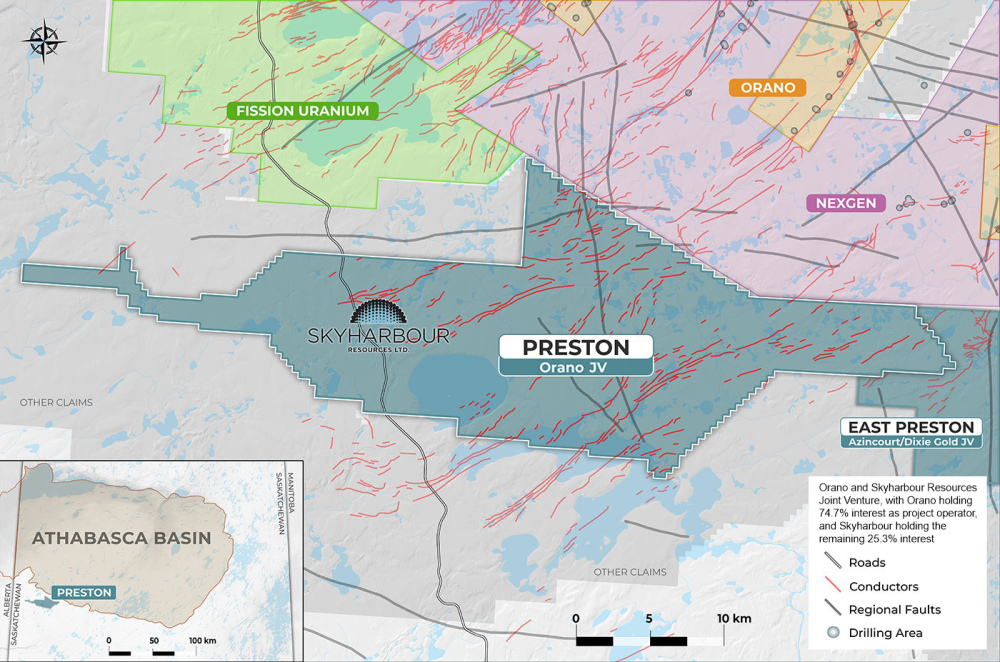

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) announced that its joint venture partner, Orano Canada Inc., is preparing a major exploration and drilling initiative for 2026 at the 49,635-hectare Preston Uranium Project in the western Athabasca Basin of Saskatchewan.

The forthcoming program will include an Airborne Gravity Gradiometry (AGG) survey, followed by detailed ground gravity surveys, culminating in a summer 2026 drilling campaign totaling approximately 3,500 meters, as stated in a release on December 9.

"The program is designed to build on the encouraging results from the previous few years and advance several high-priority target areas across the property, particularly within the FSAN and Canoe Lake grids where drilling and geophysical surveys have identified compelling structural corridors and extensive alteration zones," the release noted. Orano holds a 74.7% majority stake and operates the project, while Skyharbour retains a 25.3% minority interest.

The planned 2026 exploration campaign will feature a comprehensive AGG survey covering the entire priority corridor in the northern section of the property, according to the release. This work will include the FSAN and Canoe Lake grids, identified as the most promising areas following the 2025 drilling season. The AGG survey aims to refine discrete gravity lows, identify structural trends, and delineate potential hydrothermal or alteration-related footprints across the broader claim area.

Following the airborne work, Orano intends to conduct detailed ground gravity surveys with tight station spacing of 25 by 25 meters or 50 by 50 meters. These surveys will concentrate on key zones within the proposed drilling footprint and will be used to validate targets from the airborne data, enhance resolution over prospective features, and help distinguish basement anomalies from localized overburden variations.

A summer diamond drilling program is also proposed, consisting of approximately 3,000 to 3,500 meters across roughly ten helicopter-supported drill holes, each averaging around 300 meters in depth, Skyharbour stated. Similar to the successful approach used in 2025, drilling will target high-priority anomalies and broader structural corridors along graphitic trends known to be associated with uranium mineralization in the Athabasca Basin.

Orano anticipates that six to eight drill holes will focus on follow-up and step-out testing within the northern FSAN area, where multiple graphitic shear zones, brittle-ductile structures, and strong clay alteration were intersected in 2025. An additional two to four holes are planned for the Area B conductive corridor, an underexplored structural trend that remains largely untested but shows strong potential based on existing geophysical data.

The proposed budget for the 2026 program will be allocated to the airborne and ground gravity surveys, as well as drilling, helicopter support, logistics, and analytical work, the company stated. The planned work is expected to significantly advance the geological understanding of the Preston Project and generate new high-quality drill targets for future exploration, building on the extensive groundwork completed during 2024 and 2025.

2025 Exploration Program at Preston

The 2025 exploration program at Preston was successfully completed, comprising 5,565 meters of helicopter-supported diamond drilling across 17 holes, along with ongoing geophysical interpretation and geological analysis, as noted in the release. The program aimed to evaluate several high-priority target areas across the property, systematically testing multiple prospective geological corridors. Drilling primarily concentrated on the Johnson Lake, Canoe Lake, and FSAN grids, each representing distinct structural and geophysical environments with the potential for basement-hosted uranium mineralization.

The 2025 work marked the first-ever drilling at the Johnson Lake grid (Zone 1), where previous ML-TEM surveys and DC resistivity had identified strong conductive responses along the JL-North and JL-South trends, according to Skyharbour. Four holes totaling 1,304 meters were drilled to test the interpreted graphitic packages and resistivity lows associated with these conductors.

"We believe the partnership with Denison strengthens Skyharbour's position in the Athabasca Basin, validates Russell Lake, and provides funding and operational support," Rajeev wrote.

The Canoe Lake grid (Zone 2) continued to demonstrate strong potential and was a focal point in the 2025 program, with four holes drilled totaling just under 1,000 meters across several conductors. Previous work had identified nine conductive trends in the area, many of which had limited historical drilling. With several conductors still untested and multiple structural corridors showing strong graphitic development, Canoe Lake remains one of the most promising target zones on the property, the company stated.

The largest portion of the 2025 program was conducted on the FSAN grid (Zone 3), where 10 holes totaling 3,263 meters were drilled, targeting both direct anomalies and structural corridors. This work followed new 2024 ground gravity and SGH geochemical surveys, which had identified several compelling anomalies. The results collectively suggest a more complex structural framework in the FSAN area than previously recognized, with multiple corridors now identified as priority targets for further drilling, the company said.

Overall, the 2025 exploration program successfully validated EM-defined conductive packages, expanded the geological understanding of key structural corridors, and refined the property-scale model for basement-hosted uranium potential at Preston, according to the company. The results highlight several zones, particularly within Canoe Lake and FSAN, where additional drilling is warranted and where new geophysical datasets have outlined strong, untested targets. This multi-zone approach ensured comprehensive coverage across the Preston claims and has set the stage for a focused and technically robust 2026 exploration and drilling campaign.

A 'Transformative' Deal

Last month, Skyharbour announced a "transformative" deal with Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT), under which Denison will initially acquire a stake in Skyharbour's Russell Lake Uranium Project. Both companies will enter into four separate joint venture agreements at closing, covering various claims within Russell, as stated in a November 17 release. The project is strategically located in the central part of the Eastern Athabasca Basin in northern Saskatchewan, benefiting from regional infrastructure, including an all-weather road and powerline.

"This is a transformative transaction for Skyharbour and our shareholders as it represents a major stamp of approval for Russell with up to CA$61.5 million in combined project consideration coming in," said President and CEO Jordan Trimble. "We are very pleased to expand upon our long-standing relationship with Denison and to partner with their team to advance one of the more prospective exploration projects in the Athabasca Basin proximal to existing and developing mines."

The strategic agreement includes a total project consideration of up to CA$61.5 million, consisting of cash or share payments to Skyharbour totaling up to CA$21.5 million (including CA$18 million before year-end) and expenditures up to CA$40 million for Denison to acquire between a 20% and 70% ownership interest over seven years in the claims comprising Russell, with Skyharbour retaining the remaining interests, Skyharbour said.

Denison, a leading uranium mining company with a market capitalization of more than CA$3 billion, is developing the Wheeler River Project, which shares a 55-kilometer border with Russell. Denison, already a significant corporate shareholder of Skyharbour, now joins the company as a strategic, active funding partner at Russell.

Analysts Raise Price Targets

In a December 1 research note, Sid Rajeev, head of research at Fundamental Research Corp. (FRC), reported that the firm has increased its fair value target price for Skyharbour by 11% after applying sector multiples to the company's key assets.

"We believe the partnership with Denison strengthens Skyharbour's position in the Athabasca Basin, validates Russell Lake, and provides funding and operational support," Rajeev wrote.

FRC's new fair value target for the Canadian uranium project generator is CA$1.12 per share, up from the previous CA$1.01. At the time of the report, the uranium company was trading at about CA$0.36 per share. From that price, the return to FRC's new fair value target is 211%. Skyharbour remains a Buy.

Haywood Capital Markets Analyst Marcus Giannini noted in a November 17 report that his firm views the transaction as a significant endorsement of the advanced-stage Russell Lake project, "where Skyharbour has already outlined high-grade uranium mineralization, and which remains prospective for additional basement-hosted uranium discoveries."

The analyst did not provide a traditional rating or price target for the stock.

"Further, we note the arrangement is set to leverage the combined strengths of Skyharbour and Denison's technical teams, with Denison already well familiar with the Russell Lake project," Giannini wrote.

Red Cloud Securities Analyst David Talbot stated in a November 17 note that the new partnership is "very positive" for Skyharbour.

"In our view, this is a transformative deal for Skyharbour that should allow for more aggressive exploration at its Russell Lake properties, which border Denison’s Wheeler River project, currently in its final permitting stages," Talbot wrote. "Irrespective of current valuation, we believe the real prize lies in increased exploration activity in the Russell Lake area, thus enhancing the chances of additional high-grade uranium discoveries. The deal gives Russell Lake a major stamp of approval by Denison, while providing access to Denison’s very deep and experienced technical team. Meanwhile, Skyharbour gets to retain the bulk of interest in the Russell Lake claims and generate revenue through an administrative fee to be charged from Denison at its McGowan Lake exploration camp at the project."

Talbot continued, "We now value Skyharbour’s share in the Russell Lake project based on the new JV terms. Each JV’s current valuation estimate is based on CA$18 million cash, weighted by hectares acquired by Denison in respective JVs." Talbot maintained the firm's Buy rating and increased its target for Skyharbour to CA$0.65/share (was CA$0.55/share). "We apply a 0.80x multiple to our sum-of-parts NAVPS of CA$0.81 (was CA$0.64), to arrive at our target," he wrote.

The Catalyst: Rising Demand for Nuclear Power

On November 13, Jeff Clark of The GoldAdvisor.com reported that uranium has been added to the United States Geological Survey's Critical Minerals list, joining copper, nickel, and tungsten. Clark noted that this inclusion underscores uranium's strategic importance, following earlier statements from the White House.

He highlighted that "around 95% of the uranium that fuels America's reactors comes from outside the country," emphasizing the importance of domestic and allied supply chains. Clark also mentioned that the critical designation is advantageous for producers, developers, and explorers, stating that "critical status has a habit of loosening capital by way of government funding programs, strategic partners, and offtake conversations."

At the end of October, the spot price for uranium was US$80 per pound, a slight decrease from the year's peak of US$82.63 per pound in September, but still significantly above the year's low of US$64.23 per pound at the end of March, as reported by uranium fuel provider Cameco, noted Nuclear Newswire on November 10. Cameco also noted a long-term price of US$85.00 per pound at the end of October, marking the highest point of the year.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

The previous high was in September, with a price of US$83.00 per pound. According to Trading Economics, the recent increase in prices reflects expectations of rising demand for nuclear power, the Nuclear Newswire report said. The uranium market received a boost in late October from an US$80 billion agreement signed by the Trump administration with Westinghouse Electric to advance new nuclear reactor construction. This deal followed earlier U.S. government actions to stimulate the nuclear sector, including plans to enhance the nation’s uranium enrichment capacity and speed up the licensing process for reactor construction.

The site also noted that a report by consultancy firm DataM Intelligence indicates high optimism among uranium market forecasters, with the global uranium market projected to reach US$13.59 billion by 2032, growing at an annual rate of 4.86 percent during the 2025-2032 forecast period.

Ownership and Share Structure1

Management, insiders, and close business associates hold about 5% of Skyharbour, with President and CEO Jordan Trimble owning 1.58% and Director David Cates holding 0.84%. Institutional, corporate, and strategic investors collectively own around 55% of the company.

Skyharbour has 210.8 million outstanding shares and its market cap is CA$67.5 million. Its 52-week range is CA$0.28–CA$0.50 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

- Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.