After U.S. markets closed Wednesday, Oceaneering International Inc. (OII:NYSE), a global provider of engineered products, services, and robotic solutions for the offshore energy, aerospace, defense, and manufacturing industries, announced financial results for the third quarter of 2022 ended September 30, 2022.

The company reported that for Q3/22, it posted total revenue of US$559.7 million, compared to US$466.8 million in Q3/21. The firm provided a breakdown of revenue by business segment and indicated that its subsea robotics unit accounted for US$169.4 million, manufactured products were US$94.0 million, offshore projects group US$153.0 million, integrity management and digital solutions US$58.5 million and aerospace and defense technologies posted US$84.8 million.

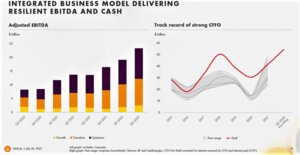

The company stated that during Q3/22, it generated cash flow from operations of US$85.9 million, had a free cash flow of US$66.6 million, and ended the quarter with US$428 million in cash on its balance sheet.

Oceaneering International advised that for Q3/22, it recorded a net income of US$18.3 million, or US$0.18 per share, versus a net loss of US$7.4 million, or a net loss of US$0.07 per share in Q3/21.

The company added that adjusted net income for Q3/22 was US$23.7 million, or US$0.23 per share, and noted that the adjustments were the result of US$1.1 million in pre-tax adjustments related to foreign exchange losses and another US$4.4 million in discretionary tax adjustments pertaining to asset valuation and tax allowances.

The company stated that during Q3/22, it generated cash flow from operations of US$85.9 million, had a free cash flow of US$66.6 million, and ended the quarter with US$428 million in cash on its balance sheet.

The firm pointed out further that during Q3/22, its fleet of 250 remotely operated vehicles (ROVs) achieved a utilization rate of 67%, and each, on average, contributed revenue of US$8,468 per day. The company added that as of September 30, 2022, its Manufactured Products division had a backlog of US$365 million.

Oceaneering International's President and CEO Roderick A. Larson commented, "Our third-quarter results were driven by improved offshore activity and pricing, particularly in the Gulf of Mexico, which ticked up further during the quarter. We produced adjusted consolidated EBITDA of US$77.6 million, which exceeded our guidance and consensus estimates."

"Offshore activity drove significant operating improvements in our energy businesses, which were led by our Subsea Robotics (SSR) and Offshore Projects Group (OPG) segments. In addition, increased manufacturing throughput led to improved operating margins in our Manufactured Products segment. We also saw a meaningful recovery in our government-focused businesses after experiencing the effects of negative timing during the second quarter of 2022," Larson added.

The firm stated that it expects that revenues in Q4/22 will decline slightly or be on par with those registered in Q3/22. The company indicated that it estimates that the manufactured products group and ADTech revenues and profitability will be higher but will be offset by slightly lower revenues and operating profitability in its SSR, OPG, and IMDS segments, in part due to seasonality.

Oceaneering indicated that for FY/22, it estimates that adjusted EBITDA will be in the range of US$215-240 million.

The company advised that for FY/23, it anticipates higher levels of activity and improved performance in each of its primary business areas led by its SSR and OPG segments. The firm said that for FY/23, it expects consolidated EBITDA of US$260-310 million and free cash flow of over US$100 million.

The company indicated that going forward, it remains focused on safety, financial discipline, free cash flow generation, debt management, and growth. The firm stated that it will continue to look for opportunities to increase its prices and improve margins to benefit shareholders.

Oceaneering is a global technology firm based in Houston, Texas, that provides underwater, on land, and in space engineered services and products and robotic solutions to the offshore energy, aerospace, defense, entertainment, and manufacturing industries. The company employs more than 10,000 people and has operations in 24 countries.

The firm's Subsea Robotics business segment offers remotely operated vehicles (ROVs) that are used to support offshore oil and gas drilling and vessel-based services such as subsea surveying, installation, construction, inspection, maintenance, and repair. The company fleet includes approximately 250 work-class ROVs. Its Manufactured Products segment manufactures distribution and connection systems, pipeline connections, and other hardware and repair systems for the energy industry.

Through its Offshore Projects Group, Oceaneering offers subsea installation, intervention, inspection, maintenance, and repair services, including ROV workover control systems and project management and engineering. The firm also provides asset integrity management, software, and analytical solutions for the bulk cargo maritime and energy industries through its Integrity Management & Digital Solutions segment. Lastly, the company's Aerospace and Defense Technologies segment supports U.S. government agencies with engineering and related manufacturing assistance for use in defense and space exploration efforts.

Oceaneering International started yesterday with a market cap of around US$1.13 billion, with approximately 100.26 million shares outstanding and a short interest of about 4.4%. OII shares opened almost 9% higher yesterday at US$12.22 (+US$0.99, +8.82%) over the previous day's US$11.23 closing price. The stock traded yesterday between US$12.12 and US$13.92 per share and closed for trading at US$13.08 (+US$1.88, +16.47%).

| Want to be the first to know about interesting Oil & Gas - Services investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Stephen Hytha wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.