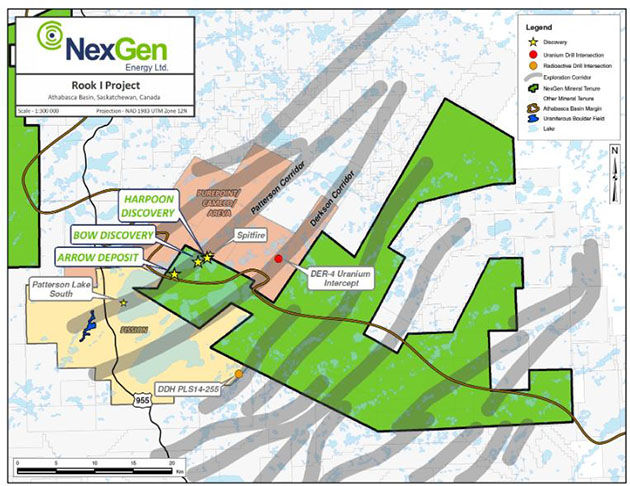

Throughout 2016, NexGen Energy Ltd. (NXE:TSX; NXGEF:OTCQX) has been announcing drill results. On Dec. 20, NexGen released the results from the final 10 holes of the 2016 drill program at the Arrow deposit, part of the Rook I property in the Athabasca Basin in Saskatchewan.

David Talbot, an analyst with Dundee Capital Partners, noted that "positive highlights include four intercepts along A2 Shear, and another on A3 Shear. Mineralization continues to be intersected at higher than [the] current resource grade of 2.63% U3O8."

These results, Talbot stated, "complete 2016's massive 73,091m drill program designed to expand and improve upon the existing 202 MM lbs resource at Arrow. We believe results should 1) increase confidence with closer spaced holes to upgrade to measured and indicated; 2) expand the mineralized footprint; and 3) delineate higher grade areas within areas previously believed to be lower grade. We estimate resource growth of at least 50% to over 300MM lbs U308."

In a Dec. 14 report, Talbot noted that "management has spent time and effort attracting a strong and experienced technical team. Plenty of geotechnical and metallurgical work is going on behind the scenes in preparation for the PEA. This should provide a strong valuation footing for investors. In the meantime the Arrow Deposit continues to grow and improve with each press release."

Gwen Preston, editor of Resource Maven, concurs, writing on Dec. 14, "If uranium continues to strengthen I would expect NXE shares to offer strong leverage, given that Arrow is the best uranium discovery in the world. The price will also rise as we approach that resource update, which could well grow the already-impressive 202-million lb. resource by 50%."

Talbot is also optimistic: "We expect NXE to remain a leader in the uranium sector moving into 2017, particularly should the uranium price wind be at its back. It remains our top exploration pick."

Garrett Ainsworth, NexGen's vice president of exploration and development, stated on Dec. 20, "Infill and step out drilling in 2016 across the Arrow Deposit has exceeded our expectations with material growth across the mineralized area as well as confirmed strong continuity. We look forward to the upcoming winter 2017 drill program which will focus primarily on infill and expansion drilling at Arrow and high priority regional targets in the vicinity of Arrow."

NexGen CEO Leigh Curyer outlined the company's next steps on Dec. 20. "With the final 2016 assays received for Arrow, we will commence the resource modelling and estimating process in order to publish an updated mineral resource estimate in the first half of 2017. Prior to the updated resource being published, we will commence our winter 2017 drill program together with the various engineering and development studies."

Read what other experts are saying about:

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles with industry analysts and commentators, visit our Streetwise Articles page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: NexGen Energy Ltd. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional disclosures about the sources cited in this article