The absence of a viable means to store a significant amount of electricity generated from renewable resources is one of the tallest hurdles limiting their growth. After a series of financial setbacks and exhaustive regulatory deliberations, energy storage fed by renewables is set to earn a scalable role due largely to a new mandate in California and market rules and incentives in the PJM Interconnection.

But will it? Can it?

Whether it's electricity stored for transmission and distribution by utilities or by end-users with their own equipment, opportunities are emerging that position energy storage as a viable option in the portfolios of utilities and power-hungry commercial entities and municipalities. Energy storage could show significant gains within two years.

This comes after a rough couple of years for energy storage generally. According to Steve Minnihan of Lux Research in Boston, a mix of technology failures including fires, bankruptcies and withdrawals pushed the industry back on its heels. Of the 10 battery storage manufacturers which once accounted for 93 percent of the global market, seven of them were tripped up by a technological shortfall or some other setback, according to Minnihan.

Now all eyes in the U.S., as well as in Canada, China, Germany, India, Italy and Japan (to name a few) are on details emerging from a mandate by California for development of 1.325 gigawatts by 2020. The mandate, in Minnihan's words, is expected to drive growth at a "torrid pace."

Early this month, the California Public Utility Commission (CPUC) released details of the long-awaited proposal to support the state's power grid with a variety of energy storage options. And public comments are now available about how the Commission's final rule will be set probably sometime in October.

As often is the case in California, which has set a very ambitious renewable energy target of 33 percent by 2020, the mandate is daring attempt to make emerging storage technologies work together with an experimental regulatory regime to help transform the market. If it succeeds, the nation, and the world, will have a virtual blueprint for scaling up this energy option with a host of technologies to choose from.

This California mandate is "paving the way forward for energy storage to participate on a level playing field as a mainstream resource," said Janice Lin, Co-Founder and Executive Director of the California Energy Storage Alliance.

"Energy storage was always out there in the ether. It wasn't a focus—until now," Lin added.

The move to enable energy storage in California began in 2010 when California Assembly Bill (AB) 2514 became law. It was the first state law of its kind. The CPUC has since decided that a goal of about 2.8 percent of the state's 2010 peak load of 47,350 megawatts (1.325 gigawatts) is a reasonable target.

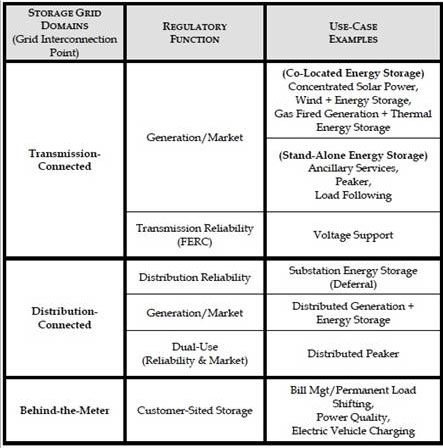

To reach that threshold, the CPUC has identified 21 storage applications working with different components of the power grid. They range from backup power for end-users, outage mitigation, "ancillary services" for the California Independent System Operator (CAISO) and "black start" support. (Black start is the process of restoring a power plant's operations without relying on the surrounding transmission network. Black starts were required during the August 2003 Canada / Northeast U.S. power outage.)

This chart by the California Public Utilities Commission illustrates the types of applications for energy storage divided for each of the three parts of the grid.

Most of the burden for achieving the California target rests with the states three investor-owned utilities (IOUs) and: Pacific Gas & Electric, San Diego Gas & Electric and Southern California Edison. Each utility has one or more notable energy storage projects under development which would count toward their respective quotes. But collectively they barely scratch the surface.

To gauge the breadth and depth of energy storage applications and the various projects capable of meeting the mandate, let's look at a few examples.

Southern California Edison is building an 8-megawatt wind energy storage system in Tehachapi, California to improve grid performance and help integrate large-scale variable energy-resourced generation. Most of these operations are designed to either shift other generation sources to meet peak loads and other grid system needs with stored electricity. The operations also could help maintain grid stability and meet demand challenges that occur due to the intermittancy of renewable sources.

Pacific Gas & Electric has a power purchase agreement with SolarReserve for a solar-thermal power project that integrates molten salt energy storage. San Diego Gas & Electric is working with S&C Electric to develop an energy storage system to support a community microgrid in Borrego Springs, California. Each of these utility projects is backed by a U.S. Department of Energy smart grid stimulus grants.

The CPUC provides the utilities with significant leeway in meeting their quotas. For instance, it asks Southern California Edison to either procure 50 megawatts of storage-based capacity for the Los Angeles basin by 2020 or acquire 35 megawatts of energy storage under the state's existing self-generation incentive program. That program pays customers for on-site generation or storage.

In case you're wondering whether pumped hydro storage—the only storage technology considered a cost-effective hedge against "peaker" plants fueled by natural gas—such projects of 50 megawatts and up are expressly prohibited from the storage mix going forward. Which means batteries, fuel cells, thermal energy storage and compressed-air are the technologies in play.

A key player in California's push for energy storage is Carla Peterman, a member of the CPUC. In a June ruling, she articulated the big picture: "When the energy storage market becomes sustainable, procurement targets for storage will no longer be needed and it will compete to provide services alongside other types of resources."

Peterman outlined a plan whereby project owners will be able to bid in their costs and be paid over the life of a contract. Meanwhile, future winning bid prices can, in her words, "adjust over time as IOUs learn more about the projects, the storage market develops and the (Energy) Commission and the CAISO continue to assess the storage needs for the state."

Minihan of Lux Research asserted that by mid-2014 or soon thereafter, the industry, policymakers and large energy users will be to see who's winning contracts. By the end of 2015, we'll be able to see which projects are making economic sense.

One of the more intriguing models for owning energy storage systems in California is a provision permitting utilities to own up to 50% of a storage asset on the customer's premise, e.g. "behind the meter." Because utilities traditionally don't share actual ownership of any asset, such an arrangement may never be realized; or they might blaze a new trail.

Still another provision in the California rules subject to a final ruling allows utilities, if they cannot procure enough "viable projects to meet the targets," to defer up to 80 percent (that's right, 80 percent) of their required procurement targets to later periods. The final rule due out as early as early October is expected to pin down how much extra time they'll be allowed. At present, procurements could be delayed until the next solicitation or perhaps until a project, or projects, are considered "viable."

So how will California determine which projects are viable?

First of all, the Electric Power Research Institute and utility consultancy DNV Kema have developed energy storage evaluation tools. Those tools are to be used in creating a "consistent evaluation protocol" that enables developers to calculate myriad benefits, including the market services that storage systems will provide and costs they will avoid or reduce.

Because storage needs can vary so widely and depend heavily on the specific application and its location, the CPUC calls on utilities to issue "request for offers," or RFOs, to enable providers to focus on each of their specific transmission or distribution needs.

California may be the emerging epicenter for energy storage but a other developers and utilities are making notable progress in their own right. Much of that activity is occurring in the PJM Interconnection power grid serving utilities from the Mid-Atlantic through the upper Midwest. That's because PJM, backed by Order 755 by the Federal Energy Regulatory Commission, makes it possible to earn money for helping balance power flows on its grid.

This month AES Energy Storage, a unit of AES Corp. in Arlington, VA., increased the reach and capacity of its battery array and supporting software to provide frequency regulation service to PJM located at the Dayton Power & Light's Tait power plant. The increase boosts AES' storage resources throughout PJM to more than 100 megawatts, all of it developed within the past five years and all without any government support.

In coal-dependent Ohio, AES' system can displace power generation from inefficient and retiring coal-fired power plants. Like similar battery operations, AES' system produces no direct emissions and requires no water to operate. And that is drawing support from environmental activists, many of whom are starting to rally behind storage as yet another way to back out fossil fuels and fill gaps left by nuclear plants whose licenses aren't being extended.

Going forward, AES Energy Storage President Chris Shelton asserts three pre-requisites for the storage market to grow quickly: 1) procurements that specify the capabilities / services needed; 2) pay is for performance; and 3) decision-makers are agnostic about technology—this to spur innovation.

On a much smaller scale, energy startup Solar Grid Storage in Silver Spring, Maryland, co-founded by former SunEdison executives, recently finished building a grid-connected battery system that stores electricity from a 402- kilowatt solar array developed by Standard Solar and funded by a Maryland Energy Administration "Game Changer" grant. The integrated system provides backup power to a commercial office complex and its microgrid in Laurel, Maryland. At the same time, the storage system can provide local voltage control and demand response services in conjunction with Potomac Electric Power Co. (PEPCO) and generate revenue by providing load control services to PJM.

From these and numerous other energy storage projects surfacing throughout parts of the U.S. alone, it will take a lot of enlightened collaboration to ensure storage meets specific needs. But as more of collaboration takes root, the upside potential for energy storage looks to expand quickly. The sky may indeed by the limit.

Jim Pierobon

The Energy Collective