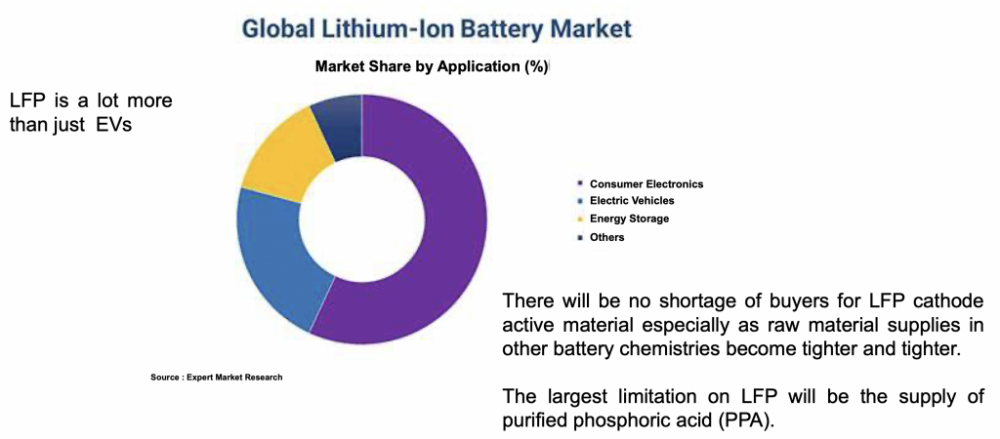

Many readers are becoming more aware that lithium iron phosphate [LFP] batteries are rising in popularity among electric vehicle makers including Ford, Volkswagen, BMW, Mercedes-Benz, and Stellantis N.V. This comes after industry leader Tesla chose the LFP configuration as its go-to battery for standard-range vehicles around the world.

There are tradeoffs in using LFP chemistries, however rapidly growing market penetration clearly shows that OEMs are comfortable with the pros and cons. LFP batteries last longer (more recharge cycles) and are safer (fewer fires!), but have a lower driving range than more powerful lithium-ion batteries using nickel and cobalt.

What initially attracted users to LFP is its lower cost, but since these batteries have become so popular, tens of billions of dollars are being invested into improving the battery density while maintaining the cost advantage. As range profiles expand, reaching a tipping point of say 300 km/charge, range anxiety will start to disappear.

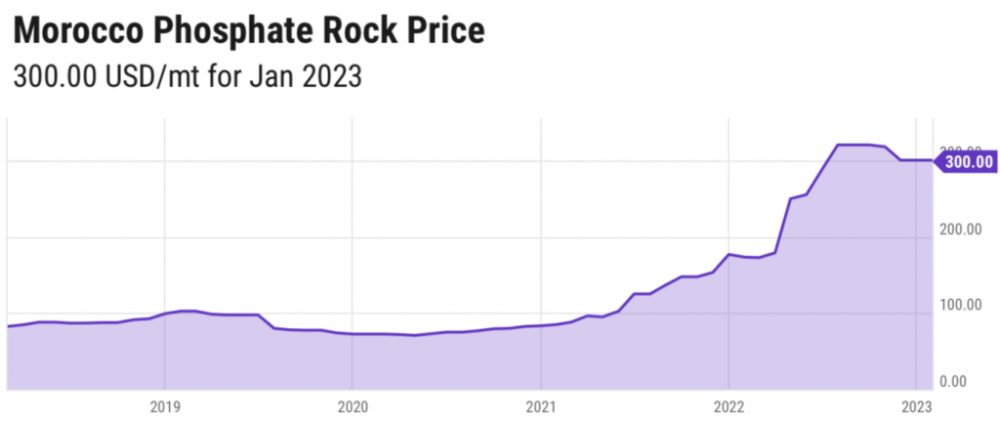

The monthly price of phosphate rock (from Morocco) traded as high as US$320/ton in the fourth quarter of last year but has declined modestly to US$300/ton, up quite a lot from about US$71/ton in April 2020 when COVID hit North America. This strong increase is noteworthy in the context of countries around the world adding phosphate to their lists of critical materials.

As impressive as the increase in phosphate rock prices is, it should be noted that the price hit US$450/ton in the 4th quarter of 2008 and remained at that level for six months. Adjusted for inflation, that’s like a price of US$640/ton in today’s dollars.

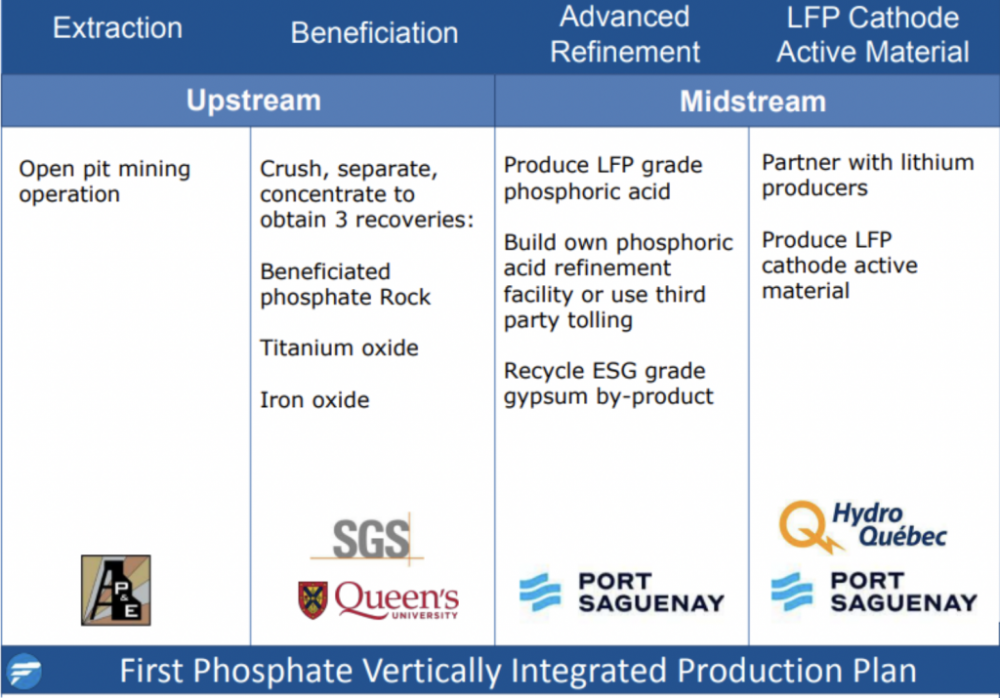

First Phosphate is not like peer phosphate or fertilizer companies who are [or hope to be] just phosphate or potash miners. Instead, they plan to vertically integrate in a substantial way, with the help of highly-skilled, cutting-edge technology partners.

Regarding critical minerals, materials, and metals, few are more critical to the human condition than phosphate. Shortages can lead to food riots and starvation in low-income regions of the world. There's no substitute for phosphate in the production and consumption of food and fertilizers. Globally a handful of companies end up controlling 90%+ of mined phosphate rock.

These players have dominated the fertilizer sector for decades. They take sedimentary-hosted phosphate from mines and concentrate it into industrial-grade phosphoric acid. However, a by-product of this process is hazardous waste containing unwanted radioactive materials and heavy metals.

This waste, amounting to well over a billion tons across the globe, has to be safely stored indefinitely.

First Phosphate

A new junior miner in the fertilizer/phosphate market is First Phosphate (PHOS:CSE), listed on the Canadian Stock Exchange [CSE] on February 22nd under the ticker: PHOS. It has a different type of phosphate, nearly 50 million tons of an igneous [hard rock] deposit with an attractive 5.2% phosphorus pentoxide [P2O5] grade.

Just 5% of phosphate deposits are held in igneous rocks, and just 1% in the type of geology First Phosphate has. This is very important because igneous rock has much lower concentrations of deleterious elements, enabling a large portion of it to be upgradable [purified] to the very highest grade of phosphoric acid.

First Phosphate is unique in other key ways as well. Instead of selling its phosphate rock at an early stage of the multistage process of refining run-of-mine ore to premium purified phosphoric acid [PPA], the company hopes to work with specialty chemical companies to advance mined material to much higher-value end products.

That way First Phosphate can retain a significant share in the profits of premium LFP battery-related materials. Management does not plan to make the cathodes that go into the batteries but wants to produce world-class PPA to sell to companies that mix it with iron sulfate and lithium hydroxide to make a crucial component of the battery cathode.

For example, Israel’s ICL Group, a leading specialty minerals company, plans to build a US$400 million “LFP cathode active material (CAM) manufacturing plant” in St. Louis, Missouri.

With an enterprise value {market cap + debt – cash} of under US$20M, and only a few (if any) pure-play phosphate juniors with projects in Tier-1 jurisdictions like Quebec and focused entirely on LFP batteries to choose from, this is a company that could see a ton of interest from investors looking for new battery metal bets.

PPA from First Phosphate in Quebec, Canada would be readily accessible when commercial production begins in three to five years.

Even closer than St. Louis, Ford is building a US$3.5 billion LFP facility in Michigan that would be reachable from Quebec within a day by rail.

First Phosphate is not like peer phosphate or fertilizer companies who are [or hope to be] just phosphate or potash miners. Instead, they plan to vertically integrate in a substantial way, with the help of highly-skilled, cutting-edge technology partners.

The company is working with very capable parties including; Queens University, SGS Canada, P&E Mining Consultants, the Port of Saguenay, Laurentia Exploration, Groupe Conseil Nutshimit-Nippour, TFI International, and Agrinova. Management has assembled a six-person advisory board of experts in areas including; geology, earth science, PPA production technologies, corporate operations, and financial planning.

Canada and the United States [Dept. of Energy + Dept. of Defense] are providing low-cost government loans and free money grants to kickstart the building of new EV and lithium-ion battery plants in Quebec/Ontario and across the U.S.

Management, led by CEO John Passalacqua will be applying for a variety of these funding programs on its own and in conjunction with partners. With the vast majority of the globe’s LFP battery production taking place in China, new sources of phosphate products from Canada will enjoy high demand for clear logistical & geopolitical reasons.

In addition to concerns about China, readers should note that over 80% of phosphate supply has traditionally come from Russia, North Africa, and the Middle East, regions that could over time find more in common with China/Russia/Saudi Arabia than the U.S. and Canada.

Near-Term Catalysts

This year is poised to be a busy and productive one.

A Preliminary Econ. Assessment [PEA] should start fairly soon and be completed by year-end, along with a metallurgical study and the evaluation of prospective PPA production partners.

One or more phosphate rock off-take agreements could be in hand in the second half of 2023 and PPA pilot plant testing is also scheduled. See a more detailed list of near-term catalysts below.

Recently First Phosphate has been announcing successes in ongoing exploration activities around the main deposit. For example, multiple surface grab samples of up to 19% P2O5 were found. Metallurgical testing indicates an anticipated apatite grade of at least 38% P2O5 at > 90% recovery.

A new discovery was made on Target 3 wherein the results of 38 grab samples produced multiple assays > 10% P2O5 (double the resource grade). In another area up to 20.5% P2O5 grab samples were reported, some of the highest-grade phosphate samples ever in the Saguenay-Lac-St-Jean region of Quebec.

Management notes that (subject to a lot more work) titanium oxide and iron oxide concentrates could be viable co-products of the P2O5. For additional exploration details and more info on the blue-sky potential, please review the latest [February] corporate presentation.

Readers are encouraged to check out First Phosphate’s website and most recent press releases. With an enterprise value {market cap + debt – cash} of under $20M, and only a few (if any) pure-play phosphate juniors with projects in Tier-1 jurisdictions like Quebec and focused entirely on LFP batteries to choose from, this is a company that could see a ton of interest from investors looking for new battery metal bets.

| Want to be the first to know about interesting Battery Metals, Cobalt / Lithium / Manganese and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Epstein Research Disclosures:

The content of this article is for information only. Readers understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about GANDER GOLD, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of GANDER GOLD are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of GANDER GOLD and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

Disclosures:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with First Phosphate. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the alidity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of First Phosphate, a company mentioned in this article.