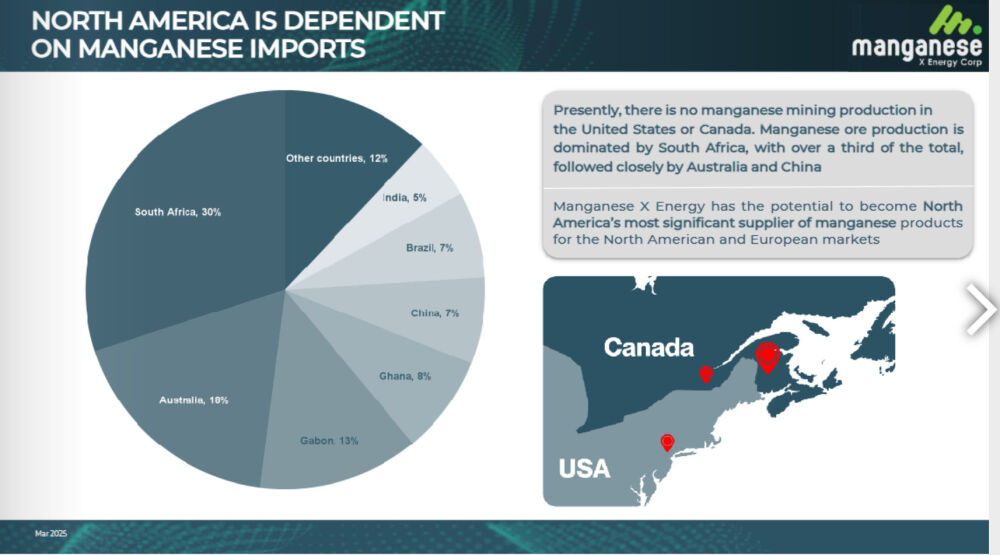

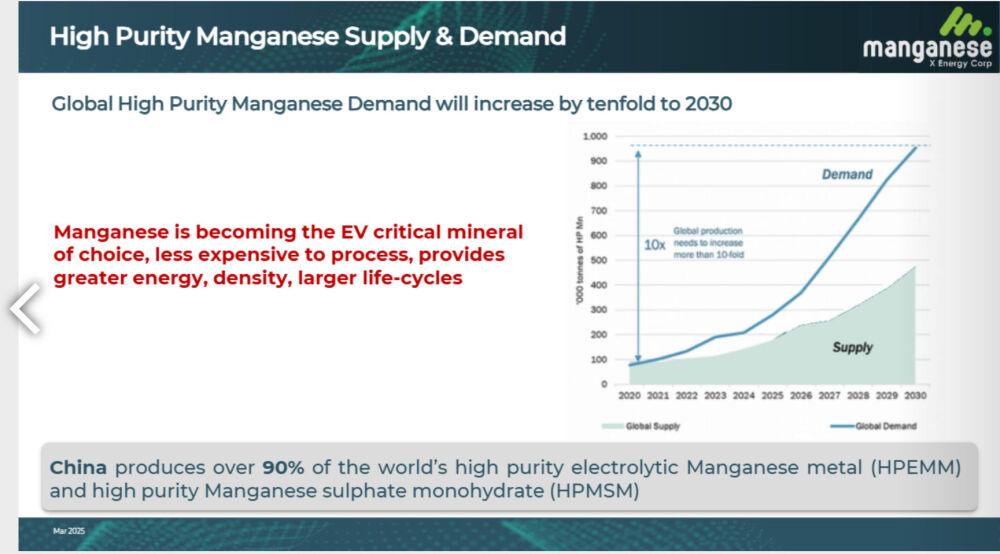

Manganese is classed as a critical mineral, and currently, there is no manganese mining production in the U.S. or Canada, which means it all has to be imported. South Africa is the biggest producer, followed by Australia, and although China is "only" responsible for 7% of world production, it is important that it produces over 90% of the world's high-purity electrolytic manganese metal and high-purity manganese sulphate monohydrate.

Clearly, in an age of trade disputes with the rising potential for conflict, this is not a good situation for North America. Enter Manganese X Energy Corp. (MN:TSX.V; MNXXF:OTCMKTS), which is positioning itself to be the most significant supplier of manganese products for North America and Canada.

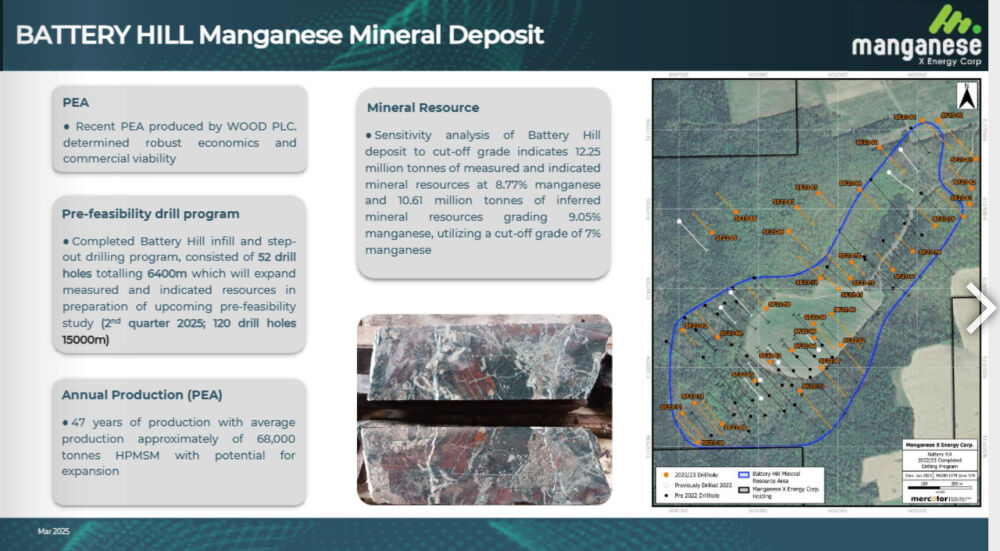

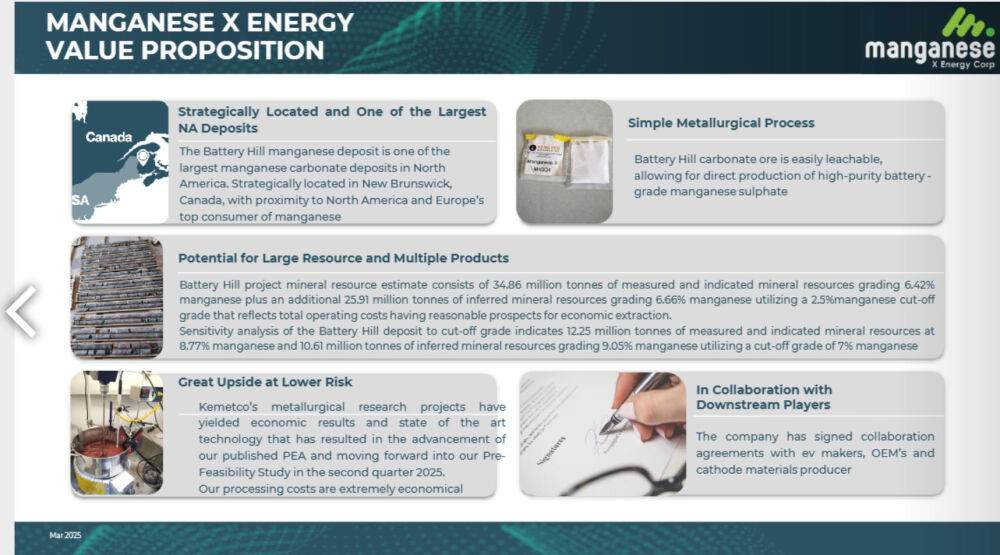

A key point is that Manganese X Energy Corp. is still several years away from production. However, it is moving in the right direction and is in possession of a major manganese resource at its appropriately named Battery Hill Project in New Brunswick which contains 34.86 million tonnes of measured and indicated mineral resources grading 6.42% manganese plus an additional 25.91 million tonnes of inferred mineral resources grading 6.66% manganese and within these tonnages somewhat lesser quantities at even higher grades.

Small wonder, then, that legendary investor Eric Sprott has a CA$2 million investment in the company. The company's flagship project Battery Hill is in New Brunswick just over the border from the U.S. State of Maine and it is reasonable to presume that if Trump makes good on his expressed desire to take over Canada as another State of the Union, then paperwork involved in importing the company's manganese into the other States of the U.S. will clearly be reduced. It is unclear, however, what State number will be assigned to the former Canada, as it depends on whether Greenland is taken over first.

Now, we will look at a number of pages from the company's latest investor deck in order to get a better idea of what the company is about.

We will start with some general points. The following page shows the main producers of manganese in the world — Canada and the U.S. are conspicuous by their absence because, at present, they don't produce any.

Global high-purity manganese demand is expected to grow rapidly through 2030, and even if this projection is overly optimistic, it should still expand significantly.

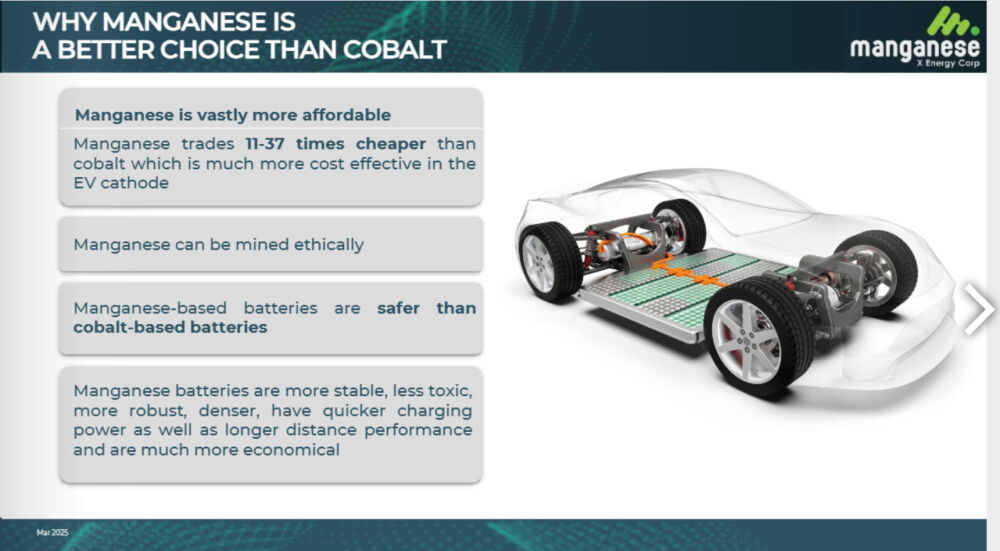

Manganese-based batteries look set to elbow out cobalt-based batteries, because they are much more economical, less toxic, and safer, and have a number of other advantages.

The trend is for much greater use of manganese in battery manufacture going forward.

Positive attributes of the company are shown below.

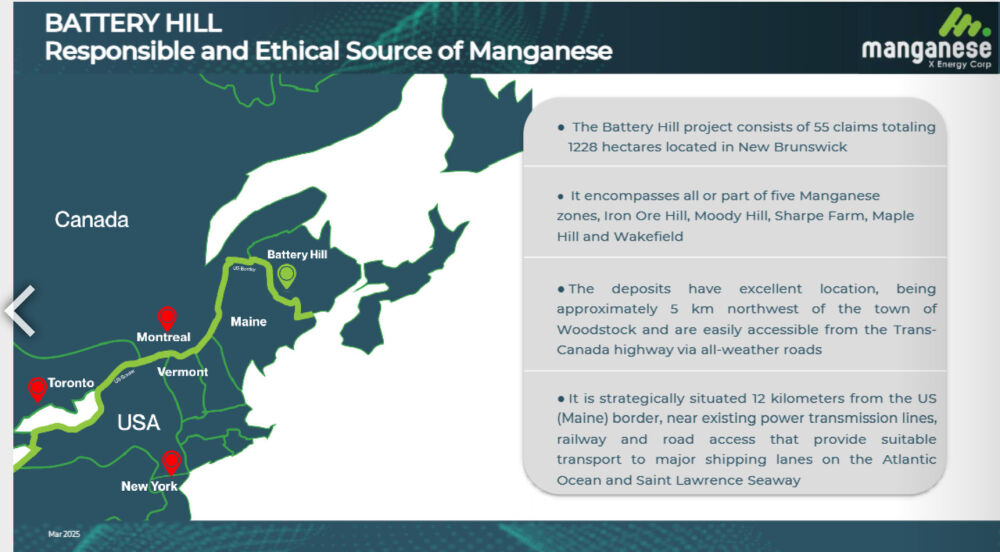

This page shows the location of the company's main Battery Hill Project, just over the border from Maine in New Brunswick.

Basic details of the Battery Hill deposit are below.

The long mine life of over 40 years is a big plus.

PEA (Preliminary Economic Assessment) highlights are here:

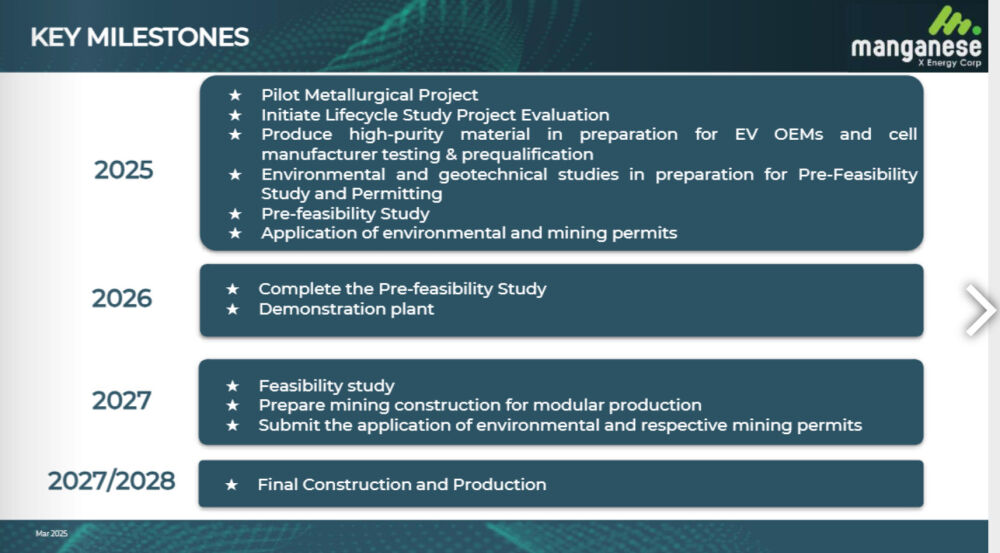

Here is the timeline to production, which looks set to start in 2028:

The company has a lot going for it and is currently seriously undervalued.

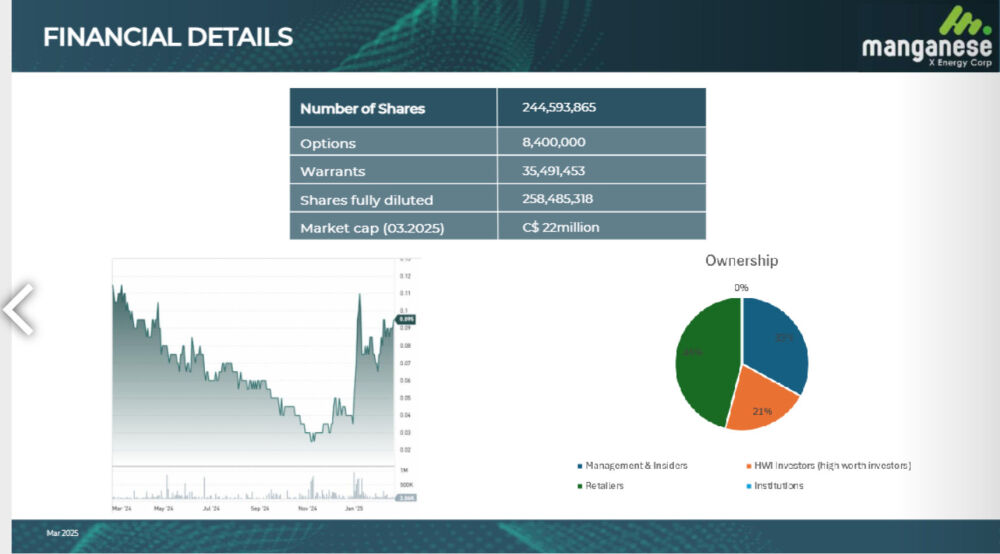

Whilst the number of shares in issue may be considered rather high at 244.6 million, less than half of them are in the float, as this cap table shows . . .

Turning now to the charts, we will start with the long-term 10-year chart to gain an overall perspective. On this chart, we see that after a dramatic and spectacular spike in 2020, there was another one that was almost as big early in 2021, but after that the stock went into a long and grueling bear market that continued for almost four years and took the stock down to just CA$0.02 by the time it hit bottom last November.

Basically, it couldn't go any lower and was destined to either recover or face oblivion, and even on this chart, we can see the recent action, which indicates that it is recovering with the price breaking clear above its 200-day moving average, which has already turned up.

Now, we move on to look at it on a 2-year chart, this time period being selected as it reveals that, despite the price continuing to make new lows until last November, basing action began as far back as the Fall of 2023. Although hard to "pigeon hole," the base pattern that is believed to have formed looks like a hybrid between a Cup & Handle base, with the Cup starting to form in the middle of last year, and a larger downsloping Head-and-Shoulders bottom, with the Left Shoulder building out in the fall of 2023.

The volume pattern suggests that the Cup & Handle interpretation is the most valid. But whatever we classify it as, price and especially volume action so far this year has been very bullish indeed, which probably reflects the fast-growing protectionist environment that we are now in, which will benefit companies that are set to be major domestic producers like this one. Although a completed breakout from this base pattern will not have occurred until it breaks clear above the band of resistance shown, which should lead to the stock accelerating to the upside, the action so far this year strongly suggests that this is going to happen, and sooner rather than later.

We can more comfortably review recent action on a 1-year chart on which we see that, following the dramatic high volume runup early in January which kicked off with a gap up which was clearly very bullish action, the price has run off sideways on much lighter volume to consolidate in a large Symmetrical Triangle which action has allowed time for the earlier overbought condition resulted from the January spike to unwind and for the 200-day moving average to swing into more positive alignment.

Note also how the On-balance Volume rose sharply on the spike and has stayed up on the consolidation. This is a very bullish setup and with the Triangle now closing up, the time is at hand for a breakout into another significant upleg that is thought likely to break the price above the key band of resistance soon on the 2-year chart.

The conclusion, therefore, is, with the price looking set to break out into another upleg, that Manganese X Energy Corp. is a Strong Buy here for all timeframes. Note that there are similarities between the setup here and that which existed for Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB) when we bought it a few weeks back, just before it broke out and went on to make a more than 50% gain.

Manganese X Energy Corp.'s website

Manganese X Energy Corp. (MN:TSX.V; MNXXF:OTCMKTS) closed for trading at CA$0.0675, US$0.0515 on May 6, 2025.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blue Lagoon Resources Inc.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.