Prospective investors should note the huge difference between oil shale and oil produced from shale reservoirs, often called shale oil.

Oil shale is an inorganic rock that contains a solid organic compound known as kerogen. Oil shale is a misnomer because kerogen isn't crude oil, and the rock holding the kerogen often isn't even shale.

Liquid crude oil consists of organic material—plant and animal remains—that's been exposed to heat and pressure over millions of years. The slow transformation of organic material into oil progresses through a number of stages. Kerogen occurs relatively early in this process. To understand where kerogen fits into the developmental timeline, consider that bitumen—the hydrocarbon found in Canada's oil sands—represents a later stage in the process. In a sense, bitumen is a higher-quality and more-useful hydrocarbon than kerogen.

To generate liquid oil synthetically from oil shale, the kerogen-rich rock is heated to as high as 950 degrees Fahrenheit (500 degrees Celsius) in the absence of oxygen, a process known as retorting.

There are several competing technologies for producing oil shale. Exxon Mobil has developed a process for creating underground fractures in oil shale, filling these cracks with a material that conducts electricity, and then passing currents through the shale to gradually convert the kerogen into producible oil. Royal Dutch Shell Plc (NYSE:RDS.A) buries electric heaters underground to heat the oil shale.

Although estimates of the cost to produce oil shale vary widely, the process is more expensive and energy-intensive than extracting crude from Canada's oil sands. Producers would require oil prices of roughly $100 a barrel before this capital-intensive process would be feasible on a commercial scale.

In the early 1980s, Exxon embarked on a massive effort to produce oil shale in Colorado. The so-called Colony Oil Shale project was expected to cost $5 billion—an exorbitant amount in 1980—but the investment appeared worthwhile based on prevailing oil prices and the company's optimistic production forecasts.

But a collapse in oil prices forced Exxon to write off a $1 billion investment. It was one of the most dramatic boom-and-bust cycles in energy industry's history. A few larger companies continue to work on oil shale, and plenty of smaller outfits market themselves to unsuspecting investors with tales of massive reserves locked in oil shale.

This article doesn't focus on the oil shale fairy tale but rather a number of shale oil reservoirs located around the U.S. Shale oil plays like the Bakken have far more in common with unconventional gas plays such as Appalachia's Marcellus Shale and Louisiana's Haynesville Shale than they do with Colorado's oil shale.

What makes an oil or natural gas play unconventional? Hydrocarbons don't occur in giant underground pools but are trapped in the pores and cracks of a reservoir rock. Conventional reservoir rocks, such as sandstone feature high porosity and permeability (that is, they have many pores capable of holding hydrocarbons, as well as fissures and interconnections trough that the oil or gas can travel). When a producer drills a well in a conventional field, oil and gas flow through the reservoir rock and into the well, powered mainly by geologic pressure.

Shale fields and other unconventional plays aren't particularly permeable. In other words, these deposits contain plenty of hydrocarbons but lack channels through which the oil or gas can travel. Even in shale fields where there's plenty of geologic pressure, the hydrocarbons are essentially locked in place.

Producers have developed and refined two major technologies in recent years to unlock the natural gas and oil trapped in shale deposits—horizontal drilling and fracturing. The first technology is self-explanatory: Horizontal wells are drilled down and sideways to expose more of the well to productive reservoir layers.

Fracturing is a process whereby producers pump a liquid into a shale reservoir under such tremendous pressure that it cracks the reservoir rock. This creates channels through which hydrocarbons can travel, improving permeability. Over the past several years, U.S. producers have perfected these techniques in a number of prolific shale gas plays. Now more and more of these exploration and production (E&P) firms are applying the same techniques to a handful of established and emerging shale oil plays.

Producers are increasingly finding that long horizontal wells—"long laterals" in industry parlance—and huge multistage fracturing jobs maximize output from shale deposits. For example, in the Bakken producers routinely drill laterals that exceed 10,000 feet in length, a distance of nearly two miles. Plenty of producers do fracturing jobs in more than 30 stages, and a few are contemplating fracturing projects of 42 stages or more. As technology and drilling techniques evolve, output and efficiency continue to improve.

The results explain why exploration and production outfits have rushed to secure acreage in the most promising plays. Not only do these fields produce crude that's often of better quality than West Texas Intermediate (the U.S. standard that's the basis for NYMEX futures), but break-even costs are also far lower than in the deepwater.

In the core of the Bakken, for example, producers need oil prices in the $35 to $40 range to earn solid returns on their drilling programs. At current oil prices, some producers enjoy internal rates of return in excess of 100%.

As you can see, it's important not to confuse shale oil projects with oil shale. With this distinction in mind, let's examine some of the largest horizontal shale oil plays in the U.S. and their prospects for future growth.

The Plays

Bakken Shale

The Bakken Shale occupies the Williston Basin, a vast area centered in North Dakota and Montana. The play also extends into Canada, though the U.S. portion is generally considered to be more prospective for oil. The map below shows exactly where this play is located.

Rocks are deposited in layers. The Bakken comprises three layers of shale—an upper, middle and lower Bakken—located at a depth of between 8,000 and 11,000 feet in the play's most productive areas. Drilling activity targets the Bakken's middle layer, a naturally fractured shale rock that contains a light, sweet high-quality crude oil.

Some parts of the play include another productive formation, the Three Forks-Sanish. Operators initially characterized the Three Forks as an area where oil that spilled out of the Bakken collected. But drilling results increasingly suggest that the Bakken and Three Forks are actually separate plays; activities in the Three Forks formation don't sap production from nearby Bakken wells.

The Williston Basin and Bakken Shale aren't new discoveries—the first wells were drilled back in the 1950s. Technology and techniques were the real discovery.

The simple vertical wells sunk in the 1950s failed to produce oil at high rates. A vertical well travels straight through the Bakken formation, but the only productive part is the 50 to 100 feet of the shaft that touches the middle Bakken. In contrast, a horizontal well drilled along the productive layer exposes thousands of productive feet to the well. In addition, hydraulic fracturing supplements the middle Bakken's natural fractures, further enhancing productivity.

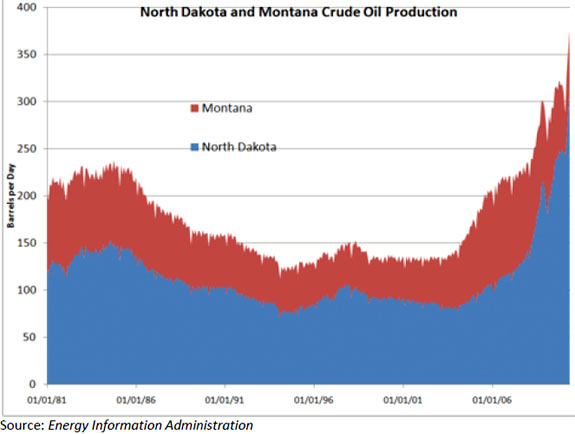

In 2000, E&P firms drilled the first horizontal wells in the field. Since then, several major producers have ramped up activity to the point that the Bakken has emerged as the leading onshore oil play in the continental U.S. The graph below tells the tale.

This graph tracks crude oil production in Montana and North Dakota from 1981 onward. Output from the Bakken area is expected to top 350,000 barrels per day (bpd) in 2010. Given that these states produce roughly 370,000 barrels per day, the data serves as a good proxy of total production from the Bakken.

As you can see, oil output declined in both states from the mid-1980s to 2002-03, when production surged. More recently, production from Montana has declined slightly because operators have shifted their focus to the North Dakota side of the play.

Estimates of the basin's potential production growth vary widely. Conservative estimates put the figure at 500,000 to 750,000 barrels per day over the next five years. Aggressive estimates suggest that the Bakken could yield 1–1.5 million barrels per day in a half-decade. Based on recent well results and comments from producers, I tend to believe that production will approach the high end of these estimates—assuming oil prices remain strong.

As for recoverable reserves, in 2008 the U.S. Geological Survey (USGS) estimated that the field contained 3.65 billion barrels of oil, 1.85 billion cubic feet of gas and 148 million barrels of NGLs. Investors should note that this estimate fails to reflect the increasingly productive Three Forks-Sanish play. Initially regarded as a gross overestimate, the USGS figure is now regarded as quite conservative. Continental Resources, the leading player in the field, pegs the region's recoverable reserves at 24 billion barrels.

But don't get vertigo from these dizzying reserve estimates; what really matters is production, how many barrels of oil per day the play generates. Under the most optimistic assumptions, the region could produce about 1.5 million barrels per day by 2015, a drop in the bucket compared to U.S. oil consumption of 20 million barrels per day.

Don't believe the hype about the Bakken enabling the U.S. to become energy independent or an oil exporter. That being said, the field is large enough that it will have a meaningful and lasting impact on U.S. oil production growth.

As far as investors are concerned, low production costs ensure that, at current oil prices, many producers are generating returns in excess of 100 percent for each well drilled. Most wells pay for themselves in 1.5 to 3 years. The economics become even more attractive in the event of higher oil prices. Companies with attractive acreage positions in the Williston Basin should be able to grow profits significantly in coming years.

Eagle Ford Shale

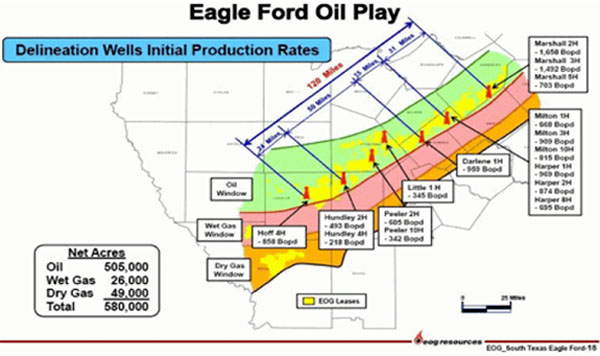

Discovered by Petrohawk Energy Corp. in 2008, the Eagle Ford is located in south Texas and consists of three distinct windows, depicted in the map below.

Wells in the northern part of the play, or oil window, produce mainly crude oil, though it also contains smaller volumes of natural gas and NGLs. Located just to the south of the oil window, the wet-gas region produces gas along with high volumes of NGLs. The play's southernmost window contains mostly gas.

Depressed natural gas prices have ensured that much of the drilling activity to date has occurred in the oil and wet-gas windows, a bias that should persist for the foreseeable future.

In terms of economics, some of the field's sweet spots offer returns rivaling those in the Bakken. With several producers planning to step up drilling in the area, you can expect to hear more about the Eagle Ford in coming years.

Niobrara Shale

Exploration and production (E&P) firms are notoriously tight-lipped about their acquisition programs and initial discovery wells for fear of instigating a land rush and losing out on prime properties. But whenever an explorer announces compelling drilling results in uncharted or forgotten territory, the competition pays attention—and opens up their wallets.

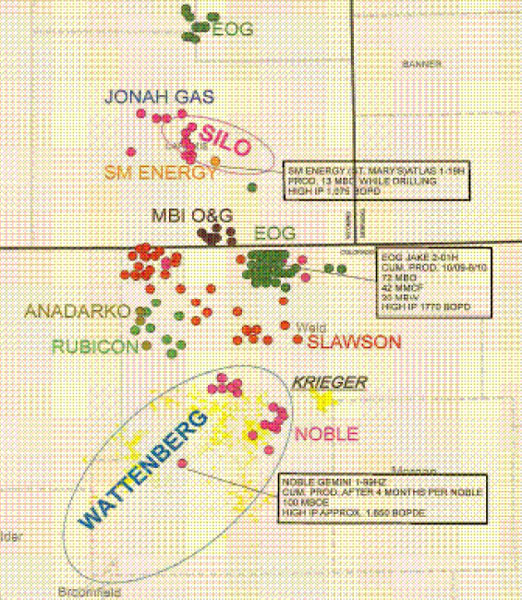

That's exactly what happened when EOG Resources revealed at its 2010 Analysts Conference that it had accumulated 400,000 net acres in the Denver-Juneburg (DJ) Basin, a sedimentary field in Colorado's eastern plains as well as parts of southern Wyoming and western Kansas and Nebraska. EOG's holdings in the DJ basin are concentrated in northeast Colorado and part of Wyoming. What management has identified as the core part of this play is near existing infrastructure in the Hereford prospect.

Confirmation of early results from #2-01H Jake set the industry abuzz. Drilled in the third quarter of 2009, the horizontal Jake well produced at a maximum rate of 1,558 barrels of oil per day from a 3,800-foot lateral. After 90 days, the Jake had produced 50,000 barrels of oil.

Although additional test wells have failed to live up to the Jake—perhaps because of restricted flows and different drilling techniques—the announcement sparked a massive land grab in the region. Early movers secured leases at $350 to $500 an acre. But these days, real estate in the play's most prospective areas goes for more than $3,000 an acre. Wyoming has reported bids as high as $5,900 per acre in land auctions held this summer.

Amid all this excitement, it's important to note that early results suggest that the Niobrara likely contains multiple core areas as well as some regions that are duds. Moreover, as Noble Energy's CEO often points out, the Niobrara effectively consists of two plays: the well-documented Wattenberg Field where Noble Energy and other operators have sunk a number of vertical wells and less-developed areas that have set investors' imaginations racing.

Well results from Noble Energy have demonstrated the benefits of horizontal drilling in areas rife with vertical wells. Remember that these vertical wells only come into contact with a small fraction of the oil-rich shale. Noble Energy's tests indicate that the average horizontal well in the Wattenberg yields 10 times the IP rate of a vertical well, seven times the recovery and double the return.

As of this writing, much of the Niobrara has yet to be de-risked. Third-quarter conference calls from EOG Resources and Noble Energy should include additional well results and could provide insight into each company's 2011 drilling program. Rest assured that we'll be monitoring these developments closely.

Disclosure: No positions