Energy Fuels Inc. (EFR:TSX; UUUU:NYSE.MKT) reported its financial results for the second quarter of 2017 on Aug. 3. The company announced $34.2 million of working capital, with cash and equivalents of $18.7 million and approximately 370,000 pounds of uranium concentrate. During the quarter, the company sold 300,000 pounds of U3O8 at an "average realized price of $50.14 per pound."

Rob Chang, an analyst with Cantor Fitzgerald, found the results positive, noting in an Aug. 8 report that "Q2/17 revenue of $17.9M beat our forecast due to an earlier than expected contract delivery of 300,000 lbs."

Looking ahead, Chang stated that "FY/17 uranium production guidance has been upheld at between 640,000-675,000 lbs while sales guidance of 160,000 lbs for the remainder of the year is in-line with our expectations after adjusting for the earlier than expected delivery in Q2. . .a new NI 43-101 resource estimate for the Canyon Mine is expected during Q3/17. The expectation is for an increase in both the uranium and copper resource."

Chang stated that "EFR remains our top leverage pick to the expected uranium price recovery as the company has several assets that are within 1-2 years of production once the decision is made to start/restart them. That will allow the company to quickly respond to what we expect to be a violent uranium price spike as utilities seek to secure long term contracts to replace those that are rolling off."

Cantor Fitzgerald is maintaining a Buy recommendation and increased its target price to CA$4.25 from CA$4.05. Energy Fuels' shares are currently trading at around CA$2.14.

Rodman & Renshaw analyst Heiko Ihle reiterated in an Aug. 4 report the firm's "Buy rating and $5.00 per share price target on Energy Fuels." He noted that "due to continued weak spot uranium prices, we expect a deliberate drop in production to 650,000 pounds in 2017. We note that this is sufficient to meet higher-priced, long-term contractual obligations for the year. Although the uranium market has remained depressed as a whole, we feel that Energy Fuels has accumulated a strong combination of both conventional and ISR projects, and that this portfolio of assets should provide investors with strong leverage to an increasing uranium price environment going forward."

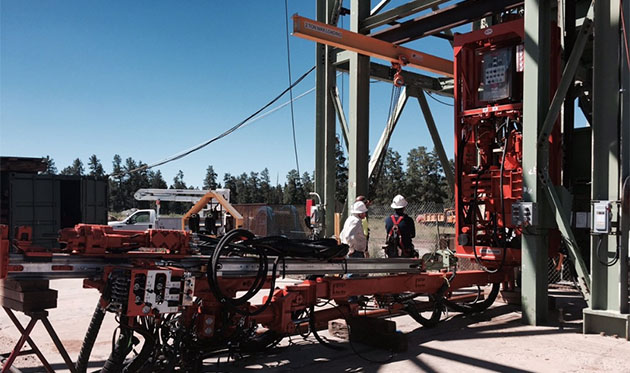

Ihle also noted that Energy Fuels' Canyon Mine resource evaluation program continued in the second quarter, "identifying additional high-grade uranium and copper mineralization. The program has resulted in multiple high-grade discoveries through the significant underground development and core drilling that has taken place. Given the positive results thus far, we expect the new resource estimate to add substantial uranium and copper resources."

Read what other experts are saying about:

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles with industry analysts and commentators, visit our Streetwise Articles page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) Energy Fuels Inc. is a billboard sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article