The Energy Report: It's been over two years since your last interview, Edward, and a lot has changed in the energy markets since then. Could you summarize your current outlook on the alternative energy space?

Edward Guinness: It's been a challenging two years, but the headwinds facing alternative energy will eventually fade.

The first major headwind has been the growth—far higher than expected—of U.S. shale gas production, which has lowered natural gas prices considerably. The resulting low electricity prices are not providing an incentive to develop alternative energy projects, and many U.S. politicians see shale gas as the answer to the country's energy problems because the extra oil produced alongside shale gas means that the U.S. is approaching national energy independence. My view is that oil is a completely fungible commodity and whichever country you're in, you're impacted by instability in fossil fuel production. And the natural gas price in the U.S. is not likely to remain at these historically low levels, particularly when the U.S. starts to export it. But at the moment, there is a U.S. perception that energy independence is a real prospect, and enthusiasm and support for renewable energy has diminished as a result.

The second major headwind has been that the financing markets have remained challenging for longer than we expected. The EU has only deteriorated as a market for financing projects. Spain, Italy and Greece, once very important end markets, now offer considerably more expensive project financing and lower subsidy regimes. Over time, Europe's importance as a percentage of the global renewables market will decrease, and within Europe there is hope that debt pricing will fall back to levels that support more project development.

Shifting gears, the environmental agenda has shifted in the past two years. Two years ago, when the issue enjoyed strong international support, climate change was the principle environmental driver for alternative energy. Now the environmental focus is much more centered on pollution, emissions and the problems fossil fuels create in developing countries. The impact of poor air quality on public health in China, for example, is a much bigger driver for change than climate concerns ever were.

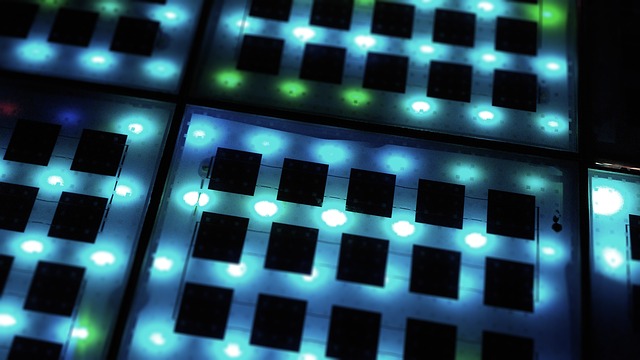

A very positive change has been the fall in pricing for solar modules, which have fallen about 75% since we last spoke. This price decrease is considerably more than anybody expected. We are really only beginning to see a demand response to that, which is very exciting.

TER: How have these changes affected the way you run your Alternative Energy Fund?

EG: Our Alternative Energy Fund is a very pure-play fund in the sector and we have maintained our focus on non-fossil fuel energy companies that we think will provide long-term returns. We only invest in companies with at least half and usually much more of their business in non-fossil fuel energy, whereas our competitors have moved away from alternative energy to invest in wider themes. Four years ago, we did split a number of our equally weighted positions in two. We have stopped doing this. Now the Alternative Energy Fund is very simply managed with 30 equally weighted holdings with no split positions. We've simplified it partly to reflect a slightly shrinking universe and partly as a flight to quality.

TER: What are your expectations for the oil and gas markets and what is your current investment strategy with your Global Energy Fund?

Ian Mortimer: One of our theses is that over the long term, oil demand will rise faster than supply. Although the supply increase from the United States has added a bit over a million barrels a day, (1 MMb/d), which is obviously quite significant in an oil market of around 90 MMb/d, the supply/demand balance is still tipped slightly toward demand. Throughout this whole period we've seen good growth in market demand outside of Organisation for Economic Co-operation and Development member countries.

One of the indicators we look at is how oil price affects global economics. At around $100 per barrel ($100/bbl), its cost makes up just over 4% of world GDP. At $150, it moves up to around 5.8%. That level is where, historically, the world starts to cut back on its use. So we think OPEC will keep it at about $100/bbl. Once it starts moving up past $125, we think demand will slow.

TER: What about natural gas?

IM: The U.S. natural gas price has a lot of moving parts and it's quite weather dependent. We think we could see a re-rating of the U.S. natural gas price to the $4–5 per thousand cubic feet ($4–5/Mcf) mark over the next 12–18 months. This could actually have quite a meaningful impact on company revenues and earnings.

EG: The energy sector has too many moving parts to get complete certainty on anything. You need to look through all that complexity to the very powerful long-term underlying drivers for sector growth, which are increasing demand, dwindling supply and rising costs.

IM: Over the last two years, energy equities actually underperformed the oil price. Historically, as the oil price starts to become sustainable at a given level, the market starts to trust that oil price and re-rates the energy equities to catch up with that price. We know that energy equities are a bit beaten up at the moment, but we're telling people that this may be an interesting period to be looking at investing.

TER: What companies in your portfolio look particularly interesting at this point?

IM: We've been looking at undervalued integrated oil and gas reserves. A lot of these companies are trading at quite low numbers. The majors as a group are currently trading at about $12 in terms of enterprise value for proven reserves (EV/P), which is quite cheap relative to where the oil price is. The EV/P ratio has historically hovered between 20–30% of the prevailing oil price. Using that metric, we'd expect companies to trade closer to $20–25 EV/P. To exploit that, we're thinking about companies like OMV (OMV:FSE) in Austria, Chevron Corp. (CVX:NYSE) and Royal Dutch Shell Plc (RDS.A:NYSE; RDS.B:NYSE), for example. We own a number of those kinds of companies in the portfolio.

We've owned Statoil ASA (STO:NYSE; STL:OSE) for a long time. It's in that bucket of cheap, integrated oil and gas companies. It's had some recent exploration success in the Barents Sea, and the market is starting to reward that. Also, a lot of these integrated companies are paying decent dividends, so there's an element of getting paid to wait.

Hess Corp. (HES:NYSE) is one of our holdings, and it has been a bit of a turnaround story. It's selling some of its potentially lower-return filling station assets and moving more toward a large-cap exploration and production company. Cheaper large-cap oil companies with long-life reserves, like Suncor Energy Inc. (SU:TSX; SU:NYSE) or Canadian Natural Resources Ltd. (CNQ:TSX; CNQ:NYSE), are trading at reasonable discounts to the prevailing oil price.

To take advantage of the rising U.S. natural gas prices, we've been investing in some companies that have more direct gas exposure, like Ultra Petroleum Corp. (UPL:NYSE). It's been trading at very low multiples and not getting much recognition for a potential uptick in the gas price.

On the international gas scene, we see particular growth in Chinese gas. We currently have a holding in PetroChina Co. Ltd. (PTR:NYSE; 857:HKSE), which is one of the big three Chinese-listed national oil companies, and it's trading at very cheap multiples with exposure to shale gas production growth and/or gas price increases.

We've had some exposure in the fund to refiners, such as Valero Energy Corp. (VLO:NYSE), which we've owned for quite a long time in the fund, and it has done particularly well taking advantage of the spread between WTI and Brent crude. It's difficult to know when the spread will turn around but we are reasonably comfortable holding Valero at the moment.

TER: What about smaller companies?

IM: One interesting example we've held for a long time is WesternZagros Resources Ltd. (WZR:TSX.V). We think that Iraq and Kurdistan could see significant production growth in the medium term. Iraq could be moving from 2.5–3 MMb/d up to, say, 5 MMb/d in the next decade, potentially. But in the short term, even 1–2 MMb/d production growth would be reasonably significant in the world market. WesternZagros is a pure play on Kurdistan production growth. It currently has no production, but was an early mover in the space with very good acreage.

Over the last five years, more and more companies have taken on acreage in Iraq, such as Genel Energy Plc (GENL:LSE) or Talisman Energy Inc. (TLM:TSX). Genel is looking to build a pipeline to the Turkish border in order to reach external markets, but Iraq still needs to resolve its petroleum law. There's still a lot of debate between Kurdistan and Baghdad about revenue sharing, which is discouraging companies from coming in.

TER: Moving on to alternative energy, many stocks haven't performed as well as expected. Did people's early expectations exceed the economic and/or technical realities?

EG: The technologies haven't been a disappointment. Wind and solar technologies have actually made colossal strides in terms of cost efficiency. The disappointment has been the macroeconomic situation and falling subsidies. Solar and wind manufacturers anticipated demand growth and increased their capacity, but this growth did not materialize as expected, which resulted in an oversupply.

You can split the types of stocks in the alternative energy space into two broad categories: manufacturers and utilities. Utilities sell energy in some form and the manufacturers provide the generating equipment and plants. In a period of oversupply and weak demand, manufacturers have to lower their costs, and many have done incredibly well on that front. On the utility side, limited financing has lowered growth profiles and there have been some adjustments to some of the subsidies, particularly in Spain. Returns have generally remained good, but company valuations have not kept pace.

TER: Where do you see the best opportunities in alternative energy at this point?

EG: We see a lot of opportunity for the medium to long term, with huge uncertainty in the near-term, meaning within the next six months. I particularly like some of the Chinese pure-play renewable utilities, such as China Datang Corp. Renewable Power Co. Ltd. (1798:HKSE), China Longyuan Power Group Corp. Ltd. (916:HKSE), China Suntien Green Energy Corp. Ltd. (956:HKSE) and Huaneng Renewables Corp. Ltd. (958:HKSE). We hold all four of them in the portfolio. These are companies with substantial portfolios of wind farms in China that have had issues in the last three years with curtailment due to lack of grid capacity. There is a strong technical push to improve the grid in China and produce cleaner energy, which goes straight through to the bottom line of these companies.

I remain a huge solar enthusiast and believe we're entering a new transition stage before installation costs fall further. Most of the cost reductions will be on improvements in the installation techniques rather than the module costs, which are a very small part of the overall cost now. In the U.S., modules now cost around $0.65 per watt and some companies are still charging $4–5 per watt for installation, compared to $1.30–1.60 in Germany and the U.K.

We think rooftop solar installations will grow more significantly in the next five years. We're also moving from a subsidized to an unsubsidized world. Once demand is underpinned by unsubsidized demand, alternative energy providers will become less vulnerable to government intervention. The U.S. is starting to see much higher growth levels as installation costs slowly get to more realistic levels and people recognize the economics of solar.

I also believe electric vehicles are going to become a much higher percentage of the fleet within 10–15 years as they become more affordable and deliver 500 miles for each 20-minute charge. That's something I can get excited about.

We only have one electric-vehicle-linked play in the fund and that's a lithium mining company called Canada Lithium Corp. (CLQ:TSX; CLQMF:OTCQX), but we are watching that space closely.

We also own shares in a small utility in the U.K. called Good Energy Group Plc (GOOD:AIM), which owns a small wind farm and has contracts to buy renewable energy from other providers that are generating energy from hydroelectric, solar or wind sources. The cost of this electricity is exactly the same as the major utilities, so it has a green proposition at no additional cost. It's seeing very high customer growth, which could potentially drive up Good Energy's valuations significantly from a low starting base.

I also like ground-source heat pumps, such as WaterFurnace International Inc. (WFI:TSX), which will be a strong beneficiary as the U.S. housing market recovers. I like the valuation of some of the large global renewable utilities like EDP Renovaveis SA (EDPR:LSE), which just announced its first dividend and is based in Spain, as well as Italy-based Enel Green Power SpA (EGPW:BIT). These companies' share prices are reasonably depressed because of concerns over the countries that they are domiciled in, but they have varying levels of actual exposure to the economies involved, and ultimately utilities are an important part of a country's economic infrastructure. Thus, we think returns will remain consistent in those countries.

TER: How would you summarize a good investment strategy for the retail investor in the current market climate?

EG: There are two ways to play this for a retail investor. The first option is to buy a fund in the space that has a good, diverse portfolio of stocks, where more than half of the holdings are manufacturing stocks. It's likely to be volatile, but potentially high return, with strong long-term drivers. It's not for the faint of heart. Second, I think investors need to look for ways to buy actual projects, which sometimes carry 15% returns with an inflation link every year. This is like being able to buy small utilities projects and get the returns directly.

TER: Do you have any other thoughts you'd like to leave with us?

EG: The last thing I'd like to leave you with is a sense that the alternative energy sector remains very unloved. The stock prices remain very low, and if you think this is a cyclical low, it's a pretty attractive point to be buying in. We're optimistic on the 5–10-year horizon, which leads us to conclude that alternative energies have the potential to provide very strong returns. While equity performance over the last five years has been very poor in this sector, we've had an indication since November of just how strong a bounce back could be. Alternative energy equities could potentially be the most outperforming sector in the world.

TER: Thank you very much, Edward and Ian, for joining us today.

EG: Thank you very much for your time.

Edward Guinness joined Guinness Atkinson Asset Management in 2006. He is co-manager of the Guinness Atkinson Alternative Energy Fund and the Guinness Alternative Energy Fund. Previously, he worked for HSBC in corporate finance beginning in 1998; in 2002, he joined Tiedemann Investment Group in merger arbitrage. He graduated from Magdalene College, University of Cambridge, with a Master's degree in engineering and management studies.

Ian Mortimer joined Guinness Atkinson Asset Management in December 2006. He is co-manager of the Guinness Atkinson Global Energy Fund. Prior to joining Guinness Atkinson, Ian completed a Doctor of Philosophy in experimental physics at Christ Church, University of Oxford, and graduated in 2006. He graduated from University College London, University of London, with a first class honors master's degree in physics in 2003. He holds an Investment Management Certificate and is a CFA charterholder.

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Interviews page.

DISCLOSURE:

1) Zig Lambo conducted this interview for The Energy Report and provides services to The Energy Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Royal Dutch Shell Plc and Western Zagros. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Edward Guinness: I or my family own shares of the following companies mentioned in this interview: None. I personally or my family am paid by the following companies mentioned in this interview: Guinness Alternative Energy Fund. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Ian Mortimer: I or my family own shares of the following companies mentioned in this interview: None. I personally or my family am paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.