I wish everyone a great Canada Day long weekend.

I have a couple of timely updates.

Inomin Mines

Recent Price $0.03

It has been a while since I updated Inomin Mines Inc. (MINE:TSX.V; IMC:FRA), but I think action in the stock will soon pick up again. We first bought the stock at $0.08, and it popped to $0.70 on their magnesium discovery in 2022.

Drill-hole B21-02 intersected 252.1 meters (m) grading 20.6% magnesium, 0.16% nickel, and 0.33% chromium. B21-02 was the first-ever drilling in the Spur zone, one of five large mineralized areas at the property.

Hole B21-01 at Spur also made another first, discovering near-surface silver and copper, intersecting 649 g/t silver and 0.29% copper over 3 meters, before the hole was terminated due to difficult ground drilling conditions.

Inomin then released some historic (2014) holes where maganese grades were not previously reported. This included BN14-23, which reported 100.6 meters (m) at an average grade of 21.5% Mg with 0.14% Ni (nickel). Inomin did some surveys and a few more drill holes in 2023 with good results, but the bear market had set in for junior explorers, and nobody cared. The stock just drifted lower since and has been trading around 3 or 4 cents for the past year.

I think that is about to change. The property is huge, 100% owned, adjacent to the Gibraltar copper mine, and has excellent infrastructure. This, along with the good drill results, has attracted. A major miner, Smitomo Metal Mining into a JV on Inomin's Beaver-Lynx project. Inomin shareholders are voting to approve the JV deal this week, and then the action should start.

Under the terms of the agreement:

- Sumitomo was granted an initial option (phase 1) to earn a 60% interest in the project by incurring minimum exploration expenditures of $3-million by the second anniversary of the definitive agreement.

- Provided that Sumitomo has exercised the initial option, Sumitomo will have a second option (phase 2) to earn an additional 20% interest in the project by incurring minimum exploration expenditures of $5-million by the third anniversary of the date on which the initial option was exercised.

- Provided that Sumitomo has exercised the initial option, Sumitomo will have the option to acquire certain non-mineral rights, including hydrogen, by paying Inomin $500,000 and granting to Inomin a royalty in certain circumstances as described in the definitive agreement.

- Inomin will be the operator of the project during at least the initial option period, entitling the company to a fee equal to 10 per cent of project exploration expenditures incurred by the company on behalf of Sumitomo.

- Inomin will be reimbursed by Sumitomo for exploration and related expenditures the company incurred at the project during the term sheet exclusivity period up to $100,000, which expenditures will count toward Sumitomo's expenditure requirement under the initial option.

A $1.7-million phase 1 work program is proposed in 2025, which is anticipated to include about 3,850 meters of drilling. Exploration is expected to start this summer. The stock has formed a wedge pattern with a triple bottom around $0.25. A break above $0.06, a higher high, is to watch for.

Not often, I put an update out on the weekend, but I was away Friday, and one of our stocks exploded upward. Gatekeeper popped 45% Friday. The stock broke through the $0.88 resistance area I have been watching after testing it a few days earlier in the week.

I just did an update on the company on June 11, and it seems the market finally figured out what I did a few years back. The COVID-19 fiasco did slow them down some, as most companies, but after a lot of patience, finally!

Gatekeeper Systems

Recent Price $1.24

Entry Price - $0.85

Opinion – Hold, Buy

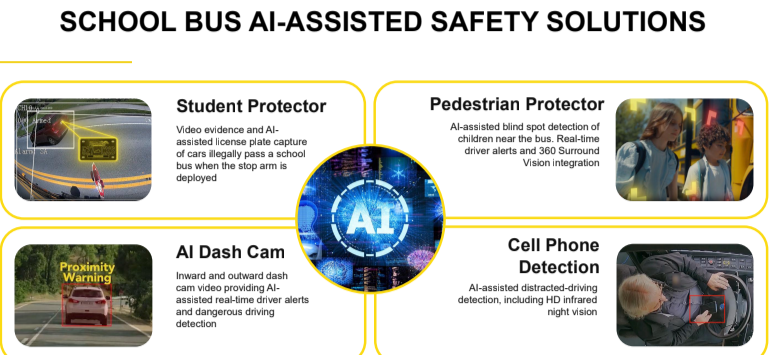

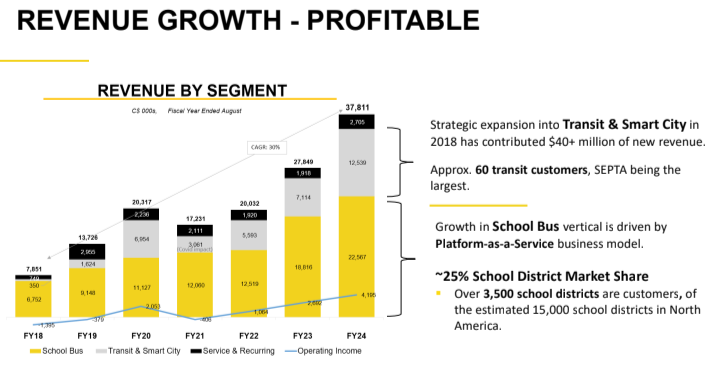

For those that have not followed my updates or do not know of Gatekeeper Systems (GSI:TSXV; GKPRF:OTCMKTS) — Gatekeeper is a leading provider of video and data solutions for a safer transportation environment for children, passengers, and drivers on public transportation fleets. Gatekeeper has provided solutions to more than 60 transit agencies and 3,500 school districts throughout North America and has installed more than 57,000 mobile data collectors for customers that record video and data daily from over 200,000 onboard devices.

The company's hosted software applications facilitate artificial-intelligence-assisted video analytics for incident management and storage. The company's platform-as-a-service (PaaS) business model is centered around the mobile data collectors, which are the cornerstone of its data company transformation.

The most important catalyst is a new regulation, and perhaps an unfortunate tragedy, too.

A Transport Canada regulation announced in February requires that, beginning on November 1, 2027, perimeter visibility systems be installed on all new school buses.

Just this past Wednesday, a 9-year-old boy, riding his bike, was struck by a school bus right in front of the school and killed. Without knowing all the details, one cannot say for sure if Gatekeeper's system would have prevented this, but I do know there are numerous blind spots around the outside of a school bus for the driver. A system like Gatekeeper's covers all blind spots and can only help.

As an experienced provider of school bus video solutions, Gatekeeper was selected as a pilot project supplier for this regulatory initiative and installed its 360 Surround Vision perimeter visibility systems on pilot project school buses in British Columbia and Ontario.

Transport Canada estimates the costs of this regulation to be $196-million in present value between 2024 and 2036, and estimates 65,105 school buses will be affected by 2036. If Gatekeeper just gets half this business, $98 million is huge for a company with only a $116 million market cap. What often happens in Canada with new government regulations is that some company with inside government connections is favored and gets the contracts (about as corrupt as third-world countries).

The most significant competitor I know is CrossSafe 360, and they do have some connection with Transport Canada. They are a private company and I am unable at this time to find out any more about management and their connections.

From what I can find, Gatekeeper has a better system, and they have a lot of industry contacts too. I will be watching Gatekeeper's pilot program closely and will dig more into this Transport Canada potential.

Regardless, GSI is showing strong growth.

My last update was the breakout on June 11. We now have a bullish golden cross this week, and the breakout on Friday.

Quite often, with a breakout like this, the stock will run for two to four days. Let's see, I may suggest part profits at a higher price.

Hold if you own the stock, if not long, I still see a lot of upside potential here.

| Want to be the first to know about interesting Technology, Critical Metals, Silver, Cobalt / Lithium / Manganese and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: [None]. My company has a financial relationship with [None]. My company has purchased stocks mentioned in this article for my management clients: [None]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.