Today, I want to take a look at European Lithium Ltd. (EULIF:OTCMKTS;EUR:ASX).

Key Points

- Vending Wolfsberg Lithium Project into NASDAQ SPAC

- EUR to receive US$750m for 82% of new Critical Metals vehicle

- Pass-through value is A$0.61 /EUR per share

- US$15m prepayment funding from BMW offtake agreement

- Has 7.5% of Tanbreez, the world's largest REE deposit

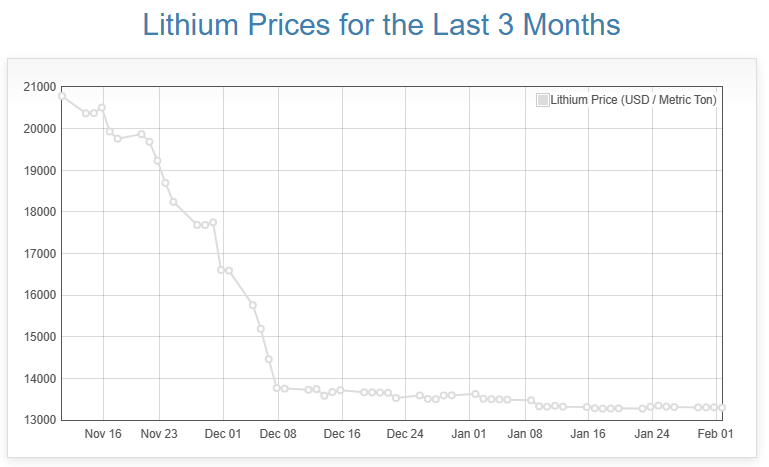

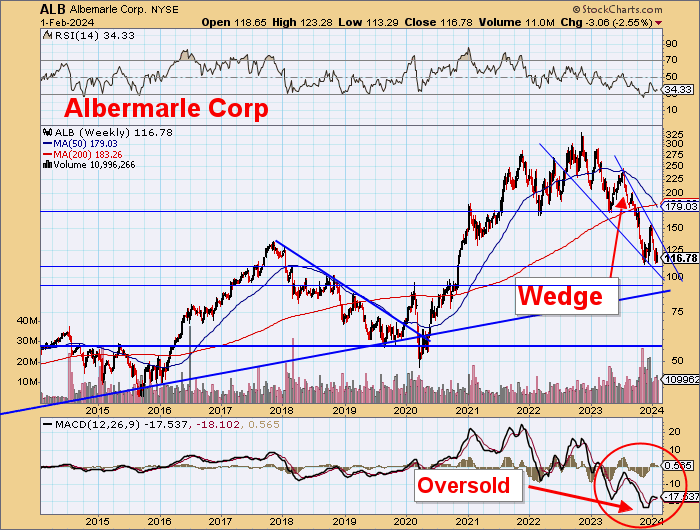

Lithium product prices are bottoming after an 85% fall from the highs of just a year ago, and the major lithium producers are >60% from their 2022 highs.

Overstocking by Chinese battery manufacturers and their subsequent destocking has crashed the lithium price and has brought intense pessimism throughout the sector.

The reality is that short-term sentiment will be insufficient to undermine longer-term prospects for lithium in the world and lithium in batteries in particular. Mine capacity is insufficient for demand two to three years out, and current low prices will ensure marginal projects will not achieve funding.

EUR has funding lined up and will be able to progress its plans toward production. Another reality is the structure of the lithium supply stream.

- Australia producers ~53% of all primary lithium but refines next to nothing

- China produces 66% of all refined lithium but mines just 11% from mostly brines and micas

- Europe essentially produces no primary lithium and no refined lithium

Many of the new projects are not spodumene, so they rely on higher-cost ores and less reliable treatment processes. EUR also has a 7.5% interest in the Tanbreez Project in Greenland, which is the world's largest rare earths deposit with a completed DFS and is ready for its next stage.

The package is attractive and the stock is due a major rerating.

Lithium is in the bottoming process.

And the major producers are close to important long-term support after a +60% decline from 2022 highs.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Barry Dawes: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.