Skyharbour Resources Ltd.'s (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) earn-in option partner, UraEx Resources Inc., has started its inaugural diamond drilling program at the South Dufferin uranium project just south of the Athabasca basin's southern boundary, near Cameco's Centennial deposit.

UraEx has the opportunity to acquire a 51% stake in the property through a total project investment of CA$4.6 million, and potentially up to a 100% interest with a CA$9.8 million investment, which includes cash, shares, and exploration costs over five years.

"Being adjacent to Cameco's Centennial project certainly underscores the potential of our drilling targets," said UraEx Chief Executive Officer and Director Tom Meredith. "The Athabasca basin is a premier global uranium district, accounting for about 20% of the world's uranium output and hosting numerous significant discoveries. It has attracted substantial investment due to its well-documented exploration history. Our primary objective is to make a discovery, and our technical team is enthusiastic about the prospects."

This summer, UraEx is launching a comprehensive, fully funded diamond drilling campaign of between eight and 12 holes totaling approximately 2,600 meters. This marks the project's first exploration in over six years.

South Dufferin Property Details

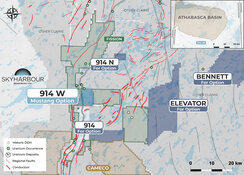

The program aims to explore the southern extension of the Dufferin Lake fault, believed to be a continuation of the structural corridor that includes Cameco's nearby deposits.

Skyharbour said Apex Geoscience Ltd. will conduct the drilling under the guidance of its personnel, operating from a local base camp with helicopter assistance for daily activities.

The summer program has a budget of about CA$1.5 million, funded by UraEx, focusing on areas with promising geological indicators such as historical geochemical anomalies and structural complexities.

The South Dufferin project encompasses 13,204 hectares across 10 claims immediately south of the Athabasca basin in Northern Saskatchewan. It extends the Virgin River shear zone known for high-grade uranium deposits found in Cameco's Dufferin Lake zone and Centennial deposit to the north, Skyharbour said.

Previous exploration at South Dufferin have included a variety of surveys and sampling methods, and some drill holes have encountered elevated uranium levels along with other notable geological features. The area holds potential for significant uranium deposits associated with the Dufferin Lake fault and other parallel faults within the shear zone, making it primed for drilling with several high-potential targets identified, the company said.

Analyst: Sector Consolidation Expected

Skyharbour is advancing its co-flagship Russell Lake and Moore Lake uranium projects, with plans to undertake between 16,000 and 18,000 meters of drilling across these projects in 2025.

Skyharbour holds a large uranium project portfolio totaling over 614,000 hectares across 36 properties in the Athabasca Basin. The company is currently partnered with nine companies advancing 13 of these projects, with potential to generate up to C$70 million in project considerations, contingent on full earn-in commitments being met. In addition to its current partners, Skyharbour retains 100% ownership of 20 other projects in the portfolio, offering flexibility for future option agreements, joint ventures, or asset sales as it continues to grow its prospect generator strategy and create shareholder value.

Skyharbour Resources Ltd. has been recognized by Sid Rajeev of Fundamental Research Corp. for having "one of the largest portfolios among uranium juniors in the Athabasca Basin."

Rajeev also noted the broader context affecting the industry, stating, "Given the highly vulnerable uranium supply chain, we anticipate continued consolidation within the sector." He further commented on market dynamics, "The rapidly growing demand for energy from the AI (artificial intelligence) industry is likely to accelerate the adoption of nuclear power, which should, in turn, spotlight uranium juniors in the coming months."

The Catalyst: Encouraging Domestic Uranium Mining

Uranium, a pivotal component for nuclear energy, is increasingly crucial in the global shift toward sustainable energy.

As technologies like artificial intelligence and data centers drive up electricity demand, the pressure on power grids is intensifying, underscoring the importance of dependable, scalable, and clean energy options such as nuclear.

To address these energy challenges, U.S. President Donald Trump has invoked the Defense Production Act to enhance nuclear fuel production by encouraging domestic uranium mining and processing. This strategy is designed to reduce America's dependence on uranium imports from nations like Russia, as highlighted by Stockhead in May.

"American domestic uranium production currently meets only 2% of U.S. reactor demand, and a U.S. ban on Russian uranium imports places a premium on domestic uranium supplies," the publication observed.

A recent piece by Mrinalika Roy for Reuters suggests that Trump's initiatives to revitalize the U.S. nuclear energy industry might boost the uranium sector, which has seen a downturn, and attract more investor attention.

According to a video on the Sprott Inc. website in January, Sprott CEO John Ciampaglia remained bullish on uranium markets in 2025.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

"If you take out the Chinese contracts that were signed (in 2024), which were quite large, the amount of uranium purchased by the rest of the world looks quite low," Ciampaglia said in the interview. "That's why we remain very constructive and bullish: all you're doing is kicking that demand down the road. It's all going to be eventually pent-up demand, which is going to support the uranium price."

Ownership and Share Structure

Management, insiders, and close business associates own approximately 5% of Skyharbour, the company said.

President and CEO Jordan Trimble owns 1.5%, and Director David Cates owns 0.65%. Institutional, corporate, and strategic investors own approximately 55% of the company.

Denison Mines owns 6.3%, Rio Tinto owns 2%, Extract Advisors LLC owns 9.6%, Alps Advisors Inc. owns 9.1%, Mirae Asset Global Investments (U.S.A) L.L.C. owns 5.68%, and Incrementum AG owns 1.05%, Skyharbour said.

Skyharbour has 204.46M outstanding shares and 199.65M free float traded shares. Its market cap is CA$65.43 million. Its 52-week range is CA$0.28–0.51 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.