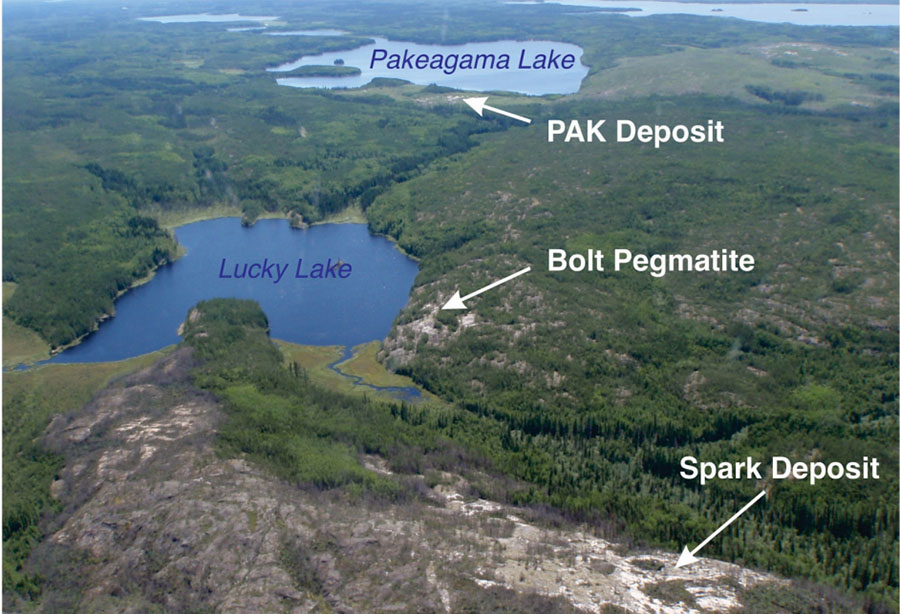

Frontier Lithium Inc. (FL:TSX.V; LITOF:OTCQX; HL2:FRA) (Frontier) is a Canada domiciled and multiple listed company evaluating and developing its 100% owned PAK Lithium Project located in NW Ontario, Canada. Since its relatively recent discovery by the Ontario Geological Survey in 1999, Frontier has defined North America's highest-grade pegmatite hosted lithium deposits at PAK.

The PAK lithium deposits, comprising two separate pegmatites (PAK and Spark), are located within a highly prospective structural corridor nicknamed "Electric Avenue". Frontier has acquired a significant tenement package. Since acquiring the project in 1999, Frontier has completed detailed geochemical and geophysical programs over PAK, with drilling and channel sampling of the pegmatites only being initiated in 2012. Since then, a relative continuous surface and drilling program, supported by metallurgical test work, has enabled Frontier to complete a Preliminary Economic Assessment (PEA) over the PAK Lithium Project.

Frontier share price (Source: Stockwatch.com)

Frontier's positive PEA (NPV8% US$975M) supports an integrated mine/mill/concentrator producing 23,174t of battery-grade hydroxide and 20,000t of technical grade spodumene concentrate annually from the PAK Project. Greenbushes (Talison) has a monopoly on the technical grade market, and high-end glass buyers such as Corning, Asahi, and Saint Gobain would gladly welcome a new entrant based in North America.

Frontier is currently carrying out additional drilling and metallurgical test work, pilot plant optimization work, and additional engineering studies to support the Pre-Feasibility Study (PFS) due for completion later in 2021.

Australian spodumene concentrate producers are consolidating and confirming downstream ambitions:

- Albemarle / Mineral Resources (Wodgina/Kemerton)

- Pilbara Minerals take-over of Altura with POSCO JV and Calix

- Tianqi Lithium / IGO Limited (Greenbushes and Kwinana stake)

The available pool of spodumene concentrate projects in Tier One jurisdictions is shrinking. We view North Carolina and Quebec/Ontario hard rock assets as future strategic suppliers of both lithium chemicals (hydroxide), and spodumene concentrate 6% (SC6) to the North American and possibly European battery supply chains.

Our forecasts show passenger EV battery demand growth in the USA at 30x between 2020 and 2030. Translated, this equates to 600 GWh of battery cell demand and approximately 500KT LCE of battery-grade lithium demand (85%-90% hydroxide). In addition, energy storage and commercial vehicles will add further battery demand. The USA currently has ~15KT LCE of lithium chemical production capacity. If the USA/North America looks to follow Europe and become largely self-sufficient, then there is a narrow window to create a regional lithium supply chain that is both scalable and sustainable/low carbon footprint. The quickest route to scaling greenfield lithium production in North America is hard rock to hydroxide. Tesla's planned Texas chemical conversion plant using spodumene from North Carolina is a validation of that thesis. We see them scaling that operation substantially over time while potentially trying to overcome the challenges around clay.

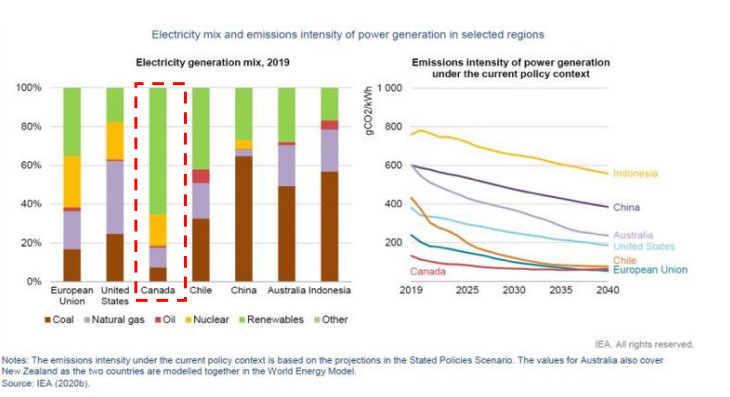

Electricity generation mix (Source: IEA)

According to the IEA, Canada's electricity generation is >80% renewables and nuclear, while China and Australia electricity generation are >75% coal, oil and natural gas. Therefore, with a reduced production and transport carbon footprint and no need for customers to hold higher inventory levels, we believe domestic North American hydroxide supply will trade at a $1,000/t+ premium to China.

The investment case for Frontier:

➢ Top 3 resource globally from a high grade, low impurity and consistency perspective (very similar to Greenbushes); having consistently high grades and low impurities across a deposit are the key characteristics that maximize the probability of a project achieving battery-grade chemicals

➢ Potential to grow the mineral resource estimate (MRE) to 50MT-60MT in the future

➢ Robust PEA with a ~US$1B after-tax NPV as an integrated battery-grade hydroxide producer

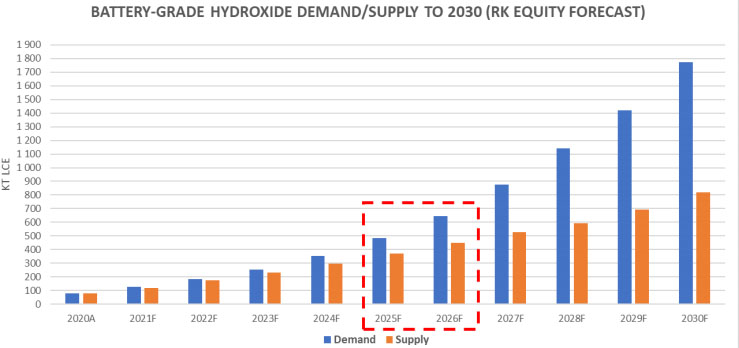

➢ Hydroxide will likely represent 85%-90% of USA/North American cathode demand by 2025/2026 (start of production)

➢ After expanding the MRE to 50MT-60MT, Frontier could either expand its hydroxide production to 45,000tpa or sell 250ktpa of SC6 to third parties – this would increase the company's NPV to ~US$1.45B – US$2B

➢ Partnered with XPS (Glencore subsidiary) – operating hydroxide pilot plant

➢ Potential to produce a high value (US$1,500/t) technical grade spodumene concentrate for the glass/ceramics market to compete with Greenbushes (Talison) monopoly

➢ High permitting probability and local First Nation support (board member)

Frontier currently trades at a significant discount to its NPV and its developing peer group due to two main reasons:

- The company is only at the PEA development stage (targeting first production in 2025/2026) and needs to complete an infill drilling program to move more of the resource from the inferred category to the measured and indicated category

- 2. The PAK project is remote and will not develop to full scale until the necessary power and road infrastructure has been completed

Regarding point 1, we see Frontier progressing through the PFS later in 2021/early 2022 and the DFS stage by H2 2023. Further, we see Frontier not only converting the existing resource from inferred to measured and indicated but expanding and potentially doubling the resource.

Regarding point 2, the phase 2 government-funded power line development targets completion by 2023/2024; phase 1 is already completed. The final crucial piece of infrastructure is all-weather road access to the project. Currently, the project can only use the winter road for three months of the year. Either the winter road can be upgraded to all-weather, or the access road used for the power lines can be upgraded. The completion of the power line access road upgrade would only be possible in 2023/2024. The nearby First Nation settlements are supportive of the road upgrade and are collaborating with Frontier. Depending on the level of infrastructure put in place for the current power line construction and level of road specifications, the desktop cost of an all-weather road is estimated at between CAD$50M-CAD$100M. Frontier is effectively 18-24 months behind its more advanced developing peers from a timeline perspective. We believe Frontier's first battery-grade hydroxide production is potentially in 2026 and aligns with a substantial supply shortfall from a market timing perspective.

Battery-grade hydroxide demand/supply to 2030 (Source: RK Equity)

When the market begins to understand the quality and resource size potential of Frontier (50MT–60MT) and its long-term strategic importance to the North American (European) battery supply chain plus the diversity of its revenue streams (battery-grade hydroxide, technical grade and chemical grade spodumene) the share is likely to re-rate.

We believe the challenge of securing an all-weather road to the project is far smaller than the technical and permitting challenges facing competing North American projects. As a result, we would argue that Frontier could trade at a premium to its peers once it secures year-round road access and ticks off key milestones, including a demonstration plant producing concentrates and battery-grade chemicals.

Click here to read the entire report.

Rodney Hooper is an independent analyst and investor based in Cape Town, South Africa.

Read what other experts are saying about:

Streetwise Reports Disclosure:

1) Rodney Hooper's disclaimers/disclosures are listed below.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Frontier Lithium. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Frontier Lithium, a company mentioned in this article.

Rodney Hooper disclosures/disclaimers

The author of this independent company research about Frontier Lithium Inc. ("Frontier Report"), Rodney

Hooper ("Rodney"), is an independent analyst and investor based in Cape Town, South Africa. This Frontier

Report remains Rodney's property, and no material contained herein may be reproduced or distributed

without the prior written approval of Rodney.

Rodney's research process includes the following protocols to ensure independence is maintained at all times: • The research process has complete editorial independence from the company. • The research does not provide a recommendation; therefore, this report cannot be interpreted as investment advice.

This Frontier Report may contain general advice that is not appropriate for all persons or accounts while believed to be accurate at the time of publication. This report does not purport to contain all the information that a prospective investor may require. Recipients of this Frontier Report must consider market developments after the date of this document and whether the Frontier Report's information is appropriate in light of his or her financial circumstances.

Information in this document has been obtained from sources believed to be true, including Frontier's CEO, President, CFO and chief geologist, and various Frontier public filings. In connection with this Frontier Report, Rodney also employed an independent external consulting geologist to assist with some of the geological/metallurgical sections.

This Frontier Report and/or excerpts from there, along with other publications by Rodney, may be distributed through various forums, including direct email, LinkedIn, Twitter, Seeking Alpha and other syndication partners, including Rock Stock Channel and Lithium-ion Rocks! a YouTube channel and podcast Rodney co-hosts with Howard Klein, both published by New York-based advisory firm RK Equity Advisors, LLC (www.rkequity.com). Over the past 60 months, RK Equity has had fee-paying advisory assignments with public companies in the battery raw materials space, including Western Lithium/Lithium Americas, CleanTeq, Lithium Power International, Millennial Lithium, Altura Mining, NeoMetals, Talon Metals Corp, Kidman Resources, Nemaska Lithium, Savannah Resources, Critical Minerals Corp, Nouveau Monde Graphite, e3 Metals, European Metals Holdings and Bacanora. As of the date of this report, Rodney, Howard or RK Equity own securities in Mineral Resources, Talon Metals, Albermarle, Piedmont Lithium, Livent, e3 Metals, European Metals Holdings, Critical Elements, Frontier Lithium, Nouveau Monde Graphite, Lynas Corp and MP Materials. Neither Rodney nor Howard Klein, nor RK Equity is a registered investment advisor or broker-dealer. The information contained herein is not financial advice and, whether, in part or its entirety, neither constitutes an offer nor makes any recommendation to buy or sell any securities.

Recipient Representations/Warranties: By accepting this report, the recipient represents and warrants that he or she is entitled to receive such a report following the restrictions set out in this document and agree to be bound by the limitations herein. Any failure to comply with these limitations may constitute a violation of the law.

Charts and graphics provided by the author.