China is now the largest Auto market in the world, and virtually every one of the cars sold there represents a net addition to its auto fleet, rather than being a mostly replacement market as is the case in the U.S. and Europe. That means each car sold today will be burning gas for many years to come. Over time, however, the easy oil has been mostly extracted. Oil companies now have to search in more remote places and have to drill much deeper.

Squeezing the last practical drop out of existing fields also becomes more important. In other words, the oil service intensity of oil exploration and production is rising. That provides a favorable long-term backdrop for the Oil Field Service industry.

This is a secular growth industry. When people talk of technology in the stock market, they usually think of computers and chips, but the real meaning of technology is the practical application of science, and in that sense these are some of the highest of high-tech firms.

Zacks Industry Classifications

The Zacks industry classifications are very fine, with 256 different industries tracked. It is not particularly noteworthy if a single small industry shows up doing well; a single firm with good news can propel a one or two firm industry to the top (or bottom) of the charts. It is interesting when you see a cluster of similar industries at the top of the list.

The same holds true for the bottom of the list. The definition of size that matters here is not the total sales or market capitalization but the number of companies in the "industry."

Among the Biggest and Best

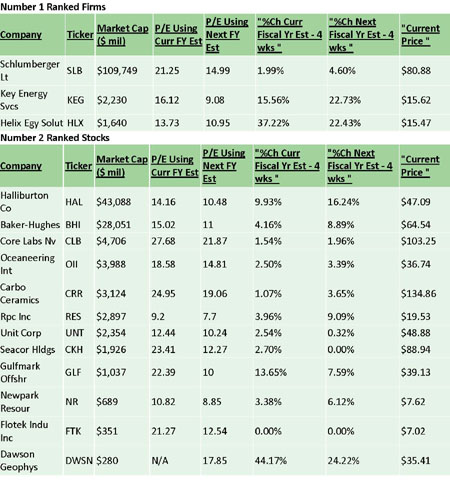

The Oil and Gas Service industry is much larger than average, not only in terms of the number of firms (34) but also in the market capitalizations of the firms involved. It is thus worth writing about on its own. It is currently in 23rd place, and improvement of 23 spots as its average Zacks Rank fell to 2.57 from 2.69. Significantly, the largest firms in the industry hold either number one or number two ranks.

There are 35 firms in these industry, of which three (8.6%) hold the enviable Zacks #1 Rank. Twelve more (34.3%) have Zacks #2 Ranks. If the Zacks ranks were random, then one would expect that 5% of the names in an industry would be #1's and 15% would be #2's.

Success Among the Smaller, As Well

The rest are all on the small side of mid cap, ranging down to firms bordering on micro cap size. The vast majority are easily in the investable range for individual investors, and even most institutions. Valuations, particularly if you look out to 2012 earnings, are attractive—particularly given the long-term tailwind that this industry has.

Every one of the Zacks #1 Ranked stocks has a single digit P/E based on 2012 earnings. The estimate increases for 2012 earnings are mostly even bigger than those for 2011 earnings.

The combination of rapidly rising expectations, low valuations and a very solid long-term thesis as to why these industries should have a very bright future for a very long time to come could well result in a gusher for your portfolio.

In evaluating the Zacks Industry Ranks, you want to see two things: a good overall score (low, meaning more Zacks #1 and #2 Ranked stocks than #4 or #5 Ranked stocks) and some improvement the relative position from the prior week. It is also helpful to understand exactly what the Zacks Industry Rank is.

The Zacks Industry Rank is the un-weighted average of the individual Zacks ranks of the firms in that industry. It does not matter if the stock is the 800 lb gorilla that dominates the industry or some very small niche player in the industry—they have the same influence on the industry rank.

Also, that means that the bigger the industry in terms of number of firms, the less influence any given company has on the industry rank. It also implies that small industries, with just two or three firms, should be the ones found at either the top or the bottom of the list. After all, if there are only two firms in the industry, it is relatively easy to get a Zacks rank of 2.00 (i.e. one with a Zacks Rank of #1 and the other with a #3). Right now, that industry rank would be tied for 6th place among the 255 industries tracked.

The same obviously goes for the bottom of the list as well. If there are 50 firms in the industry, and it ends up at one of the extremes, that means there has to be something pretty significant going on. Thus, I do not always focus on the very highest rated industries, but on the highest rated ones in which there are a large number of firms.

http://www.zacks.com/