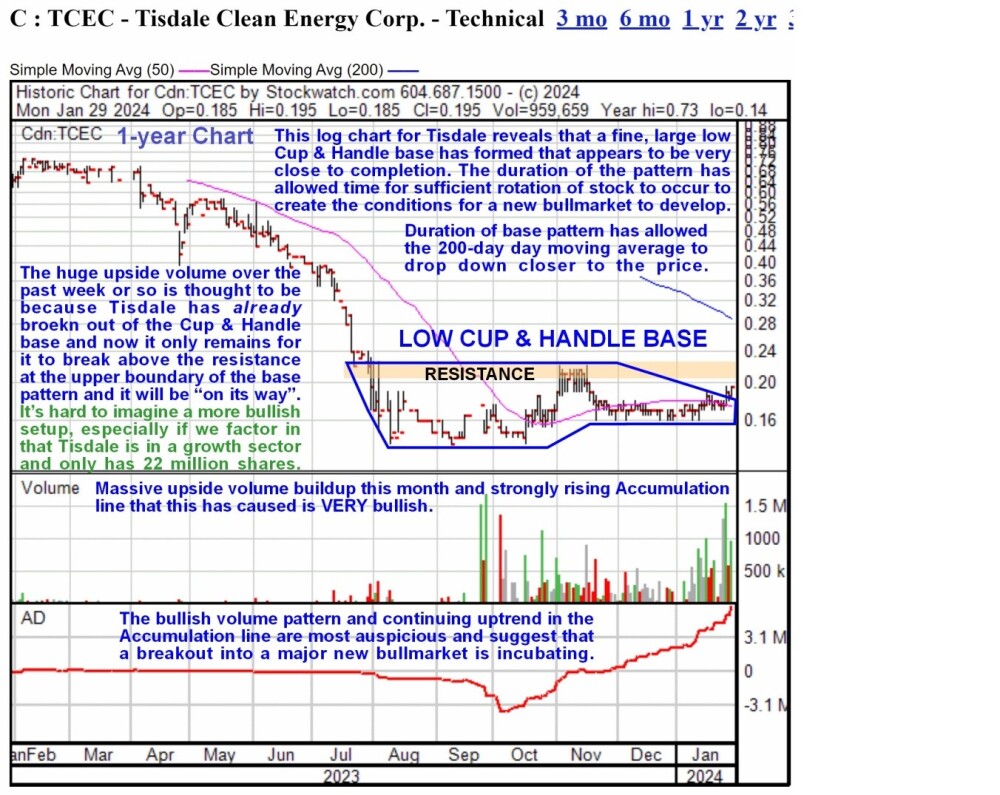

It’s seldom that you come across a stock setup as bullish as that which currently exists in Tisdale Clean Energy Corp. (TCEC:CSE) where there is still everything to go for. Not only is the setup extraordinarily bullish, as we will see, but it will "have the wind at its back" going forward because the company is in a strong growth sector — uranium — and it has a very low number of shares in issue, understood now to be approximately 22 million and of these, only about 6 million are in the float, and so if this stock attracts more attention from the investing public, it is clear that its upside potential from here is great.

A 1-year logarithmic chart shows the setup to advantage. The use of the log scale chart enables us to "open out" the base pattern and thus see more clearly what is going on. On it, we can see that, following a severe decline, the stock started a basing process back last July – August, and it is clear that this base pattern has taken the form of a fine low Cup & Handle base that now looks to be about complete, and it may even already be complete as the very high volume a few days back as it crossed above the provisional upper boundary of the "Handle" of the pattern suggests that this boundary is valid. If this is so, then it only remains for the price to break above the resistance marking the upper boundary of the entire base pattern — once it does that, a major new bull market will "officially" have begun, and it will be on its way, and this looks likely to happen soon.

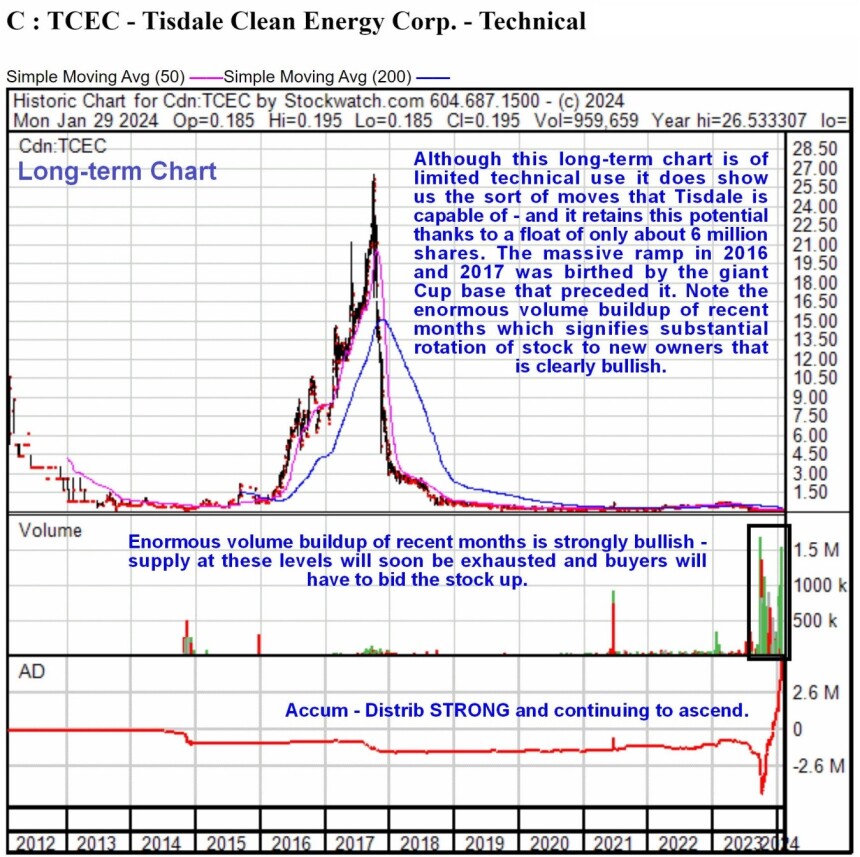

Although it is of limited use technically, the long-term 12-year chart is interesting as it shows us the kind of moves that Tisdale is capable of — back in 2016 and 2017, the stock soared to hit a peak at more than CA$26, and so the price now is but a tiny fraction of that.

Although it may, of course, be somewhat optimistic to expect it to repeat this performance, the still modest number of shares in issue at about 22 million and relatively tiny float at around 6 million shares, as mentioned above, means that huge gains from here are certainly very possible and it should be comforting for investors or would-be investors in the stock to know that the CEO of the company, Alexander Klenman, has demonstrated his confidence in the company by steadily buying the stock since November and adding 692.000 shares in open market buys to his position.

Tisdale Clean Energy is therefore rated a Strong Buy here for all timeframes.

Tisdale Clean Energy's website.

Tisdale Clean Energy Corp. closed for trading at CA$0.19, $0.141 at 10:00 am EST on January 30, 2024.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [Tisdale Clean Energy Corp.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Tisdale Clean Energy Corp.].

-

Street Smart, an affiliate of Streetwise Reports, has compensated [Clive Maund], for writing this article. However, the views, opinions, analyses, and any recommendations in [Maund]'s article are solely their own personal views, opinions, analyses, and recommendations, and are expressly not those of Street Smart or Streetwise Reports. The content created by [Maund] is about companies they believe in based on their personal investment opinions and analyses, and their opinions and analyses are not influenced or dictated by Streetwise Reports or its affiliates or as a result of compensation provided by Street Smart.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.