While everybody is focused on oil, natural gas prices are moving in a very different direction.

Up.

As of this afternoon, natural gas prices at Henry Hub stood at $4.15 per 1,000 cubic feet (or million BTUs). Since last Thursday, the price of natural gas has jumped by 13.7%.

Located in Erath, Louisiana, Henry Hub serves as the official delivery location for futures contracts on the NYMEX. It serves the same function that Cushing, OK does for crude.

The week-long spike in price shows that natural gas doesn't necessarily move in tandem with oil.

And that is providing us with some real nice short-term opportunities…

These Four "Super Shifts" Mean Higher Natural Gas Prices

Now keep in mind that crude oil prices will be recovering. Despite what the "sky is falling" pundits are telling you, the long term direction for crude is up.

As for natural gas, the market is now cycling into a seasonal demand pattern that will send prices higher, assuming the winter is about the same as last year. Unusually early storms have already hit New England, boding well for those who suggest there is another cold winter on the way.

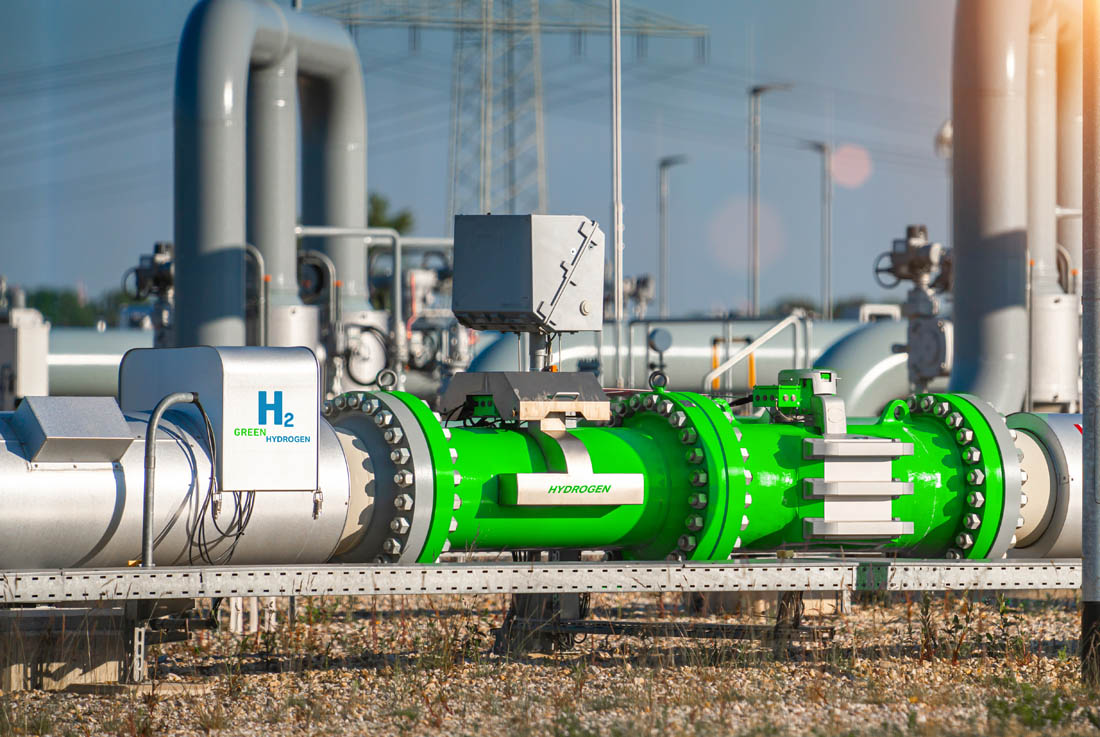

The important point to remember is this: The current increase in natural gas prices may be winter related, but there are four other "super shifts" taking place that will buttress higher prices as we move into 2015. They include the use of natural gas in electricity generation; the petrochemical industry; liquefied natural gas (LNG) exports; and a new generation of fuel cell and battery applications.

Of course, the transition from coal to natural gas has been going on for some time now. And while there is a balance forming in several specific regions in the country where coal (even lower grade coal) has reached usage equilibrium with gas, the larger move to gas continues to gain momentum.

In fact, co-fueled generating plants used to refer to power stations that produced electricity from coal or gas. But for several sections of the country, that designation now means either gas or renewables like solar, wind, biomass, and even geothermal out west.

We are now on track to exceed the predications I made several years ago. By 2020, at least one-third of the U.S. generating capacity derived from coal will have been retired since 2012. The vast majority of that will be switching over to natural gas.

I initially estimated that each 10 Gigawatts (GW) of generating capacity would require an additional 1 billion cubic feet of gas per day. That now stands at an additional 1.2 billion cubic feet of gas per day, with at least 30 GW moving over to gas.

To put this in perspective, this transition alone – ignoring any of the impact on coal from the intensifying Environmental Protection Agency standard increases – will eliminate almost twice the current natural gas storage surplus nationwide.

We are also seeing a much bigger transition from oil to natural gas in the production of petrochemicals. This has resulted in an energetic competition among several regions for the building of several multi-billion dollar cracker facilities.

These crackers would serve as the sourcing for all manner of petrochemicals from plastics to advanced fuels produced from gas. Currently, there are seven serious proposals on the boards to probably build three initial plants nationwide.

Then there's the LNG trade, with exports from the U.S. scheduled to be phased in about this time next year. I have talked about the LNG revolution on several occasions here in OEI. The only additional point I want to make this time around is to remind you that American exports should account for between 6 to 8% of a rapidly expanding global LNG market by 2020. That's starting from where we are today, which is ground zero.

Finally, there have been some significant technological changes in battery and fuel cell applications that may result in major additions to natural gas demand in the near future.

That, combined with the already developing use of LNG and compressed natural gas (CNG) for higher-end truck engine retrofitting, is adding another primary outlet for gas.

Natural Gas: Better Returns to Tide Us Over

Against this backdrop of increasing usage and demand, is the massive unconventional (shale, tight, coal bed methane) reserves available in the U.S. (and progressively elsewhere in the world). It is what will allow us to ramp up considerable amounts of new production to meet any new increases in demand.

Natural gas prices, therefore, are not going to be moving back up to the almost $13 per 1,000 cubic feet experienced several years ago. To put matters in major perspective: We now have enough extractable reserves to increase U.S. production by 25% per year into the foreseeable future.

Nobody is about to do that, of course. It would destroy the pricing mechanisms. Yet, it does indicate how much additional demand can be easily met.

The combination of these factors with a normal winter means we now have the makings of a nice pricing foundation moving forward. That will translate into opportunities in several places in the upstream-midstream-downstream natural gas sequence.

In future issues, I'll be targeting moves in specific sectors with strategic selections and approaches.

Given that a number of these moves have already translated into a number of double and triple-digit profits for Energy Advantage and Energy Inner Circle members, we are going to have some nice opportunities to choose from.

Those profits from the natural gas side will tide us over very nicely while crude oil stabilizes. And the truth is, while crude oil gets more press, natural gas is likely to be where the better returns are found over the next few months.

Kent Moors

Oil & Energy Investor