After 45 years spent trying desperately to decipher the secret code of the financial markets, I have learned to respect the action of the "tape" — as in "ticker tape" — more than any of the well-intended research reports or mass media newsletter pumps. In fact, over a year ago, I made the determination that this new generation of cell phone traders all move in and out of markets like flocks of birds feeding in an insect-ridden marsh. Just as hundreds of swallows dive and retreat in search of moths and mosquitoes and errant crickets, the new generation of social media traders dive and retreat in the direction of cyberspace "gurus" who point these massive legions of well-heeled kiddies to whatever "flaveur du jour" that tickles their fancies on any given day.

It reminds me of my youth sitting in the front row of the Imperial Room of the Royal York Hotel in Toronto when grown men in suit-and-tie went running for the payphones after a prominent newsletter guru mentioned a "hot stock to own." They would literally trip over chairs and tables scrambling to get to those cherished payphones to make the call to their brokers before the rest of the 200 attendees figured it out. By the way, a dime was all that was required to make any type of local call back in those heady days before cell phones.

The actual point of this wandering diatribe is this: I just witnessed the embryonic advance of the kiddies as they finally realized that you cannot store electricity in lithium-ion batteries until you have more of it. Once you have "more of it" through the massive advance of nuclear energy programs, you cannot receive it unless you have expanded the transmission grid. And you cannot expand the grid without copper.

Copper

I made the call on copper last year, knowing full well that I could very well be a) early or b) wrong. The copper bears were waving the "China crash!" flag along with the "Hard Landing!" banner, but I elected to read the annual reports for all of the major copper producers and, more importantly, copper users expressing unanimous concern over the outlook for copper supplies in 2024 and beyond. Copper bounced around between $3.50/lb. and $4.00/lb. for most of the past year, but it never seemed to be able to catch the attention of the kiddies, the algobots, or the mainstream financial media until we reached The Ides of March.

I detect an ample dose of irony in the fact that it took this long for copper to decisively break above the $4.00/lb. level without the help of any mainstream narrative. I heard nothing today from Bloomberg, BNN, or CNBC regarding copper, which is, for all copper bulls, "magic to our ears."

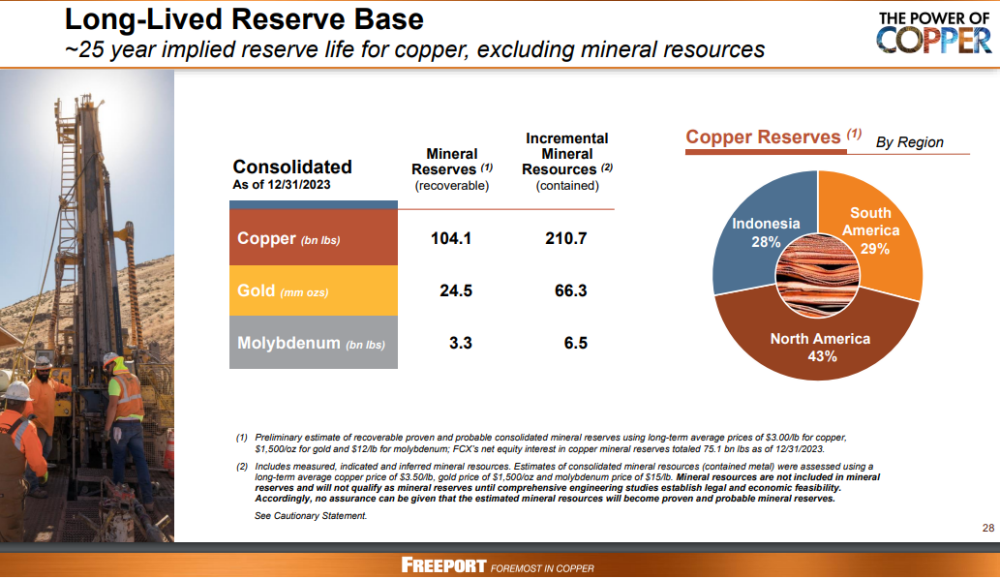

Subscribers should now own copper or copper-centric equities like Freeport-McMoRan Inc. (FCX:NYSE) whose mining operations include both copper and gold extraction (also molybdenum) from three continents around the globe.

Of the blue-chip mining names that populate the large resource funds, FCX is the largest producer of copper at 1.53 m/t, with Codelco (1.45 m/t) and BHP (1.13 m/t) following closely behind. What sets FCX ahead of the pack is the 24.5 million ounces of gold reserves contained largely in the Grasberg Mine in Indonesia.

Subscribers to my service know that I have named both copper and gold as the top two metals for performance in 2024, with copper an integral component of the Electrification Movement while gold is a time-tested store of value that protects wealth against profligate spending and currency debasement by governments the world over.

To be able to gain exposure to both copper and gold through one multinational mining giant is a distinct advantage to monitoring a basket of companies covering the same metals field.

I first purchased FCX in the $38 range through the shares directly and through the FCX June $40 call options at $3.05. One month later, the stock is ahead 17.3%, with the calls ahead at 158% to $6.48 per contract. What is impressive is that copper only just broke out through the

psychologically-important $4.00/lb. level to close out the week at $4.1235/lb., the highest print since April of 2023. When added to my two top junior copper names Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) and American Eagle Gold Corp. (AE:TSXV), the GGMA 2024 Portfolio is well-positioned to benefit from the growing copper shortage narrative that has been for the most part ignored by the mainstream media that are only too content to flash quotes for Bitcoin or Nvidia (NVDA:NASDAQ) across the screen twenty times an hour.

What the kiddies seem to have finally discovered is that while lithium and uranium have specific and very narrow uses in today's world, copper is used in everything from autos to housing to electronics and very heavily in technology hardware. Bring on a structural deficit in copper, and you have serious problems for a myriad of industries that can only be rectified with a dramatic rise in copper prices, which can then justify the exploration and development of new sources of supply. Given the length of time that passes between discovery and production, even after a big move in copper prices spurs a raft of positive feasibility studies, none of these new mines will impact supply for at least five years, which allows a lot of runway for this new emerging copper bull. Indeed, these are exciting times for the copper bulls.

GLD:US

As delighted (and vindicated) as one could ever be with the recent explosive move in gold to all-time highs, it takes years of suffering and scars from failed trades to look objectively at what was a vintage breakout and decide to stand aside. I absolutely agonized over the move in GLD:US to $203 after calling the lows in January when it traded down into the convergence zone between the 100-day and 200-day moving averages. It traded down to below $184 for a very brief period on February 14, at which point I was traveling and actually missed the entry-level by one day.

Scrambling to replace my call option position over the next few days, I found myself chasing the market, which is a practice that has always cost me money (and a lot of it). I replaced 60% of the position that I jettisoned two weeks earlier with GLD at $190 and then cursed myself for missing the entry point because my truck needed a new set of wipers. As maddening as that was, it was last week that I had to grit my teeth, pinch my nose, close my eyes, and sell the position at $20 for a 158% move in three weeks.

As good a trade as it was, I waffled over the decision because there were still over 100 days left until expiry. Alas, with the RSI screaming along at 85 (overbought) and the MACD and MFI charts up in the clouds as well, I wiped the tears away and took the profit and have since chewed my fingernails off fearing that I might be buying it back at considerably higher prices.

If it conforms to other corrective periods, GLD should (operative word "should") pull back to the 38.2% Fibonacci retracement level just under $196, with the worst case being the 50% level at $193.51. We have had three runs at the $190-195 range since 2020 with each one being soundly

repelled by the bears. To have a 3-year, $40 basing range followed by a breakout like this suggests at least another $40 to the prior all-time high at $194.44, taking my target for 2024 up to $234. Translating that to the gold price, it extrapolates out to $2,500/ounce. So, if anyone wonders what keeps me awake at night, it is that I am out of my call position and, to coin a famous Dennis Gartman phrase: "I'm flat, and I'm nervous!"

Canadian Junior Resource stocks

I spoke last week of the dreaded "PDAC Curse" that has, in past years sent the junior Canadian resource stocks into a tizzy once all of the booths are broken down and shipped back into

storage units until the next convention is announced. I have been telling subscribers that this year may just turn out to be different in that the juniors are coming off one of the worst three-year stretches in recent memory, with financings at about 20% of the historical norm. Despite big moves in lithium and uranium in 2021-2023 that brought a number of big deals, there has been virtually nothing for gold or silver and only a couple for copper-based upon new discoveries and led by major miners seeking a foothold.

Coming off such a stagnant period, the big moves in copper and gold and the improved action in the silver market and in the Senior Miners prompt me to think that the TSX Venture Exchange, the second-worst-performing exchange in the world last year behind Shanghai, may be about to break with tradition and embark upon a bull run.

Typically, the TSXV tracks gold prices, and while gold is up 21% since the October lows, the TSXV is up a paltry 10% having just broken the downtrend line drawn off the 2022 top above 1,000. Now at 550.90, if the TSXV can get through the August 2022 peak at 675, then I can envision a move back above 1,000, driven primarily by rising prices for copper and gold.

However, as always, you have to be invested in those metals that will catch the attention of the kiddies because the Boomers are all finished as the main drivers of markets these days. In the case of the junior resource space, the kiddies have used Bitcoin as their personal store-of-value inflation hedge largely because they sought to avoid the pain trade experienced by the Boomers in holding gold and silver since August 2020. In an ironic twist, the kiddies look quite differently at copper, which they know will be needed to eliminate fossil fuel dependence through electrification. Additionally, one thing that always changes the narrative is price action, so despite their preference for crypto, if they see gold miners ramping up in response to the breakout in the spot while Bitcoin deflates back down to earth, they will be forced to move into the junior gold and junior silver names with the same vengeance and conviction that they did with crypto.

So, before you all dump your junior miners because PDAC is over and the summer doldrums are about to arrive, you might be well-advised to accumulate a basket of gold and copper juniors

and possibly a few silver juniors, but only if the silver price can hold above $26.50/oz. for more than a New York moment.

Speaking of silver, the trade is as follows: On a 2-day close above $26,50, I will buy a 25% position in a basket of silver names. If that works, on a 2-day close above $30/oz., I will go "ALL IN". I will let price dictate the course of action. It is really that simple.

Getchell Gold Corp.

Lastly, for those that follow Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), I suspect that each time you see this name in one of my missives, it is followed by rolling eyes and exasperated groans and while I certainly cannot blame you for such reactions, the opportunity that I have been broadcasting since last September in the form of the debenture offering has ballooned from a less-than-thrilling CA$2.3 million first tranche closing in January that effectively rescued the Fondaway Canyon asset to be today at around $4.6 million (my guesstimate) leaving only a $400k balance.

More importantly, it allows the company to complete the metallurgical study in advance of issuing a Preliminary Economic Assessment for the Fondaway asset, where 2,059,900 ounces (indicated and inferred) are wide open along strike and to depth for further enhancement through drilling. The goal is to move the deposit to a "Tier Two" status (3m ounces), whereby it will certainly demand a re-rating and subsequent improvement in market cap, which stands at a meager $20 million or less than $10/ounce. Even on a fully diluted basis, the market cap is only $13.24/ounce and when one looks back to 2000-2011 during the last big golden bull, ounces in Nevada averaged around $100 with low-grade commanding lower prices and high-grade the opposite.

I have been pumping the Fondaway Canyon tires ad nauseum for the better part of four years, which means that I was defying all logic and flying directly into the face of a hurricane-force maelstrom, which is the only way to describe the junior gold market from 2020 until two weeks ago. During that horrid period that felt like forty-eight months in the dentist's chair getting root canals on every tooth in one's head, Getchell doubled its resources while delivering drill holes such as in May of 2022 announcing "25 meters of 10.4 g/t Au" in the newly-discovered North Fork Zone.

Unfortunately, those torrential headwinds nullified anything in the way of share price appreciation, which was typical of the bear market environment. As of the recent breakout to new highs, that ugly bear market environment has now ended. I expect 2024 to unfold with investors showing appreciation for exploration success, especially on top of an existing resource located in a favorable jurisdiction like Nevada. With that resource, Getchell is an ideal proxy for higher gold prices, a reality soon to be recognized by the investing public.

Gradually Then Suddenly

I leave you with one final thought regarding recent developments in the precious metals arena. The U.S. government is reminiscent of a famous line by Ernest Hemingway in response to the question: "How did you go broke?" His famous reply was, "Two ways, gradually, then suddenly."

That perfectly describes the U.S. fiscal condition as it is at the stage in the process where "gradually" is ending and "suddenly" is arriving. In this event, they will have great difficulty in selling their bonds, so in order to keep the government financed, they can either raise taxes, which will crater the economy, or they can collateralize their bonds.

The only collateral held by the U.S. government other than taxation is the 8,134 metric tonnes of gold held by the Fed in trust for the U.S. Treasury. That represents over 286 million ounces of gold. At last count, the U.S. national debt was over $34 trillion, which in ounces of gold is $119,298 per ounce. If one uses the same percentage of equity required as a down payment on a home when applying for a mortgage, 10% would amount to $11,929/ounce of gold.

That remains the only plausible way that the USS Nimitz will be allowed to use the U.S. government credit card the next time it pulls into Gibraltar for a re-fit. A gold reset is on the horizon and remains the main reason why central banks the world over are buying gold hand over fist.

Food for thought.

| Want to be the first to know about interesting Base Metals, Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp., Fitzroy Minerals Inc., and Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with

- Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.