Bruce Edgelow: Juniors have begun to transition from drilling moderately priced individual vertical wells to drilling much more capital-intensive resource plays. For example, in 2000 the cost to drill and complete one well in Pembina was ~$330,000. By 2010, the cost had ballooned to ~$2.75 million (M) due to horizontal drilling and more complex completion techniques. This trend is expected to continue as resource plays become increasingly dominant and as larger budgets, bigger capital bases and higher production become more commonplace. As such, access to capital will be more vital for juniors than it has been in the past.

We expect consolidation to occur as a result of the critical mass needed to meet these increased capital requirements. Liquidity-challenged small producers may be attractive targets for larger, well capitalized companies looking to expand their asset bases. In this landscape, juniors will need to be nimble early movers. Those that can jump on a niche emerging resource play and pioneer economic extraction techniques will have an advantage.

TER: Which resource plays will remain hot spots for junior E&Ps?

BE: Development plays such as the Cardium, Viking and Bakken shales should continue to dominate the oil and gas landscape. These repeatable development-style plays require ample land inventory to provide sufficient drilling opportunities. Given increasing operating prices, juniors will need enough capital to fund full-cycle economics. Moreover, drilling and completion costs are likely to further increase as even more advanced technology will be required to unlock the full resource potential.

On the other hand, demand for conventional plays with smaller pools bearing exploration risk is reducing. The appetite to fund natural gas activity is virtually non existent unless the producer is in a niche play that can still be economic at current depressed prices. Investors and capital providers will need to develop an increasingly keen eye toward overall corporate economics in order to determine if a company has the scale, talent and asset profile to exploit the opportunities available.

TER: You've addressed the higher costs associated with horizontal drilling. How are revolutionized extraction techniques benefiting juniors?

BE: The industry is reporting fewer dry holes. Technological innovation has made previously uneconomic plays much more viable. Five years from now, one can expect significant advances in fracturing technology to have further increased economies of scale. It is expected that there will be a significant uptick in the number of plays that are not even on the radar screen at this time. Going forward, the industry will likely find that larger pools are repeatable and that the technology being deployed is increasingly efficient.

TER: Can you tell us more about full-cycle economics and why they matter?

BE: The full cycle growth story will be the preeminent method whereby juniors thrive in a changing marketplace. This includes organic growth, acquisitions, farm-ins and joint ventures. As in the past, juniors will continue to drill using cash flow, available debt and equity to grow with the end goal being a corporate sale to a larger company with excess capital looking to diversify. Full-cycle economics refers to this entire trajectory from small- to mid- or large-cap companies. Investors will have to assess a junior's ability to progress to the next few stages.

TER: What kinds of business strategies will boost a junior's odds of making the leap to the next market-cap level?

BE: A land accumulation strategy could be a viable and successful method for a junior company over the coming years. For instance, with the Duvernay in its infancy and largely unproven at this time, a junior might choose to assemble a strong land base and sit on it without expending the large capital requirements to drill. It may be able to wait for better-capitalized players to prove up the regional play with the exit strategy to sell their land at higher values.

TER: You've placed a lot of emphasis on organic growth and scalability. Are the days numbered for small companies out there?

BE: Junior oil and gas companies will still be very active in this space in five years. However, there will likely be fewer of them as a result of consolidation and incrementally higher entry costs. We expect that the overall environment for juniors will be made more difficult as significant equity support will be imperative for juniors. We expect a $10M starter kit will not meet the capital needs of a junior going forward. To have a greater probability of success, a junior may require $100M or more to sustain an adequate capital program for one to two years. To receive this backing from investors, juniors will need to deliver top-quartile reserves, production and cash flow growth on a per share basis. If they don't perform at these levels, investors will be much more likely to deploy their capital to more stable mid-cap companies that yield a higher risk-adjusted return, including dividend income.

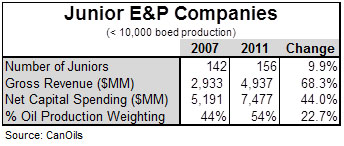

The number of juniors in the defined universe has increased nominally in recent years in comparison to significant growth in revenue and capital spending [see table below]. As I alluded to earlier, we expect this number to reduce due to consolidation and further increased capital requirements.

TER: So what will it take for an undercapitalized junior E&P to attract investment?

BE: For a junior oil and gas company to thrive in an increasingly competitive market, numerous attributes will be critical. A quality, experienced management team will be more important than ever before. It is crucial that management maintains a strong balance sheet and keeps capital spending within board-approved budgets. Furthermore, maintaining an optimal capital structure with reasonable and serviceable debt levels will be of the utmost importance. We expect to see a greater number of juniors succumb to high debt, while others will risk the company on the success of a few high-risk wells. Executives will need to manage risk appropriately in terms of effective deployment of capital as well as hedging commodity price fluctuations. They will also need to plan for potential higher-interest costs on debt and manage those costs through a stand-alone interest-rate hedging program.

TER: Currently, natural gas prices are lagging far behind oil prices. Do you think this trend will continue?

BE: The commodity pricing environment will likely dictate that plays be oil focused with strong netbacks. Notwithstanding, juniors will likely require multiple core areas of strong assets that each add economic value and the ability to increase reserves, production and cash flow on a per share basis. Finally, a company must not fall in love with their assets, but be willing to adapt quickly to changing market conditions. But who knows? With all the conversion to oil activity and some recent positive signs for natural gas demand, it may not be too soon before there is a swing back into the currently abandoned natural gas space. Time will tell.

TER: Thank you for sharing your thoughts on what's to come in this space.

BE: Thank you for having me.

Bruce Edgelow is responsible for helping to build ATB Financial's energy business and capabilities. His team consists of industry specialists in all aspects of the energy industry, including drilling and service, pipelines, utilities, midstream, exploration and production. Before joining ATB, Edgelow was a senior Royal banker and has more than 39 years of experience with a focus on the oil and gas industry. He is a Fellow of the Institute of Canadian Bankers, has attained the ICD.D designation, and is a very active participant in community and church activities. He also serves as a director for the Calgary Counselling Centre and sits on SAIT's Board Advisory Council. Edgelow has also been a speaker at numerous oil and gas industry seminars on finance.

Upcoming SEPAC Presenters:

- Hyperion Exploration Corp. (HYX:TSX.V)

- Paramount Resources Ltd. (POU:TSX)

- Vero Energy Inc. (VRO:TSX)

- Sure Energy Inc. (SHR:TSX)

- Guide Exploration Ltd. (GO:TSX)

- Palliser Oil & Gas Corp. (PXL:TSX.V)

- Surge Energy Inc. (SGY:TSX)

- Cequence Energy Ltd. (CQE:TSX)

- 3MV Energy Corp. (CVE:TMV)

- Tuscany Energy Ltd. (TUS:TSX.V)

For more information on the SEPAC Oil & Gas Investor Showcase, click here.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.