NexGen's latest mineral resource estimate for the Rook I property has caught the attention of industry analysts.

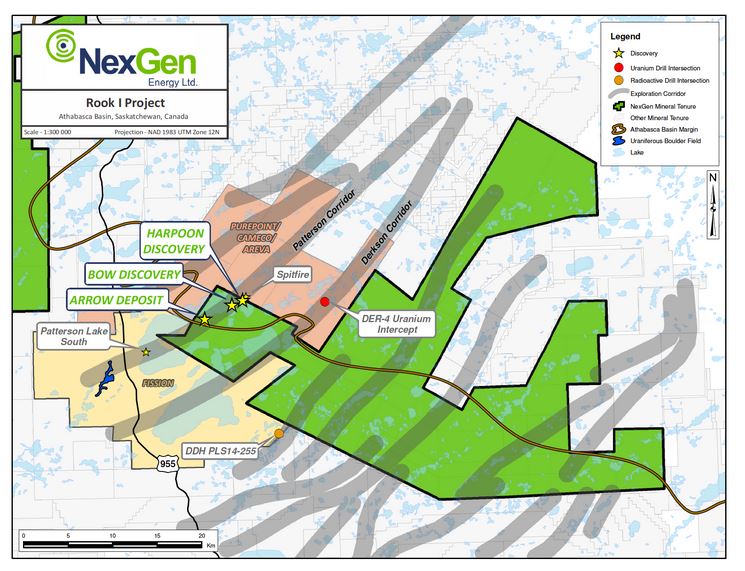

Earlier this month, NexGen Energy Ltd. (NXE:TSX; NXGEF:OTCQX) released an updated mineral resource estimate for the 100%-owned Rook I property in Canada's uranium-rich Athabasca Basin. The estimate includes Indicated resources of 179.5 million pounds (179.5 Mlb) of U3O8 in 1.18 million tonnes (1.18 Mt) grading 6.88% U3O8, including the high-grade A2 core of 164.9 Mlb of U3O8 in 0.40 Mt grading 18.84% U3O8. The Inferred resource estimate is 122.1 Mlb in 4.25 Mt grading 1.30% U3O8.

The company noted that the 2016 drilling has "converted 89% of the March 2016 Arrow Deposit Maiden Inferred Mineral Resource into the updated Indicated Mineral Resource category. This level of conversion is truly unprecedented, which continues to confirm the strong continuity of grade and thickness seen across the Arrow deposit converted."

Paradigm Capital analyst David Davidson noted in a March 7 research report that "NexGen's discovery of the Arrow uranium deposit represents one of the larger and highest-grade discoveries in the Athabasca basin in decades. After only three years of drilling, the company released an updated NI-43-101 indicated & inferred resource of 5.5 Mt grading 2.5% U3O8 for a contained 302Mlb of U3O8. Additional drilling in all likelihood will expand the resource, which should allow for a potential development scenario."

Looking ahead, Davidson added, "NXE is well into its planned 35,000m 2017 winter drill campaign and we remain convinced that additional uranium pounds will be added, albeit at a slower rate than to date."

A March 20 uranium outlook report by BMO Capital Markets had analyst Alexander Pearce and Edward Sterck reporting, "We have upgraded NexGen to Outperform (Speculative) on the back of improved valuation multiples following its resource update and the recent share price pullback." He added that "the geological qualities of the orebody warrant a premium, in our view, particularly given further upside potential from what is already one of the largest resources in the Athabasca. Near-term catalysts include a PEA in mid-2017 and PFS by year-end."

Eight Capital analyst David Talbot noted in a March 6 report that "this new resource bodes well for an upcoming PEA. While Arrow's ultimate size remains unknown, it has become clear that the A2 HG Shear Zone alone can make a tremendous starter zone down ~400m. This will likely become the basis for the PEA. We expect excellent recovery at 98%, and there does not appear to be many deleterious metals which complicate milling. . .high grades and relatively little tonnage or throughput requirements should make this a very low cost production."

Rob Chang, in an interview with Uranium Investing News on March 16, stated that "NexGen recently increased their resource to 300 million pounds. Fantastic size. This is a world-class asset, and even though the market may have been expecting a little bit more, I think it will eventually get to that size anyway, maybe 400, perhaps 500 million pounds. But 300 on its own is fantastic and should not be sneezed at at all."

"Not only am I certain this will become a mine, this might very well be the best uranium mine out there, and perhaps one of the best mines period across any commodity when you factor in how cheap it's going to be to produce from it, and the quality and the grades that you're going to get from this asset. NexGen's sitting on one of those once-in-a-career type of assets that's very nice to see," Chang concluded.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles with industry analysts and commentators, visit our Streetwise Articles page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: NexGen Energy Corp. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional disclosures about the sources cited in this article

Disclosures from Paradigm Capital, NexGen Energy Ltd. Research Note, March 7, 2017

1. The analyst has an ownership position in the subject company. No

2. Paradigm Capital Inc. has assumed an underwriting liability for, and/or provided financial advice for consideration to the subject companies during the past 12 months. No

3. Paradigm Capital Inc. expects to receive or intends to seek compensation for investment banking services from the subject companies in the next 3 months. Yes

4. Paradigm Capital Inc. has greater than a 1% ownership position in the subject company. No

5. The analyst has a family relationship with an Officer/Director of subject company. No

The analyst (and associate) certify that the views expressed in this report accurately reflect their personal views about the subject securities or issuers. No part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations expressed in this research report.

Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is determined by revenues generated directly or indirectly from various departments including Investment Banking, based on a system that includes the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and investment guidance and client feedback. Analysts are not directly compensated for specific Investment Banking transactions.

BMO Capital Markets, Uranium, March 20, 2017

Analyst's Certification: We, Alexander Pearce and Edward Sterck, hereby certify that the views expressed in this report accurately reflect our personal views about the subject securities or issuers. We also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Analysts who prepared this report are compensated based upon (among other factors) the overall profitability of BMO Capital Markets and their affiliates, which includes the overall profitability of investment banking services. Compensation for research is based on effectiveness in generating new ideas and in communication of ideas to clients, performance of recommendations, accuracy of earnings estimates, and service to clients.

Company Specific Disclosures: For Important Disclosures on the stocks discussed in this report, please go to http://researchglobal.bmocapitalmarkets.com/Public/Company_Disclosure_Public.aspx.

Eight Capital, NexGen Energy Ltd., March 6, 2017

Eight Capital has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research and other businesses. The compensation of each Research Analyst/Associate involved in the preparation of this research report is based competitively upon several criteria, including performance assessment criteria, the quality of research and the value of the services they provide to clients of Eight Capital. The Research Analyst compensation pool includes revenues from several sources, including sales, trading and investment banking. Research analysts and associates do not receive compensation based upon revenues from specific investment banking transactions.

Eight Capital generally restricts any research analyst/associate and any member of his or her household from executing trades in the securities of a company that such research analyst covers, with limited exception.

Research Analyst Certification

Each Research Analyst and/or Associate who is involved in the preparation of this research report hereby certifies that:

• the views and recommendations expressed herein accurately reflect his/her personal views about any and all of the securities or issuers that are the subject matter of this research report;

• his/her compensation is not and will not be directly related to the specific recommendations or views expressed by the Research Analyst in this research report;

• they have not affected a trade in a security of any class of the issuer whether directly or indirectly through derivatives within the 30-day period prior to the publication of this research report;

• they have not distributed or discussed this Research Report to/with the issuer, investment banking at Eight Capital or any other third party except for the sole purpose of verifying factual information;

• they are unaware of any other potential conflicts of interest.

Uranium Investing News, "Rob Chang: A Uranium Price Turnaround is Coming," March 16, 2017

Securities Disclosure: I, Jocelyn Aspa, hold no direct investment interest in any company mentioned in this article.

This interview is not paid-for-content.

Disclosures from Cantor Fitzgerald Report on NexGen Energy Ltd., March 6, 2017. Facts may have changed.

Potential conflicts of interest

The author of this report is compensated based in part on the overall revenues of CFCC, a portion of which are generated by investment banking activities. Cantor may have had, or seek to have, an investment banking relationship with companies mentioned in this report. CFCC and/or its officers, directors and employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. Although CFCC makes every effort possible to avoid conflicts of interest, readers should assume that a conflict might exist, and therefore not rely solely on this report when evaluating whether or not to buy or sell the securities of subject companies.

Disclosures as of March 6, 2017

CFCC has provided investment banking services or received investment banking related compensation from NexGen Energy within the past 12 months.

The analysts responsible for this research report do not have, either directly or indirectly, a long or short position in the shares or options of NexGen Energy.

The analyst responsible for this report has visited the material operations of NexGen Energy.

No payment or reimbursement was received for the related travel costs.

Analyst certification

The research analyst whose name appears on this report hereby certifies that the opinions and recommendations expressed herein accurately reflect his personal views about the securities, issuers or industries discussed herein.