Anyone that has followed the evolution of processes that are used to make fuels out of waste recognizes that the permutations and combinations of processes that can be used has become mind-boggling, as the pathways that can best be used, continue to change. As a consequence, it is no longer straight forward as to what will work best in making a limited number of fuels out of a particular biorefinery feedstock, as many more biorefining options are reaching commercial scale.

As a consequence, alternative biofuels conversion pathways that should now be considered are not only a result of advances being made in biorefining technology. They are a result of changes in the sustainability and cost of feedstocks that are available to specific biorefineries. They are also a result of changes in the supply of and demand for conventional fuels that the biofuels to be produced are targeting to replace, and the price that such biofuels are expected to command.

In our previous biofuels project development efforts, we had initially focused on converting forestry wastes into bio-coal for export. We then followed the pathway for using such wastes to generate power. We are now focused on a biorefinery project designed to use municipal solid wastes (MSW) in combination with forestry wastes to produce biofuels.

In pursuing the many pathways for making this conversion, we have concentrated on intermediate processes that appear to work best on Refuse Derived Feedstock (RDF), which contains a large proportion of MSW. We have backed away from processes that use various forms of acid-hydrolysis, turning instead to processes that convert RDF/MSW streams into syngas.

We have examined a range of downstream processes that convert syngas into liquids, focusing first on those less expensive processes that are limited to producing intermediate liquids, such as biomethanol, then on those that produce fuel grade ethanol. We then decided to evaluate the cost and benefits of using a newly developed "small scale" F-T catalytic hydrocracking process that could convert syngas into jet fuels, which could command a price premium over ethanol and could be sold using long-term contracts.

But we still find ourselves having to "connect the dots," as we have just been made aware of the option for converting syngas into LNG using a small scale LNG process and having LNG marketed as transportation fuel at prices that are expected to be substantially lower than gasoline and biodiesel. Although this exercise in connecting this set of dots has been undertaken to provide insights needed in selecting the best alternative pathway for a waste-to-biofuels project development effort in which we are supporting, the focus of this article is to explore this Waste-to-LNG pathway in greater depth, to illustrate the complexity in trying to choose the best waste-to-biofuels pathway.

Basic Arguments for Considering a Waste-to LNG Pathway

The following sections provide information supporting the following arguments for making LNG from MSW derived RDF:

1. LNG demand is now expected to grow significantly on a worldwide basis both in the short term and medium term.

2. LNG demand in the US will benefit from growth in supplies of shale gas, as not all of this gas will be used to replace coal to generate power, nor will US exports of LNG absorb the expected excess.

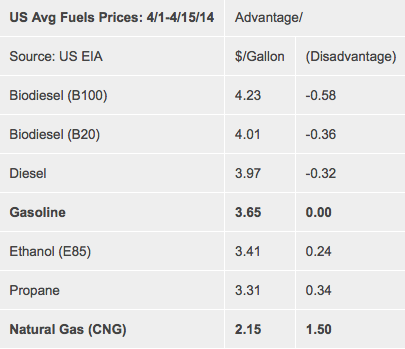

3. Price spreads of competing transportation fuels should act as an incentive for supporting investment in infrastructure needed to facilitate more widespread use of LNG to fuel trucks, trains and ships.

4. New small-scale LNG processes will make it economically feasible for modest sized managers of solid wastes, such as the hundreds of SWAs, to convert RDF into LNG and CNG, to supply the maritime and transport sector of the US transportation fuels market.

5. Potential JV Partners already exist who are positioned to market LNGs that SWA's can produce.

Re: The Growing Worldwide Demand for LNG

The May 31, 2014, issue of The Economist magazine contained a significant article on the fast developing international market for liquefied natural gas ("LNG"), aptly titled "Bubbling up" which they claim is being driven by increased worldwide demand for natural gas. This article suggests that this expected increase in demand for gas (and by implication, LNG) can be attributed in part, to the expected increased use of gas in generating power in China and other Asian countries.

With respect to the "bubbling up" of LNG demand, this article quotes a prediction made by sources in The International Gas Union (IGU) that LNG's share of the world market for gas will "rise from approximately 20% now, to as much as 30%, if all the projects being planned come to fruition." Another independent source quoted in this article, predicted that global LNG demand could double by 2030.

This article points to the fact that much of the gas that is expected to be produced will first be liquefies and transported by LNG tankers to LNG terminals before it is it returns to gaseous form as this technology is no longer considered "exotic." The article suggests that LNG capacity is already undergoing a major expansion. The first wave of large-scale LNG projects commenced this year in Papua, New Guinea that is expected to increase worldwide LNG capacity by over one-third by 2018.

And a second wave of LNG projects are already underway in Australia that are expected to double LNG production capacity, adding "80 billion cubic meters (bcm) of gas to world supply by 2025. . . (which is) more than Germany's entire current consumption of gas." This article also mentions that added LNG supplies will be coming from LNG projects in the Russian Arctic, from Sakhalin in the Russian Far East, as well as from the aforementioned LNG projects in Papua, and Australia. However, this article does point to the fact that "in the past, huge capital and running costs involved in LNG (operations) have hampered the market's growth (both overseas and in the U.S.)."

Re: LNG Demand in the U.S.

As to LNG produced in the US, The Economist Magazine article suggests that "the shale-gas boom in the U.S., has stimulated development of LNG terminals to facilitate LNG exports that could exceed 750 bcm, by 2018." But this article does not address the market for LNG within the U.S.

An article titled "Small-Scale LNG and The Jones Act" recently appeared in The Maritime News magazine. This article provided assessments of small scale LNG market development in the U.S., using estimates of the capacity of current and proposed small to mid scale liquefaction facilities as a proxy. These estimates were based on LNG projects that have been announced by six major liquefaction project developers.

This $1.50/gallon price advantage was corroborated by Clean Energy Fuels, one of the major companies that are actively engaged in developing the transportation segment of the U.S. LNG market. Clean Energy Fuels, recently reported that "CNG (was costing) up to $1.50 less per gallon equivalent than diesel fuel. . . (and that this savings) translates to annual fuel cost savings (natural gas vs. diesel) of up to $15,000 per truck (emphasis added)." They also claim that some fleets owners that they supply with CNG are finding that their hourly operating costs have been reduced by "as much as $10 per hour."

CNG Marketing Targets

Being targeted are bus lines, taxi fleets, municipalities that operate fleets of trucks, solid waste management truck fleets, police departments, and wholesale and retail operations that operate their own truck fleets.

Some LNG producers, such as Clean Energy and Applied LNG, are already providing LNG and CNG fueling at selected truck stops along selected interstate highway corridors that are used by a select number of major interstate freight carriers. A logical target market for LNG use would be those interstate trucking lines that are on the list of the 50 largest in the U.S. that use these corridors. The largest such carrier is FedEx, who generates over $4.7 billion in annual revenues. There are 19 other "large" carriers, each of whom generate between $1 billion and $3 billion in annual revenues.

And the remaining 30 of these 50 largest carriers generate between $130 million and $900 million per year. With a reported savings of $15,000 per truck all of these carriers should have an interest in running more of their trucks on CNG and all are large enough to invest in fleet conversions. And many of these trucking lines make frequent use of selected interstate corridors such as I-95 in the east, I-80 and I-5, that strategically located small scale LNG plant could service. And it seems reasonable to assume, that there will be many of these trucking firms that could easily absorb all the LNG provided by strategically located small scale LNG plants that are developed.

The next question in "connecting the dots" on the biogas-to-LNG pathway, is whether small-scale plants can be as financially viable as those that convert RDF into biogas and then into jet fuel. Recently announced is a company that is positioned and committed to develop this biogas to LNG pathway.

Cyrostar's Small Scale LNG Plant Technology

The recent Economist magazine article suggests that as technology evolves for making and handling LNG, costs will decline, and cost effective LNG plants could be built for small-scale operations. Mentioned in the article was a French company, Cyrostar, which makes small-scale liquefaction plants to turn biogas into LNG.

Cyrostar is an international company that is headquartered in France that has been involved in LNG technology for over 60 years. A review of their web site confirms that they do in-fact offer small-scale LNG plants that perform liquefaction of biogas in quantities ranging from 5 to 400 tons per day. In subsequent discussions with their US business development manager, it was confirmed that Cyrostar's process could convert 1.3 mcf of methane rich syngas into 17,000 gallons of LNG.

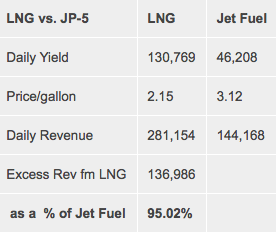

In other words if a gasifier is used that produces 10 mcf/day of methane rich syngas from 1,000 tons per day of RDF, the Cyrostar liquefaction process will convert this 10 mcf/day of syngas into 130,769 gallons of LNG. This compares to the 46,000 gallons per day of jet fuel that could be produced from the same amount of syngas.

Assuming the following yields and priced, the estimated revenue that can be realized from each fuel indicates that if the same amount of syngas were used to make LNG rather than JP-5, the revenue that is realized would be almost twice as much, assuming the yields and prices hold true.

Cyrostar's representative indicated that the capital cost of a small scale liquefaction unit is estimated to cost ~$40 million, which is $15 million less than the estimated cost of a Velosys F-T GTL process used to make jet fuel from syngas.

He then opined that if the cost of syngas produced from RDF were comparable to the cost of natural gas with similar properties, namely $4 to $5/mcf, then making LNG from it would be a financially viable proposition.

This assertion has yet to be validated, as metrics and costs to be used in assessing the cost of making syngas and converting syngas to JP-5 need to be validated. In addition, metrics and costs associated with converting syngas to LNG still needs to be obtained.

The Bottom Line

Based on what is known so far, making RDF into syngas and then into LNG and CNG for sale into the US transportation fuel market may become a better pathway to follow than using RDF derived syngas to produce jet fuel for the US military.

The Known Unknowns of LNG Marketing and Distribution.

The owners of small-scale LNG plants are not capable of providing large enough quantities of LNG for export, as in all likelihood, many of these plants that are developed will not be close enough to the large export terminals that service this trade.

To service the US market, small-scale LNG plants that can produce syngas from wastes could economically serve end users on a regional basis, if they have access to companies that can provide the needed storage and delivery infrastructure.

To serve the maritime segment with LNG, small-scale LNG plant operators will need to be located close to ports that cater to the Jones Act fleet and have strategic partners that already service this market.

With respect to the transportation segment of the US LNG market, this market is just evolving and much of the LNG to be sold as transportation fuel will have to first be liquefied and delivered as CNG to large numbers of users and select fueling stations.

This will require a network of LNG storage facilities, LNG tankers and LNG to CNG fueling stations and with a few exceptions, do not now exist. Further, this infrastructure that will be needed to distribute LNG produced by a small LNG plant must be strategically located to serve its potential end users. In most cases, this infrastructure does not exist or if it does, it is more than likely is inadequate.

In any case, if the transportation sector is the primary target market for the LNG to be produced, significant added investment in LNG infrastructure will have to be made either as part of the project or by a strategic business partner who takes on the marketing responsibility. In any case, the added cost of distribution will cut into the profits that are expected from the "price advantage" that LNG now has.

Project Financing Impediments and Obstacles

Conventional financing may be more of a problem if the LNG pathway is followed rather than the jet fuel pathway, because LNG will more than likely have to be sold on a spot basis under short term contracts, creating substantial market risk that could scare away lenders conventional sources of project financing.

If the syngas to jet fuel pathway is followed and if the jet fuel is sold to the Navy or Air force, the U.S. DoD is able to offer longer-term fuels procurement contracts that guarantee off-take and provide cost based price escalation. Clearly, these DoD fuels procurement contracts offer less market risk and are much more acceptable to providers of project financing.

Steps That Are Needed to Decide On the Waste-to-LNG Pathway

Part of the early-on project development effort required by those contemplating developing small scale LNG facilities, would be to identify potential LNG marketing and distribution partners needed to service US LNG maritime and/or transportation sector markets. And once identified, letters of interest will be needed from those that are able to meet the project's LNG marketing objectives on the best terms.

In addition, a project sponsor will have to be found that will be willing to assist with seed financing that will then be needed in order to develop a credible pre-feasibility study that will be used in making a LNG pathway decision and re-used in developing a business plan to facilitate project financing. This "study" should not only include adequate disclosures demonstrating that the technology to be used is adequately proven and is supported by actual demonstrations. This study must also be based upon costs and metrics derived from adequately detailed engineering assessments.

And this study ought to include explicit marketing plans supported by a sufficient number of written commitments from those that will be responsible for the project's marketing and distribution. Obtaining a few written expressions of interest from potentially significant end users may be needed to bolster the study's credibility.

And if a decision is reached to pursue either the waste-to-LNG pathway, a financing plan should then be prepared that identifies potential sources of financing and suggests alternative financing structures that could best be used.

Final Observation: "Connecting the dots" in choosing among alternative waste-to-biofuels pathways is not a simple exercise.

Tim Sklar

Biofuels Digest