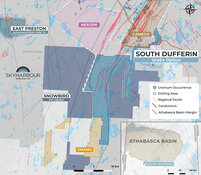

Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; T1KC:FSE) has reported geochemical assay results from its Winter 2025 drill program at the South Falcon East Uranium Project, located 18 kilometers outside the Athabasca Basin in Saskatchewan. The project, which hosts the Fraser Lakes B Uranium Deposit, is part of an option agreement with Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE), allowing Terra to earn up to a 75% interest.

Seven diamond drill holes totaling 1,927 meters were completed between February and March 2025. Assays from 682 samples revealed uranium mineralization in multiple holes along a northwest-southeast trending fault. Notably, hole SF0065 returned 18.1 meters grading 0.03% U₃O₈, including 1.6 meters of 0.12% U₃O₈. Hole SF0067 returned 3.87 meters at 0.05% U₃O₈, with a subinterval of 0.17% U₃O₈ over 0.5 meters, the highest grade sample of the program.

According to the company, the lab assays were on average 5 to 30% higher than earlier gamma probe results, a typical variation for uranium exploration. Pathfinder elements such as cobalt, nickel, and lead also returned elevated values, particularly in hole SF0067, suggesting further vectoring potential to the north.

"These are some of the best drill results to date at South Falcon," said Greg Cameron, CEO of Terra Clean Energy, in a company news release. "Several holes returned higher-grade values, including as much as 466% greater than the deposit average."

The Fraser Lakes B Deposit currently contains a historical inferred resource of 6.96 million pounds U₃O₈ at an average grade of 0.03% U₃O₈, according to a 2015 technical report filed by Skyharbour Resources. Terra is not treating the historical estimate as current and has not completed sufficient work to classify it as a current resource.

Uranium Sector Strengthened by Supply Constraints and Policy Momentum

The uranium sector has entered a phase marked by tight supply conditions, renewed investor interest, and robust political support for nuclear energy across North America and Europe. According to a July 14 report from Crux Investor, the uranium industry operated under a pricing structure that remained below the level necessary to incentivize new production. While spot uranium hovered near US$65 per pound, term contracts exceeded US$80 per pound, creating a growing disconnect between short-term market activity and long-term procurement needs. "The uranium sector stands at an inflection point," the report noted, citing constrained supply and increasing demand from both conventional nuclear power and emerging small modular reactors.

Political backing has also played a central role in reshaping the market. Crux Investor quoted Energy Fuels CEO Mark Chalmers, who said, "The ongoing support by both parties for nuclear power, and reestablishing our ability to mine and produce nuclear power, is gaining momentum." IsoEnergy's Marty Tunney added that bipartisan support for nuclear energy was "one of the few topics where you've got bipartisan support on the nuclear front."

Kitco echoed that trend in its July 14 commentary by Sprott, reporting that global sentiment and institutional capital returned to the uranium market in June, driving a 9.99% rise in spot prices to US$78.56 per pound. marking its strongest monthly performance of the year. The article noted that "uranium miners jumped more than 18% in June, demonstrating their torque to shifting sentiment."

Structural demand drivers such as artificial intelligence and data center expansion were also influencing the sector. The Kitco article highlighted that over 28 gigawatts of new nuclear capacity had been tied to digital infrastructure. "AI is emerging as a powerful new driver of long-term nuclear demand," the report stated, with firms like Amazon partnering with nuclear providers to meet rising energy needs for cloud operations.

Geopolitical events further added pressure to global supply chains. The Kitco commentary described uranium as "one of the few commodities with truly inelastic demand," noting that national policy changes, like the World Bank's reversal of its nuclear funding ban, had supported a long-term bullish demand outlook. Meanwhile, the July 4 passage of the "Big Beautiful Bill" in the U.S. preserved nuclear production tax credits, providing long-term policy clarity.

Analyst Commentary Underscores Positive Outlook for Terra Clean Energy

Multiple analysts and commentators have shared supportive perspectives on Terra Clean Energy Corp. and its activities at the South Falcon East uranium project, particularly in light of the company's recent and upcoming drill programs.

On April 7, Fundamental Research Corp. highlighted the results of the company's winter drilling campaign, stating, "Six out of seven holes of a recently completed drill program by Terra Clean Energy Corp. at the South Falcon East project intersected uranium mineralization. The company is planning a summer drill program."

HoldCo Markets followed with a research note on April 30, that reinforced optimism about the company's valuation outlook, stating, "Given Terra Clean Energy Corp.'s robust near-term drilling plans, the risk remains on the upside for a material valuation rerate. . .seeing that the deposit remains open in numerous directions, additional work spend may lead to an increase in both grade and resource size."

Adding further context, Jeff Clark of TheGoldAdvisor.com wrote on May 1, "Terra Clean Energy Corp.'s 2,500m summer drill program at South Falcon East will test an area highlighted in winter drilling that is defined by an intersection of three prospective alteration types. . .the program budget for the summer field season on the project, including drilling, is CA$2M."

Ongoing Expansion in a Strategic Region

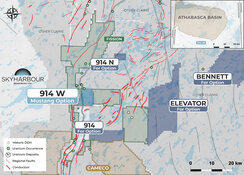

Terra Clean Energy is planning a follow-up summer drill program at South Falcon East, targeting an area about 120 to 150 meters north of the most recent drilling. The program will include 2,500 meters of helicopter-supported diamond drilling and is expected to run for 4 to 5 weeks beginning in August 2025.

The summer campaign will focus on the intersection of several geological features often associated with higher-grade uranium deposits in the Athabasca Basin, including graphitic metasediments, brittle reactivated structures, and both clay and hematite alteration zones. These features have now been identified at the Fraser Lakes B deposit.

According to the company's April 2025 investor presentation, the Way Lake Conductor, which runs through the project, remains largely underexplored and has the potential to host multiple uranium-bearing zones across its 25-kilometer extent. The company noted that past drilling has confirmed the presence of high-grade alteration and mineralization in additional areas, including the T-Bone Lake zone north of the current deposit.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; T1KC:FSE)

Terra Clean Energy had 36,334,471 shares outstanding as of April 2025, with a market capitalization under CA$5 million at that time. The company continues to explore opportunities to expand and better define the Fraser Lakes B deposit, which it has described as a shallow, near-surface uranium project with proximity to established infrastructure in the Athabasca region.

Ownership and Share Structure

According to Refinitiv, four strategic entities own 3.52% of Terra Clean Energy. They are Planet Ventures Inc. with 2.02%, Terra Director Alex Klenman with 1.29%, Terra Chief Financial Officer Brian Shine with 0.14% and Mark Ferguson with 0.07%.

The rest is in retail. There are no institutional investors at this time.

Terra Clean Energy has 36.33 million (36.33M) outstanding shares and 35.06M free float traded shares. Its market cap is CA$2.65M. Its 52-week range is CA$0.095–0.44 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Terra Clean Energy and Skyharbour Resources Ltd. are each a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Terra Clean Energy.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.