TICKERS: CLF, FPX, IZN, , FOS, SCY, TECK, NPK; AMHPF

John Kaiser: Alternative Energy Fuels a Mining Bloom

Interview

Source: Karen Roche and JT Long of The Energy Report (5/12/11)

Advances in energy and agriculture are creating demand for previously ignored metals such as scandium, tellurium and indium. In this exclusive interview with The Energy Report, Mining Analyst John Kaiser, editor of Kaiser Research Online, explains the science that could exponentially increase the value of overlooked stocks.

Advances in energy and agriculture are creating demand for previously ignored metals such as scandium, tellurium and indium. In this exclusive interview with The Energy Report, Mining Analyst John Kaiser, editor of Kaiser Research Online, explains the science that could exponentially increase the value of overlooked stocks.

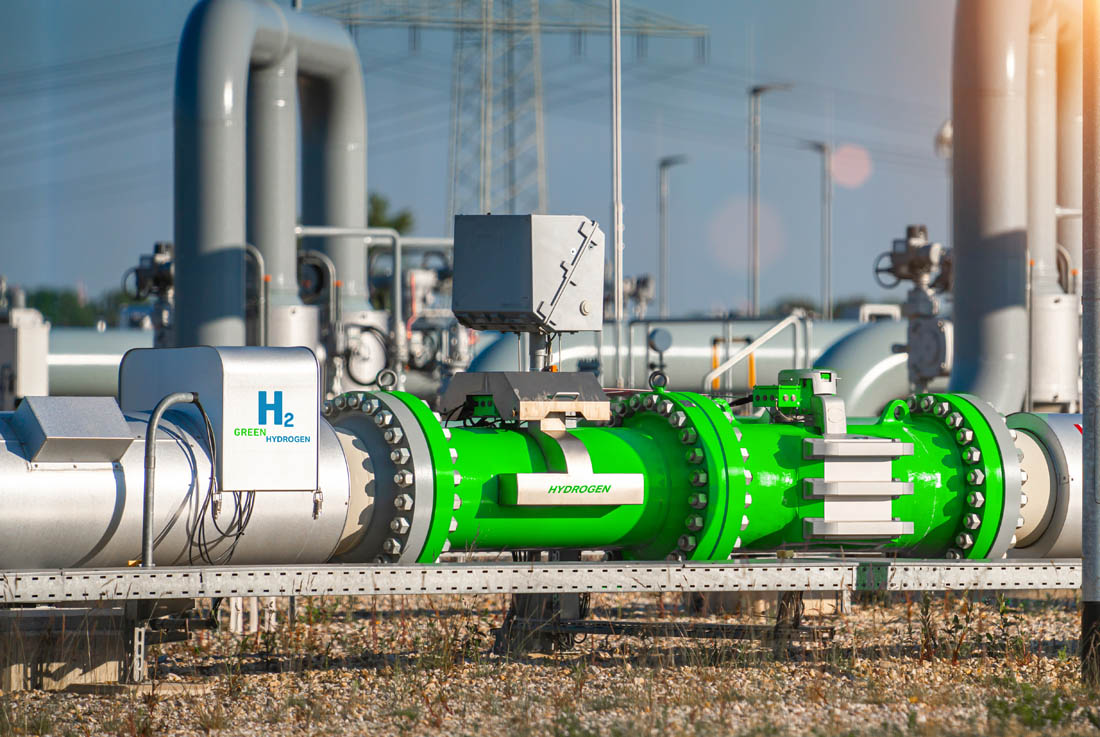

The Energy Report: Thank you John for agreeing to give us a peek at some of the revolutionary changes emerging in the energy markets today. You have written about the push for alternative forms of energy fueled by a growing middle class population in developing countries. In particular, your April 15th Kaiser Bottom-Fish Report focuses on Bloom Box, a solid oxide fuel cell that could jump-start the next generation of electricity with the help of scandia stabilized zirconia. What's the status of this project?

John Kaiser: Solid oxide fuel cells have been around for a long time but they have had technical problems such as the decomposition of the electrolyte core due to the fuel cell's high internal temperature. Bloom Energy tackled this problem by doping the zirconium core with scandium. The result is a robust box ready for production, with the caveat that it will take a decade to truly demonstrate that frequent replacement of the core is not necessary. The company has installed 140 of them already in California commercial buildings at a cost of $800,000 each and expects to have 200 of them in place by the end of 2011. The next step will be scaling down to residential capacity at a cost-effective price. If the company can actually make this work, the market would be extraordinary.

Like most clean energy technologies, the Bloom Box involves a high upfront capital cost; and because natural gas is not free like wind or sunshine, you may ask why a consumer is not better off just paying the price of electricity generated through traditional gas power plants on an as-needed basis. The answer lies in the near doubling of electricity generated by the same unit of fuel using a Bloom Box. Ironically, the more expensive natural gas becomes over time, the faster the payback. If we add a carbon price the payback is even quicker.

California is largely powered by natural gas combustion, which delivers efficiency of about 35% compared to the 60% of power harnessed in the non-combustion solid oxide chemical-electrical process. Gaseous fuels—hydrogen, methane, any biogas—can be input and the only residuals are electricity, carbon dioxide and water. The bottom line is a smaller carbon footprint.

TER: Based on developments like this, what is the outlook for scandium supply and demand in the future?

JK: No scandium mines exist in the world right now. Five tons or so come from scrap metal and stockpiles left over from former uranium mines in the Ukraine. The strategic metal is mainly used to make a light, strong aluminum alloy that can be welded. That makes it popular in the aerospace and defense industries. Scandium is one of these "Field of Dreams" stories. If you build a supply, all kinds of technology commercialization becomes feasible. More than 100 patents have been filed in the last 50 years for uses involving scandium. An accessible scandium supply would pave the way for all kinds of new technologies. The key here is efficiency. In the case of the Bloom Box, it provides functionality that allows this electrochemical process to be effective. But for most of these other applications it's all about aluminum scandium alloys, making items more durable, more efficient and lighter. That leads to lower energy cost to move cars, planes or anything else engineers can imagine. And if things last longer there is also an energy savings.

Because of this latent demand, a few companies are addressing the supply problem. In Q112, EMC Metals Corp. (TSX:EMC) plans to deliver a feasibility study for the development of the Nyngan Gilgai Project in Australia. Nyngan has an unusually high scandium grade; what EMC hopes to bring to the table is an improved recovery process designed by its chief technology officer, Willem Duyvesteyn.

TER: So, EMC Metals' strategic advantage is this better method of extracting scandium from the ore and then going and finding similar deposits which were previously not feasible using conventional recovery processes?

JK: That's right. The days of discovering large high-grade deposits of any nature in readily-accessible regions are gone. The new game is to apply innovative extraction technologies to deposits regarded as too low grade or metallurgically challenged to be economical. EMC is looking for deposits with elevated scandium grades previously considered worthless. It just picked up some properties in Norway where pegmatite formations contain fairly large scandium crystals. The company will test its metallurgical bag of tricks to see if they can extract scandium from these complex minerals and provide a supply from that part of the world.

TER: Are there any other scandium projects in the works?

JK: While EMC is looking at primary scandium production plays, others are looking at scandium as a byproduct. Orbite VSPA Inc. (TSX.V:ORT) is developing an alumina clay deposit in Québec using a new proprietary process involving solvent extraction. The company hopes to sell metallurgical grade alumina to the dozen aluminum smelters across the St. Lawrence River where they have access to cheap hydroelectricity. Electricity is key to refining aluminum, so smelters are always built near an abundant supply of cheap electricity. Today, the smelters import alumina from tropical regions such as Jamaica and Brazil where it is derived from laterite deposits called bauxite which are double the grade of alumina clay deposits. Tomorrow, If Orbite can produce and sell its alumina at a competitive price, without the transportation cost risk, its deposit could replace the Quebec aluminum smelter industry's dependency on imported alumina.

As a bonus, Orbite believes the company can extract low-grade scandium as well as gallium from the alumina clay. Gallium, used by the electronics industry and a key input for a new style of thin-film photovoltaic solar panels, is currently recovered as a byproduct of alumina production from bauxite using an expensive process. If Orbite can get scandium and gallium as a byproduct of their alumina clay process, and scale up the alumina production, they could provide a significant supply of scandium to world markets, a feat possibly more profitable than providing a secure local supply of alumina to smelters. The trick is to demonstrate that the scandium and gallium do not end up with the 3% portion of impurities in the alumina sold to the smelter, and that Orbite's process enables it to selectively and cost-effectively extract the scandium and gallium remaining in the solution. Proving this will be a high impact milestone for Orbite.

TER: Are advances in other alternative energy technologies driving demand for metals?

JK: Definitely. A new tellurium-based solar panel is making a refinery byproduct metal suddenly valuable. Unfortunately, no one mines for tellurium. It is produced as a refinery byproduct of certain copper concentrates. The USGS estimates annual tellurium production at about 300,000 lbs., which at the current price of $200/lb. makes the tellurium market worth about $60 million per year, which is "peanuts" compared to the $100 billion-plus value of annual copper production.

Maybe the existing applications that require tellurium use so little that a price jump to $1,000/lb. would barely dent the profitability of the end-product. You would think that all you need is a higher commodity price to generate the supply needed to meet demand. The problem with critical metals recovered by refining base metal concentrates is that their production is linked to the global business cycle. No company is going to increase copper production because demand for tellurium is going through the roof. Those copper /tellurium byproduct mines are likely already mining copper ore at capacity. Furthermore, a dirty secret of the refining and smelting industry is that it does not pay anything to the producer for critical metals such as indium, tellurium and selenium that it recovers from the refinery slag. The entrepreneurial challenge for resource juniors is to find a base or precious metals deposit with an elevated grade for a critical metal such as tellurium and get a partner with sufficient clout to force the smelters and refiners to treat critical metals as payables.

Indium, typically recovered by zinc refineries, is another example of an obscure metal hijacked by technology innovation. Demand surged during the last decade when it turned out that indium was useful in display panels. The price is now $700/kg. compared to less than $100/kg. at the start of the past decade when cathode ray tube monitors still ruled. Thin-film copper-indium-gallium-selenium (CIGS) photovoltaic cells stand to generate new demand for indium and gallium as consumers hop onto the local solar energy bandwagon. Teck Resources Ltd. (NYSE:TCK; TSX:TCK.A, TSX:TCK.B) produces indium as a byproduct of its monster Red Dog zinc mine in Alaska. Because it smelts its own zinc concentrates, it profits from the indium byproduct. Red Dog's production rate, however, is a function of global zinc demand and the permitted operating infrastructure; it is simply not responsive to indium demand and price, which presents a crisis in terms of simplistic free market capitalism.

The problem for solar panel manufacturers is that the mining industry is not geared to delivering a supply response to higher prices when they involve these critical byproduct metals. The mining industry is subject to the supply-demand cycles of the major metals such as copper, nickel, zinc, lead, iron and aluminum. However, the beauty of entrepreneurial capitalism is that thoughtful individuals can and will identify niche opportunities for which they can deploy specialized exploitation strategies.

For example, resource juniors are now searching for zinc deposits with elevated indium grades on the premise that in a world awash with a glut of zinc supply, future development priority will be given to zinc deposits with a conventional zinc grade but an exceptional indium grade. This is an opportunity for the juniors to investigate because the markets for these metals have generally been too small for the big mining companies who prefer to focus on large scale base metal mines which, examples like Red Dog or Neves Corvo in Portugal excepted, tend not to have a meaningful indium credit. China has been an indium source because the country is home to numerous zinc deposits exploited through small scale mining methods. However, the government has added indium to its restricted list with the result that the world may suffer indium supply shortages in much the same way it is suffering from China's strategic decision to allocate rare earth production to domestic users.

TER: Other than in China, what companies are finding indium and where?

JK: One of the companies I have been following is Lithic Resources Ltd. (TSX-V: LTH). It has a zinc deposit in, of all places, Utah, home of monster world-class mines such as Bingham Canyon. The Crypto deposit, discovered decades ago and sidelined as an interesting but marginal skarn-style zinc deposit, has been demonstrated by Lithic to have an unusually high indium grade along with its zinc, copper, silver and gold, which will be the bread and butter of a future mine. The indium, however, has the potential to be the gravy.

America, despite its wide open spaces bathed in sunshine, lags Germany, Spain and Japan in the deployment of solar energy capacity. China, the world's primary producer of indium and gallium, lags in tenth place but is pushing hard to become the dominant deployer and provider of solar energy technology. Lithic is now in the process of raising money to do step out drilling following an independent consultant's recommendation that the resource be boosted at least 50% to make it feasible at base-case prices, which reflect the dismal reality of the past three years rather than considerably higher spot prices. In my view, unless you subscribe to the belief that raw material prices reflect "bubble" conditions, Crypto is feasible without the extra tonnage. But if the juniors can boost the tonnage with exploration drilling while the zinc mountain in the warehouses finally peaks, this "boring" zinc deposit with the indium icing will be able to withstand the more pessimistic scenarios bandied about by the "apocaholics."

TER: Agriculture is another global resource problem looking for a mineral solution. In your December newsletter you said fertilizer plays are becoming hot again as the world contemplates the deadly combination of climate change-driven disruption of crop harvests and the growing appetite of developing nations. What about potash companies? Are you seeing those as part of the supply chain that is going to benefit from these factors?

JK: Yes, potash demand is going to go up because emerging middle classes in India and China are developing an appetite for meat, which takes 10 times as much grain to produce as grain for bread. The limited amount of fertile land available will increase the demand for fertilizer. This will increase demand for potash and probably increase potash prices.

Location is an important factor for fertilizer. Brazil is one of the few countries that actually has an enormous amount of arable land available for agriculture. But it has a 90% potash import dependency. Importing potash from the Ukraine or Canada consumes a large amount of energy. Those transportation costs are added to the potash price. One of the companies I have been following is Verde Potash (TSX.V:NPK), formerly known as Amazon Mining. The company owns about 15 billion tons of glauconite, a silicate-based potash existing at surface in Brazil's agricultural heartland. At 9%–11% K2O (potassium oxide), glauconite is lower grade than the 20%–30% grade of sylvite, the salt-based potash also known as potassium chloride mined from deep evaporite beds or extracted from brines. Brazil's glauconite deposits were first recognized during the eighties, but never developed because imported conventional potash was so much cheaper. But with $400/ton potash, this stuff suddenly becomes feasible to develop. The company plans to convert the glauconite into "ThermoPotash," a whole rock product that can be blended into fertilizer blends. Brazil's government is very supportive of Verde Potash, but the reality is that glauconite processed and marketed as ThermoPotash will never replace more than 15% of Brazil's import dependency.

But, once again, entrepreneurial capitalism has come into play. Verde Potash commissioned a scientist at Cambridge University, Dr. Derek Fray, to investigate the possibility of a process for converting the silica-based glauconite into conventional salt-based potash products that can serve as a complete replacement for imported potassium chloride. A patent application for such a process was filed in December 2010 and Verde Potash is now setting up independent metallurgical studies to demonstrate that glauconite can be cost effectively converted into conventional potash fertilizers. If it works, Verde Potash's process would allow its huge glauconite deposit to replace all of Brazil's import dependency. Because similar low-grade silicate-based potash deposits exist elsewhere in the world, other agricultural economies armed with a technology license from Verde Potash could also turn their "worthless" glauconite deposits into a game-changing solution to fertilizer import dependency.

TER: Any other fertilizer companies you are following?

JK: PhosCan Chemical Corp. (TSX:FOS) has a phosphate deposit in Ontario that was stranded mid-development when the market fell apart in 2008. At the time, PhosCan had grandiose goals of becoming a vertically-integrated phosphate fertilizer producer based on skyrocketing fertilizer prices. Although fertilizer prices have rebounded from the 2008 crash, they are still well below peak 2008 prices. PhosCan has shelved its capital cost-intensive plan for a vertically-integrated plant in favor of investigating the feasibility of developing itself as a producer of phosphate rock to existing fertilizer giants such as Cargill with costs offset by byproduct credits from niobium and rare earths. With the help of a $60M war chest built up during 2008 and still largely intact, PhosCan hopes to turn the Martison deposit into a multi-stream mine that serves both the fertilizer and clean energy sectors.

TER: What other little nuggets do you have John?

JK: First Point Minerals Corp. (TSX-V:FPX) is an exciting, energy-related company. It has identified a type of low-grade nickel deposit where the majority of the nickel content occurs as a nickel-iron alloy technically known as awaruite and more commonly described as a natural stainless steel—the host rocks never look rusty. This type of deposit occurs within ophiolite belts—black oceanic rocks that have been shoved onto the continent. The ultramafic rocks normally contain about 0.25% nickel, but this nickel is locked up in the crystal lattice of a mineral called olivine. Extracting nickel from olivine is hopelessly expensive. Under the right metamorphic conditions Mother Nature squeezes the nickel out of the olivine so that it is able to combine with iron to create grains of nickel-iron alloy also known as awaruite. Cliffs Natural Resources Inc. (NYSE:CLF), a producer of key inputs for the steel-making industry, optioned the Decar Project in British Columbia in late 2009 and bought a 14% equity stake in First Point. The key here is that even though Decar is low grade, about two-thirds of the nickel grade occurs as nickel-iron alloy which Cliffs and First Point believe can be recovered through gravity and magnetic separation. In stark contrast to laterite and sulphide nickel ores, no chemicals and very low energy inputs are needed. Plus, the tailings are fairly benign in terms of acid-generating waste. We hope to learn by the end of the second quarter how much of Decar's nickel grade is recoverable and at what cost.

Not only has First Point's management thought outside the box in targeting a low-grade style of nickel deposit that could do for nickel what porphyry deposits did for copper during the 50s, but it has put its experience in geochemistry to use in developing an efficient geochemical method for establishing what percentage of a rock's fire-assayed nickel grade is due to nickel-iron alloy. During 2010, an independent lab and metallurgist certified this method as valid. Armed with this low cost and quick turnaround tool for assessing the awaruite content of otherwise mediocre looking black rock, First Point is now scouring the world looking for similar deposits. Hopefully, in the next 6 to 12 months, the company will announce that it has acquired several billion ton deposits of this style of low-grade natural stainless steel (nickel-iron alloy) deposit. Such an achievement would make First Point of enormous value to countries such as China, which is looking for a source of nickel whose production is not tied to expensive, energy-intensive, environmentally-hazardous chemical processes. That is why this $0.77 stock could be worth an awful lot more.

TER: Thank you for your time. This has been great.

JK: You're welcome.

John Kaiser, a mining analyst with over 25 years' experience, is editor of Kaiser Research Online. He specializes in high-risk speculative Canadian securities and the resource sector is the primary focus for an investment approach he developed that combines his "bottom-fishing strategy" with his "rational speculation model." Kaiser began work in January 1983 as a research assistant with Continental Carlisle Douglas, a Vancouver brokerage firm that specialized in Vancouver Stock Exchange listed securities. In 1989 he moved to Pacific International Securities Inc., where he was research director until April 1994 when he moved to the United States with his family. He launched the Kaiser Bottom-Fishing Report (now Kaiser Research Online) as an independent publication in October 1994 and developed it into an online commentary and information portal. He has written extensively about the junior resource sector, is frequently quoted by the media, and is a regular speaker at investment conferences. Since 2008 he has developed a focus on security of supply issues and how they relate to critical metals such as rare earths.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) Karen Roche and JT Long of The Energy Report conducted this interview. They personally and/or their families own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Verde Potash.

3) John Kaiser: I personally and/or my family own shares of the following companies mentioned in this interview: EMC, Orbite, First Point, Lithic. I personally and/or my family am paid by the following companies mentioned in this interview: None.

John Kaiser: Solid oxide fuel cells have been around for a long time but they have had technical problems such as the decomposition of the electrolyte core due to the fuel cell's high internal temperature. Bloom Energy tackled this problem by doping the zirconium core with scandium. The result is a robust box ready for production, with the caveat that it will take a decade to truly demonstrate that frequent replacement of the core is not necessary. The company has installed 140 of them already in California commercial buildings at a cost of $800,000 each and expects to have 200 of them in place by the end of 2011. The next step will be scaling down to residential capacity at a cost-effective price. If the company can actually make this work, the market would be extraordinary.

Like most clean energy technologies, the Bloom Box involves a high upfront capital cost; and because natural gas is not free like wind or sunshine, you may ask why a consumer is not better off just paying the price of electricity generated through traditional gas power plants on an as-needed basis. The answer lies in the near doubling of electricity generated by the same unit of fuel using a Bloom Box. Ironically, the more expensive natural gas becomes over time, the faster the payback. If we add a carbon price the payback is even quicker.

California is largely powered by natural gas combustion, which delivers efficiency of about 35% compared to the 60% of power harnessed in the non-combustion solid oxide chemical-electrical process. Gaseous fuels—hydrogen, methane, any biogas—can be input and the only residuals are electricity, carbon dioxide and water. The bottom line is a smaller carbon footprint.

TER: Based on developments like this, what is the outlook for scandium supply and demand in the future?

JK: No scandium mines exist in the world right now. Five tons or so come from scrap metal and stockpiles left over from former uranium mines in the Ukraine. The strategic metal is mainly used to make a light, strong aluminum alloy that can be welded. That makes it popular in the aerospace and defense industries. Scandium is one of these "Field of Dreams" stories. If you build a supply, all kinds of technology commercialization becomes feasible. More than 100 patents have been filed in the last 50 years for uses involving scandium. An accessible scandium supply would pave the way for all kinds of new technologies. The key here is efficiency. In the case of the Bloom Box, it provides functionality that allows this electrochemical process to be effective. But for most of these other applications it's all about aluminum scandium alloys, making items more durable, more efficient and lighter. That leads to lower energy cost to move cars, planes or anything else engineers can imagine. And if things last longer there is also an energy savings.

Because of this latent demand, a few companies are addressing the supply problem. In Q112, EMC Metals Corp. (TSX:EMC) plans to deliver a feasibility study for the development of the Nyngan Gilgai Project in Australia. Nyngan has an unusually high scandium grade; what EMC hopes to bring to the table is an improved recovery process designed by its chief technology officer, Willem Duyvesteyn.

TER: So, EMC Metals' strategic advantage is this better method of extracting scandium from the ore and then going and finding similar deposits which were previously not feasible using conventional recovery processes?

JK: That's right. The days of discovering large high-grade deposits of any nature in readily-accessible regions are gone. The new game is to apply innovative extraction technologies to deposits regarded as too low grade or metallurgically challenged to be economical. EMC is looking for deposits with elevated scandium grades previously considered worthless. It just picked up some properties in Norway where pegmatite formations contain fairly large scandium crystals. The company will test its metallurgical bag of tricks to see if they can extract scandium from these complex minerals and provide a supply from that part of the world.

TER: Are there any other scandium projects in the works?

JK: While EMC is looking at primary scandium production plays, others are looking at scandium as a byproduct. Orbite VSPA Inc. (TSX.V:ORT) is developing an alumina clay deposit in Québec using a new proprietary process involving solvent extraction. The company hopes to sell metallurgical grade alumina to the dozen aluminum smelters across the St. Lawrence River where they have access to cheap hydroelectricity. Electricity is key to refining aluminum, so smelters are always built near an abundant supply of cheap electricity. Today, the smelters import alumina from tropical regions such as Jamaica and Brazil where it is derived from laterite deposits called bauxite which are double the grade of alumina clay deposits. Tomorrow, If Orbite can produce and sell its alumina at a competitive price, without the transportation cost risk, its deposit could replace the Quebec aluminum smelter industry's dependency on imported alumina.

As a bonus, Orbite believes the company can extract low-grade scandium as well as gallium from the alumina clay. Gallium, used by the electronics industry and a key input for a new style of thin-film photovoltaic solar panels, is currently recovered as a byproduct of alumina production from bauxite using an expensive process. If Orbite can get scandium and gallium as a byproduct of their alumina clay process, and scale up the alumina production, they could provide a significant supply of scandium to world markets, a feat possibly more profitable than providing a secure local supply of alumina to smelters. The trick is to demonstrate that the scandium and gallium do not end up with the 3% portion of impurities in the alumina sold to the smelter, and that Orbite's process enables it to selectively and cost-effectively extract the scandium and gallium remaining in the solution. Proving this will be a high impact milestone for Orbite.

TER: Are advances in other alternative energy technologies driving demand for metals?

JK: Definitely. A new tellurium-based solar panel is making a refinery byproduct metal suddenly valuable. Unfortunately, no one mines for tellurium. It is produced as a refinery byproduct of certain copper concentrates. The USGS estimates annual tellurium production at about 300,000 lbs., which at the current price of $200/lb. makes the tellurium market worth about $60 million per year, which is "peanuts" compared to the $100 billion-plus value of annual copper production.

Maybe the existing applications that require tellurium use so little that a price jump to $1,000/lb. would barely dent the profitability of the end-product. You would think that all you need is a higher commodity price to generate the supply needed to meet demand. The problem with critical metals recovered by refining base metal concentrates is that their production is linked to the global business cycle. No company is going to increase copper production because demand for tellurium is going through the roof. Those copper /tellurium byproduct mines are likely already mining copper ore at capacity. Furthermore, a dirty secret of the refining and smelting industry is that it does not pay anything to the producer for critical metals such as indium, tellurium and selenium that it recovers from the refinery slag. The entrepreneurial challenge for resource juniors is to find a base or precious metals deposit with an elevated grade for a critical metal such as tellurium and get a partner with sufficient clout to force the smelters and refiners to treat critical metals as payables.

Indium, typically recovered by zinc refineries, is another example of an obscure metal hijacked by technology innovation. Demand surged during the last decade when it turned out that indium was useful in display panels. The price is now $700/kg. compared to less than $100/kg. at the start of the past decade when cathode ray tube monitors still ruled. Thin-film copper-indium-gallium-selenium (CIGS) photovoltaic cells stand to generate new demand for indium and gallium as consumers hop onto the local solar energy bandwagon. Teck Resources Ltd. (NYSE:TCK; TSX:TCK.A, TSX:TCK.B) produces indium as a byproduct of its monster Red Dog zinc mine in Alaska. Because it smelts its own zinc concentrates, it profits from the indium byproduct. Red Dog's production rate, however, is a function of global zinc demand and the permitted operating infrastructure; it is simply not responsive to indium demand and price, which presents a crisis in terms of simplistic free market capitalism.

The problem for solar panel manufacturers is that the mining industry is not geared to delivering a supply response to higher prices when they involve these critical byproduct metals. The mining industry is subject to the supply-demand cycles of the major metals such as copper, nickel, zinc, lead, iron and aluminum. However, the beauty of entrepreneurial capitalism is that thoughtful individuals can and will identify niche opportunities for which they can deploy specialized exploitation strategies.

For example, resource juniors are now searching for zinc deposits with elevated indium grades on the premise that in a world awash with a glut of zinc supply, future development priority will be given to zinc deposits with a conventional zinc grade but an exceptional indium grade. This is an opportunity for the juniors to investigate because the markets for these metals have generally been too small for the big mining companies who prefer to focus on large scale base metal mines which, examples like Red Dog or Neves Corvo in Portugal excepted, tend not to have a meaningful indium credit. China has been an indium source because the country is home to numerous zinc deposits exploited through small scale mining methods. However, the government has added indium to its restricted list with the result that the world may suffer indium supply shortages in much the same way it is suffering from China's strategic decision to allocate rare earth production to domestic users.

TER: Other than in China, what companies are finding indium and where?

JK: One of the companies I have been following is Lithic Resources Ltd. (TSX-V: LTH). It has a zinc deposit in, of all places, Utah, home of monster world-class mines such as Bingham Canyon. The Crypto deposit, discovered decades ago and sidelined as an interesting but marginal skarn-style zinc deposit, has been demonstrated by Lithic to have an unusually high indium grade along with its zinc, copper, silver and gold, which will be the bread and butter of a future mine. The indium, however, has the potential to be the gravy.

America, despite its wide open spaces bathed in sunshine, lags Germany, Spain and Japan in the deployment of solar energy capacity. China, the world's primary producer of indium and gallium, lags in tenth place but is pushing hard to become the dominant deployer and provider of solar energy technology. Lithic is now in the process of raising money to do step out drilling following an independent consultant's recommendation that the resource be boosted at least 50% to make it feasible at base-case prices, which reflect the dismal reality of the past three years rather than considerably higher spot prices. In my view, unless you subscribe to the belief that raw material prices reflect "bubble" conditions, Crypto is feasible without the extra tonnage. But if the juniors can boost the tonnage with exploration drilling while the zinc mountain in the warehouses finally peaks, this "boring" zinc deposit with the indium icing will be able to withstand the more pessimistic scenarios bandied about by the "apocaholics."

TER: Agriculture is another global resource problem looking for a mineral solution. In your December newsletter you said fertilizer plays are becoming hot again as the world contemplates the deadly combination of climate change-driven disruption of crop harvests and the growing appetite of developing nations. What about potash companies? Are you seeing those as part of the supply chain that is going to benefit from these factors?

JK: Yes, potash demand is going to go up because emerging middle classes in India and China are developing an appetite for meat, which takes 10 times as much grain to produce as grain for bread. The limited amount of fertile land available will increase the demand for fertilizer. This will increase demand for potash and probably increase potash prices.

Location is an important factor for fertilizer. Brazil is one of the few countries that actually has an enormous amount of arable land available for agriculture. But it has a 90% potash import dependency. Importing potash from the Ukraine or Canada consumes a large amount of energy. Those transportation costs are added to the potash price. One of the companies I have been following is Verde Potash (TSX.V:NPK), formerly known as Amazon Mining. The company owns about 15 billion tons of glauconite, a silicate-based potash existing at surface in Brazil's agricultural heartland. At 9%–11% K2O (potassium oxide), glauconite is lower grade than the 20%–30% grade of sylvite, the salt-based potash also known as potassium chloride mined from deep evaporite beds or extracted from brines. Brazil's glauconite deposits were first recognized during the eighties, but never developed because imported conventional potash was so much cheaper. But with $400/ton potash, this stuff suddenly becomes feasible to develop. The company plans to convert the glauconite into "ThermoPotash," a whole rock product that can be blended into fertilizer blends. Brazil's government is very supportive of Verde Potash, but the reality is that glauconite processed and marketed as ThermoPotash will never replace more than 15% of Brazil's import dependency.

But, once again, entrepreneurial capitalism has come into play. Verde Potash commissioned a scientist at Cambridge University, Dr. Derek Fray, to investigate the possibility of a process for converting the silica-based glauconite into conventional salt-based potash products that can serve as a complete replacement for imported potassium chloride. A patent application for such a process was filed in December 2010 and Verde Potash is now setting up independent metallurgical studies to demonstrate that glauconite can be cost effectively converted into conventional potash fertilizers. If it works, Verde Potash's process would allow its huge glauconite deposit to replace all of Brazil's import dependency. Because similar low-grade silicate-based potash deposits exist elsewhere in the world, other agricultural economies armed with a technology license from Verde Potash could also turn their "worthless" glauconite deposits into a game-changing solution to fertilizer import dependency.

TER: Any other fertilizer companies you are following?

JK: PhosCan Chemical Corp. (TSX:FOS) has a phosphate deposit in Ontario that was stranded mid-development when the market fell apart in 2008. At the time, PhosCan had grandiose goals of becoming a vertically-integrated phosphate fertilizer producer based on skyrocketing fertilizer prices. Although fertilizer prices have rebounded from the 2008 crash, they are still well below peak 2008 prices. PhosCan has shelved its capital cost-intensive plan for a vertically-integrated plant in favor of investigating the feasibility of developing itself as a producer of phosphate rock to existing fertilizer giants such as Cargill with costs offset by byproduct credits from niobium and rare earths. With the help of a $60M war chest built up during 2008 and still largely intact, PhosCan hopes to turn the Martison deposit into a multi-stream mine that serves both the fertilizer and clean energy sectors.

TER: What other little nuggets do you have John?

JK: First Point Minerals Corp. (TSX-V:FPX) is an exciting, energy-related company. It has identified a type of low-grade nickel deposit where the majority of the nickel content occurs as a nickel-iron alloy technically known as awaruite and more commonly described as a natural stainless steel—the host rocks never look rusty. This type of deposit occurs within ophiolite belts—black oceanic rocks that have been shoved onto the continent. The ultramafic rocks normally contain about 0.25% nickel, but this nickel is locked up in the crystal lattice of a mineral called olivine. Extracting nickel from olivine is hopelessly expensive. Under the right metamorphic conditions Mother Nature squeezes the nickel out of the olivine so that it is able to combine with iron to create grains of nickel-iron alloy also known as awaruite. Cliffs Natural Resources Inc. (NYSE:CLF), a producer of key inputs for the steel-making industry, optioned the Decar Project in British Columbia in late 2009 and bought a 14% equity stake in First Point. The key here is that even though Decar is low grade, about two-thirds of the nickel grade occurs as nickel-iron alloy which Cliffs and First Point believe can be recovered through gravity and magnetic separation. In stark contrast to laterite and sulphide nickel ores, no chemicals and very low energy inputs are needed. Plus, the tailings are fairly benign in terms of acid-generating waste. We hope to learn by the end of the second quarter how much of Decar's nickel grade is recoverable and at what cost.

Not only has First Point's management thought outside the box in targeting a low-grade style of nickel deposit that could do for nickel what porphyry deposits did for copper during the 50s, but it has put its experience in geochemistry to use in developing an efficient geochemical method for establishing what percentage of a rock's fire-assayed nickel grade is due to nickel-iron alloy. During 2010, an independent lab and metallurgist certified this method as valid. Armed with this low cost and quick turnaround tool for assessing the awaruite content of otherwise mediocre looking black rock, First Point is now scouring the world looking for similar deposits. Hopefully, in the next 6 to 12 months, the company will announce that it has acquired several billion ton deposits of this style of low-grade natural stainless steel (nickel-iron alloy) deposit. Such an achievement would make First Point of enormous value to countries such as China, which is looking for a source of nickel whose production is not tied to expensive, energy-intensive, environmentally-hazardous chemical processes. That is why this $0.77 stock could be worth an awful lot more.

TER: Thank you for your time. This has been great.

JK: You're welcome.

John Kaiser, a mining analyst with over 25 years' experience, is editor of Kaiser Research Online. He specializes in high-risk speculative Canadian securities and the resource sector is the primary focus for an investment approach he developed that combines his "bottom-fishing strategy" with his "rational speculation model." Kaiser began work in January 1983 as a research assistant with Continental Carlisle Douglas, a Vancouver brokerage firm that specialized in Vancouver Stock Exchange listed securities. In 1989 he moved to Pacific International Securities Inc., where he was research director until April 1994 when he moved to the United States with his family. He launched the Kaiser Bottom-Fishing Report (now Kaiser Research Online) as an independent publication in October 1994 and developed it into an online commentary and information portal. He has written extensively about the junior resource sector, is frequently quoted by the media, and is a regular speaker at investment conferences. Since 2008 he has developed a focus on security of supply issues and how they relate to critical metals such as rare earths.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) Karen Roche and JT Long of The Energy Report conducted this interview. They personally and/or their families own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Verde Potash.

3) John Kaiser: I personally and/or my family own shares of the following companies mentioned in this interview: EMC, Orbite, First Point, Lithic. I personally and/or my family am paid by the following companies mentioned in this interview: None.