So far, 2023 is the most difficult market going back to 2008.

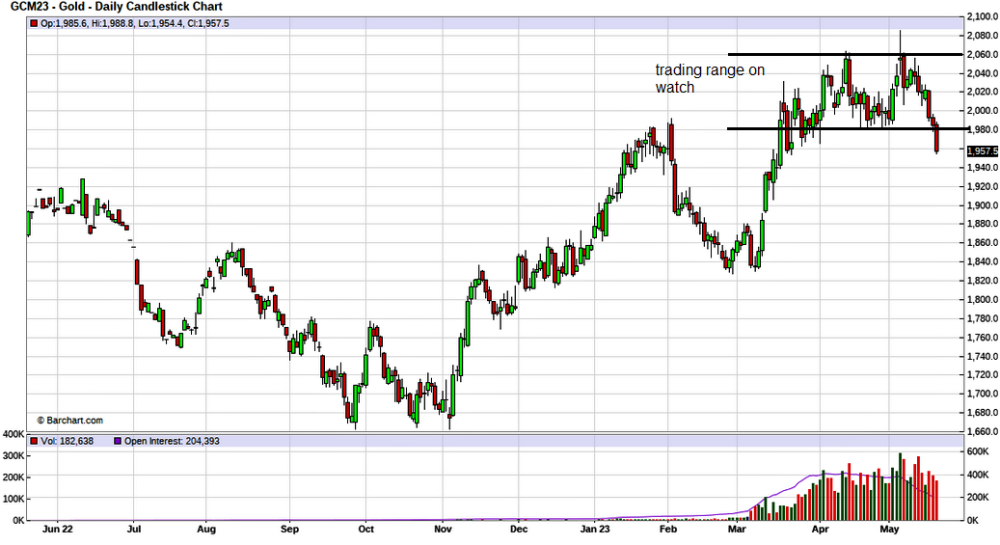

Nothing is going anywhere but gyrating up and down in tight trading ranges.

A handful of tech stocks have helped the main equity indexes, but even so, the S&P 500 has been bouncing mostly around between 3,900 and 4,150.

Oil has been bouncing between roughly US$70 and US$80. Counter to what they said, the government released another 2.4 million barrels from the SPR last week for the seventh straight weekly drain.

Do as I do, not as I say. Most promising was gold which looked like it was in a new higher trading range, but the gold price broke down today. I believe gold is telling us that the Fed pivot is much farther off than the market narrative suggests.

Annual inflation unexpectedly rose to 4.4% in April, Statistics Canada said. Analysts polled by Reuters had expected the annual rate to edge down to 4.1% from 4.3% in March. Month-over-month, consumer prices gained 0.7% from March, higher than the forecast 0.4% increase. Derek Holt, VP at Scotiabank.

"I don't see any slowing down in terms of the underlying price pressures." Canada is not a lot different than the U.S.; perhaps this is a precursor to what we will see in the U.S., especially once lower energy prices work through the annual numbers.

There is a lot of discussion around green energy and going electric, but not so much on the reality of getting there. Wind and solar are only good for about 20% to 25% of the grid because they are intermittent. As I pointed out in my April 28 Climate Change report, battery storage is not the answer either.

In a real-life example where there was little wind for several days in UK's offshore, it would have required 1600 Gwh of storage to make up for that loss. That is 1,000 times the capacity of the world's largest grid storage battery at Moss Landings, California.

The world has already tapped most of the hydropower, so there is only one solution to replace fossil fuel for its baseline power load, and that is nuclear. Most promising is the upcoming module (smaller) nuclear power plants, and I plan a complete report on this in the near future.

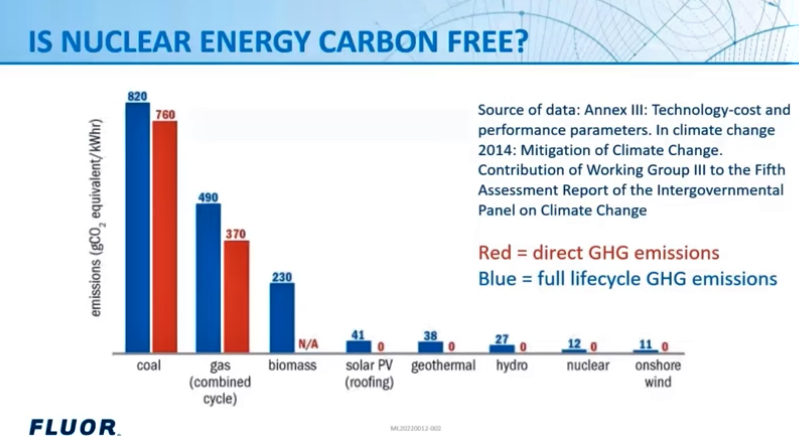

This chart above includes carbon emissions from the mining of materials to build components and emissions from the manufacturing process as well. This is then calculated over the life cycle of those energy-producing plants. Nuclear is the best option when it comes to emissions other than a small advantage with onshore wind.

For today, I will focus on uranium, hydrogen, and my favorite uranium/nuclear stock, Cameco.

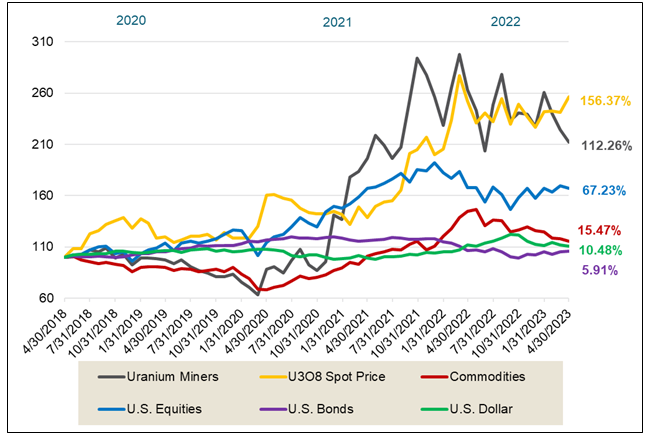

This next chart is from Sprott's Uranium Report, and you can see that Uranium has been the best performer in the commodity sector and a reason I have kept Cameco as a long-term hold.

Cameco

Original Entry Price - $3.25 (reflects 3 for 1 split than 2 for 1)

Cameco Corp. (CCO:TSX; CCJ:NYSE) is the largest publicly listed uranium producer by market capitalization and has had tremendous contracting success recently. In 2022, there were approximately 114 million pounds of total long-term contracts per UxC, and Cameco alone accounted for 80 million pounds.

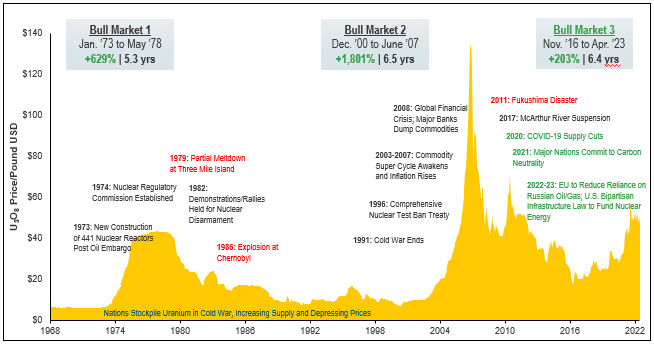

The chart below, also from Sprott, shows the longer-term bull cycles in uranium.

We did extremely well with Cameco, buying it in 2000 and watching the stock split twice in the bull run up to 2007.

This gave us a buy price of US$3.25 and a 3.7% dividend yield. It has been on my Millennium index for 22 years, with my next longest pick there at 14 years.

It is currently about 1100% above our buy price, and that does not include dividends, but is Cameco a buy now?

This next bull run in uranium has much further to go, especially as nuclear energy is coming back in favor of the green push. Microsoft founder Bill Gates is behind developing smaller, cheaper reactors that could supplement the power grid in communities across the U.S.

Tennessee Valley Authority President and CEO Jeff Lyash put it simply: You can't significantly reduce carbon emissions without nuclear power.

"At this point in time, I don't see a path that gets us there without preserving the existing fleet and building new nuclear," Lyash said. "And that's after having maximized the amount of solar we can build in the system."

A recent poll released by the Angus Reid Institute found that 57% of Canadians who were surveyed would like to see further expansion of nuclear energy in the country. That's an increase from 51% support just a year and a half ago.

While 500 kilometers was an acceptable distance between one's home and a nuclear plant for 58% of respondents, 42% said they would not be comfortable with that proximity, according to the poll. This is an issue that small modular nuclear plants would fix.

Canada has four nuclear power plants — three in Ontario and one in New Brunswick. Bruce Power in Ontario is the biggest, supplying about 30% of Ontario's electrical needs. Cameco did own a 31.6% interest and sold that in 2014 for US$450 million.

In March, U.S. President Biden and Prime Minister Trudeau affirmed their intent to promote enhanced collaboration on nuclear energy and technology between their two countries.

On May 11, 2023, the Italian parliament voted in favor of bringing back nuclear.

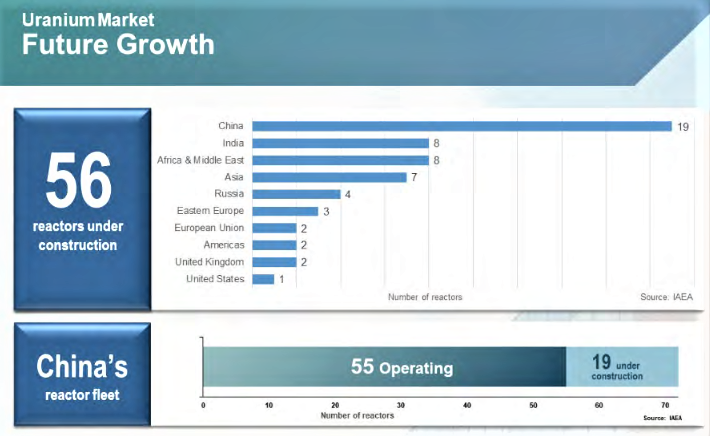

The representative sample of 1,005 French people questioned online in January 2023 are 70% in favor of this low-carbon energy available in their country, while only 34% had an above all positive view of it when a previous edition of the study was conducted at the end of 2019. I could go on; interest in nuclear is climbing around the world. It is clear to see in this chart from Cameco's presentation.

These nuclear plants take many years to construct and cost tens of billions each. New smaller modular plants will soon add to this mix, and Cameco will benefit from that as well.

In April, Cameco announced it had extended its long-term exclusive nuclear fuel supply arrangement with Bruce Power (Canada's only private-sector nuclear generator) for an additional ten years to 2040. The agreement is estimated to represent an additional US$2.8 billion in business. Cameco also finalized its agreement with Energoatam, Ukraine's state-owned nuclear energy utility, ten to provide all of Ukraine's nuclear fuel needs from 2024 to 2036, estimated at 40-67 million pounds of U3O8 equivalent.

Finally, Cameco signed a ten-year supply contract with Westinghouse Electric Company to support Bulgaria's UF6 needs. Nuclear power accounts for more than 30% of Bulgaria's electricity supply, and with this agreement, Cameco will deliver an estimated 2.2 million KgU as UF6 (or 5.7 million pounds U3O8 equivalent).

Cameco is more a net buyer in spot markets than a seller. Pretty much all of their production is for long-term contracts. This still gives them exposure to higher prices and, at the same time, protection from lower prices.

They currently have 215 m pounds in long-term contracts going out over a decade. This graphic from their presentation shows their key producing assets with planned production for contracts.

Cameco sold 25.6 m pounds of uranium in 2022 at an annual average price of Cdn US$57.85.

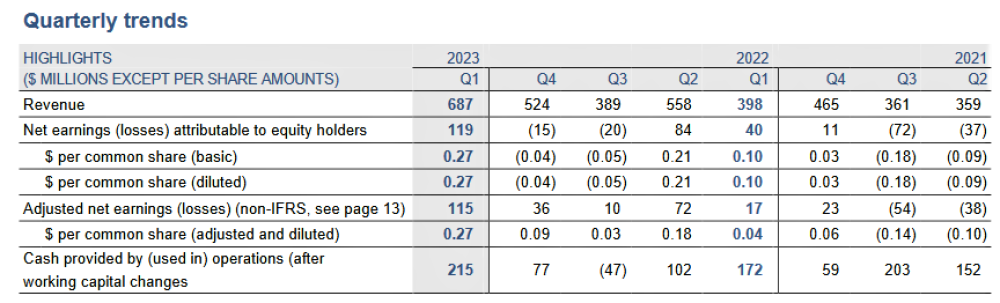

In Q1 2023, they had very strong profits of US$119 million, more so than all of 2022 combined.

Cameco will also benefit from current and future geopolitical events, they point out. The global nuclear industry is reliant on Russian supplies for approximately 14% of uranium concentrates, 27% of conversion, and 39% of enrichment, the geopolitical realignment is also highlighting the security of supply risk associated with the growing primary supply gap and shrinking secondary supplies while increasing the focus on the origin of supply.

Nearly 80% of primary production is in the hands of state-owned enterprises, over 70% comes from countries that consume little-to-no uranium, and nearly 90% of consumption occurs in countries that have little-to-no primary production. In April, five of the G7 Nations, including Canada, the US, France, Japan, and the United Kingdom, announced an alliance to develop shared supply chains for nuclear power.

According to a joint statement, they have "identified potential areas of collaboration on nuclear fuels to support the stable supply of fuels for the operating reactor fleets of today, enable the development and deployment of fuels for the advanced reactors of tomorrow, and achieve reduced dependence on Russian supply chains."

The stock shows it had a great run. I believe there is great long-term value, but near and medium term, the stock might struggle. I am expecting another down leg in equity markets and looking at that time to add to positions or initiate one if you currently don't own the stock. That said, a break out above the US$40 resistance area could change my mind.

Hydrogen as green energy is starting to take hold in Canada, in particular, NFLD. On May 17, there was news that a subsidiary of South Korean company SK Group had signed a deal with World Energy GH2 to buy a minority stake in a Canadian green hydrogen project for US$50 million.

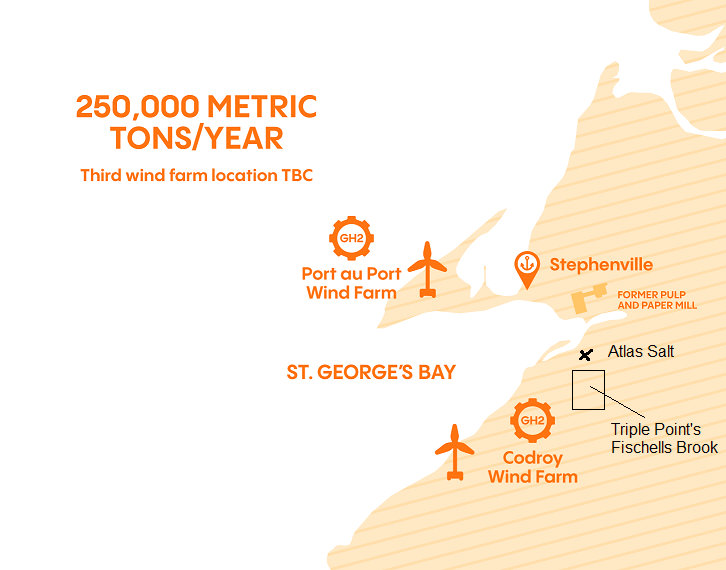

Under the deal, SK Ecoplant will acquire a 20 % stake in the first stage of the Nujio'qonik project in Newfoundland and Labrador. This is very good news for us, as this project is in the same location as Atlas Salt, but more importantly, the spinout from Atlas Salt is called Triple Point.

Atlas Salt

Recent Price - $1.21/ Entry Price - $0.80 Opinion – buy on weakness, near $1.00

Atlas Salt Inc.'s (TSXV:SALT; OTC:REMRF) stock is beaten up pretty much like everything else, but I expect we are going to realize some pretty strong value on an eventual buyout. And don't forget we will get additional value from Triple Point.

That stock should trade later this year, and to recall, we got approximately 0.279 of a Triple Point share for each Atlas Salt share. Triple Point has to do some more exploration work but likely has salt domes in the same area as the Nujio'qonik project.

These will be perfect for storing the hydrogen from that project. The Mi'kmaw name for Bay St. George is Nujio'qonik. Pronounced ‘new-geo-ho-neek,' it means ‘where the sand blows.'

Project Nujio'qonik will be Canada's first commercial green hydrogen/ammonia producer created from 3+ GW of renewable electricity through wind projects in one of the world's best wind resource regions. The plan is to develop 3+ GW of renewable electricity through wind projects on the west coast of the island portion of Newfoundland and Labrador.

The sites will be developed concurrently with a staggered target delivery schedule, with increased hydrogen production over time. A 3+ GW wind farm will deliver approximately 250,000 tons/year of hydrogen using 1.5 GW electrolyzers.

You can watch a three-minute youtube video about the project here.

Conclusion

I am looking to buy Cameco on a market correction to benefit from long-term trends. Triple Point should be a good public play on this new hydrogen development once it IPOs.

Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp., a company mentioned in this article.

- Ron Struthers: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Cameco, Atlas Salt, and Triple Point.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Struthers Stock Report Disclaimers:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate.

The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information.

Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.