The Opportunity: Institutions and Tax Free Accounts

In terms of MLPs, many institutions that I have spoken with in the Boston area—even very large billion-dollar plus multi-family office types—refuse to buy individual MLPs. They prefer not to deal with the K-1s, don't like the lack of liquidity, and the more sophisticated ones are scared away by state income tax issues.

On the retail investor side, there is a huge pool of investible capital held in retirement accounts, which generally are not appropriate structures within which to invest directly in MLPs (direct MLP investing in a retirement account is possible, but complicated by UBTI—unrelated business taxable income).

Solution? Enter AMLP, the MLP ETF

So, how can investors get passive exposure to the MLP sector that has averaged more than 15% annualized returns since 2000, but in a way that is liquid and can be done in a retirement account? Someone who is contemplating this may happen upon a commercial for the Alerian MLP ETF ($AMLP) on CNBC. Or on the off chance they still read physical copies of the Wall Street Journal or Barrons, they may see a print ad for AMLP.

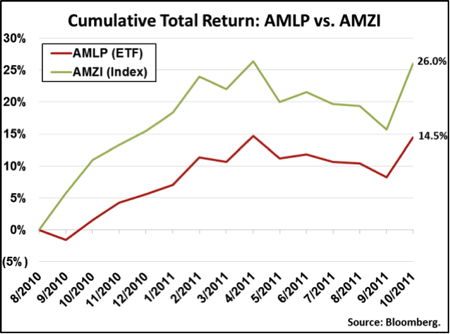

As the ads state, AMLP has no K-1s, IRA and is 401k eligible, with 1099 qualified dividends. Hmm, this product seemingly offers the solution to the MLP puzzle, and looking at the Alerian website, it becomes clear that many people have come to the same conclusion because in just over a year, AMLP has more than $1.6 billion (B) in assets (wow!). According to Alerian's website, AMLP's objective is to "seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index." What they won't tell you is what a bad job their ETF does at tracking the index. What you wont see on the website is the following chart, which shows the total returns since inception through the end of October for the index (AMZI) and for AMLP.

Since inception, the tracking error has been large and persistent, and with good reason, even if that reason takes some digging in the prospectus to find. There is at least one vocal investor, Ron Rowland, who has been all over this from before AMLP launched, and his article from September 2010 (when AMLP only had $128 million in assets) explains the nuances of why the tracking error exists. Essentially, the tracking error is because AMLP is a corporation (the only ETF in existence structure as a corporation) and must overcome double taxation, which it does by passing it along to investors in the form of a tracking error. Alerian will contend that the tracking error is to the benefit of investors in a downturn, but for the amount of upside you give up, you could afford to protect your downside in a number of other ways that are more efficient.

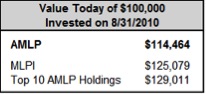

People out there may respond to the above chart by saying something like, "yeah there is a big tracking error, but the index is not something I can invest in, that’s why I bought AMLP." Ah, but there are two pretty simple options will get you diversified MLP exposure. One involves K-1s, the other doesn't. The chart below highlights what you would have if you put $100,000 to work in AMLP compared with UBS E-TRACS Alerian MLP Infrastructure Index ETN (MLPI) and compared with buying and equal $10,000 stake in each of the 10 largest holdings of AMLP. MLPI would have returned 25.1%, which is basically the above return for the AMZI index minus the management fee of 0.85%. Investing directly in the 10 largest MLPs in the index would have netted you 29.0%. These are all gross return numbers and don't include transaction costs (which would be higher for the direct MLP investment) or personal taxes on sales or dividends, but its an apples to apples comparison.

It should be noted that everyone agrees—including one of the masterminds behind AMLP, Kenny Feng—that if you can own MLPs directly, that's the best way to own them from a tax / tax shield benefit perspective. But if you can't own MLP directly, the bottom line is that in order to get rid of the K-1 and UBTI issues and to get passive exposure to the sector, there are tradeoffs that often mean reduced returns. There is no perfect solution, no free lunch. . .but there are better options available than AMLP, including better options offered by Alerian.

The positives of AMLP, including diversification, single 1099 vs. multiple K-1 forms, and the ability to invest in a retirement account, can all be achieved with exchange-traded notes. The only additional risk an exchange-traded note adds is the counterparty risk associated with the bank issuing the note. The counterparty in the above product MLPI is UBS, but the most liquid MLP ETN out there is AMJ, backed by JP Morgan. AMJ has more than $3B in assets, and is the best option out there for people to use as a vehicle to buy options against or to short as protection against a long MLP portfolio. But given there is no tracking error, it's also useful for gaining broad MLP exposure with minimal transaction costs in a retirement account. Amazing stat that Alerian had in a presentation a few weeks ago: AMJ's assets represent more than 20% of the global market for ETNs, pretty amazing.

Who Cares?

From the perspective of long MLP investors, it's not a bad thing that $1.6B of capital has entered the sector through this ETF that otherwise probably would not have entered the space. More capital means MLP unit prices generally are higher, and that more capital can be raised in the capital markets by MLPs. More capital invested in growth projects leads to more distribution growth from MLPs.

Also, all of the advertising that AMLP does helps shed light on the sector, attracting people to the space that may not find its way into AMLP. It may even have led to more traffic on my website, as people are seeing commercials on CNBC, then googling "what is an MLP?", which leads them here, and potentially leads them to contact me to become a client.

The only thing that really scares me is how fast this AMLP bubble could pop and how fast this capital could leave the sector. Never before has it been so easy to enter and exit the sector, as it is now with ETFs and open-end funds.

If people are satisfied with AMLP, and willing to take a haircut on the returns available from alternatives, either out of laziness or ignorance, fine with me I guess. Although clearly I would prefer to manage some of the combined $5B plus that Alerian is managing, kudos to them for finding (or creating) a need and filling it, for recognizing the explosion in demand for ETF products, and for marketing the hell out of it.

I guess the ultimate lesson here is: if you see something being advertised on a CNBC commercial, approach with extreme caution.

Disclosure: The information in this article is not meant to be financial advice, we are not your financial advisor and I am posting my comments for informational purposes only.