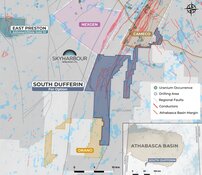

Against a backdrop of fast-rising uranium prices, Skyharbour Resources Ltd. (SYH:TSX.V; SA:NYSE.MKT) has launched a winter drill program at its 100% owned Moore Uranium Project in Canada’s prolific Athabasca Basin in Saskatchewan.

The 37,705-hectare Moore project is just 15 km east of Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT) development-stage Wheeler River project at the southeast end of the basin and southwest of Cameco Corp. (CCO:TSX; CCJ:NYSE) regional infrastructure for its Key Lake and McArthur River mines.

Skyharbour plans to drill at least 2,500 meters over as many as nine holes in the Maverick East Zone at Moore and at the Grid 19 target area. It will also investigate new zones in and around its Viper target, about 1.5 km northeast of the main Maverick zone. Viper drilling will follow up on a historical intersection of 0.27% U308 over 4.5 meters.

Higher Resource Prices Push Up Uranium Stock Prices

For investors, drilling could not be happening at a better time. In March 2021, the spot price for uranium hovered around US$30 per pound (US$30/lb). On March 4, the spot price pushed through the US$50/lb. threshold to $51.25/lb., a year-over-year increase of 85.7%, according to to TradingEconomics.com.

With Russia’s invasion of Ukraine showing few signs of slowing down, and Russia, Uzbekistan and Kazakhstan among the world’s top eight uranium-producing countries, uranium prices are set to climb even higher.

The fresh spike in prices pushed Skyharbour’s share price to CA$0.70 on March 4, up from CA$0.52 on Feb. 22, two days before the invasion started.

Even if global tensions ease, uranium’s fundamentals look favorable. In February, Leigh Goehring and Adam Rozencwajg, both managing partners of their eponymous New York-based investment firm, Goehring and Rozencwajg, published a natural resources market commentary titled, The Distortions of Cheap Energy, where they point to some positive signs for uranium prices.

The most promising is that the European Union now officially recognizes nuclear energy as “green” energy, much to the dismay of some Germans.

They write: “Over the last two years, over $1 trillion has been invested in Environmental, Social and Governance-friendly products. This capital is now free to invest in uranium. At the same time, there are only two major producing uranium companies [Cameco and Kazatomprom (KAP: LSE)] with a combined market capitalization of US$18 billion. Total global mine supply at a uranium spot price of US$40 per pound equates to a mere US$5B. The price of uranium and uranium related equities could surge now that previously restricted capital is able to move into the industry.”

Success Stories Among Uranium Juniors

Could exploration success in a bullet-proof mining jurisdiction coupled with soaring uranium prices possibly make Skyharbour the next hot takeout target? Perhaps like Hathor Exploration? Company President and CEO Jordan Trimble has his sights set on lofty goals.

“We are a high-grade exploration and early-stage development company. So our main focus is very much trying to emulate the success of Hathor, NexGen Energy, Fission Uranium, or other notable recent discovery successes in the Athabasca basin — it's the highest grade depository of uranium in the world,” said Trimble.

Hathor, NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT), and Fission Uranium Corp. (FCU:TSX; FCUUF:OTCQX; 2FU:FSE) have all created remarkable shareholder value in the Athabasca Basin. In 2011, Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) bought Hathor and its high-grade Roughrider project for CA$670 million (CA$670M) or CA$4.70 per share. NexGen Energy started as an explorer in the basin and now has a market cap of CA$3.1B, while Fission Uranium continues to develop the Triple R deposit on the feasibility-stage Patterson Lake South (PLS) project and is valued at CA$580M. That’s after Fission bought out partner Alpha Minerals, which owned 50% of PLS, for CA$185M.

That value started with the drill bit.

Additional Discoveries Are Made at Moore

Skyharbour made additional discoveries at its Moore project in 2017. Winter and summer 2017 drill programs totalled 9,485 meters with high-grade uranium in multiple drill holes, including 20.8% U3O8 over 1.5 meters, inside an interval of 6% U3O8 over 5.9 meters. Keep in mind that this all occurred at about 275 meters depth.

In 2021, drilling highlights included hole ML21-03, which returned 2.54% U3O8 over 6 meters from 276 meters r to 282 meters r including 6.8% U3O8 over 2 meters. Hole ML21-19, one of the final six holes drilled in the fall of 2021 on the Maverick East Zone at Moore, intersected 19.5 meters of 0.54% U3O8 from 269.5 to 289 meters down-hole, including a promising 4 meters of 2.07% U3O8.

The upcoming drill program will feature a two-pronged approach. “Our goal is twofold. One is to continue expanding the high-grade zones and discover additional high-grade zones at that Maverick corridor. We have several high-grade lenses or pods of uranium mineralization that had been discovered historically that we've been expanding. Secondly, we believe there is more mineralization with potentially larger and higher-grade zones in the feeder zones of the underlying basement rock. That will be a focus for drill testing in this upcoming program,” Trimble told Streetwise.

Uranium can be an extremely valuable commodity, but it’s difficult to compare uranium grades to those of gold or copper. To make an apples-to-apples comparison, you must break down different commodities into value per tonne of ore. For example, using a uranium price of US$35/lb and a US$1,900/oz gold price, an intercept of 1% uranium per metric tonne is the equivalent of 13.9 grams per tonne gold. That means one tonne of ore in either case is worth roughly US$700. At that point, profitability becomes all about the cost of mining.

In-Situ Recovery at Wheeler River Is One for the History Books

About 15 km west of Maverick sits Denison’s Wheeler River uranium project. Denison plans to be the first company operating in the Athabasca Basin to mine a major uranium deposit using in-situ recovery. The New York-listed uranium company also owns a large equity position in Skyharbour, and Denison's President and CEO David Cates sits on Skyharbour’s board.

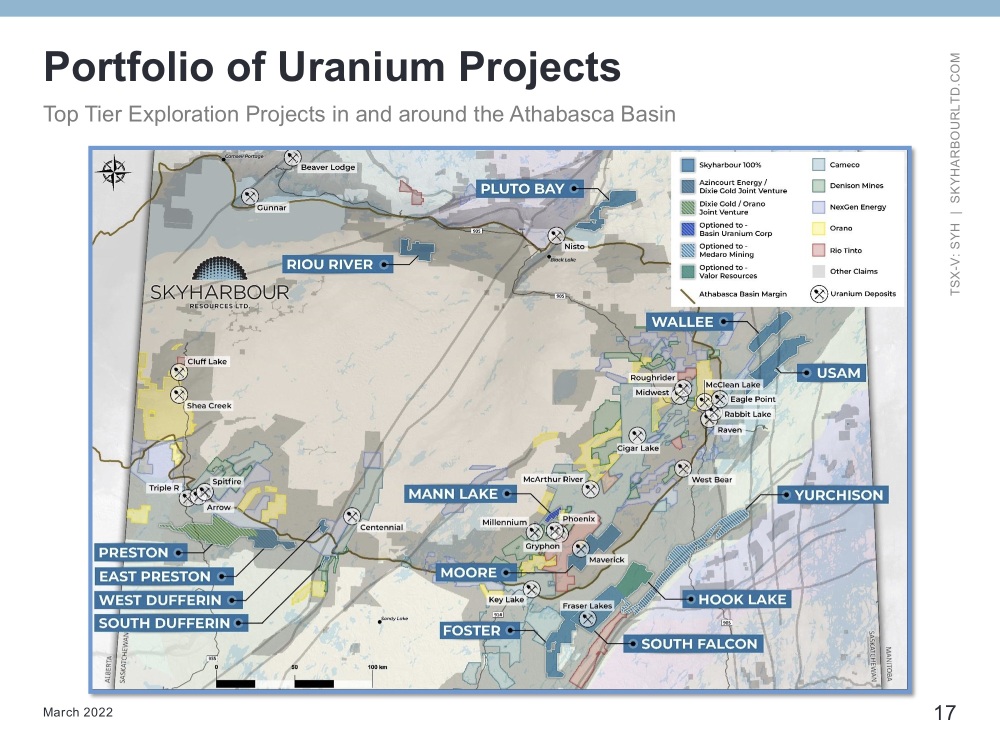

This low-cost mining method involves drilling boreholes into a deposit, pumping in a solution that essentially dissolves the mineralization and then pumping out the “pregnant” solution. It’s much cheaper than traditional mining methods and could open up the potential to mine additional deposits in the Athabasca Basin. Prospect Generator Model Makes More Possible Skyharbour controls more than 385,000 hectares in the Athabasca Basin, more land than it could afford to explore on its own, so it’s employing the prospect generator model across its holdings.

So far, Skyharbour has become a one-stop shop for companies seeking uranium assets. “We've got five partner companies now, two of which are joint venture partnerships, and three are still under earn-in option agreements. One of our JV partners is Orano, which is France's largest nuclear fuel cycle and uranium mining company. They own a 51% stake in the Preston project,” said Trimble. Skyharbour has joint-ventured properties to Orano Canada and Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC), while it has optioned properties to Medaro Mining (MEDA:CSX), Valor Resources Ltd. (VAL:ASX), and Basin Uranium Corp. (NLCR:CSX).

These deals have netted Skyharbour cash and varying amounts of shares in each company that is publicly traded. David Talbot, a mining analyst with Toronto-based Red Cloud Financial Services, sees the Yurchison project option as positive for the junior.

"Skyharbour Resources Ltd. signed an option agreement to vend its wholly-owned Yurchison uranium project in the Wollaston Domain, immediately east of the Athabasca Basin, to Medaro Mining. Skyharbour continues to deliver on its strategy by bringing in dedicated partners to help advance its portfolio of uranium projects in the Athabasca basin region while adding real cash value to its balance sheet," Talbot wrote in a November note.

He has a 12-month price target of $0.85 on Skyharbour. Fully diluted Skyharbour has about 168 million shares outstanding.

Disclaimers:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources Ltd., Basin Uranium Corp., Azincourt Energy Corp., Cameco Corp. and Rio Tinto Plc, all companies mentioned in this article.

| Want to be the first to know about interesting Uranium and Clean Energy investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |