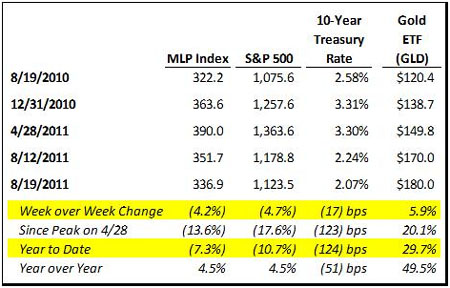

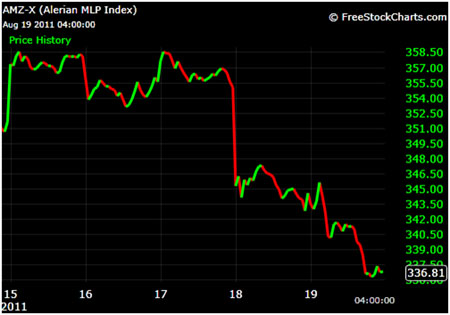

While for the week, MLPs were down 4.2%, from Monday's close through Friday's close, MLPs dropped 6.0%, including 3% on Thursday and 2.3% on Friday. On the chart below you can see the bulk of the drop came in between Wednesday and Thursday, and continued on Friday afternoon.

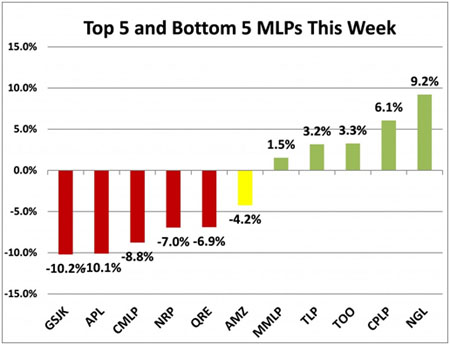

Commodity prices were in the driver's seat last week, as commodity-price sensitive names dominated the bottom five. There wasn't much news out of the MLPs, other than WMB management reiterating their belief that WMB's bid is superior to ETE's for SUG, particularly in light of market action that has dropped ETE by roughly $5 a share in the past month. SUG responded that for now its sticking with ETE, but this drama is likely far from over given the shareholder vote is a few months away.

Of the positive movers, MMLP continued to recover from a huge drop after earnings a few weeks ago, TLP as well. The top performer for the week, NGL, announced a propane acquisition and a few firms initiated coverage of the company with positive comments.

The chart above doesn't include the publicly-traded MLP general partners, but GPs were hit particularly hard last week. On average, GPs dropped 7.3% this week, with XTXI (-16.5%), KMI (-11.0%), and ATLS (-10.4%) having the largest week over week declines. GPs tend to be more heavily owned by institutions, particularly GPs that are structured as corporations like XTXI, KMI and TRGP, because with corporations there are not the same hurdles to ownership as for MLPs. So, when broad markets decline, the volatility of the corporately-structured GPs tend to fluctuate in value wildly.

This week, Citigroup will host what used to be the UBS conference in Las Vegas (it changed this year because of a mass exodus of energy investment bankers from UBS to Citigroup, including my brother). I will not attend the conference, but I saw press releases from many MLPs who will be attending the conference, but the funny thing is, I found only one press release (from MWE) that actually stated where the conference was being held (MWE's press release).

Every other MLP press release I read mentioned that management was attending the conference, but just left out where the conference was. Here is how EPD's press release reads:

Enterprise Products Partners L.P. (NYSE:EPD) today announced that Michael A. Creel, president and chief executive officer, W. Randall Fowler, executive vice president and chief financial officer, and John R. Burkhalter, vice president of investor relations, of Enterprise's general partner, are scheduled to participate in the Citigroup Master Limited Partnership / Midstream Infrastructure Conference on Wednesday and Thursday, August 24 and 25, 2011. (EPD Website)

In EPD's press release for the NAPTP conference in May, the location is pretty clearly spelled out. Here is how that press release reads:

Enterprise Products Partners L.P. (NYSE:EPD) today announced that Michael A. Creel, president and chief executive officer of Enterprise's general partner, is scheduled to present at the NAPTP Annual Investor Conference in Greenwich, Connecticut on Thursday, May 26, 2011 at 4 p.m. EDT.

It's easy to understand why public companies don't want to advertise that their executives are spending a day or two on the company's dime in Las Vegas, but I thought it was amusing in an otherwise pretty bleak month for MLPs. Also, I am not picking on EPD, literally every MLP except MWE failed to mention location in their press release.

Good luck this week, looks like Libya news might push oil down further putting more pressure on MLP unit prices today, but we'll see. I'll be in the office while executives get wined and dined in Vegas, and most of Wall Street is on vacation.

-Hinds Howard, MLP Hindsight

Disclosure: The information in this article is not meant to be financial advice, we are not your financial advisor and I am posting my comments for informational purposes only. Long EPD.