Streetwise Articles

What's Behind July's 9% Rise in Crude Oil Prices

Source: Tony Daltorio, Money Morning (8/5/13)

"U.S. crude oil prices finished the month of July on a very positive note. Front-month futures ended July at just above $105 a barrel. That put those futures up about 9% for July, the largest one-month gain for crude oil in 11 months."

More >

Top Ten Stocks for a Uranium Price Rebound: David Talbot

Source: Zig Lambo of The Energy Report (8/1/13)

When it comes to uranium market sentiment, "it's all about Japan," says David Talbot, senior mining analyst at Dundee Capital Markets. With restart applications trickling in and reactor construction underway throughout the world, a turnaround looks less like an "if" and more like a "when." In the meantime, Talbot sees many investors sitting on the sidelines. In this interview with The Energy Report, Talbot discusses the catalysts that could trigger the next uranium boom and the companies that could make investors wish they had arrived at the party a little earlier.

More >

Jocelyn August: Top Five Catalysts for Small-Cap Energy Equities

Source: Brian Sylvester of The Energy Report (7/30/13)

Catalysts are a little like earthquakes: They shake things up. These announcements of drill results, production starts and resource estimates can influence stock prices, sometimes for the better, sometimes for the worse. In this interview with The Energy Report, Jocelyn August, senior analyst and product manager for Sagient Research's CatalystTracker, explains which catalysts have the biggest effect on small- and large-cap companies and identifies upcoming events that could move the needle in the oil and gas and uranium spaces.

More >

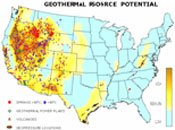

Is It Time to Start to Talk About Geothermal Again?

Source: Jason Hamlin, Gold Stock Bull (7/29/13)

"Geothermal is a renewable energy source that is expected to grow fivefold in the next seven years and produces more than double the energy of solar and wind combined."

More >

How to Invest in LNG: A 3-Step Strategy

Source: Keith Schaefer, Oil & Gas Investments Bulletin (7/26/13)

"Greg Coleman outlines his three-stage plan for grabbing a chunk of the profits from the massive ramp-up coming in LNG."

More >

Capture Upside in Undervalued, Underfollowed Energy Stocks: Peter Epstein

Source: Rita Sapunor of The Energy Report (7/25/13)

Big gains are rarely found by jumping on the bandwagon. Peter Epstein, independent analyst and founder of MockingJay Inc., argues that market darlings won't reward latecomers; that's why he spends his time finding undervalued, underfollowed junior resource companies. In this interview with The Energy Report, Epstein shares his resource stock diamonds in the rough, including a uranium name commercializing a groundbreaking technology and a graphite company beating its competitors to market.

More >

Could Small Modular Reactors Goose Uranium Prices?

Source: Tom Armistead of The Energy Report (7/23/13)

Nuclear power is the best option for clean base-load power generation, according to Gold Stock Trades Editor Jeb Handwerger. As proof, he points to signs that even environmentalists are beginning to favor it. Meanwhile, uranium stocks are rising and large nuclear construction programs overseas should keep upward pressure on them. But as Handwerger explains in this interview with The Energy Report, the future of nuclear power generation may lie with small modular reactors, and the U.S. is leading their development.

More >

Is the Next Big Oil Discovery in Resource-Rich Australia?

Source: John C. K. Daly, Oilprice.com (7/23/13)

"According to a U.S. government report, resource-rich Australia could be home to as much as 10 times the existing known gas reserves, higher than its existing oil reserves."

More >

Stock Picking in the US Shale Basins: Neal Dingmann

Source: Tom Armistead of The Energy Report (7/18/13)

As an oil analyst at SunTrust Robinson Humphrey, it's a given that Neal Dingmann has his eye on energy stocks come rain or shine. But whether you're bullish or bearish on U.S. shale development, it's wise to know which stocks are poised to deliver shareholder value. In this interview with The Energy Report, Dingmann tiptoes through North America's major shale plays (including an interesting hybrid) and points out the cream of the crop.

More >

Opportunity Ahead in the Energy Supercycle?

Source: Frank Holmes, Frank Talk (7/18/13)

"We see severe price declines as possible buying opportunities during this ongoing commodity supercycle."

More >

A Short Seller's Investment Guide to Obama's Climate Change Initiatives

Source: Tom Armistead of The Energy Report (7/16/13)

"Regulation" is a dirty word among many investors, but for speculators like Rodney Stevens, portfolio manager at Wolverton Securities Ltd. and author of The Disciplined Speculator newsletter, state-mandated emissions caps and renewable energy goals present an extraordinary opportunity for growth. In this interview with The Energy Report, Stevens makes a bullish case for solar stocks and offers several names for traders playing offense or defense. Whatever your strategy, Stevens says get the heck out of bonds and into equities.

More >

Will Wireless Power Revolutionize Mobile Tech?

Source: Louis Basenese, Daily Reckoning (7/16/13)

"Battery improvement has seriously lagged other technologies over the past 20 years or so."

More >

Chris Mayer's Four-Point Formula for Returns

Source: Tom Armistead of The Energy Report (7/11/13)

It's time to tear your eyes away from those stock price charts. Chris Mayer, Agora Financial managing editor and author of "World Right Side Up" and "Invest Like a Dealmaker," walks us through his four-point company evaluation strategy, "CODE," identifying crucial, less publicized metrics that give real insight into a company's value. In this interview with The Energy Report, learn how to pick your stocks like a seasoned financial analyst. As Mayer explains, with global finance shifting back to emerging economies, it's an exciting time to be an investor.

More >

Who Will Benefit from the Mexico Natural Gas Export Boom?

Source: Dave Forest, Oil & Gas Investments Bulletin (7/10/13)

"Mexico could be the surprise driver of marginal demand—and gas prices."

More >

Sprott Money Managers Share the Secret for Surviving the 'Bernanke Put'

Source: Zig Lambo of The Energy Report (7/9/13)

The "Bernanke Put," or promises of quantitative easing, has become the standard government response to economic uncertainty. But while the powers that be insist everything's fine, Sprott Resource Corp. Founder Kevin Bambrough and COO Paul Dimitriadis see financial deterioration around the globe. Only one thing is for certain: Taking the contrarian view provides the best opportunities to buy low and sell high. In this interview with The Energy Report, they explain why they expect energy assets to perform better in the long haul, cluing us in on a few names they are considering for big returns.

More >

What the Next 'Arab Spring' Means for Oil Prices

Source: Kent Moors, Oil & Energy Investor (7/8/13)

"But two developments are threatening to heat things up yet again—and fast."

More >

Porter Stansberry Reveals the Greatest Threat to the U.S. Economy and One Easy Way to Protect Yourself

Source: Karen Roche of The Gold Report (7/3/13)

America is staring down a fiscal catastrophe, says Porter Stansberry, the outspoken investment analyst who has coined the phrase "the end of America." Americans are living beyond their means, he says, and the global economy is tired of holding our debt. Nothing short of economic disaster will befall us. But amid such grim predictions, in this interview with The Gold Report, Stansberry takes a moment to praise the enduring value of timeless investments, such as farmland and. . .Krispy Kreme. Stansberry shares his thoughts on everything from the Federal Reserve to Hong Kong.

More >

America is staring down a fiscal catastrophe, says Porter Stansberry, the outspoken investment analyst who has coined the phrase "the end of America." Americans are living beyond their means, he says, and the global economy is tired of holding our debt. Nothing short of economic disaster will befall us. But amid such grim predictions, in this interview with The Gold Report, Stansberry takes a moment to praise the enduring value of timeless investments, such as farmland and. . .Krispy Kreme. Stansberry shares his thoughts on everything from the Federal Reserve to Hong Kong.

More >

An Unexpected New Demand Source for US Natural Gas

Source: Dave Forest, Oil and Gas Investments Bulletin (7/2/13)

Mexican imports of U.S. gas have skyrocketed 92% since 2008.

More >

To Plot Your Energy Investments, Consult the Map: James West

Source: Peter Byrne of The Energy Report (7/2/13)

Understanding asset values is the name of the game for early-stage resource plays—that's how investors in the Bakken made huge returns. But with the first round of shale plays largely maturing, where are the next big opportunities for junior explorers? In many cases, abroad, says James West, publisher of The Midas Letter. In this interview with The Energy Report, West rolls out the map and shows us where juniors are headed. He also names some companies who are thriving on North American soil. If boots-on-the-ground prospecting puts a glint in your eye, read on.

More >

How Exporting US Gas Will Transform Global Energy Markets: Sam Wahab

Source: Peter Byrne of The Energy Report (6/27/13)

Here's the situation: North America is swimming in cheap natural gas, whereas international markets are thirsty for it and paying a premium. Now that the DOE is beginning to approve LNG export permits, North American producers have major incentive to drill, baby, drill. To get an expert perspective on the coming LNG supply shift, The Energy Report turned to Cantor Fitzgerald Analyst Sam Wahab, who keeps tabs on global oil and gas developments from his base in London. This is a must-read interview for anyone who wants to profit from a potentially massive shift in natural gas fundamentals.

More >

Rising Powers, Shrinking Planet: What’s Next in the Energy Debate?

Source: James Stafford, OilPrice.com (6/26/13)

"Could the accelerated development of renewable energy prove to be the only way to avoid an inevitable spiral of war and disaster?"

More >

Are You Protected from Oil Price Downside? Chen Lin Shares His Strategy

Source: Zig Lambo of The Energy Report (6/25/13)

Remember when oil shot up to $148 a barrel? Chen Lin does, and he sees potential for Wall Street market manipulation to push the oil price in the opposite direction—as low as $47 a barrel. Plus, he's bearish on China now. The good news is that Lin, publisher of What Is Chen Buying/Selling?, was willing to share his personal investment strategy in his interview with The Energy Report. Find out where Lin booked profits this year and get the names he's turning to for protection against oil price downside.

More >

African Shale Gas Production Could Break Out

Source: Justin Williams, Energy & Capital (6/24/13)

"South Africa (which holds the fifth-largest reserve in the world), Morocco, Algeria, Tunisia, Libya, and Egypt are among the small group of countries that have the potential and are exploring for gas on the continent, according to the U.S. Energy Information Administration."

More >

Profit from Seasonal Energy Cycles: Roger Wiegand

Source: Peter Byrne of The Energy Report (6/20/13)

For short-term traders, understanding cyclical markets is the key to profits. And with the hottest summer months ahead, natural gas could get a price boost when air conditioners start to hum, says Roger Wiegand, publisher of the Trader Tracks investment newsletter. In this interview with The Energy Report, Wiegand shares some promising names for investors who are ready to read the technical charts—and mark their calendars.

More >

Fadel Gheit: Avoid the Middle East, Invest in US Refineries

Source: Tom Armistead of The Energy Report (6/18/13)

Shifting commodity prices are a given in the oil and gas industry, but sometimes the industry landscape changes in unexpected ways. In this interview with The Energy Report, Oppenheimer & Co. Managing Director and Senior Energy Analyst Fadel Gheit discusses the effect of Middle Eastern geopolitical issues on oil production, dissects the changing oil and gas production situation in the U.S. and explains how the shift in natural gas prices has turned the refinery business from the industry's perennial ugly duckling into a beautiful swan.

More >