Streetwise Articles

The 'Water Alchemists' in the New Wild West

Source: Keith Schaefer, Oil and Gas Investments Bulletin (10/28/12)

"A 21st century wild-west scenario is developing in Texas. It all has to do with the fast-rising use of water in the Lone Star state's energy patch."

More >

Uranium Supply Squeeze Offers Opportunity

Source: Rick Mills, Ahead of the Herd (10/26/12)

"The likelihood of a shortage of mined uranium makes companies with near-term uranium production very interesting."

More >

Africa and Kurdistan Show Great Oil and Gas Potential: Lionel Therond

Source: Peter Byrne of The Energy Report (10/25/12)

With Iraqi sanctions impeding profitability, explorers and producers are flocking to Kurdistan for cheap production and access to international buyers, explains Lionel Therond, head of oil and gas research at Standard Bank. Meanwhile, discoveries throughout Africa hint at vast untapped potential. In this exclusive interview with The Energy Report, Therond gives us the geological lay of the land in key emerging plays.

More >

Putting America’s Energy Boom In Perspective

Source: Matt Insley, The Daily Reckoning (10/25/12)

"Today we're on the global hunt for oil and gas, and yet again it's brought us back to one hugely profitable place: our own backyard!"

More >

Americans Use More Efficient and Renewable Energy Technologies

Source: R&D Magazine (10/25/12)

"Americans used less energy in 2011 than in the previous year due mainly to a shift to higher-efficiency energy technologies in the transportation and residential sectors."

More >

China Restarts Nuclear Program

Source: Huffington Post, Gillian Wong (10/24/12)

"China is the world's biggest energy consumer, and building new reactors is a key part of Beijing's plans to curb demand for fossil fuels."

More >

Natural Gas Has Sex Appeal: Andrew Coleman

Source: Zig Lambo of The Energy Report (10/23/12)

With prices on the rise and a cold winter approaching, some gas names have already begun to rally. But Andrew Coleman of Raymond James takes a cautious approach—that's why he looks for oil and gas companies that can survive a tough market. In this exclusive interview with The Energy Report, Coleman shares how to gain exposure to promising shale plays using defensive investing tactics. Read on to learn which companies are measuring up with strong balance sheets, dominant acreage positions and top-tier technology.

More >

Canada Denies Petronas: A Catch-22 for LNG Exports

Source: Keith Schaefer, Oil & Gas Investments Bulletin (10/23/12)

"Stocks that foreign companies looking to cash in on Canada's short shipping lines have been eyeing won't be bought out now—at least not for a while."

More >

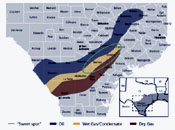

Unlock the Eagle Ford with These Three Words

Source: Matt Insley, The Daily Reckoning (10/22/12)

"The Eagle Ford is in between the optimization phase and the harvest phase, ready to pay out for investors."

More >

Jeb Handwerger: Uranium Stocks Are at Two-Year Lows, Pounce Now and Ride the Upswing

Source: Brian Sylvester of The Energy Report (10/18/12)

Jeb Handwerger, Gold Stock Trades editor, says coal and natural gas lobbyists are kicking the uranium industry while it's down in the shadow of the Fukushima nuclear accident. It's still stormy out there, but the sector may prove be the pot at the end of the rainbow for contrarian investors. In this interview with The Energy Report, Jeb Handwerger challenges investors to take a calculated risk on a sector with major potential.

More >

We're a Lot Less Together in the Oil World than We Used to Be, According to the IEA Outlook

Source: Margaret McQuaile, Platts (10/18/12)

"Interdependence has been a consistent theme in oil for many years, the idea being that even a small supply disruption in one part of the globe can have an impact thousands of miles away. Say goodbye to that notion."

More >

The Oil of Iraqi Kurdistan: A Power Showdown

Source: Jen Alic, Oil & Gas Investments Bulletin (10/18/12)

"For the Kurdistan Regional Government (KRG) of Northern Iraq, it's all about control. Oil majors like ExxonMobil, Chevron and Total are willing to sign deals with the KRG at risk of losing big contracts with Baghdad."

More >

Exxon's Biggest Canada Deal Signals Shale Rush

Source: Bloomberg, Joe Carroll and Rebecca Penty (10/18/12)

"The Duvernay shale, which is soaked in natural gas as well as petroleum liquids such as propane and ethane, which fetch higher prices, may rival the mammoth Eagle Ford formation in south Texas."

More >

Play Housing and Agriculture with Energy

Source: Frank Holmes, Frank Talk (10/18/12)

"Companies involved in oil refining, exploration and production, drilling and infrastructure stand to gain, as well as companies involved in food, forest and paper products. These are essential ingredients for the billions of people on the planet."

More >

Coal Stocks See Better Days Ahead if Romney Wins Election 2012

Source: David Zeiler, Money Morning (10/16/12)

"If Mitt Romney wins Election 2012, it'll be a rare piece of positive news for the coal industry and a boost for beaten down coal stocks."

More >

Bruno del Ama: Do ETFs Offer Value for MLPs?

Source: Brian Sylvester of The Energy Report (10/16/12)

Bruno del Ama is co-founder and CEO of Global X, which has recently rolled out its own MLP ETF. But as del Ama asserts, how to gain exposure to this promising asset class is really a matter of investor preference. In this exclusive interview with The Energy Report, del Ama explains the differing structures of popular MLP ETFs on the market and names the MLP stocks that are delivering success.

More >

2013 Natural Gas Prices: Now Is the Time to Be Bullish

Source: Kent Moors, Money Morning (10/16/12)

"As we move into the winter season, two things are becoming clear. First, this one will be colder than last year, nationwide. Second, natural gas prices are moving up."

More >

Is Energy Independence Really on the Oil and Gas Agenda?

Source: The Christian Science Monitor, Kurt Cobb (10/16/12)

"Inadequate infrastructure has U.S. oil and gas priced below global rates, but when transportation costs are reduced, companies will ship their oil to the highest bidder."

More >

China Issues Nuclear Safety Blueprint, Eyes $13B Investment

Source: Reuters, Fayen Wong (10/16/12)

"China will have to spend around 80B yuan ($12.74B) by 2015 to upgrade the security of its nuclear facilities and radioactive contamination control to international standards, a report issued by the Ministry of Environmental Protection said."

More >

Evolving Microbes Help Turn Bio-Oil into Advanced Biofuels

Source: R&D Magazine (10/15/12)

"Iowa State researchers are using a hybrid approach to produce the next generation of biofuels."

More >

EU Ministers Adopt More Iran Sanctions, Including Gas Ban

Source: Stuart Elliott, Platts (10/15/12)

"EU foreign ministers adopted Oct. 15 a raft of new sanctions against Iran, including a ban on the import of natural gas, a ban on the supply of vessels for the transportation or storage of Iranian oil and a ban on flagging Iranian vessels."

More >

VPs Debate, Gas Inflates, MLPs Deflate. . .Distributions to Disinflate?

Source: Hinds Howard, MLP HINDSight (10/14/12)

"In the absence of news, commodity prices drove the bus, which helped MLPs outperform the S&P 500 for the week."

More >

Cameco Signs Landmark Kintyre Uranium Deposit Development Agreement

Source: Dorothy Kosich, Mineweb (10/12/12)

"But as CEO Tim Gitzel told analysts last July, 'We need more price, or more pounds, or hopefully both' to develop the project."

More >

Fresh MLP All-Time Highs Again

Source: Hinds Howard, MLP HINDSight (10/11/12)

"MLPs closed this week at brand new all-time highs after gaining another 2.3% this week, outpacing a big week from the S&P 500 (+1.5%)."

More >

Hydraulic Fracturing and Water Use: Get the Facts

Source: Dana Bohan, Energy InDepth (10/11/12)

"Given that large portions of our nation are facing serious drought conditions, there are justifiable concerns about our water supply. To fully understand this issue, it's important to analyze real-world data relating to water consumption."

More >