The Latest Oil & Gas - Exploration & Production Articles from Streetwise Reports

Trump Does It Again: Oil and Our Gold Stocks

Contributed Opinion

Ron Struthers comments on a possible ceasefire with Iran and discusses how he believes the oil market has it wrong, as the Strait of Hormuz will likely see continued restrictions. He also looks at his gold picks with a comparison of best buys.Energy Co.'s Shallow Gas Prospects Have a High Chance of Success

Research Report

ADX Energy Ltd.'s (ADXRF:OTCMKTS; ADX:ASX) strategic focus on shallow gas prospects has a high probability of success, according to an Auctus Advisors research note.Short Levels on MAG 7 Stocks Flash Warning & Recon Africa

Contributed Opinion

Ron Struthers' short indicator shows the market is quite complacent and could be set for a correction. Also, a look at Recon Africa and their large oil and gas play in Namibia.Iran, Israel, and Oil: The Middle East Conflagration Looks Set To Get a Lot Worse.

Contributed Opinion

Technical Analyst Clive Maund explains why current events between Israel, Iran, and the U.S. could cause oil to skyrocket. Other Than That Mrs. Lincoln, How Was the Play?

Contributed Opinion

Rick Mills of Ahead of the Herd once again interviews Bob Moriarty of 321Gold to discuss Trump's presidency, the current turmoil in the Middle East, the economy, gold, and some companies they have kept their eyes on.War & Debt: How Investors Can Protect Themselves

Contributed Opinion

Newsletter writer Stewart Thomson addresses the question: How should investors protect themselves against the financial dangers presented by war and debt?Co. Relaunches Growth Plan in Bullish Natural Gas Market

Research Report

Coverage was initiated on this undervalued energy firm about to embark on a three-well drill program at its flagship asset in Mississippi, noted a Research Capital Corp. report.Exploration Firms Seize Opportunity Amid Global Oil Reset

Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC; JLM:FRA), Panoro Energy ASA (PEN:OSE; 1PZ:FRA), and Ring Energy Inc. (REI:NYSE) pursue bold strategies to unlock value from powering AI data centers to boosting reserves and expanding U.S. shale production. Read more to see how each company is adapting to shifting oil market dynamics and long-term energy trends.Energy Co. Achieves Favorable Pricing for Its Gas Production

Research Report

Southern Energy Corp. (SOU:TSX.V; SOUTF:OTCQX; SOUC:AIM) recently released first quarter 2025 production of 2,135 barrels of oil equivalent per day. Read on to see how this aligned with Auctus Advisors' exectations.Four of Oil & Gas Co.'s Wells in Austria Now Drill Ready

Research Report

A potential return of 900% is implied in Auctus Advisors' target price on this energy firm, the management consultancy noted in a report.Oil and Gas Exploration Co. Shares Good Well Result

Research Report

Serica Energy Plc. (SQZZF:OTCMKTS:SQZ:AIM) recently reported solid production performance, according to an Auctus Advisors research note.Energy Co. to Redevelop Oil Field in Gulf of Thailand

Research Report

Along with a positive investment decision, this oil and gas explorer-producer achieved a slight Q1/25 financial beat, noted a Research Capital Corp. report.Energy Co. Buys First LNG Production Facility

Research Report

This and other developments "mark a key step toward near-term cash flow from LNG operations," noted a Research Capital Corp. report.Is Now Time for Commodities, Precious Metals, and Juniors?

Contributed Opinion

Rick Mills of Ahead of the Herd once again interviews Bob Moriarty of 321Gold, speaking about current events and commodities, as well as sharing some investment ideas.Canadian Oil & Gas Co. Closes Acquisition of Dutch E&P

Research Report

The acquirer is "well-positioned to deliver continued growth and shareholder returns into 2025 and beyond," noted a Research Capital Corp. report.Energy Co. Produces 12,000 Barrels of Oil Per Day in Q1/25

Research Report

Forecasted total cash flow through 2027 is sufficient to support continued shareholder dividends, noted Auctus Advisors in a report.Oil Producer Exceeds Production Targets With Outstanding Well Performance

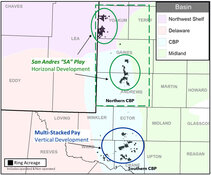

Oil and gas exploration and production company Ring Energy Inc. (REI:NYSE) provides an operational update that includes exceeding the high end of guidance for barrels per day. One analyst says a recent acquisition should help with free cash flow for the company.Texas Co.'s Oil Wells Outperform in Q1/25

Research Report

Also during the quarter, this U.S.-based explorer-developer completed an acquisition of producing assets, also in the same state, noted a Water Tower Research report.Energy Co. Boosts 2P Oil Reserves By 22% in 2024

Research Report

On this news, the oil and gas explorer-producer's target price is raised, now implying 111% return potential, Auctus Advisors noted in a report.Settlement Agreement Could Boost Oil & Gas Co.'s Cash Flow

Research Report

Orca Energy Group Inc. (ORC.B:TSXV; ORXGF:OTCMKTS) is to receive US$52M via weekly installments from the Tanzanian parastatal electric utility that fell into payment arrears, noted a Research Capital Corp. report.Oil is Buying Opportunity, Some Experts Say

A technical analyst says oil is poised for a big upleg. A newsletter writer says oil prices must be higher to foster U.S. production growth. Read on for further market insights.Co.'s Total Oil Production is Steady

Research Report

Late in Q1/25, the Canadian company brought a new well online in Colombia's Carrizales Norte field, noted an Auctus Advisors report.US Oil & Gas Co. Posts Strong Q1/25

Research Report

The target price on this energy firm implies 316% return potential despite being reduced recently to reflect lower Brent oil price assumptions, noted an Auctus Advisors report.Shrinkage

Contributed Opinion

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and movements in his trading account.Experts' Outlook on Oil Market is Bearish

Given worsening global trade policy and decreasing oil demand, persisting uncertainty could push down the oil price further, to close to or even lower than US$50 a barrel, analysts said. Find out what this means for oil exploration and production companies.Showing Results: 1 to 25 of 39 Next