The Latest Gold Articles from Streetwise Reports

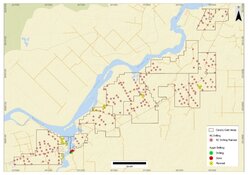

Gold Explorer Launches Major 20,000m Drilling Program in Brazil

Canary Gold Corp. (BRAZ:CSE; CNYGF:OTC; K5D:FSE) updates shareholders about ongoing exploration efforts at its expansive Madeira River project in Rondonia, Brazil. Read to see why one expert rates the stock a Speculative Buy.Gold Corp. Gets Buy Rating on High-Grade Discovery Momentum

Research Report

Couloir Capital reaffirms Buy on Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB; X7W:FSE), citing high-grade drill results at Pearl and Sherridon, Centerra Gold's continued strategic backing, and a fully funded 32,000-meter 2026 exploration program.High-Grade Hits Continue as Major Red Lake Drill Program Advances Across Multiple Veins

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQX; UJO:FSE) reported new high-grade assay results from its fully funded infill and conversion drilling program at the Rowan Project in Ontario's Red Lake district. The latest results included multiple strong intercepts across both modeled and newly identified vein zones.Gold Miner Resumes High-Grade Placer Production in British Columbia

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCQB) shares an update from the Wingdam underground paleoplacer project in the Cariboo Mining District of British Columbia. Find out how much the stock surged in December 2025 after the company had resumed gold recovery.Gold Co.'s Black Pine MRE Shows 17% Resource Growth Ahead of 2026 Feasibility Study

Research Report

Liberty Gold Corp. (LGD:TSX; LGDTF:OTCQX) announced a significant update to the Black Pine Mineral Resource Estimate. The updated MRE reveals a 17% increase in Measured & Indicated resources to 4.9Moz and a 47% jump in Inferred resources to 1.05Moz, while a high-grade core of 1.91Moz at 0.99g/t adds further value, according to a BMO Capital Markets research note.Gold Co. Moves Toward Production

Contributed Opinion

Bob Moriarty of 321Gold.com explains why he likes ESGold Corp. (ESAU:CSE; ESAUF:OTCQB; Z7D:FSE).Mine Expansion Targets Up To 3x Throughput as Processing Upgrades and Fleet Additions Advance

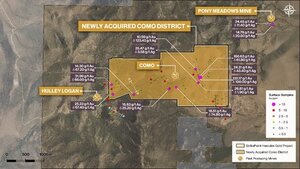

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) reported progress on a two-stage expansion at its La Guitarra mine designed to raise processing capacity from 500 tonnes per day to as much as 1,500 tonnes per day. The company said plant upgrades, equipment purchases, and infrastructure work were underway, with key installations expected to be completed in 2026.Gold Explorer Expands Massive Project in Nevada's Walker Lane

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) finalizes an agreement to acquire certain unpatented mining claims in the historic Como Mining District from a subsidiary of Newmont Mining Corp. Read why StrikePoint "may be one of the most overlooked gold exploration stories in Nevada's Walker Lane," according to one technical analyst.Metals Co.'s Dual-Project Strategy Positions it for Major Re-Rating, Analyst Says

Research Report

Red Cloud Securities analyst Ron Stewart initiates coverage of Galway Metals Inc. (GWM:TSX.V; GAYMF:OTCQB), citing significant undervaluation of the company's 2.3-million-ounce Clarence Stream gold project in New Brunswick and the Estrades gold-base metal project in Quebec. Read on to see his rating and price target. Gold Co. Completes Drill Program, Confirms Pit Expansion Potential

Research Report

The completion of the Area C Drill Program at Lake Victoria Gold's (LVG:TSXV, LVGLF:OTCQB) Imwelo Gold Project in Tanzania confirmed down-dip and east-west mineralization extensions, supporting final pit design and advancing the project toward construction in Q2Q3 2026 and first gold production in 2027, noted an Atrium Research flash.Silver Developer Targets Big Gains with Contango Merger

Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA; DVQ:FSE) prepares for a special meeting of shareholders to discuss and vote on a special resolution regarding the previously announced statutory arrangement with Contango ORE Inc. Read why one expert says the company's latest results are "hard to ignore."Junior Miner Finds 13.1g/t Gold at Filion Project in Ontario

Torr Metals Inc. (TMET:TSX.V) announces results from 14 reconnaissance rock grab samples collected in late 2025 from a large historical trench network identified through LiDAR. Find out why one technical analyst recommends the stock.Gold Co.'s Black Pine Resource Jumps 22%

Research Report

Liberty Gold Corp. (LGD:TSX; LGDTF:OTCQX) reported a 22% increase in mineral resources at its Black Pine gold project in Idaho to 5.9 million ounces, noted a National Bank research analyst.Deep Drilling Uncovers Eight Gold Veins Stretching Hundreds of Meters

Radisson Mining Resources Inc. (RDS:TSX.V; RMRDF:OTCQB) reported new geological modelling at its 100 percent owned O'Brien Gold Project, outlining at least eight parallel veins beneath the historic mine. The company highlighted continuity of mineralization across a 250-meter by 700-meter area as part of its fully funded 140,000-meter step-out drill program.New Agreement Secures Gold and Silver Output Through 2037

Triple Flag Precious Metals Corp. (TFPM:TSX; TFPM:NYSE) agreed to fund US$84.3 million for development of the gold-dominant E44 open pit deposit at Northparkes. The company secured guaranteed minimum deliveries of 45,052 ounces of gold and 446,200 ounces of silver from 2030 through 2037.A Phase Two Copper-Gold Drill Program and Bullish Charts; Is It Time To Buy?

Contributed Technical Analyst Opinion

Stewart Thomson shares an update on Algo Grande Copper Corp. (ALGR:TSX.V) to explain why he thinks the stock is so exciting. Gold and Silver Move in Different Directions

Contributed Opinion

Global Analyst Adrian Day looks at the action of gold and silver the week of February 7, 2026, and shares his view on how to invest. He also looks at developments from several companies on his list. A Next Generation Treasury Co.

Contributed Technical Analyst Opinion

Matador Technologies Inc. (MATA:TSX.V; MATAF:OTCQB; IU3:FSE) combines strategic Bitcoin accumulation, Bitcoin-native product development, and participation in digital asset infrastructure with the goal of driving long-term shareholder value without dilution. Matador is also a product launchpad and investment vehicle dedicated to bringing innovative gold products to traditional investors. 9.2 Meters of Copper, Gold and Silver Highlight Ongoing Drilling at Spanish VMS Project

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCQX; LLJA:FSE) reported new copper, gold, zinc, and silver intercepts from the El Cura deposit at its Iberian Belt West project in Spain. The company is advancing three VMS deposits through prefeasibility, while analysts continue to model significant precious metals contribution at IBW.Full Ownership Secured Across Major Northern Land Position After Final Option Payment

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB; X7W:FSE) completed its remaining obligations and is moving to 100% ownership of the Tremblay property within its 70,000-hectare land package. The company also finalized work commitments, issued shares for the remaining payment, and granted 2.9 million incentive stock options.New 3D Model Maps Mineralization 900 Meters Deep Across 2 Kilometers at Qubec Gold Project

ESGold Corp. (ESAU:CSE; ESAUF:OTCQB; Z7D:FSE) reported completion of an ANT-based 3D geological model at its Montauban Project in Quebec, outlining mineralization to approximately 900 meters depth and about 2 kilometers of strike length. The company stated the model identified open mineralized trends, deep structural corridors, and areas that had not previously been drilled.A District-Scale High-Grade Gold Story Taking Shape in Newfoundland

Contributed Technical Analyst Opinion

John Newell of John Newell & Associates explains why he likes Toogood Gold Corp. (TGC:TSVX; TGGCF:OTCQB) and believes it is a Speculative Buy.Gold Producer Restarts Massive Mill Operation in British Columbia

Ascot Resources Ltd. (AOT:TSX.V) announced that, pending regulatory approval, it would change its name to Cambria Gold Mines Inc. Read the story to find out why it may be a good time to buy in the sector.Idaho Antimony Co. Received Upgraded Price Target

Research Report

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) received an upgraded price target from H.C. Wainwright & Co. Read on to see why.Gold Stocks Vs. ETFS

Contributed Opinion

Ron Struthers of Struthers Resource Stock Report explains his thoughts on buying gold stocks versus buying ETFS and shares one stock he believes is a Strong Buy.