IberAmerican Lithium Corp. (IBER:CBOE; IBRLF:OTCQB) is a hardrock lithium exploration and development company that is looking to fully explore and bring to production as rapidly as possible its 100% owned properties in the mining-friendly jurisdiction of Galicia in NW Spain where infrastructure is excellent. The company's properties are located in the "sweet spot" of one of the few rich lithium belts in Europe that runs from Portugal in the west through Northwestern Spain and into France and with the European Union pushing Spain to develop this belt and big markets nearby for the lithium eventually produced, the prospects for successful lithium miners in the area are bright.

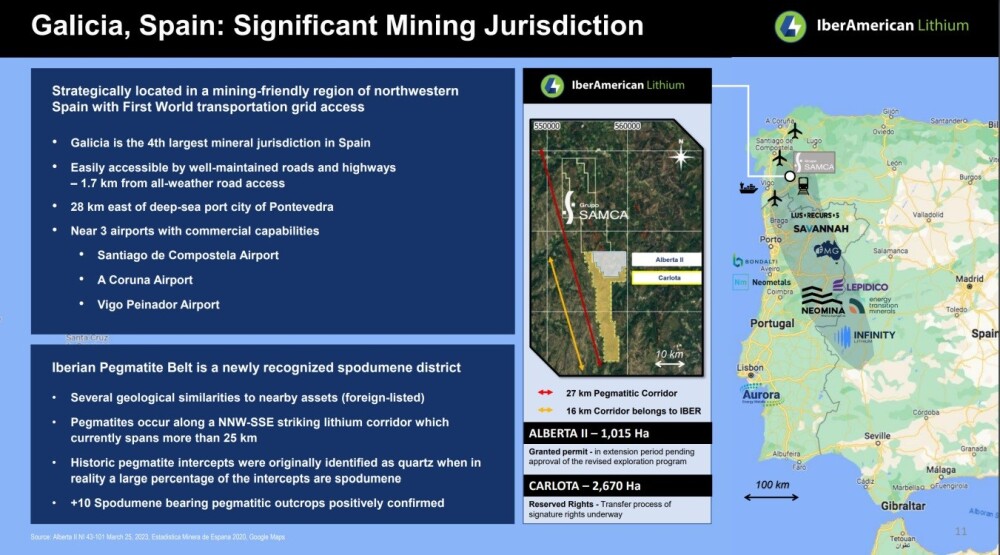

The company has two properties in this district, namely the Alberta II and Carlota properties, which are adjacent, and together, they comprise a large area with a 16 km strike along the belt. These were acquired in two stages from another company called Strategic Minerals Europe Corp. (SNTA.WT), the reason being that earlier work on the properties had discovered 11 meters of 1.24% lithium, which is rich. This is why, when the company went to raise CA$7 million to develop the project, it had no trouble in doing so, and as it was oversubscribed, it ended up raising CA$9 million.

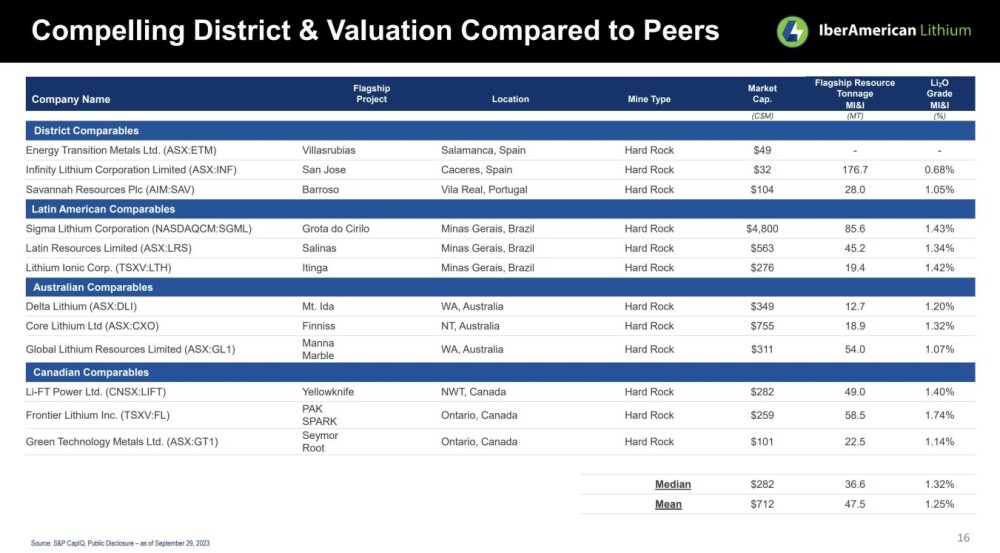

There are two other important projects in the area, including the success of nearby Savannah Resources Plc. (SAV:LON) has major positive implications for IberAmericanLithium. Savannah, which has a market cap of CA$104 million, is just over the border on the same lithium belt in Portugal, where it is bringing a 20 million ton resource bearing 1.06% lithium to production.

Meanwhile, Energy Transition Minerals (GDLNF:OTCMKTS;ETM:ASX), also an exploration company capitalized at CA$49 million, is moving ahead with its projects. Savannah's shares trade on the London Stock Exchange, Transition's on the Australian Stock Exchange, and IberAmericanLithium, with a CA$20 million market cap, as we know, trades on the Canadian market.

One final point that investors will want to take into consideration is that as companies along the lithium belt advance their projects to production, we are likely to see a marked pickup in M&A activity, one big reason for this being the pursuit of economies of scale in processing and distributing the final product.

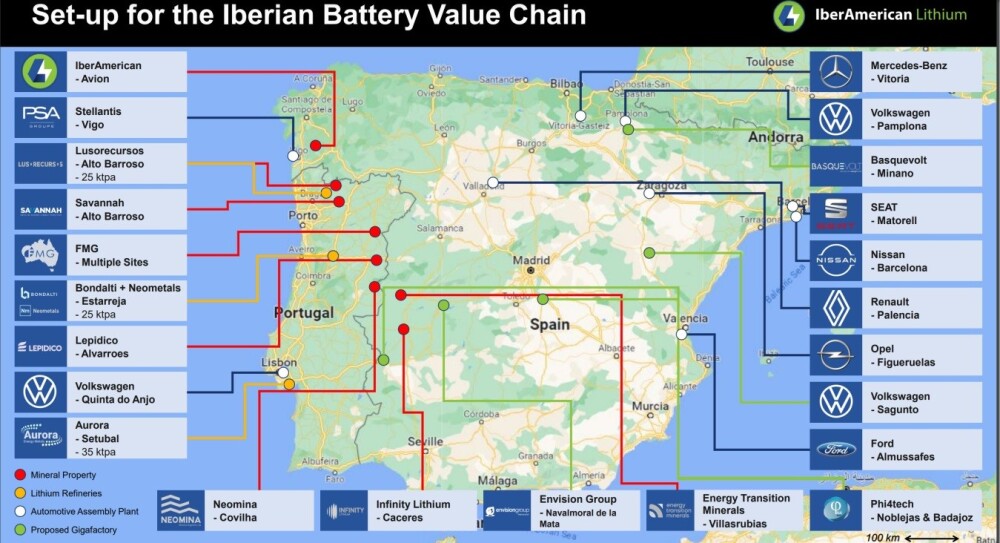

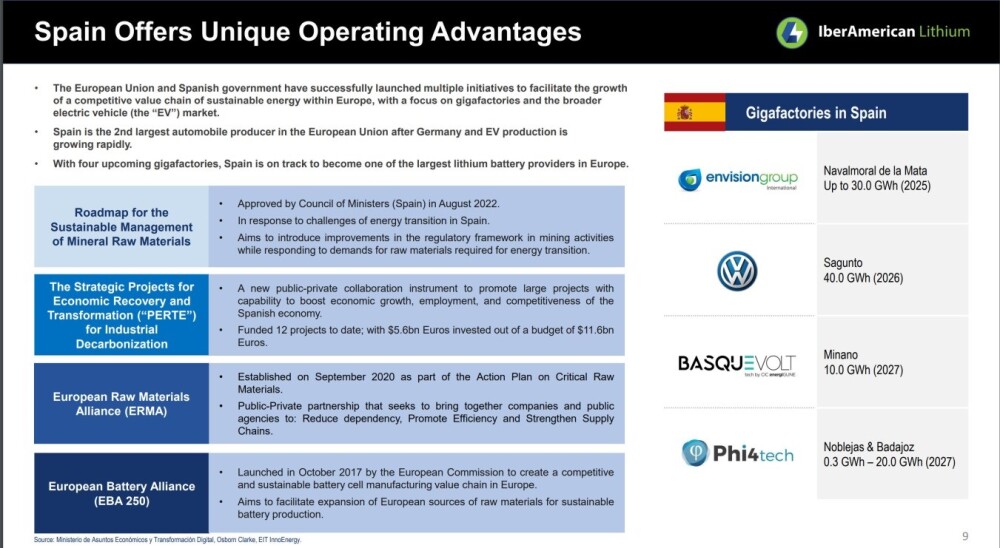

The following important slides were lifted from the company's latest Investor Deck.

The first slide shows where the company's properties are located in Northwest Spain and their position relative to the nearby border with Portugal and to other companies operating along the belt, in particular Savannah…

The next slide shows that big markets for the company's end product are close at hand.

This slide makes clear that Spain is on track to become one of the largest lithium battery providers in Europe.

The following slide clearly shows the favorable valuation of IberAmericanLithium to its peers.

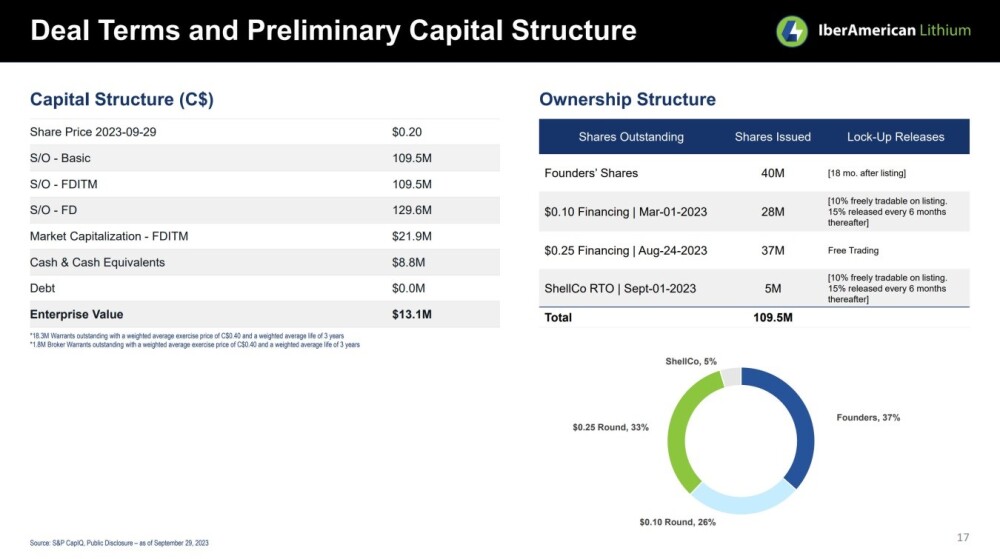

Lastly, we can see on the slide the ownership structure of the shares that the founders of the company believe in, as they own 37% of the stock, which gives more grounds for confidence.

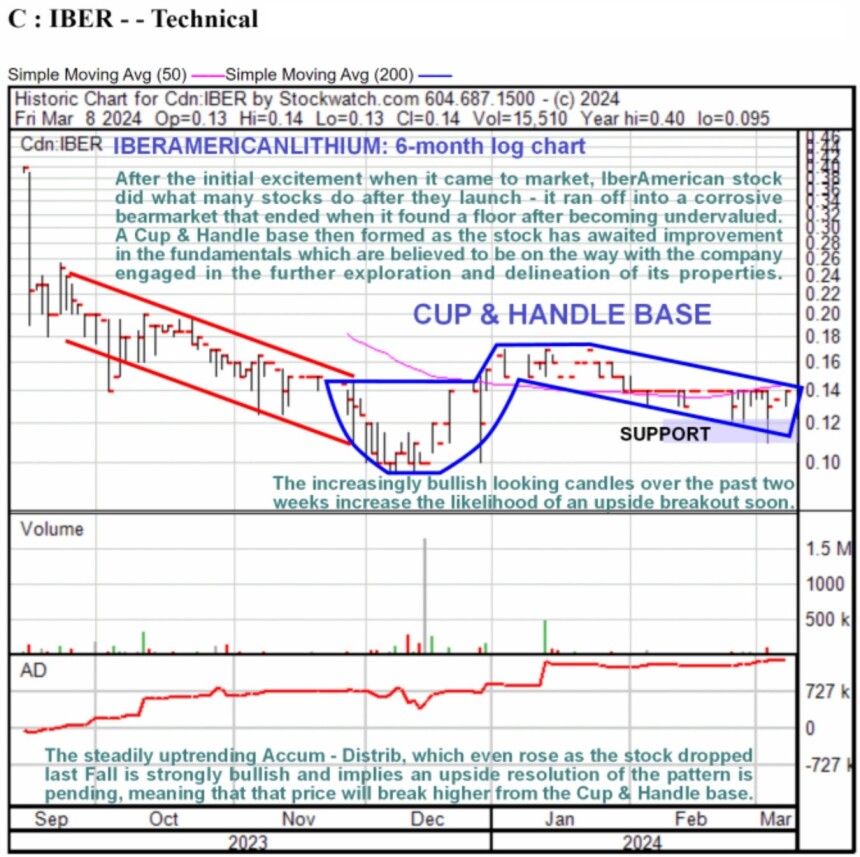

Turning now to the stock chart for IberAmerican Lithium, we see on its 6-month chart that after the initial excitement when it came to market last September, it ran off into a bear market for several months as investors lost interest, which is normal.

Also normal is that the self-feeding downtrend gets overdone, resulting in the stock being undervalued, which is still a result of the company's continuing progress. The stock hit bottom in December when a small Cup base formed, which had actually started to form by late November, with the price ascending to complete the right side of the Cup around the New Year.

Because it takes time for the fundamental situation to continue to improve, what usually happens on completion of the Cup is that the price runs off sideways to down for quite a while, forming a "Handle" to complement the Cup, thus completing a Cup & Handle base pattern. This has now been done, and the pattern looks complete, which means that we can expect an uptrend to get started soon. While the price pattern alone suggests this outcome, it is made considerably more likely in the case of IberAmerican Lithium by the steadily uptrending Accumulation line at the bottom of the chart, which is decidely bullish in purport.

The conclusion is that the chart for IberAmerican Lithium points to a breakout into a new bull market soon, with the run of bullish-looking candles over the past two weeks suggesting that such a breakout may be imminent.

IberAmerican Lithium Corp. (IBER:CBOE; IBRLF:OTCQB) closed at CA$0.14 on March 8, 2024.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- IberAmerican Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of IberAmerican Lithium Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.