Bion Environmental Technologies Inc. (BNET:OTCQB) is a unique company that has developed patented processes for the large-scale treatment of farm animal waste, especially that produced by beef cattle, with the aim of greatly reducing resulting pollution and instead converting the waste into significant quantities of useful by-products that can be recycled for use on the farm or production facility or can be sold.

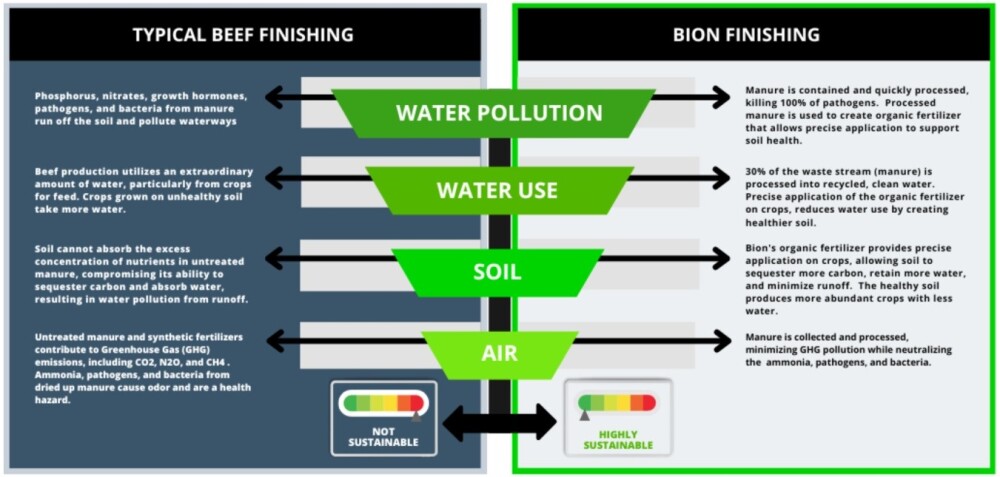

The following graphic, lifted from the company's latest investor deck, shows the difference between traditional beef production and beef production using Bion's systems.

With the current drive toward sustainable production, the company's time has come, especially as its technologies will greatly assist consumer lobby groups who represent the vast numbers of consumers who do not want to eat insects in making a case for continued consumption of real meat products on the grounds that, thanks to the company's processes and technologies, meat production has become much more sustainable with much less environmental impact.

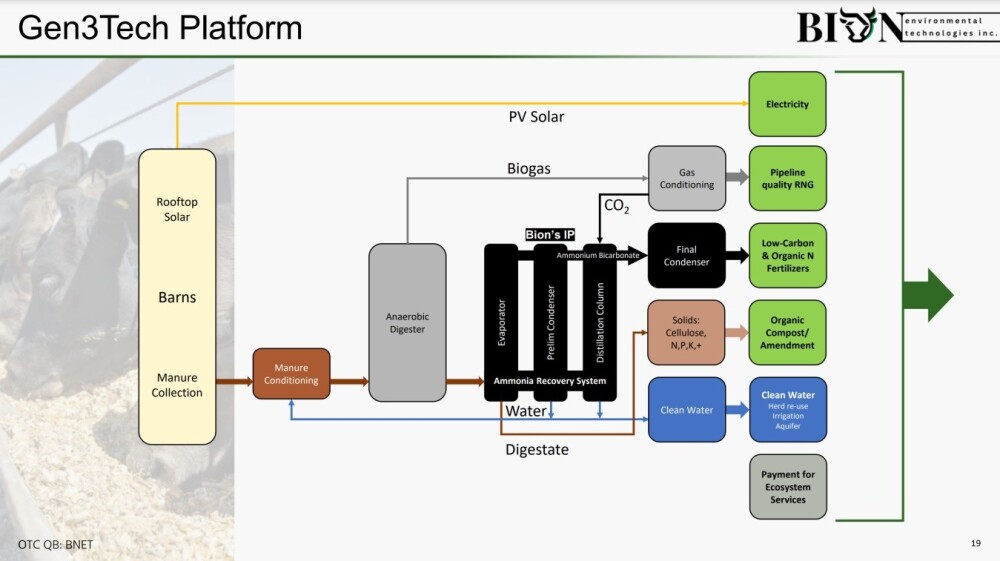

In the United States, 1.4 billion tons of raw untreated sewage from farm animals is dumped on the ground every year, resulting in horrendous environmental impacts from nitrate runoff, etc. The company's patented processes will vastly reduce this waste and instead convert it into a range of products including biogas, organic composts, and fertilizers, and extract clean water for reuse.

In addition to the economic benefits to the farmer of reusing organic material and water on the farm or production facility, the company's high-tech "barn solution" will allow for the production of electricity from the solar panels on the barn roofs on a significant scale.

The following slide shows in simplified form the processes involved in treating cattle waste and converting it into useful products.

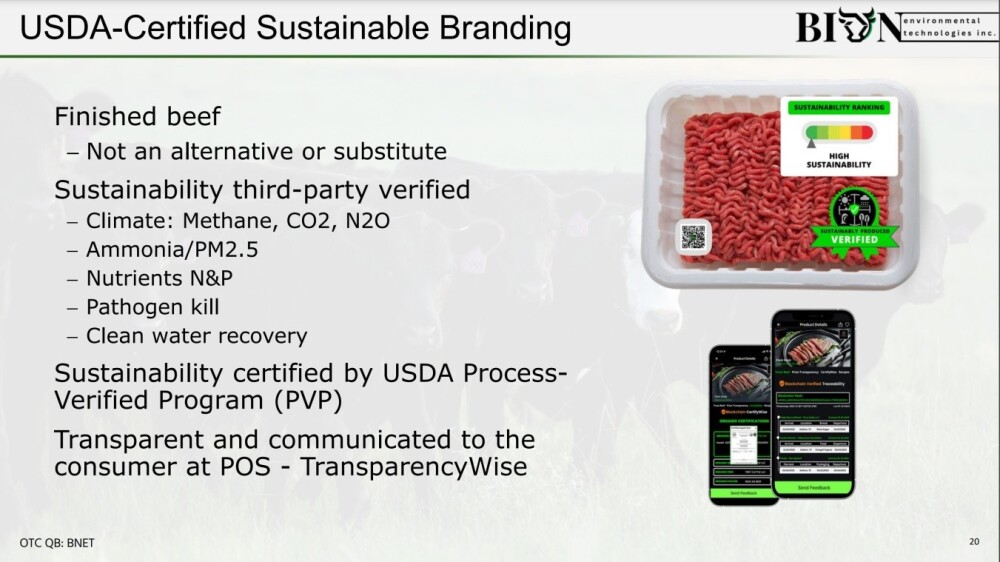

Application of the company's processes and technology will result in beef product that will meet the USDA's certified sustainable requirements.

After years of work, the company has developed and refined these processes and already has many patents, so it is at an advanced stage and "ready to go" and now it is looking for major partnerships.

Yesterday came the positive news that the company has applied for OMRI Listing for Commercial 10-0-0 Nitrogen Fertilizer. This follows on from it having received an OMRI listing for its initial product, a 0.5% ammonium bicarbonate solution, back in 2020 and it is also preparing an application to the California Department of Food Agriculture (CDFA) for a 6-0-0 nitrogen fertilizer product.

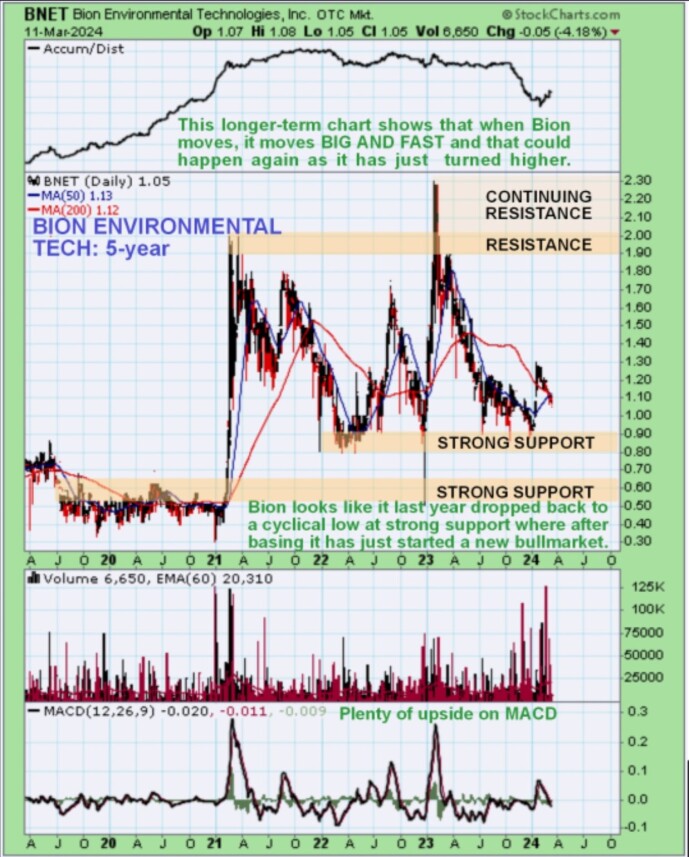

Now, we will review the stock charts for the company on which we will see that it is shaping up very well and looks like it has started a new bull market.

Starting with the 6-month chart, we see that there was a sharp runup in mid-January that, price-wise, has the characteristics of an "impulse wave" or a move in the direction of the primary trend, now up — it was a big sharp runup with a couple of prominent gaps.

However, volume was not as strong as we would like to see, which is why the Accumulation line didn't do much yet; ironically, this line has risen significantly as the price has since reacted back in what looks like a normal correction to the preceding upwave, which bodes well for another upleg to start soon.

Nevertheless, it is still "on the defensive" at the time of writing and could drop further short term. What will probably happen soon is that we see some sort of reversal candle like a "bull hammer," which will signify that the price is reversing back to the upside. Before leaving this chart, note the bullish moving average cross that occurred not long ago which is another factor suggesting that the stock will start higher again soon.

Zooming out a little on the 1-year chart enables us to see that a Triple Bottom base pattern was built out between July and December. On this chart, the sharp rally in January certainly looks different and like an impulse wave, as pointed out above, and because it did not succeed in breaking the price out of the base pattern whose upper boundary is the resistance level shown in the $1.23 - $1.30 zone, it can fairly be described as a "preliminary breakout," and it should be noted that such breakouts are usually followed by "the real deal" — a decisive breakout that is often considerably more dramatic and the reaction back of the past month is believed to be the prelude to such a move.

With the MACD having more than fully neutralized the earlier overbought condition, there is "plenty of gas in the tank" to drive a second and probably bigger upleg.

Zooming out again via a 5-year chart, we see that Bion is down near the bottom of a very large trading range that started to form back early in 2021 following a dramatic spike.

The strong support in this area is believed to have put a floor under the price in the $0.80 - $0.90 zone. An important point well worth observing on this chart is that when Bion decides to move, it moves BIG and it moves FAST. This is made abundantly clear by the two dramatic spikes during the life of this chart — the one early in 2021 just mentioned above and a similar one early last year.

Lastly, we will zoom out still further by means of the 20-year chart as there are more useful insights to be gleaned from this chart. This chart reveals something that is doubtless completely unknown to the vast majority of investors, which is that the very large trading range that we observed on the 5-year chart is, in fact, the "Handle" of a gigantic Cup or Pan & Handle base that started to form as far back as 2013.

This giant pattern started to form following a severe bear market from the 2010 peak when it almost touched $4.50 and since this peak marked the high point of what looks like a relief rally following an even worse decline from the start of 2006 peak at about $8.50, it can be seen that this giant base pattern developed after a horrendous bear market from the start 2006 peak.

A final important point to observe on this chart is that throughout the development of the gigantic Cup / Pan & Handle base from about 2013, the Accumulation line has trended strongly higher, although it has dipped a bit recently, which promises an eventual upside resolution of the pattern that is considered to be likely to happen soon for both fundamental and technical reasons.

The conclusion is that, with a new upleg believed to be imminent, Bion Environmental Tech looks like a Strong Buy here for all timeframes.

Bion's website.

Bion Environmental Technologies Inc. (BNET:OTCQB) closed at $1.09 on March 12, 2024

| Want to be the first to know about interesting Special Situations and Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Bion Environmental Technologies Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Bion Environmental Technologies Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.