Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) announced the closing of the first tranche of its non-brokered private placement, raising gross proceeds of approximately US$739,948.96. The financing included 35,329,931 non-flow-through units and 13,999,997 flow-through units, each priced at 1.5 cents per unit. Each unit consists of one common share and one common share purchase warrant, with warrants exercisable at five cents per share until July 15, 2028.

According to the company, proceeds will be allocated toward the exploration and development of Azincourt's Harrier uranium project and Snegamook uranium deposit, located in the Central Mineral Belt of Newfoundland and Labrador, Canada. Remaining funds will be used for general working capital. The company stated that proceeds will not be used for payments to non-arm's-length parties or investor relations activities.

In connection with the offering, Azincourt paid cash finders' fees totaling US$44,895 and issued 2,993,000 finders' warrants. These warrants are exercisable at five cents per share for a term of three years. All securities issued are subject to a four-month plus one-day hold period under Canadian securities laws, expiring on November 16, 2025, and remain subject to approval by the TSX Venture Exchange.

The flow-through shares are eligible under Canada's Income Tax Act, specifically Subsection 66(15), which provides tax benefits for qualified exploration expenditures. The company has committed to incur eligible exploration expenses equal to the gross proceeds of the flow-through shares by December 31, 2026, and renounce them to investors with an effective date no later than December 31, 2025.

Uranium Sector Faces Supply Constraints Amid Policy Shifts and Structural Demand Growth

The uranium exploration and development sector has operated under evolving supply-demand dynamics and heightened geopolitical focus, with recent policy actions and market behavior shaping its trajectory. According to the World Nuclear Association's uranium market summary, mine production continued to supply roughly 90% of global uranium requirements, with the remainder sourced from secondary supplies like recycling and stockpiles. The Association noted that "spot prices recovered from 2003 to 2009, but have been weak since then," and emphasized that "the price cannot indefinitely stay below the cost of production." Demand, the Association explained, is largely insulated from economic volatility due to the high capital, low fuel cost structure of nuclear power. The 2023 edition of its Nuclear Fuel Report forecast a 28% increase in uranium demand between 2023 and 2030.

On July 14, Kitco published a commentary by Sprott that reported a sharp market rebound in June. Spot uranium prices rose 9.99% to US$78.56 per pound, and uranium miners climbed 18.19% during the same period. Sprott attributed the gains to "improving sentiment and renewed institutional capital flows," supported by policy shifts in the U.S. and Europe. These included the World Bank's reversal of its nuclear financing ban and U.S. legislation preserving tax credits for nuclear energy production. Sprott wrote, "World Bank and global governments are turning pro-nuclear, boosting the long-term uranium demand outlook." The firm also highlighted the growing influence of artificial intelligence and data center infrastructure on nuclear demand, with over 28 gigawatts of capacity announcements tied to AI-linked projects.

Also on July 14, Crux Investor provided further insight into uranium market challenges. While political alignment in favor of nuclear energy created a supportive regulatory environment, the report cautioned that pricing remained below necessary incentive levels. "Current uranium prices, hovering around US$65 per pound, remain well below the US$100+ levels needed to incentivize new production," the publication stated. Term contracts were being signed at levels above US$80, indicating higher utility willingness to secure supply, yet processing bottlenecks and the depletion of high-grade deposits strained the supply side.

Crux also noted the rising value of domestic uranium in North America due to geopolitical supply chain concerns. The publication stated that "domestic uranium commands premium pricing due to supply chain security concerns," which has differentiated U.S.-based supply in both pricing and procurement strategies. The commentary warned of execution risks facing newer entrants and emphasized that "utilities need assurance of safe domestic supply," a concern especially pertinent in the context of emerging energy demands from data centers and national security infrastructure.

Project Development Outlook

Azincourt is currently advancing its uranium exploration activities at the 49,400 hectare Harrier project, which contains the Snegamook uranium deposit and 14 additional zones of known uranium mineralization — with historic grades reported as high as 7.48% U₃O₈ in surface samples.

The company is working to verify and expand historical mineralization at the Snegamook Deposit. Historical exploration data is being digitized and analyzed to support a maiden drill campaign. According to the company's April 2025 investor presentation, Snegamook contains several mineralized uranium lenses, with previous drilling identifying values up to 1,110 parts per million U₃O₈.

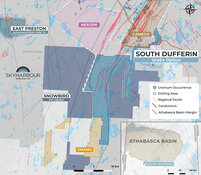

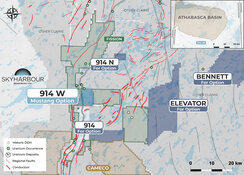

Azincourt is also preparing for additional exploration at its East Preston Project in Saskatchewan's Athabasca Basin, an area recognized for its high-grade uranium resources. The company has identified alteration zones and geochemical anomalies through recent drill programs, indicating potential mineralization trends.

Technical Signals Point to Strong Momentum in Azincourt Energy

Technical Analyst Clive Maund, in a May 13 statement shared exclusively with Streetwise Reports, expressed a positive view on Azincourt, highlighting chart patterns and volume behavior that pointed to strong upward momentum.

He noted that the company's stock formed a flat base at lower levels from August 2024 through March, followed by a breakout on heavy volume—a move he described as very bullish. The stock then pulled back to the upper edge of the base, which he identified as a typical "buy spot" before a potential next move higher. Maund also pointed out that the accumulation line continued to climb to new highs even as the stock price briefly declined, which he viewed as an additional indicator of strength.

"Azincourt Energy is rated an immediate Strong Buy ahead of the expected second upleg, which is likely to be sizable," he wrote.

On May 14, Red Cloud Securities issued a research update on Azincourt Energy Corp., maintaining a "BUY (Speculative)" rating based on exploration potential and land position strength. According to analyst David A. Talbot, the company's expanded 49,400-hectare Harrier project in Labrador's Central Mineral Belt offered "significant room for discovery potential in one of the best mineralized regions for uranium." He added that Azincourt held "a very good footprint in the area" and noted that the region, while historically underexplored, was viewed as having strong potential to emerge as Canada's next major uranium district.

Talbot highlighted that Harrier represented "one of the largest land positions in the CMB" and pointed to multiple high-grade surface samples, including "up to 7.48% U₃O₈." He observed that only 124 drill holes had tested the property to date, with many focused on the Snegamook zone, and identified 14 mineralized zones across the Harrier property. He stated that "management found out there were 25 historical drill holes" at Moran Heights, where surface values reached "up to 5% and 7% U₃O₈."

The report emphasized Azincourt's strategy of combining the Snegamook and Harrier projects for cohesive geological interpretation and noted that the company was planning reconnaissance work in 2025 to define drill targets for 2026. Talbot wrote that "Azincourt trades at a discount on the basis of EV at CA$8.4M vs. peers at CA$105.8M," suggesting valuation upside compared to sector averages.

While the East Preston project in Saskatchewan was expected to take a lower priority, Talbot stated that Azincourt's renewed focus on Labrador was "to help quench its desire to actually chase U mineralization" and reflected management's interest in channeling capital toward projects with immediate exploration upside.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC)

Red Cloud concluded that positive exploration outcomes could support further stock performance, citing "the goal this time around is to delineate resources and discover deposits." No target price was assigned in the report, but the BUY (S) rating remained in place as of May 14.

Ownership and Share Structure

According to Refinitiv, insiders and institutional investors own 0.9% of Azincourt Energy. President, CEO and Director Alex Klenman is the major shareholder, with 0.39%. Other insider shareholders are Director Paul Reynolds and Vice President of Exploration Trevor Perkins.

Institutional investors are Arrow Capital Management LLC and Tidal Investments LLC. The rest is in retail.

As of June 12, Azincourt has 390.54 million (390.54M) outstanding shares and 387.5M free float traded shares. Its market cap is CA$7.14M. Its 52-week range is CA$0.01–0.45 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Azincourt Energy has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.