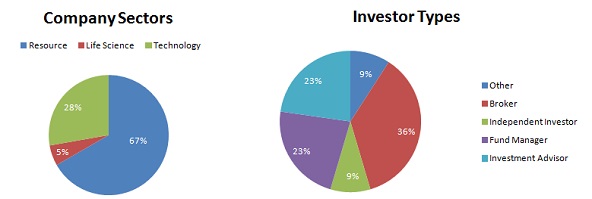

The event brought 18 companies and 20 professional investors together in the beautiful Napa Valley at the end of November for a series of one-on-one meetings that resulted in insights Swaney says just can't be found on company websites. For those who couldn't make it to the Wine Country for this exclusive meeting, The Gold Report asked professional investors in attendance to share their secrets for making the most of these meetings, and had them flag the companies they would be following up on in the coming weeks.

Michael Jacks, head of private equity at Sutter Securities, said that his preparation process is different for different types of companies. The conference was a mix of resource and tech plays at different levels of advancement. "For operating companies, you can look at the market, cost of production, distribution channels and margin, but for the small mining companies, it is really a play on the guy running it," he says. "I want to know if he has done it before and earned money for shareholders. I want to know his model. Mining companies have to raise a staggering amount of capital and it takes a while. I have to trust that he knows what he is doing." Jacks acknowledged it is impossible to learn everything about a company in 20 minutes, "but if a guy is a blowhard and he is telling me he is going to take his $0.06/share stock to $0.20/share without giving me specifics, I will walk away. I don't like braggarts. I want to know if he has a step-by-step plan for moving the project forward realistically. And I want to know if he has experience executing on a similar plan. I found five companies I was interested in and two were resource companies."

Investor Stephen M. Reznik quickly sizes up companies by looking at either their Bloomberg or Yahoo Finance profiles. He prints out the 2-, 3-, 5- and 10-year price charts, looks at the ownership structure, enterprise value (equity market cap + debt), cash, liquidity, banking lines and quality of management. "High pessimism in the industry or overall market is normally a plus in terms of delivering value," Reznik says. "Some of best buys ever were when we bought straw hats in the winter."

Matt Geiger, general partner of the investment fund MJG Capital, enjoyed the "speed dating format" and found a handful of names that he said "look extremely attractive at current share prices." That short list included SilverCrest Metals Inc. (SIL:TSX.V). He described the company as having "all the signs of a classic Joel Greenblatt value investment. It is a recent spinout trading below cash breakup value despite management's deep expertise and a collection of Mexico-based exploration properties that are ready to be tested. These are the types of opportunities only available in the very depths of bear markets." Read more of Geiger's thoughts on recent conferences and companies of interest.

"Quaterra Resources Inc. is going to weather this downturn and be a great performer when the markets turn." --Dudley Baker, Common Stock Warrants

A poll of attendees showed some clear favorites at the end of the two days. Platinum Group Metals Ltd. (PTM:TSX; PLG:NYSE.MKT) was a clear winner. The South African company is in the heart of global platinum production country and just closed $80 million ($80M) in financing through Liberty Metals and Mining Holdings and Sprott Resource Lending Partnership for the advancement of the WBJV Project near Rustenburg, South Africa. It will be the company's first mine.

Altius Minerals Corp. (ALS:TSX.V) made a number of "follow-up" lists on news of the company's progress building a diversified Canadian mineral royalty that includes zinc, nickel, gold, silver, copper, potash, cobalt and thermal coal.

At the top of many lists was SilverCrest Metals Inc. (SIL:TSX.V), which recently closed an oversubscribed private placement for $2.5M as it pursues a "phased approach" to taking projects in Mexico's historic metal districts from discovery to production.

Avalon Rare Metals Inc. (AVL:TSX; AVL:NYSE; AVARF:OTCQX) drew attention for its leverage to lithium, tantalum, zirconium, indium, gallium, germanium, tin and rare earths through three advanced projects. Avalon is currently investigating the possibility of producing a high-purity lithium chemical for the rapidly expanding market in lithium ion batteries.

For those interested in capitalizing on the popularity of smartphones, Siyata Mobile (SIM:TSX.V) raised eyebrows with its 3G fixed truck phone and the introduction of the VOYAGER Ultimate Connected Vehicle Smarthpone, billed as the world's first 3G connected vehicle device.

Datawind Inc. (DW:TSX) was a favorite in the low-cost Internet connectivity space. The company's mission is to bring the Internet—and its ability to create tremendous social and economic benefits—to billions of unconnected people in the developing works. The company's Internet Delivery Platform offers a low-cost inexpensive, prepaid, 2G Internet service plan.

Quaterra Resources Inc. (QTA:TSX.V; QTRRF:OTCQX) was on hand to talk about its copper assets in Yerington, Nevada. The company had just announced results from the first core hole in the Bear copper deposit and investors were taking notice. Dudley Baker, founder of Common Stock Warrants, called this "a company that is going to weather this downturn and be a great performer when the markets turn."

Also of interest was Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE), an advanced-stage gold exploration company focused on district-scale discoveries on the Railroad-Pinion gold project in Nevada's Carlin Trend. The company brought with it news of new gold intersects north of the Dark Star Gold deposit that, according to management, "confirm discovery of a substantial new, higher-grade oxide deposit."

Check out the snapshots and voting results for all of the companies.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) The following companies mentioned in the interview are sponsors of Streetwise Reports: Gold Standard Ventures Corp. and Quaterra Resources Inc. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

2) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.