ChatGPT was nonexistent just three years ago. Today it boasts 800 million weekly users, making it history's most rapidly adopted product.

Yet few realize the enormous electricity demands of ChatGPT — and similar artificial intelligence (AI) systems. Even fewer anticipate the cascading impact AI will trigger across energy markets.

Consider this: when you interact with ChatGPT, you're connecting to massive computing facilities packed with specialized processors that generate so much heat they require continuous cooling to prevent destruction.

A single new Nvidia Corp. (NVDA:NASDAQ) AI chip consumes electricity equivalent to two households. Modern AI facilities require 5X the power of conventional data centers. Even a basic ChatGPT interaction consumes at least 10X more electricity than searching on Google.

The pressing question becomes, "Where will the electricity come from to power these AI factories?"

- RiskHedge chief analyst Stephen McBride says the answer is obvious: nuclear energy.

Nuclear abandonment was once unaffordable.

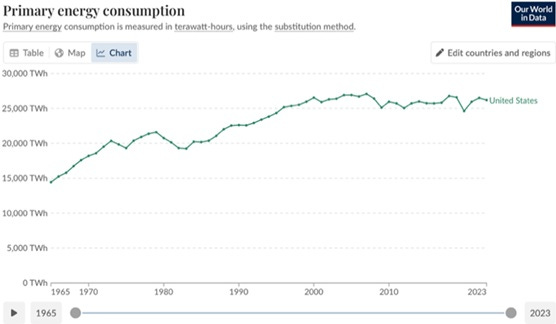

Throughout the last 20 years, America's energy usage has declined steadily. "Why do we even need nuclear?" seemed reasonable to ask.

Stephen says we're entering a new demand era — where AI, robotics, manufacturing resurgence, and electrification all require additional power.

Not just clean power, but reliable, uninterrupted power. Energy reliable enough to stake a $10 billion data facility on.

This reality is compelling everyone to reconsider atomic energy.

- We're already witnessing this major perspective shift. . .

Recently, the World Bank removed its prohibition on financing nuclear energy projects — the first such action since 1959.

New York, formerly exemplifying misguided energy policies, is now changing direction. After decommissioning its biggest nuclear facility in 2021, the state now intends to construct a new nuclear plant capable of generating sufficient electricity for 1 million residences.

Meanwhile, states including Illinois, Montana, and Wisconsin have eliminated longstanding restrictions on building new nuclear facilities. Texas recently approved a $350 million fund for constructing new reactors.

And in the most significant development yet, President Trump issued four executive orders designed to free nuclear energy from its regulatory constraints.

Regulations became so excessive that nuclear plants were forced to restrict radiation exposure to 0.0001 millisieverts annually — less than what you receive from eating a banana. Little wonder that constructing atomic energy facilities has been virtually impossible.

After decades of bureaucratic hurdles and excessive regulation, the barriers are finally crumbling. AI's voracious energy requirements delivered a wake-up call to regulators.

- AI has become nuclear's strongest ally.

AI computing centers urgently need vast quantities of clean, dependable energy.

Nuclear delivers precisely that.

It serves AI as oil served the industrial revolution: the essential fuel powering a new era of unprecedented advancement.

Why else would technology giants be racing around, financial resources ready, acquiring all available atomic energy?

For instance, within the past year:

- Microsoft Corp. (MSFT:NASDAQ) formed an agreement to help reactivate a reactor at Pennsylvania's iconic Three Mile Island facility.

- Alphabet Inc. Class A (GOOGL:NASDAQ) established a partnership with startup Kairos Power to develop several SMRs for powering its computing centers.

- Amazon.com Inc. (AMZN:NASDAQ) entered a 17-year arrangement with Talon Energy Corp. (TLN:NASDAQ) to supply its facilities with nuclear power. It's also participating in a consortium investing $500 million in SMR startup X-energy.

- Meta Platforms Inc. (META:NASDAQ) secured a 20-year agreement to purchase electricity from Constellation Energy Group's (CEG:NYSE) Clinton nuclear facility in Illinois. This arrangement ensures the Illinois facility remains operational beyond its previously planned 2027 closure.

Several years ago, Stephen predicted we'd soon witness AI facilities powered by nuclear energy. It seemed somewhat far-fetched then.

Now, it's becoming reality!

- We're entering the second atomic age. So, how do we capitalize on this trend?

You might consider purchasing shares in a uranium producer like Cameco Corp. (CCO:TSX; CCJ:NYSE). Stephen initially wrote about Cameco in 2018.

But Cameco isn't an exceptional business — and never will be. They sell uranium, a commodity. This means their success depends on uranium prices, which they cannot control.

Stephen:

In the past decade, uranium prices have traded as low as $18 and as high as $100. That’s like running a lemonade stand where the price of lemons changes by 80% every few years.

No matter how well you run the business, your margins are at the mercy of the market.

Instead, I recommend owning picks-and-shovels companies that will benefit from long-term, structural tailwinds. Businesses with pricing power and the ability to grow earnings regardless of where the commodity winds blow.

For more insights, subscribe to our investing letter, The Jolt.

We publish fresh research on stocks and crypto every Monday and Friday.

| Want to be the first to know about interesting Uranium and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Chris Reilly: I, or members of my immediate household or family, own securities of: Microsoft. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.