li2O

Canaccord rates Frontier Lithium Speculative Buy.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Frontier Lithium Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Frontier Lithium Inc., a company mentioned in this article.

Disclosures For Canaccord Genuity Group Inc., Frontier Lithium Inc., Aug. 17, 2022

Analyst Certification: Each authoring analyst of Canaccord Genuity whose name appears on the front page of this research hereby certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring analyst's personal, independent, and objective views about any and all of the designated investments or relevant issuers discussed herein that are within such authoring analyst's coverage universe and (ii) no part of the authoring analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the authoring analyst in the research, and (iii) to the best of the authoring analyst's knowledge she/he is not in receipt of material non-public information about the issuer.

Analysts employed outside the US are not registered as research analysts with FINRA. These analysts may not be associated persons of Canaccord Genuity LLC and therefore may not be subject to the FINRA Rule 2241and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by the research analyst account.

Lithium Price and Market Risk: Our Estimates and valuation are extremely sensitive to lithium prices, and we can make no assurances that the future price trajectory of the metal will be in line with our estimates. A weaker-than-expected price could impact the advancement of FL's project and projected cash flows. These factors could materially impact our valuation.

Project Risk: The PAK Lithium Project (PAK + Spark Deposit) is at a PEA level, with work currently being completed on a prefeasability study expected in mid-2022. Accordingly, the project is subject to changes in operational parameters, including estimates of initial capital and operating costs that could impact our assessed valuation. To be conservative, we have escalated our capital and operating costs estimates and applied a higher discount rate to our valuation.

Permitting Risk: Our estimates and valuation assume the successful receipt of permits for PAK Lithium Project, however, there is no guarantee that this will be the case, or that the permits will be received within our assumed timelines. To meet our assumed timeline for first production, project permits need to be finalized by the end of 2024. As further detailed under the permitting section of this report, the project will be subject to an Environmental Assessment at the provincial level only (no Federal Impact Assessment required), which typically means shorter permitting timelines.

Financing Risk: As a development company with no operating cash flow, Frontier is reliant upon the capital markets to remain a going concern. There is no guarantee that FL will be able to access capital markets should there be changes in the market sentiment and/or pricing.

Foreign Exchange Risk: Frontier Lithium's PAK project is located in Ontario, with the majority of operating costs expected to be denominated in Canadian dollars. Giving that lithium contracts are routinely denominated in US dollars, the relative exchange rates could have a significant impact of FL's financial performance.

Required Company Specific Disclosures: Frontier Lithium Inc. currently is, or in the past 12 months was, a client of Canaccord Genuity or its affiliated companies. During this period, Canaccord Genuity or its affiliated companies provided investment banking services to Frontier Lithium Inc.

In the past 12 months, Canaccord Genuity or its affiliated companies have been lead manager, co-lead manager, or co-manager of a public offering of securities of Frontier Lithium Inc. or any public disclosed offer of securities of Frontier Lithium Inc. or any related derivatives.

Canaccord Genuity or one or more of its affiliated companies intend to seek or expect to receive compensation for investment banking services from Frontier Lithium Inc. in the next three months.

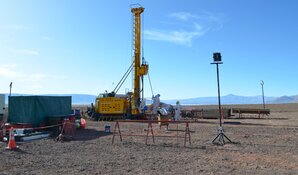

An analyst has visited the material operations of Frontier Lithium Inc. No payments were received for the related travel costs.

General Disclaimers: The authoring analysts who are responsible for the preparation of this research have received (or will receive) compensations based upon (among other factors) the investment banking revenues and general profits of Canaccord Genuity. However, such authoring analysts have not received, and will not receive, compensation that is directly based upon or linked to one or more specific investment banking activities or to recommendations contained in the research.

The information contained in this research has been compiled by Canaccord Genuity from sources believed to be reliable, but (with the exception of the information about Canaccord Genuity) no representation or warranty, express or implied, is made by Canaccord Genuity, its affiliated companies or any other person as to its fairness, accuracy, completeness, or correctness. Canaccord Genuity has not independently verified the facts, assumptions, and estimates contained herein. All estimates, opinions, and other information contained in this research constitute Canaccord Genuity's judgement as of the date of this research, are subject to change without notice and are provided in good faith without legal responsibility or liability.

The research is provided for information purposes only and does not constitute an offer or solicitation to buy or sell any designated investments discussed herein in any jurisdiction where such an offer or solicitation would be prohibited. As a result, the designated investments discussed in this research may not be eligible for sale in some jurisdictions. This research is not and under no circumstances should be construed as, a solicitation to act as a securities broker and dealer in that jurisdiction.

To the fullest extent of the law, none of Canaccord Genuity, its affiliated companies or any other person accepts any liability whatsoever for any direct or consequential loss airing from or relating to any use of the information contained in this research.