"Electricity demand is actually falling," my friend Mark told me, between casts.

It was a sultry evening in July. We were fishing for (saltwater) trout, discussing the power grid. He works for one of the major U.S. electric power generators.

I had asked him where the extra electricity was going to come from, to meet rising demand.

I thought I mis-heard him…

"What do you mean, down? Everything is electronic these days. How could demand be down?"

His answer was simple—efficiency.

"Everything does more with less electricity today. Dryers, air conditioners, refrigerators…they all use less electricity. Even though we have more connected devices, we don't use more electricity."

I honestly didn't believe him, so I looked it up…he was right.

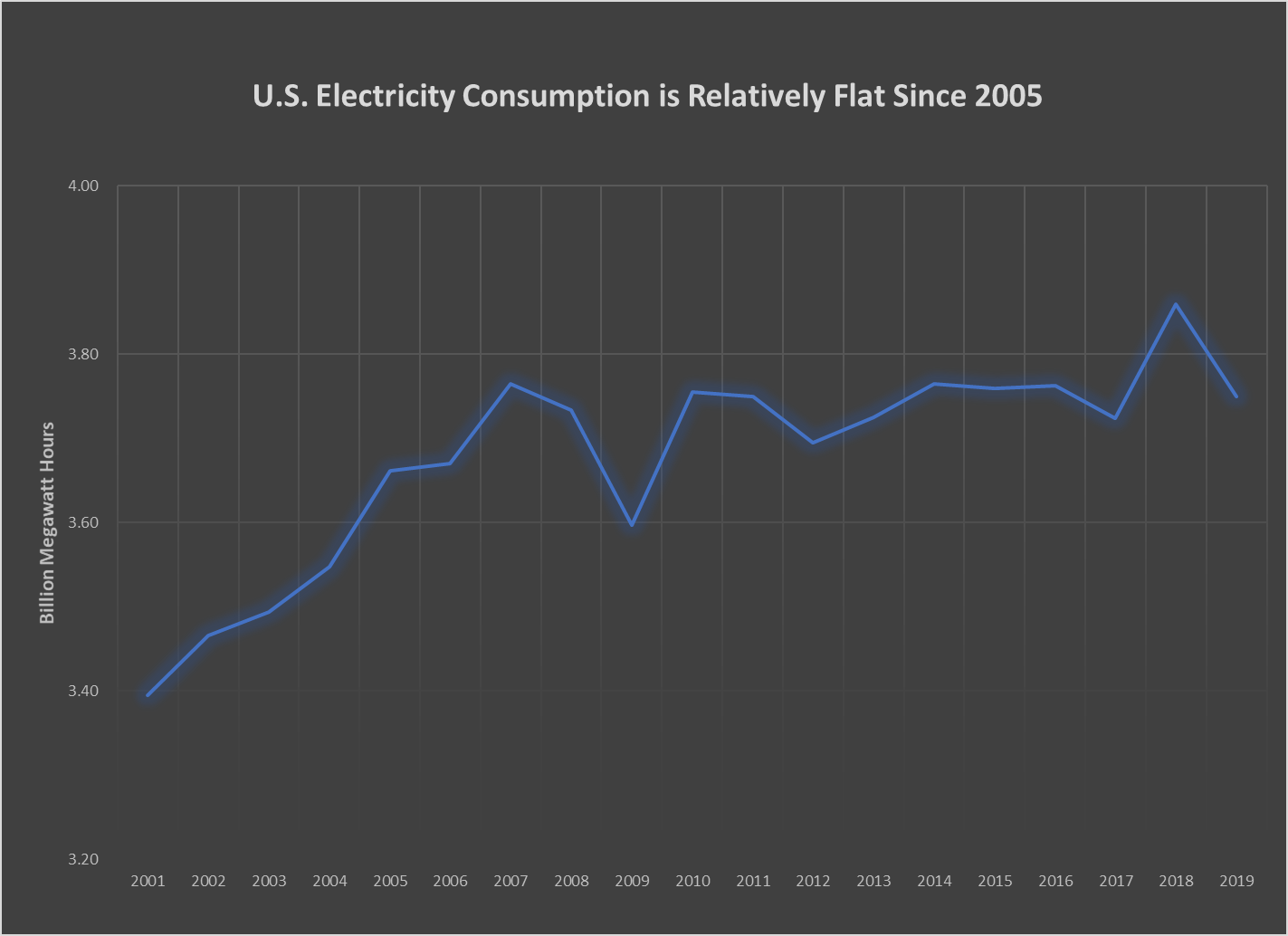

The chart below comes from the U.S. Energy Information Administration (EIA):

It shows the flat trend in electric power consumption. The U.S. consumed 3.73 billion megawatts per year on average for the last 15 years. In 2019, the U.S. consumed just 3.75 billion megawatts.

I had no idea.

So, I did some digging into efficiency. Turns out, it's the most important thing for electric power usage. Because efficiency kept consumption flat, even as we turned to a fully energized America.

Much of the savings came from residential power consumption…but industry is starting to go through a massive shift in that direction as well. And that opens some interesting investment ideas…

It's not Energy, It's Energy Data

While many investors focus on production, there's another way to play energy.

We read volumes about battery power, solar power, and wind power. But the most effective energy source is simply using less.

That's where the energy data comes in.

Giant industrial processes once analog, are now digital. And the companies send the data to the cloud. You've seen those internet cameras or thermostats that you can check on your phone? Well, imagine being able to check the status of a massive gas turbine…on your phone.

That's what energy data is about. Everything from wind turbines to giant heating and cooling units send their data up into the cloud.

The investment ideas are businesses who can take that data and reduce energy consumption.

There's one small company that already successfully created efficiency solutions. Its AI program found a more efficient way to control power use…and saved Bank of America $40 million per year.

At Bank of America, the AI analyzes data from over 3,300 bank branches and cut the company's energy use by 12%.

This tiny company now has over 50,000 "connected assets" worldwide. They service companies like Starbucks, Sysco, TELUS, Exelon, Husky Energy and Duke Energy.

Across the company's portfolio, it saves about 120 million kilowatt hours of energy per year. That's 80,000 tons of carbon dioxide…and the equivalent of removing 18,000 passenger car emissions annually.

That's an incredible savings and it will continue to grow.

The company is mCloud Corp. (MCLD:TSX), an C$85 million market cap company that's hard to categorize. It is a technology company that works across sectors to improve efficiencies.

It's an energy data company.

The interesting thing about mCloud is that its clients pay a subscription, rather than a giant capital cost. That's a superior model, because it generates a robust recurring revenue stream. And it's easy for its clients to sign up without a large upfront cost.

In 2019, the company generated C$18.3 million in revenue. However, 2020 is a growth year. By year end the company projects 70,000 connected assets—up 40% from 2019.

And the company projects C$70 million in revenue for 2021. Up 282% from 2019. More importantly, 70% of that will come from subscriptions to its AI platform.

Despite 2020's many challenges, this company's energy data solutions, which they call "asset care" is in high demand. As this company grows, management plans to list on the Nasdaq exchange in the U.S. That will allow it to be included in technology indices.

This company is an excellent candidate for investors looking for growth, technology, and "green" investments.

Reach Matt Badiali at www.mattbadiali.net.

Matt Badiali is a geologist and independent financial analyst. He spent fifteen years researching and writing about great investments inside the natural resources sectors. He can be reached at www.mattbadiali.net.

[NLINSERT]Streetwise Reports Disclosure:

1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: No. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: No. My company has a financial relationship with the following companies mentioned in this article: No. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.