Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) announced the completion of its definitive repurchase agreement with Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT) for Denison to acquire an initial interest in Skyharbour's Russell Lake Uranium Project, according to a release from Skyharbour on December 17.

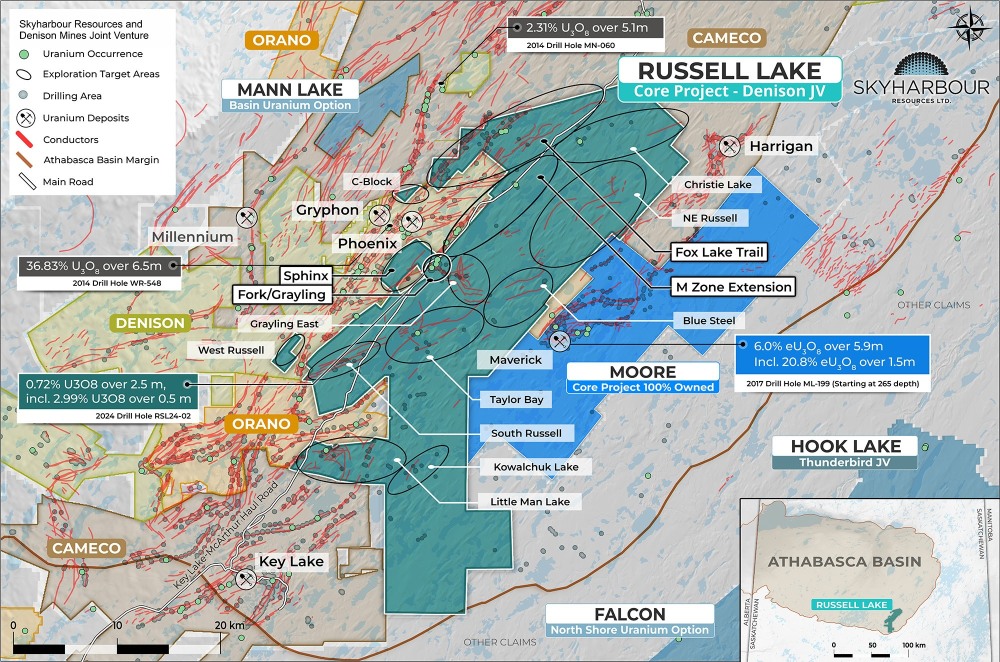

The parties have entered into four separate joint venture agreements on various claims comprising the Russell project, which is strategically situated in the central part of the Eastern Athabasca Basin of northern Saskatchewan, with access to regional infrastructure, including an exploration camp, an all-weather road, and a powerline, the release said.

"We are thrilled to close this major transaction for Skyharbour and to embark on the next chapter of exploration at Russell with a multi-billion-dollar strategic partner and large shareholder in Denison Mines," said Skyharbour President and Chief Executive Officer Jordan Trimble. "With up to CA$61.5 million in combined project consideration contemplated, we are confident that this strategic agreement will expedite the discovery process at the project while minimizing equity dilution for our shareholders. Based on initial technical meetings and strategy sessions with Denison, we are excited about the combined exploration options for the near term."

According to Trimble, Russell is one of the more prospective exploration projects in the Athabasca Basin, near to existing and developing mines including Denison's Phoenix deposit at Wheeler River.

"Denison will also be able to provide considerable insight and experience as we jointly advance Russell," Trimble continued. "Lastly, we now enter the new year with a healthy treasury of over CA$11 million to fund our exploration efforts and corporate activities through 2026 while various partner companies fund exploration at numerous other projects in our portfolio."

The strategic agreement's total consideration of up to CA$61.5 million includes cash payments to Skyharbour totaling CA$10 million, additional consideration of CA$8 million payable in cash and shares before year-end, and expenditures and cash payments totaling up to CA$43.5 million for Denison to acquire between 20% and 70% ownership interest over seven years in the claims making up Russell, with Skyharbour retaining the remaining interests.

Denison President and CEO David Cates added, "As Denison nears receipt of final regulatory approvals for the Phoenix In-Situ Recovery mine proposed for our flagship Wheeler River property, we are also making measured investments in our project pipeline, including our next development assets and high-potential exploration properties. Given its proximity to Wheeler River, Denison has had an interest in adding Russell to our property portfolio for strategic reasons."

Co. Remains Operator With Ownership Interest

Skyharbour welcomes Denison as a strategic, active funding partner at Russell, with Denison being one of Skyharbour's largest corporate strategic shareholders, according to the release. The project has been divided into four distinct joint ventures: Russell Lake, Getty East, Wheeler North, and the Wheeler River Inlier Claims. Skyharbour will retain initial ownership interests of 80%, 70%, 51%, and 30%, respectively. Denison has the option to earn up to a 70% interest in the Wheeler North and Getty East properties through option agreements.

The geological teams of Denison and Skyharbour have begun collaborating to advance and unlock value across the joint ventures, utilizing top-tier exploration and development expertise in the region, Skyharbour said.

Denison has committed to a minimum of CA$4 million in exploration expenditures over the first two years at Wheeler North and Getty East combined. Additionally, Denison has agreed to fund its pro-rata 20% participation interest in the Russell Lake claims through 2029, until total exploration expenditures on the property reach CA$10 million.

The agreement also gives Skyharbour "a much stronger treasury and bigger drill plans," Jeff Clark wrote.

Skyharbour will remain the operator with an 80% ownership interest in the Russell Lake claims, which comprise over 53,192 hectares of the original 73,314-hectare Russell Lake Project. The company will also act as the operator during the first earn-in at Getty East, with Denison solely funding the exploration to meet the earn-in option criteria. Skyharbour will also generate revenue from its operator fee at the McGowan Lake exploration camp at the Project, as well as from cash and other sources.

The company will continue to directly advance its high-grade Moore Uranium project as well as the Russell Lake claims at Russell, while partner companies fund exploration at some of the Company's other projects.

The consideration payment included a CA$10 million cash payment, with CA$2 million paid upon execution of the strategic agreement and CA$8 million paid upon closing. An additional CA$8 million is payable in cash and shares by Denison on or before December 31, 2025, with a minimum of CA$2 million payable in cash.

"It is anticipated that Denison will also be making use of the current exploration camp at McGowan Lake on the project, which will continue to be operated by Skyharbour, and an administrative fee will be payable by Denison to Skyharbour," the release noted. "The claims comprising Russell are subject to various existing underlying royalties to other parties."

Skyharbour has received conditional approval from the TSX Venture Exchange for closing. The issuance of shares from Denison to Skyharbour remains subject to applicable exchange approvals.

'A Major Stamp of Approval' for Project From Denison

In an updated research note on December 18, Red Cloud's Head of Equity Research David Talbot said closing the deal is "transformative" for Skyharbour.

"We believe the real prize lies in increased exploration activity in the RL claims area, thus enhancing the chances of additional high-grade uranium discoveries," the analyst wrote. "The deal gives Russell Lake a major stamp of approval by Denison, while providing access to Denison's very deep and experienced technical team. It also opens up the ability to put exploration focus back on its co-flagship Moore Lake project, where a maiden resource is expected in H1/26."

Talbot maintained Red Cloud's Buy rating of the stock and its target price of CA$0.65/share.

"We apply a 0.80x multiple to our sum-of-parts NAVPS of CA$0.81, to arrive at our target," he wrote. "Upcoming catalysts: 1) pending assays from Russell and Moore (ongoing), and 2) follow-up drilling at Russell and Moore."

In another report on December 1, Sid Rajeev, head of research at Fundamental Research Corp., raised the firm's fair value target price on Skyharbour by 11% after applying sector multiples to the company's flagship assets.

"We believe the partnership with Denison strengthens Skyharbour's position in the Athabasca Basin, validates Russell Lake and provides funding and operational support," Rajeev wrote.

FRC's new fair value target on the Canadian uranium project generator is CA$1.12 per share (CA$1.12/share), previously CA$1.01, noted Rajeev. In comparison, the uranium company was trading at about CA$0.36/share at the time of the head of research's report. From that share price, the return to FRC's new fair value target is 211%. Skyharbour remains a Buy, the analyst said.

"For Denison, the attraction is obvious: a suite of high-potential exploration blocks wrapped around Wheeler River with real discovery potential that can bolt onto an already world-class development story anchored by the Phoenix ISR project," TheGoldAdvisor.com founder Jeff Clark wrote about the deal on November 20.

For Skyharbour, the smaller partner, the impact is even more dramatic, he said, with the "big-company spend" giving it "junior-company leverage."

"Skyharbour keeps operatorship and an 80% working interest across the largest and most target-rich part of the former Russell Lake package, while Denison funds its 20% share up to CA$10M," Clark said "Russell Lake still contains multiple basement- and sandstone-hosted targets and long stretches of untested EM conductors that haven't seen modern work. In other words: it's an exciting exploration opportunity."

The agreement also gives Skyharbour "a much stronger treasury and bigger drill plans," he wrote.

Clark continued, "Skyharbour has, in short, turned a single, underexplored but promising asset into a portfolio of funded or partly funded JV interests, anchored by a large operated block and backed by a major partner next door."

He said he is overweight on the stock because "it's a uranium name that hasn't yet left the station. If it makes a discovery, it will."

Haywood Capital Markets Analyst Marcus Giannini noted in a November 17 report that his firm views the transaction as a significant endorsement of the advanced-stage Russell Lake project, "where Skyharbour has already outlined high-grade uranium mineralization, and which remains prospective for additional basement-hosted uranium discoveries."

The analyst did not provide a traditional rating or price target for the stock.

The Catalyst: Producers, Developers Attracting Renewed Attention

The year 2025 marked a pivotal shift in uranium pricing dynamics, according to a report by Ryan Charles for Crux Investor on December 17. Following the sharp spot-driven rally of 2023-2024, price movements became more range-bound, testing investor confidence while reinforcing the strength of the long-term thesis.

According to Trading Economics data, spot U₃O₈ fluctuated between US$63.17 per pound in March and US$83.33 per pound in September, with the price appearing to find support at the US$75 level since late August, Charles wrote. This pricing behavior suggests that downside risk is increasingly limited by cost curves and contracting economics rather than sentiment alone.

For institutional investors, the more significant signal emerged from the long-term contract market. According to data compiled by Cameco, long-term prices rose from approximately US$80/pound at the start of 2025 to US$86/pound by late November, reflecting active negotiations between utilities and producers rather than speculative flows. These prices are approaching the incentive levels needed to justify mine restarts, in-situ recovery expansions, and new project development.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

Within this context, U.S.-based producers and near-term developers are attracting renewed attention, he wrote. The investment focus shifted from spot price leverage to the ability to meet contract demand within realistic permitting and construction timelines.

On November 13, Clark wrote for The GoldAdvisor.com that uranium has been added to the United States Geological Survey's Critical Minerals list, joining the ranks of copper, nickel, and tungsten. Clark pointed out that this inclusion highlights uranium's strategic importance, following earlier statements from the White House.

He emphasized that "around 95% of the uranium that fuels America's reactors comes from outside the country," underscoring the need for domestic and allied supply chains. Clark also noted that the critical designation benefits producers, developers, and explorers, stating that "critical status has a habit of loosening capital by way of government funding programs, strategic partners, and offtake conversations."

Ownership and Share Structure1

Management, insiders, and close business associates hold about 5% of Skyharbour, with President and CEO Jordan Trimble owning 1.54% and Director David Cates holding 0.82%. Institutional, corporate, and strategic investors collectively own around 55% of the company.

Skyharbour has 210.83 million outstanding shares and its market cap is CA$62.2 million. Its 52-week range is CA$0.28–CA$0.50 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

- Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.