Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) announced the acquisition of 21 new uranium exploration claims in northern Saskatchewan through cost-effective online staking.

This addition boosts the Company's total land holdings to 616,939 hectares (ha) across 37 projects in which it has an interest, Skyharbour said in a release. These claims, wholly owned by Skyharbour, enhance the Company's extensive portfolio of uranium projects within the Athabasca Basin, known globally for its high-grade uranium deposits and consistently rated as a top mining jurisdiction by the Fraser Institute.

While continuing to prioritize its co-flagship projects at Russell Lake and Moore, Skyharbour will integrate these new claims into its expanding prospect generator business model. The company said it plans to actively seek strategic partners to develop these assets through earn-in and joint venture agreements.

Some details of the new claims:

- Haultain Project: A new project encompassing five newly staked claims covering 6,607 ha, situated approximately 46 kilometers southwest of Cameco's Key Lake operation. Historical electromagnetic (EM) conductors and corresponding magnetic lows suggest potential graphitic pelitic gneisses within the property. To date, only preliminary exploration efforts such as prospecting, mapping, and geochemical sampling have been carried out.

- Bonville Project: The project includes a single newly staked claim that spans 1,497 ha, located roughly 60 kilometers south of Cameco's Key Lake operation. Positioned in the Wollaston Domain outside the current boundaries of the Athabasca Basin, geological mapping reveals that the property is primarily underlain by Wollaston Supergroup metasedimentary gneisses, notably including potentially graphitic lower Wollaston Supergroup pelitic gneisses. Historical exploration activities on the Bonville Project have included airborne magnetic and EM surveys, geochemical sampling, and prospecting, dating back to the 1960s and 1970s.

- Bolt Extension Project: Includes four newly staked claims that lie next to Skyharbour's existing Bolt Project, which is currently optioned to UraEx Resources. Previous explorations have included both airborne and ground geophysics, along with sampling of lake sediments and water. More recent exploratory efforts uncovered multiple EM conductors, magnetic lows, and faults that continue into the Bolt Extension claims.

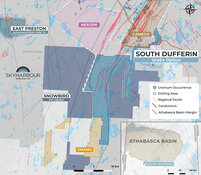

- South Preston: Adds one new claim adjacent to Skyharbour's existing Preston JV, totaling 956 ha.

- Tarku Project: Features one new claim adjacent to Skyharbour's existing South Dufferin Project, totaling 3,233 ha.

- Elevator Project: Consists of two newly re-staked claims totaling 8,012 ha.

- 914 Project: Includes three newly re-staked claims totaling 1,133 ha.

- Bennett Project: Adds two newly re-staked claims, expanding the project by 5,033 ha.

- Spence Project: Comprises two newly re-staked claims totaling 11,915 ha.

- Yurchison Project: Includes one re-staked claim totaling 3,278 ha.

Uranium Sentiment on the Rise, Analyst Says

Skyharbour is advancing its co-flagship Russell Lake and Moore Lake uranium projects, with plans to complete between 16,000 and 18,000 meters of drilling across these projects in 2025.

The company holds a large uranium project portfolio totaling over 616,000 hectares across 37 properties in the Athabasca Basin. The company is currently partnered with nine companies advancing 13 of these projects, with potential to generate up to CA$70 million in project considerations, contingent on full earn-in commitments being met. Skyharbour's partner companies are expected to contribute an additional 15,000 to 16,000 meters of drilling in 2025. Combined with Skyharbour's own program at Russell and Moore Lake, this brings the total planned drilling across the portfolio to over 30,000 meters for the year. In addition to its current partners, Skyharbour retains 100% ownership of over 20 other projects in the portfolio, offering flexibility for future option agreements, joint ventures, or asset sales as it continues to grow its prospect generator strategy and create shareholder value.

Skyharbour has been recognized by Sid Rajeev of Fundamental Research Corp. for having "one of the largest portfolios among uranium juniors in the Athabasca Basin."

In an updated research note on June 25, Rajeev noted that Skyharbour and its partners are exploring during a period of positive momentum in the uranium market.

"Uranium sector sentiment is on the rise, fueled by increasing prices, robust institutional investment, and major tech companies committing to nuclear power for their future expansion," Rajeev noted. "We believe Skyharbour is strategically positioned to leverage this upward trend."

After applying sector multiples to its fair value target price on Skyharbour, FRC slightly adjusted it to CA$1.01 per share from CA$1.02. At the time of Rajeev's report, Skyharbour's shares were trading at CA$0.33 each, implying a potential return of 206%. The firm maintains a Buy rating on Skyharbour.

The Catalyst: Re-Invigorating the Nuclear Power Industry

Uranium is a critical element for nuclear power and is becoming increasingly important in the global transition to sustainable energy sources. As the demand for electricity surges due to the growth of technologies such as artificial intelligence and data centers, the strain on power grids is becoming more pronounced, highlighting the need for reliable, scalable, and clean energy solutions like nuclear power.

In response to these energy demands, U.S. President Donald Trump has activated the Defense Production Act to boost nuclear fuel production by promoting domestic uranium mining and processing. This move aims to lessen America's reliance on uranium imports from countries like Russia, as noted by Stockhead in May.

"Currently, American domestic uranium production satisfies only 2% of U.S. reactor needs, and a U.S. prohibition on Russian uranium imports underscores the value of domestic sources," the publication stated.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

A recent article by Mrinalika Roy for Reuters posits that Trump's efforts to rejuvenate the U.S. nuclear energy sector could invigorate the uranium industry, which has experienced a slump, and draw increased investor interest.

The uranium industry is on the brink of substantial growth, spurred by increasing global energy requirements and favorable policy frameworks, according to a report by Rich Duprey for 24/7 Wall St. on July 28. The International Energy Agency said nuclear capacity is expected to see significant expansion by 2030, driven by the escalating demand for clean energy.

Ownership and Share Structure

Management, insiders, and close business associates own approximately 5% of Skyharbour, the company said.

President and CEO Jordan Trimble owns 1.5%, and Director David Cates owns 0.65%. Institutional, corporate, and strategic investors own approximately 55% of the company.

Denison Mines owns 6.3%, Rio Tinto owns 2%, Extract Advisors LLC owns 9.6%, Alps Advisors Inc. owns 9.1%, Mirae Asset Global Investments (U.S.A) L.L.C. owns 5.68%, and Incrementum AG owns 1.05%, Skyharbour said.

Skyharbour has 204.46M outstanding shares and 199.65M free float traded shares. Its market cap is CA$60.47 million. Its 52-week range is CA$0.28–0.51 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.