Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC PINK: JLM:FRA) portfolio company H2U Technologies announced it has successfully demonstrated the first non-iridium proton exchange membrane (PEM) electrolyzer for commercial hydrogen production.

PEM catalysts currently rely on the rare and costly platinum-group metal iridium to make hydrogen, which is being pushed as a clean and safe alternative to fossil fuels.

H2U said it would construct its first proof-of-concept units and ship them by the end of the year.

Atrium Research analyst Nicholas Cortelluci, who recently initiated coverage on the company, has written that Jericho's 6.5% minority interest in H2U has "massive upside potential."

Atrium Research analyst Nicholas Cortelluci, who recently initiated coverage on the company, has written that Jericho's 6.5% minority interest in H2U has "massive upside potential."

"We view this as a major development for H2U as it (comes) one step closer to developing a solution to one of the biggest issues in the green hydrogen space today," Cortelluci wrote on June 27. "We are maintaining our BUY rating and CA$0.40/share target price on Jericho Energy Ventures."

The world's energy suppliers are scaling up electrolyzer manufacturing for hydrogen, which is the most abundant molecule in the universe but doesn't occur on its own naturally on Earth. It must be separated from water or hydrocarbon carbons.

If PEMs supplied all electrolyzer production in 2030 in a net zero emissions scenario, demand for the element would jump nine times its current global production, the International Energy Agency stated in its Global Hydrogen Review.

"H2U's solution aims to decrease production costs and alleviate supply chain constraints," Cortellucci wrote.

The Catalyst: More Hydrogen Technology Needed

Jericho started as an oil company but, in 2020, began to pivot toward green energy. The company continues to use profits from oil and gas assets to fund its investments in zero-emission hydrogen technologies.

The U.S. Department of Energy said the hydrogen market "is in its infancy" but that it has the "potential for near-zero greenhouse gas emissions."

"Hydrogen generates electrical power in a fuel cell, emitting only water vapor and warm air," the agency wrote. "It holds promise for growth in both the stationary and transportation energy sectors."

The world needs more hydrogen technology and projects if it wants to meet a net-zero emissions scenario by 2050, the IEA wrote.

Almost US$26 billion in United States taxpayer money is being made available for hydrogen projects because of recent acts of Congress, The Guardian said.

It's also a "uniquely versatile energy carrier," according to a report by the Hydrogen Council. "It can be produced using different energy inputs and different production technologies. It can also be converted to different forms and distributed through different routes — from compressed gas hydrogen in pipelines through liquid hydrogen on ships, trains or trucks, to synthesized fuel routes."

The world needs more hydrogen technology and projects if it wants to meet a net-zero emissions scenario by 2050, the IEA wrote.

"Faster action is required on creating demand for low-emission hydrogen and unlocking investment that can accelerate production scale-up and deployment of infrastructure," the agency wrote.

Analyst: Potential Return Significant

The non-iridium PEM technology is based on ten years of research and development and US$122 million in funding from the U.S. Department of Energy through the California Institute of Technology's Joint Center for Artificial Photosynthesis, Cortelluci wrote. The technology is exclusively licensed to H2U by Caltech.

Mark McGough, chief executive officer of H2U, said he expects the breakthrough will bring down gas production costs and alleviate supply strain constraints, making green hydrogen more accessible and cost-effective.

"This is a significant milestone for H2U on our path to solving a key problem facing the hydrogen industry: The dependency on scarce and precious materials currently needed to make hydrogen," McGough said. "We believe H2U's non-iridium PEM electrolyzers have the potential to transform the green hydrogen industry."

Newsletter writer Clive Maund wrote for Streetwise Reports that hydrogen "is a fuel of the future" and that Jericho is "moving with the times."

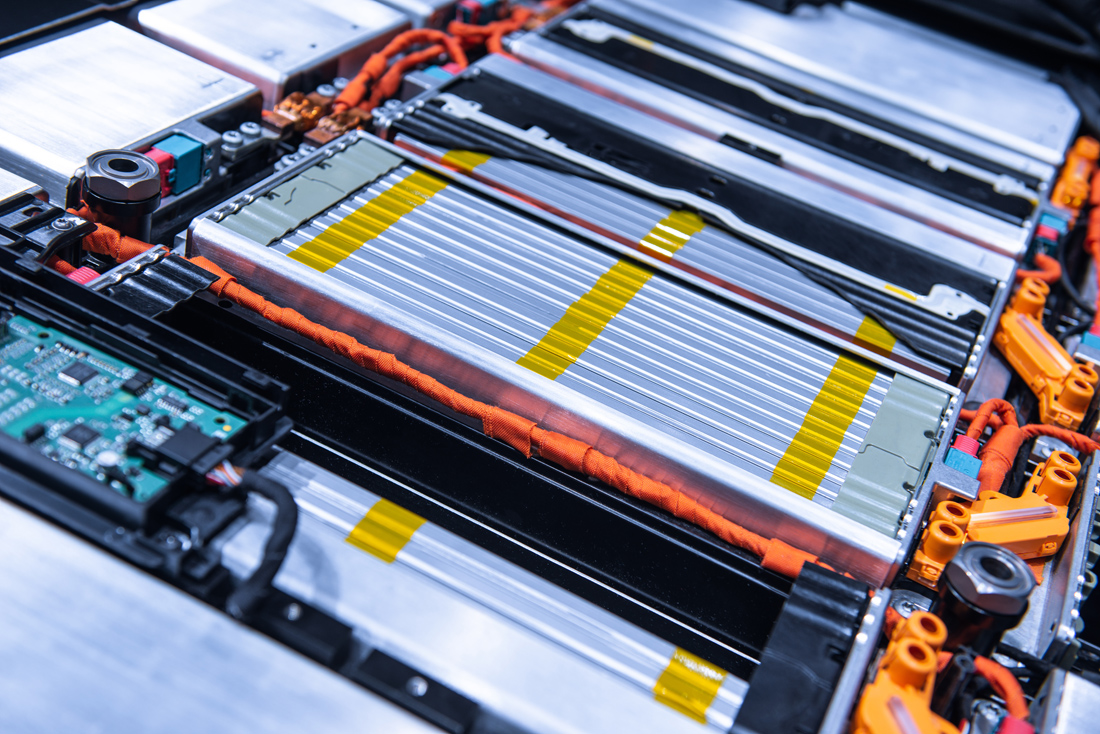

The 200-kilowatt (kW) units H2U is developing come in plug-and-play, standard shipping containers, the company said.

"From a 200-W (watt) benchtop, short stack to a 200kW full containerized system in less than eight months using catalysts never before seen in a PEM electrolyzer is a tremendous accomplishment," said H2U's chief commercial officer, David Martin. "Now the world can see that there are easily integrated, direct replacement electrocatalysts for the gigawatts of electrolyzers being planned across the world."

Cortelluci said the potential return for investors with Jericho is significant.

"Jericho Energy is positioned for the energy transition by owning and operating both cash-flowing hydrocarbon joint venture assets and innovative hydrogen applications," he wrote. "The future of the company lies with its patented Hydrogen Technologies."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC PINK: JLM:FRA)

Newsletter writer Clive Maund of CliveMaund.com wrote for Streetwise Reports that hydrogen "is a fuel of the future" and that Jericho is "moving with the times."

Ownership and Share Structure

Around 35% of Jericho's shares are held by management, insiders, and insider institutional investors, the company said. They include CEO Brian Williamson, who owns 1.26% or about 2.85 million shares; founder Allen William Wilson, who owns 0.87% or about 1.97 million shares; and board member Nicholas Baxter, who owns 0.5%, or about 1.1 million shares, according to Reuters.

Around 10% of shares are held by non-insider institutions, and 65% are in retail, the company said.

JEV's market cap is CA$63.43 million, and it trades in a 52-week range of CA$0.46 and CA$0.22. It has 248.14 million shares outstanding, 178.38 million of them floating.

Sign up for our FREE newsletter

Important Disclosures:

- Jericho Energy Ventures Inc. is a billboard sponsor of Streetwise Reports and pays a monthly SWR sponsorship fee between US$3,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Jericho Energy Ventures Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.