Apple reported earnings this week and the stock surged, taking the Dow Jones above 22,000 points for the first time in history.

This is our script playing out as Wealth Research Group laid out months ago—we called it the Blow-Off Top.

The future holds broad indexes like the S&P 500, Dow Jones and NASDAQ soaring into all-time highs until there are no buyers left—we are two to three quarters away from seeing this.

At this point, investors purchasing stocks are doing so at the highest valuations the stock market has ever experienced.

Most sophisticated investors are like us at this point:

1. All our Wealth Stocks, in which we took positions in for fair valuations, are part of our long-term core portfolio, and we won't sell unless they become incredibly overvalued, which is when we'll consider taking profits.

Remember that in the long run, compounding will get you to financial independence—it never fails, and we are positioned in the highest-quality businesses in the world.

2. Cash allocation should be around 20%, as liquidity will allow us to seize opportunities quickly.

But the biggest news yesterday isn't the Bitcoin fork, which didn't damage the cryptocurrency in the least. In fact, Bitcoin Cash is up 50% in a day the last time I checked. It's not Dow Jones at all-time highs, either—it is the USD index breaking down.

Our top cryptocurrencies are on fire.

This isn't normal for the world's reserve currency—this is highly unusual, and I want us to be prepared.

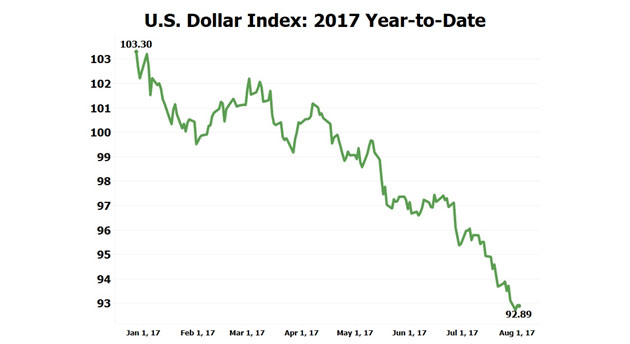

The USD rose 40%+ from early 2011 to the end of 2016. It was a massive uptrend, with huge implications for the global economy, but 2017 has seen a strong reversal.

The first six months of 2017 were the worst six-month stretch for the dollar since 2011.

The dollar is down more than 10% total in 2017. On July 21, the U.S. dollar hit a new 52-week low. That's the first 52-week low we've seen in the dollar in more than a year.

After new 52-week lows, the dollar has fallen 1.3% in six months, 2.9% over the next year, and 4.8% over the next two years.

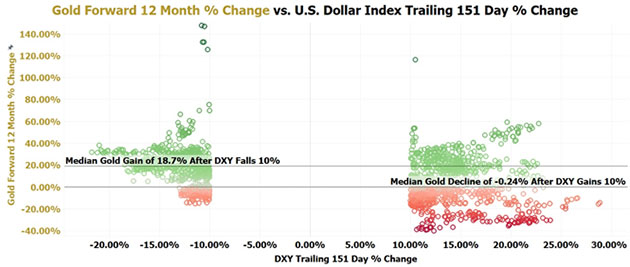

The last time that the U.S. Dollar Index declined by 10% or more in a period of 151 trading days was back on April 29, 2011. At the time, gold was trading for $1,540.25, and over the following four months, it soared by $354.75 (a 23% gain) to a new record high of $1,895.

From today's price of $1,270, a 23% move would take the price to $1,562, which would make 34% of the world's undeveloped assets economic once again—certain high-quality mining shares will absolutely go parabolic.

This will be such a legendary run that you'll probably be able to fund a decade of retirement from the profits you'll bank.

Historically, from 1971 through today, when the U.S. Dollar Index declines by 10% or more during a period of 151 trading days, gold has gained by a median of 18.7% over the following 12 months.

The way we're going to get ahead of this trend is by holding our physical gold and silver coins and bullion—that's our insurance for mismanagement of the fractional reserve banking system.

On top of that, we have been smart about partnering with the best management teams that can turn raw deposits into cash-flowing mines. And with the coming commodities bull market, these seed investments, which were made at times of severe pessimism, will be our biggest gainers.

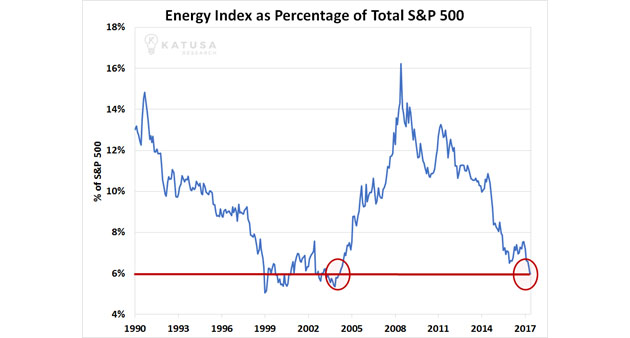

Energy is the key to a commodities bull market.

When oil prices rise, the commodities sector, as a whole, becomes the focal point of the investment universe.

It's either tech or commodities, and we get to benefit from both because we have been early to the cryptocurrencies sector, and we will be the pioneers of blockchain stocks as well.

Simultaneously, we have a foothold with the most solid mining companies out there.

The dollar is suffering a bear market, and while middle class America is losing purchasing power, our portfolio is completely hedged.

Lior Gantz, the founder of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by Wealth Research Group