For Montana's oil industry, the carpet was pulled out from underneath them when the media's attention was snatched away by the state's neighbor to the east. . .

It must have been painful for them to watch North Dakota's oil industry explode, even in spite of a massive global recession. But the last laugh hasn't been heard.

And that's because Montana is preparing to re-take the spotlight—and for investors searching for the next phase of the Bakken oil boom, it's time to give Montana its due.

Sympathy for Montana

If you've looked into the Bakken formation, there's a good chance you've come across the Elm Coulee oil field.

Located in Richland county, on the eastern side of Montana, the Elm Coulee field was discovered in 2000. Like most Bakken wells, companies have utilized horizontal drilling and multi-stage fracturing techniques to increase production.

By 2006, the field was pumping out 56,000 barrels per day from approximately 350 wells, with an estimated ultimate recovery of 270 million barrels. A year later, the Elm Coulee field had become the highest-producing onshore field in the lower 48 states.

To put that into perspective, Montana's oil production in 2003 averaged 53,000 barrels per day. In 2006, the Elm Coulee field was responsible for almost 60% of the state's production that year.

You've got to have some sympathy for Montana. . .

Though Montana shares a portion of the now-famous Bakken, the Treasure State's oil production has struggled while a good old-fashioned oil boom has been taking place right next door in North Dakota.

Over the last five years, oil and gas producers across the U.S. have had shale fever. But sadly for Montana, North Dakota has taken center stage.

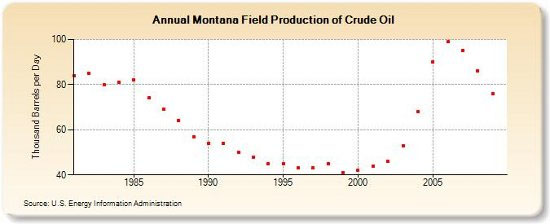

After an impressive start into the shale fever gripping the country's oil producers, Montana's oil production lost momentum.

The state's production (pictured below)—which reached averaged 99,000 barrels per day in 2006—fell to 76,000 barrels per day in 2009.

Montana became the forgotten stepchild in the U.S. oil industry.

But don't feel too sorry for them, because things are about to change. . .

Time to Cash in on the Bakken Fame

As you know, North Dakota has been a hotbed of activity for oil and gas drillers.

According the Baker Hughes rig count, there are 128 active drilling rigs. You only need one guess to figure out where those rigs are drilling. . .Approximately 95% of those rigs are drilling in the Bakken and Three Forks formations. The Three Forks formation is located beneath the Bakken.

That means the number of active rigs has jumped 333% since oil prices collapsed to $33 per barrel in December 2008.

North Dakota's drilling boom is paying off, too. Last week, North Dakota overtook Oklahoma's position as the country's third-most active drilling state. Remember, North Dakota surpassed Oklahoma in 2009 to become the fourth-largest oil producer in the U.S.

And North Dakota's success is good news for Montana.

Drillers looking to expand their Bakken exposure are starting to revisit Montana. As companies continue to improve upon drilling and completion techniques, those Montana leases are looking more attractive.

How can we be sure?

Digging a little further, you'll discover that the Montana Board of Oil and Gas is being flooded with drilling permit applications. According to one administrator, Tom Richmond, oil and gas there could be more than 300 permits this year.

Taking another look at the latest rig count by Baker Hughes, there are only five rigs currently drilling in Montana. All five are drilling the Williston Basin in Richland County.

2011 is shaping up to be a strong year for Montana.

The latest scramble to pick up leases in northeastern Montana is reminiscent of the land rush that occurred in North Dakota in 2008. If you remember, the catalyst for North Dakota's oil boom was when the USGS updated their Bakken assessment in April 2008.

Of course, the Bakken has been extremely generous to investors. In fact it's helped my readers close winner after winner—including more than 400% on one of our favorite Bakken stocks.

You can bet they won't miss out on Montana's good fortune.

Until next time,

Keith Kohl Editor, Energy and Capital

Montana Oil: The Next Bakken Rush