When commodity cycles turn, the earliest opportunities are rarely obvious. Capital typically moves first into large producers, then into developers, and only later into the smaller exploration names that offer true leverage. Uranium now appears to be entering that middle phase, where fundamentals are tightening but valuations across much of the junior space have yet to respond.

That sets the stage for Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC), a Canadian uranium explorer with advanced projects in Tier-1 jurisdictions and a market capitalization that still reflects the last cycle rather than the one now taking shape.

Uranium Macro Context: Why This Cycle Matters

Uranium is no longer considered a speculative corner of the energy market. It is increasingly viewed as a strategic fuel. At COP28, more than 30 countries formally committed to tripling global nuclear capacity by 2050, reinforcing what utilities have already acknowledged through their actions. Nuclear power is essential for baseload electricity, grid stability, and meeting long-term decarbonization goals.

The problem is supply. Years of underinvestment have left global uranium production structurally short of reactor demand, forcing utilities back into the long-term contracting market. These contracts are being signed at higher prices and for longer durations, tightening available supply even further. In that environment, new discoveries and advanced exploration projects in stable jurisdictions are not optional. They are required. This shift is what brings overlooked junior uranium explorers back into focus.

About the Company

Azincourt Energy is a Canadian-based resource company focused on the acquisition, exploration, and advancement of uranium projects in proven districts. The company has been active in uranium exploration for more than a decade, navigating a prolonged bear market while steadily building a portfolio that is now well positioned for a recovery phase.

Today, Azincourt's core assets are located in Canada's two most important uranium jurisdictions: the Athabasca Basin in Saskatchewan and the Central Mineral Belt in Newfoundland and Labrador. Rather than chasing early-stage conceptual ground, the company has deliberately focused on advanced but underexplored projects where historical work has already confirmed uranium mineralization and modern exploration techniques can add value.

The Project That Can Move the Market Capitalization

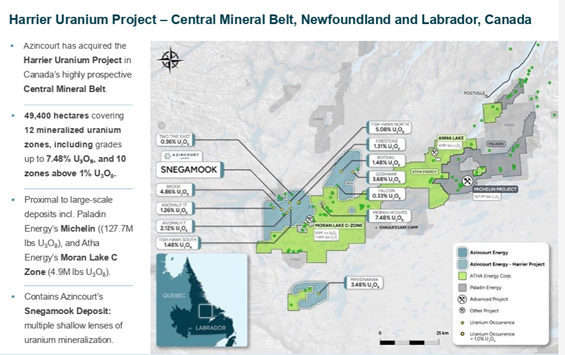

While Azincourt controls multiple uranium assets, the project most likely to move the shares in the near to medium term is the Harrier Project, which includes the Snegamook Uranium Deposit in Labrador's Central Mineral Belt.

This is a district with a genuine uranium pedigree. The Central Mineral Belt hosts several large uranium deposits, including Paladin Energy's Michelin deposit, one of the world's largest undeveloped uranium resources. What makes Harrier compelling is not only its location but also how little systematic exploration has been applied across a very large land package.

Historical work has identified at least twelve uranium zones on the property, including multiple shallow lenses with grades exceeding 1% U₃O₈ and surface samples as high as 7.48% U₃O₈ at Moran Heights. Despite these results, only a limited number of drill holes have ever been completed across the project, leaving significant room for expansion both along strike and at depth.

Azincourt acquired the Snegamook Deposit in late 2024 and completed site work in 2025 that confirmed historical drilling, examined archived core, and identified areas with clear potential to expand known mineralization. An updated NI 43-101 resource and follow-up drilling are planned. In a strengthening uranium market, a defined resource or a new high-grade discovery in this setting would likely lead to a meaningful re-rating.

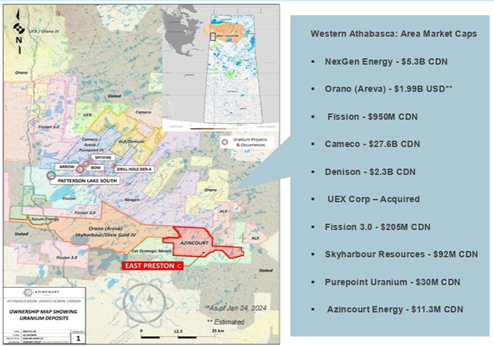

The company's East Preston Project in the Athabasca Basin adds additional upside optionality. Located along a conductive trend between major deposits such as NexGen's Arrow and Cameco's Centennial area, East Preston has demonstrated uranium enrichment, clay alteration, and structural features consistent with unconformity-style uranium systems. While this project is a longer-dated catalyst, success in the Athabasca Basin is typically rewarded quickly by the market.

Management

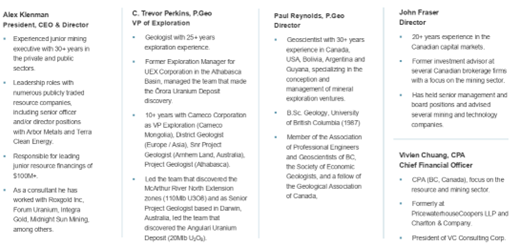

Azincourt is led by Alex Klenman, President, CEO, and Director, a seasoned junior mining executive with more than 30 years of experience across exploration, capital markets, and corporate development. He has been directly involved in over CA$100 million in financings and has guided multiple resource companies through challenging market cycles.

The technical strength of the company is anchored by C. Trevor Perkins, P.Geo., Vice President of Exploration, who brings more than 25 years of global uranium experience. His background includes senior exploration roles at UEX Corporation and Cameco, where he was part of teams responsible for major discoveries such as the McArthur River North Extension and the Angulari uranium deposit. This is a team with direct experience discovering and advancing uranium systems, not one learning the commodity for the first time.

The broader board and management group adds depth in geology, finance, and capital markets, providing a balanced approach to exploration execution and shareholder stewardship.

Market Capitalization and Share Structure

At the time of writing, Azincourt Energy is trading around CA$0.07, placing the company in micro-cap territory.

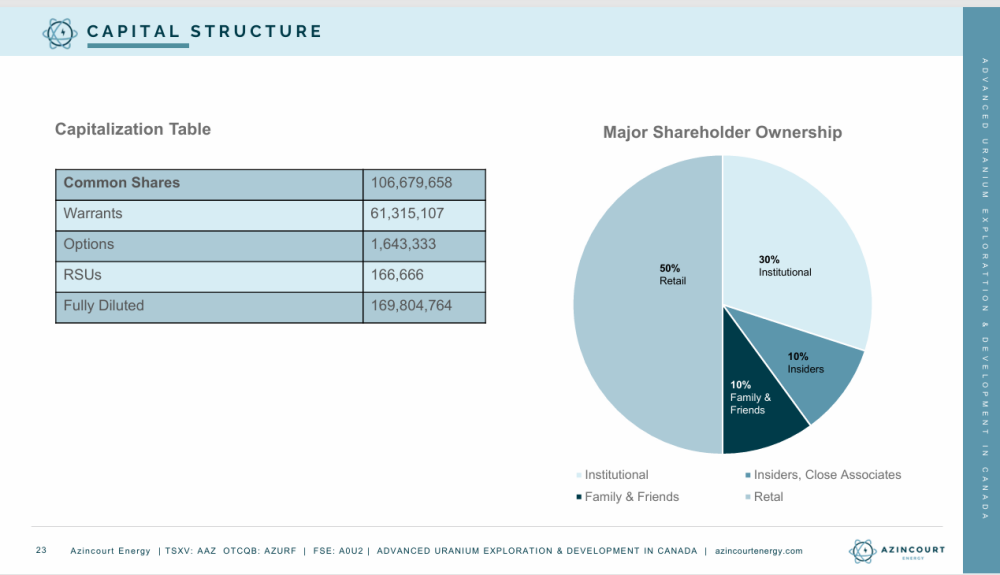

The company has approximately 106 million shares outstanding and roughly 169 million shares fully diluted, including warrants, options, and RSUs. At current prices, the market capitalization remains modest relative to the quality, scale, and jurisdictional strength of its uranium assets.

When compared to peer uranium explorers operating in the Athabasca Basin and Central Mineral Belt, many of which trade at significantly higher valuations without defined resources or recent discoveries, Azincourt's discount stands out. In a sector where capital rotation can be swift once sentiment improves, this gap is worth close attention.

Technical Analysis

From a technical perspective, the chart for Azincourt Energy Corp. shows the characteristics of a long basing pattern following a prolonged bear-market decline. Price action has compressed near the lows, suggesting that sustained selling pressure has largely been exhausted and that the market is beginning to stabilize.

More recently, volume has started to increase on upside moves, a subtle but important signal that accumulation may be taking place rather than short-term trading. Support appears well defined near current levels, while the first meaningful resistance zone sits near CA$0.20, which aligns with prior congestion and the former breakdown area on the chart.

A sustained move through this level would mark a technical change in character and open the door to a re-rating toward the CA$0.40 area, where the shares previously encountered resistance during stronger uranium sentiment. Beyond that, and assuming continued strength in the uranium sector along with company-specific catalysts, the broader chart structure supports a longer-term, big-picture target near CA$0.70.

These levels should be viewed as logical technical reference points rather than price predictions. They provide a framework for how the market has historically valued the shares and how far they could travel if uranium equities broadly re-rate and Azincourt delivers on its exploration objectives.

Conclusion

Azincourt Energy Corp. represents a high-risk, high-reward uranium opportunity offering genuine optionality at a point in the cycle where fundamentals are improving faster than market valuations.

The company controls advanced uranium assets in Tier-1 Canadian jurisdictions, is led by a technically credible team with real uranium discovery experience, and is positioned ahead of a potential sector-wide re-rating as utilities return to long-term contracting and supply constraints continue to tighten. This is not a momentum-driven story today. It is an early-cycle setup where patience matters.

For investors comfortable with exploration risk and seeking leveraged exposure to a sustained uranium bull market, Azincourt Energy is a speculative buy at current levels around CA$0.07, with the understanding that value creation will ultimately depend on execution, drilling results, and broader market conditions.

More information is available at the company's website: https://www.azincourtenergy.com

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Azincourt Energy Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.