The technical case for buying North Shore Uranium Ltd. (NSU:TSX) here is clear, simple, and STRONG.

Before we look at its stock charts, we will take some time to overview the fundamentals of the company using its latest investor deck.

North Shore is a stock that we went for too soon, early in February, as it has since drifted lower, but as we will shortly see, the case for buying it here is considerably stronger than it was back then.

The first slide from the investor deck sets out the company's vision in the context of the outlook for uranium.

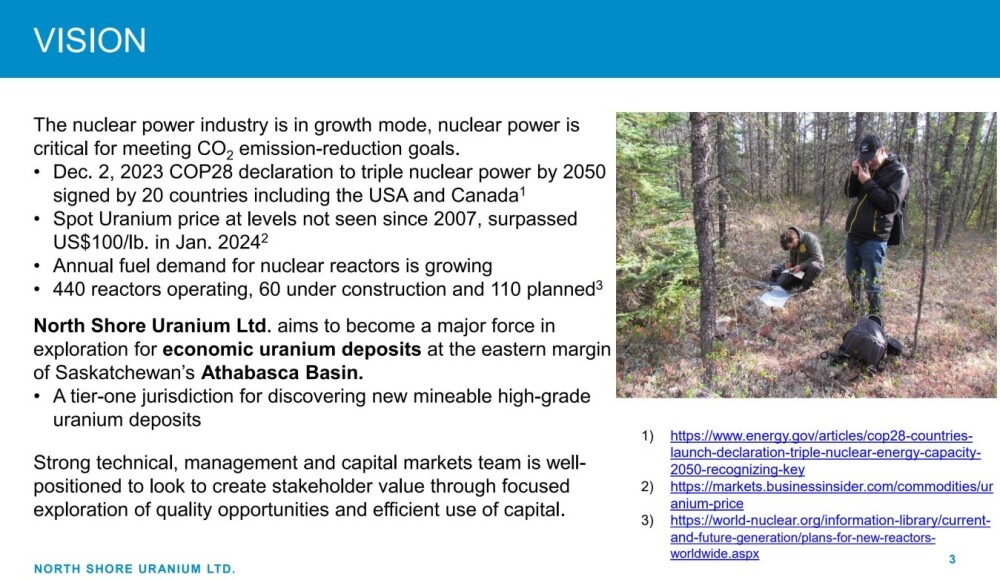

The company has two properties that it is exploring for uranium on the eastern margins of the Athabasca Basin in Saskatchewan, the Falcon property and the West Bear property, whose locations are shown on the following slide.

It should be noted that although Falcon is technically outside the boundary of the basin, this does not reduce its potential for discovery as the same geological formations that are present in the Falcon area underlie some of the major uranium mines within the basin.

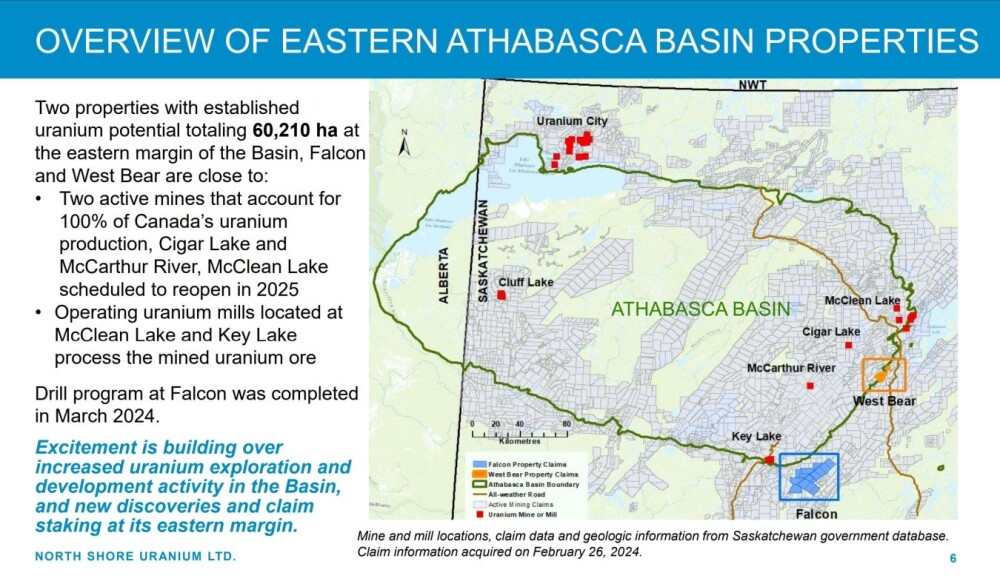

An overview of the Falcon property is provided on this slide.

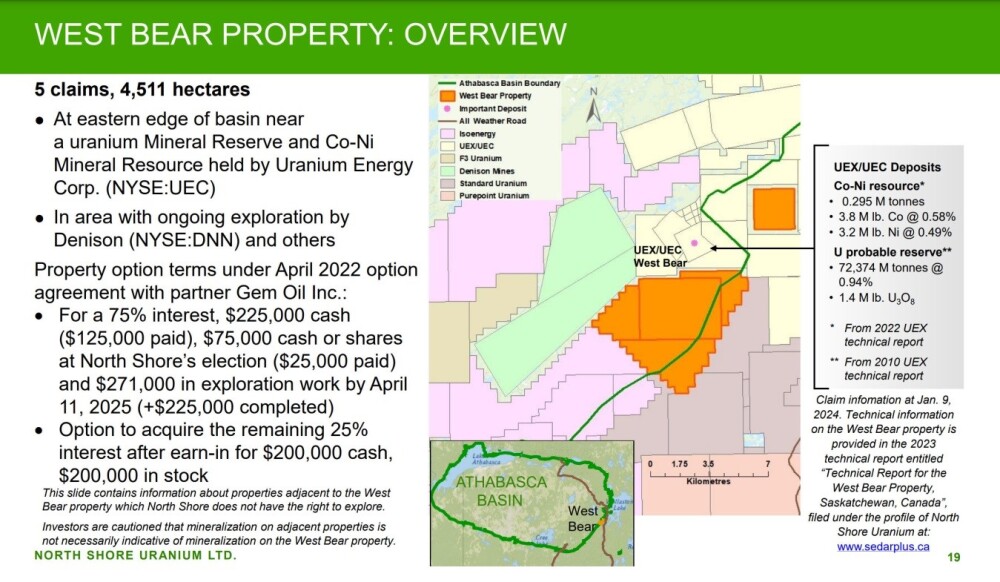

An overview of the company's other property, West Bear, is provided on this slide.

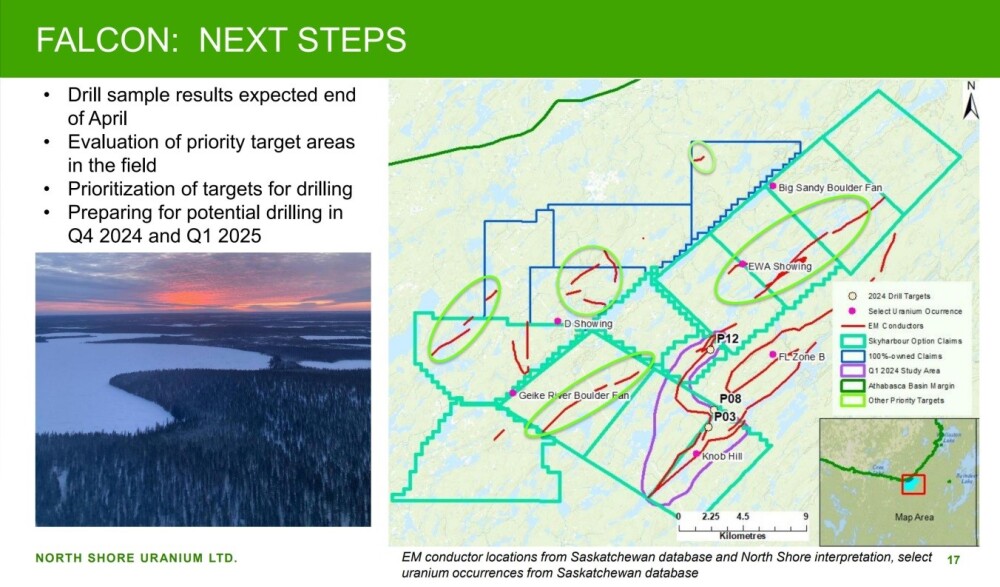

Ongoing and upcoming work on the Falcon property is set out on this next slide, and of particular note for investors is that drill sample results (from the March drilling program) are expected very soon.

This could move the stock and might help explain the strong Accumulation we are seeing on the stock chart.

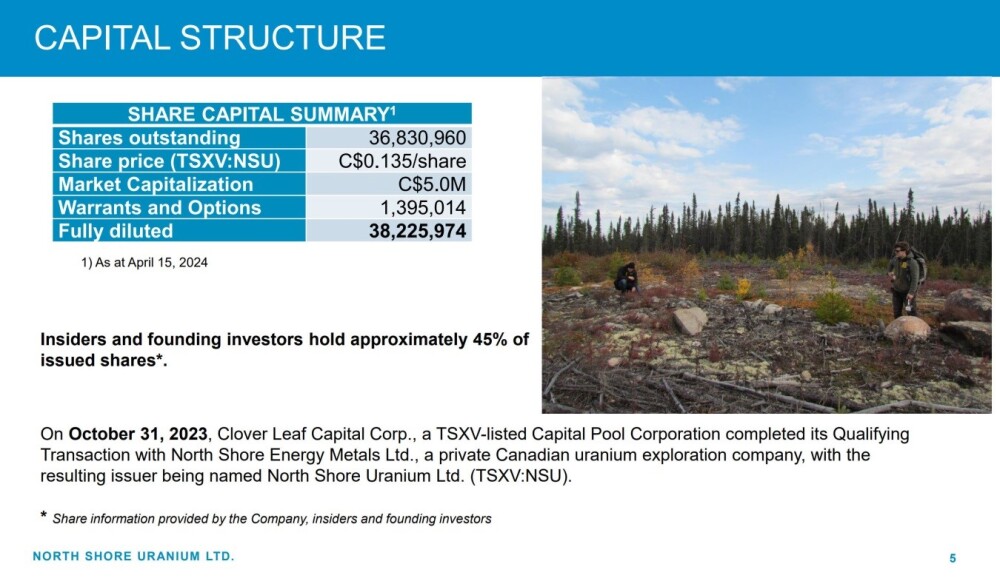

Our last slide sets out the capital structure of the company, and an important and very positive point to note is that of the 36.8 million shares in issue, approximately 45% are held by insiders and founding investors.

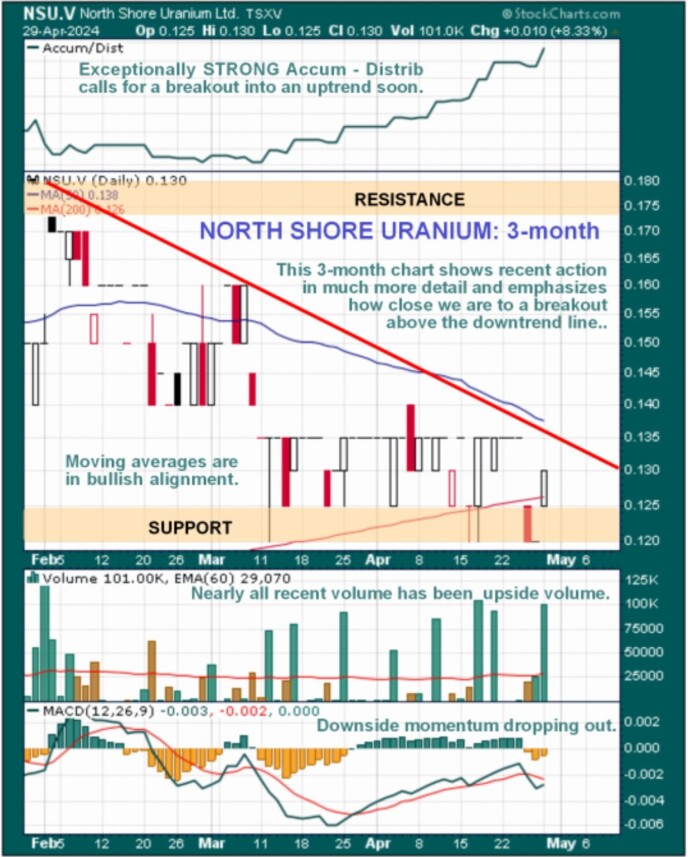

Now we will proceed to see why the technical case for buying the stock is so strong and for this purpose, we will use two charts, one going back nine months — there is no need to go back further because the stock only started trading last November — and the other going back 3-months which will enable us to examine recent action in more detail.

Starting with the 9-month chart, we see that after coming to market on November 2, the stock promptly "hit the skids," which is quite a common occurrence with new issues caused by early speculators "cashing out," and it plunged from CA$0.30 back to CA$0.12 where it found support and stabilized.

As it turned out, this support level at CA$0.12 has provided a floor ever since with a sideways trading range forming above it, bounded on the upside by CA$0.18 although, since early February, there has been a downward bias with the price being shepherded lower by the downtrend line shown so that the trading range appears, at first sight, to have morphed into a bearish Descending Triangle BUT — and this a big but — by far the majority of the volume, while this Triangle has formed, has been upside volume, which is why the Accumulation line has been trending so strongly higher and this is a powerful positive divergence which is a strong indication that an upside breakout into a major uptrend and new bull market is pending or "in the works" that will have little trouble breaking the price above the resistance shown in the CA$0.12 area.

Note also the bullish alignment of the moving averages with the rising 200-day coming into play, which is increasing the chances of an upside breakout soon, especially as the price and moving averages are now bunching together in a potent manner.

The 3-month chart enables us to see recent action in much more detail and, in particular, the extraordinary positive divergence of the Accumulation line, which is trending strongly higher, and we can also see how close the price is now to breaking above the downtrend line.

We, therefore, stay long, and North Shore Uranium is rated a Strong Buy for all timeframes, with the case for buying it here considerably improved than when we first looked at it.

North Shore Uranium website.

North Shore Uranium Ltd. (NSU:TSX) closed at CA$0.13, on April 29, 2024.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- North Shore Uranium has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of North Shore Uranium.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.